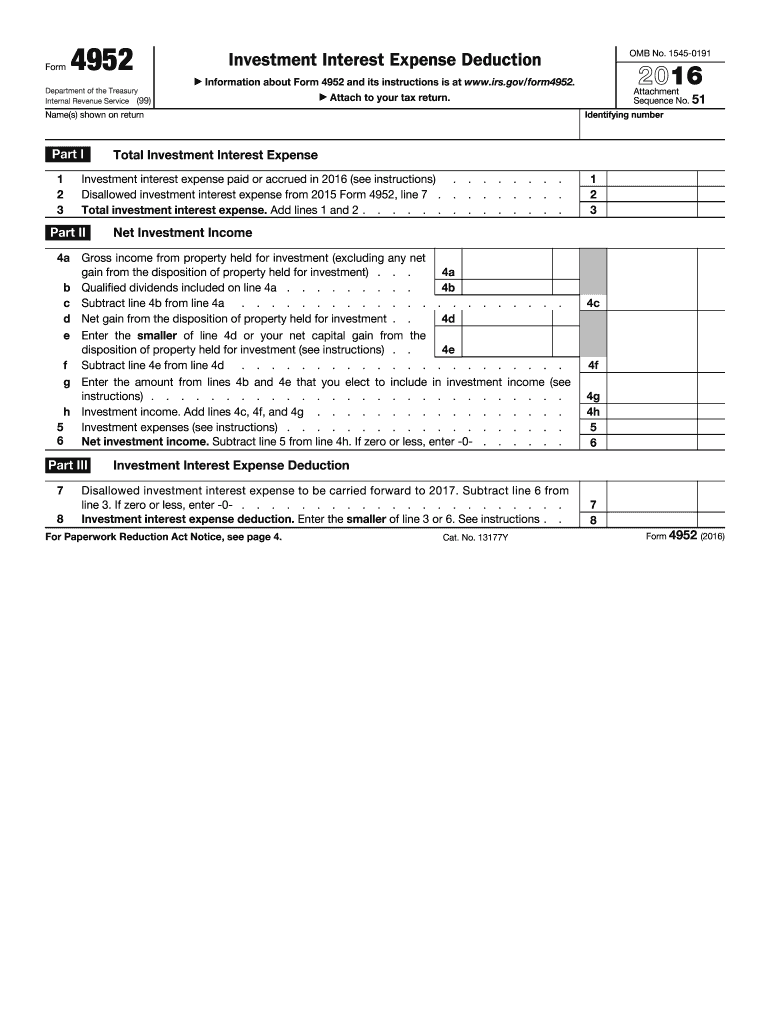

Irs Form 4952 Instructions

Irs Form 4952 Instructions - Download form 4952 from the irs website or use tax preparation software. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. How to file form 4952? How you can identify investment interest expense. This article will walk you through irs form 4952 so you can better understand: • any interest expense that is capitalized, such as construction interest. Filing form 4952 involves several steps: Instructions for form 8582, passive activity loss limitations, for details.

Instructions for form 8582, passive activity loss limitations, for details. How you can identify investment interest expense. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. This article will walk you through irs form 4952 so you can better understand: • any interest expense that is capitalized, such as construction interest. How to file form 4952? Download form 4952 from the irs website or use tax preparation software. Filing form 4952 involves several steps:

Filing form 4952 involves several steps: Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. Instructions for form 8582, passive activity loss limitations, for details. How you can identify investment interest expense. • any interest expense that is capitalized, such as construction interest. This article will walk you through irs form 4952 so you can better understand: Download form 4952 from the irs website or use tax preparation software. How to file form 4952?

IRS Form 6251 Instructions A Guide to Alternative Minimum Tax

This article will walk you through irs form 4952 so you can better understand: Instructions for form 8582, passive activity loss limitations, for details. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. • any interest expense that is capitalized, such as construction interest. How you can identify investment interest expense.

Form 4952 Fillable Printable Forms Free Online

Filing form 4952 involves several steps: Instructions for form 8582, passive activity loss limitations, for details. Download form 4952 from the irs website or use tax preparation software. How you can identify investment interest expense. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover.

IRS Form 4952 Instructions Investment Interest Deduction

• any interest expense that is capitalized, such as construction interest. This article will walk you through irs form 4952 so you can better understand: Download form 4952 from the irs website or use tax preparation software. How to file form 4952? How you can identify investment interest expense.

Form 4952 Fillable Printable Forms Free Online

Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. How you can identify investment interest expense. How to file form 4952? This article will walk you through irs form 4952 so you can better understand: Instructions for form 8582, passive activity loss limitations, for details.

IRS Form 4952 Instructions Investment Interest Deduction

How to file form 4952? Filing form 4952 involves several steps: This article will walk you through irs form 4952 so you can better understand: Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. How you can identify investment interest expense.

IRS Form 8990 Instructions Business Interest Expense Limitation

This article will walk you through irs form 4952 so you can better understand: How you can identify investment interest expense. How to file form 4952? Filing form 4952 involves several steps: Download form 4952 from the irs website or use tax preparation software.

IRS Form 8995 Instructions Your Simplified QBI Deduction

Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. This article will walk you through irs form 4952 so you can better understand: • any interest expense that is capitalized, such as construction interest. Filing form 4952 involves several steps: Instructions for form 8582, passive activity loss limitations, for details.

IRS Form 4952 Instructions Investment Interest Deduction

Download form 4952 from the irs website or use tax preparation software. How you can identify investment interest expense. Filing form 4952 involves several steps: • any interest expense that is capitalized, such as construction interest. Instructions for form 8582, passive activity loss limitations, for details.

IRS Form 8990 Instructions Business Interest Expense Limitation

Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. Filing form 4952 involves several steps: Instructions for form 8582, passive activity loss limitations, for details. • any interest expense that is capitalized, such as construction interest. How you can identify investment interest expense.

Download Instructions for IRS Form 6069 Return of Certain Excise Taxes

• any interest expense that is capitalized, such as construction interest. Instructions for form 8582, passive activity loss limitations, for details. Download form 4952 from the irs website or use tax preparation software. Filing form 4952 involves several steps: How you can identify investment interest expense.

Filing Form 4952 Involves Several Steps:

• any interest expense that is capitalized, such as construction interest. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. Download form 4952 from the irs website or use tax preparation software. How you can identify investment interest expense.

This Article Will Walk You Through Irs Form 4952 So You Can Better Understand:

How to file form 4952? Instructions for form 8582, passive activity loss limitations, for details.