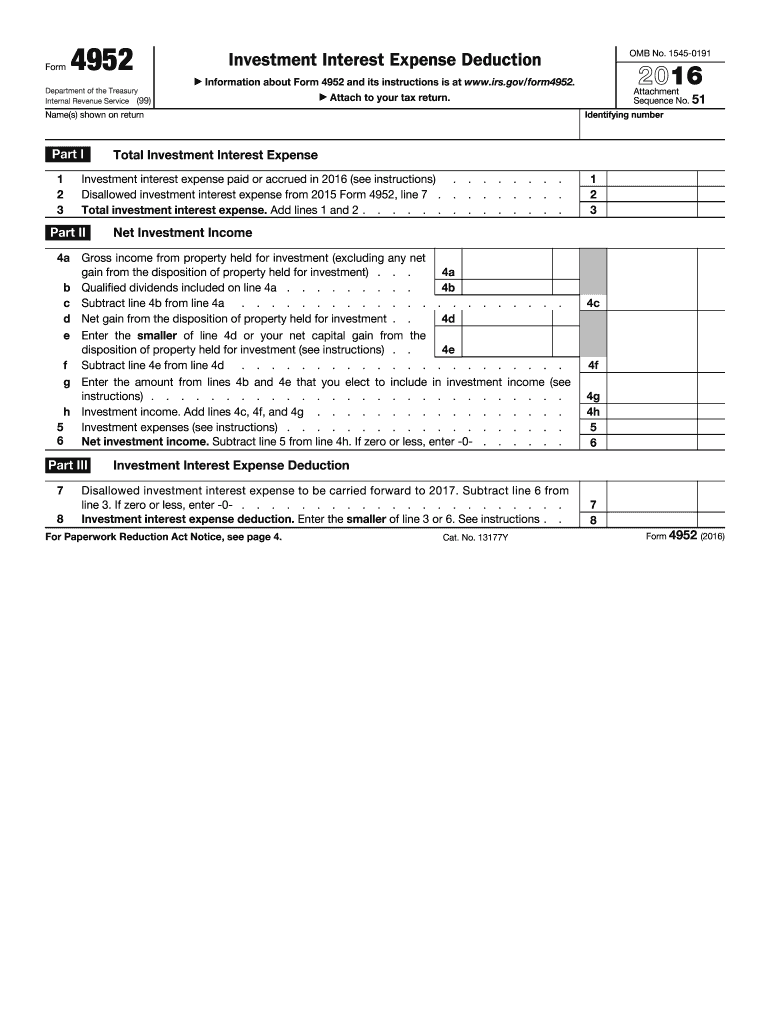

Irs Tax Form 4952

Irs Tax Form 4952 - Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. Form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry. You don’t have to file form 4952 if all of the following apply. How you can identify investment interest expense. This article will walk you through irs form 4952 so you can better understand: • your investment income from interest and ordinary dividends minus any.

How you can identify investment interest expense. This article will walk you through irs form 4952 so you can better understand: Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. • your investment income from interest and ordinary dividends minus any. Form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry. You don’t have to file form 4952 if all of the following apply.

Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. • your investment income from interest and ordinary dividends minus any. You don’t have to file form 4952 if all of the following apply. How you can identify investment interest expense. This article will walk you through irs form 4952 so you can better understand: Form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry.

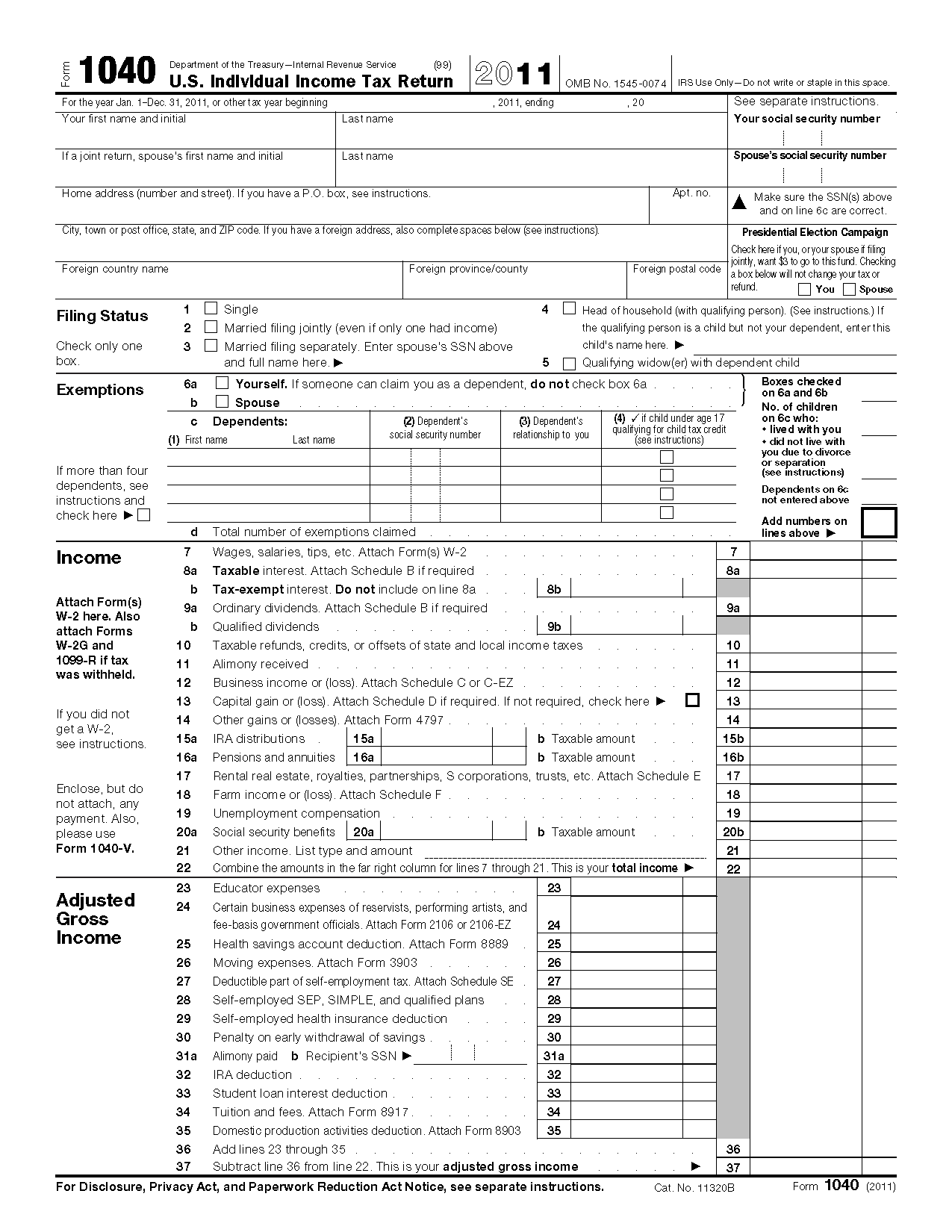

Printable Federal Tax Form 1040 Printable Forms Free Online

Form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry. This article will walk you through irs form 4952 so you can better understand: Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. How you can identify investment interest.

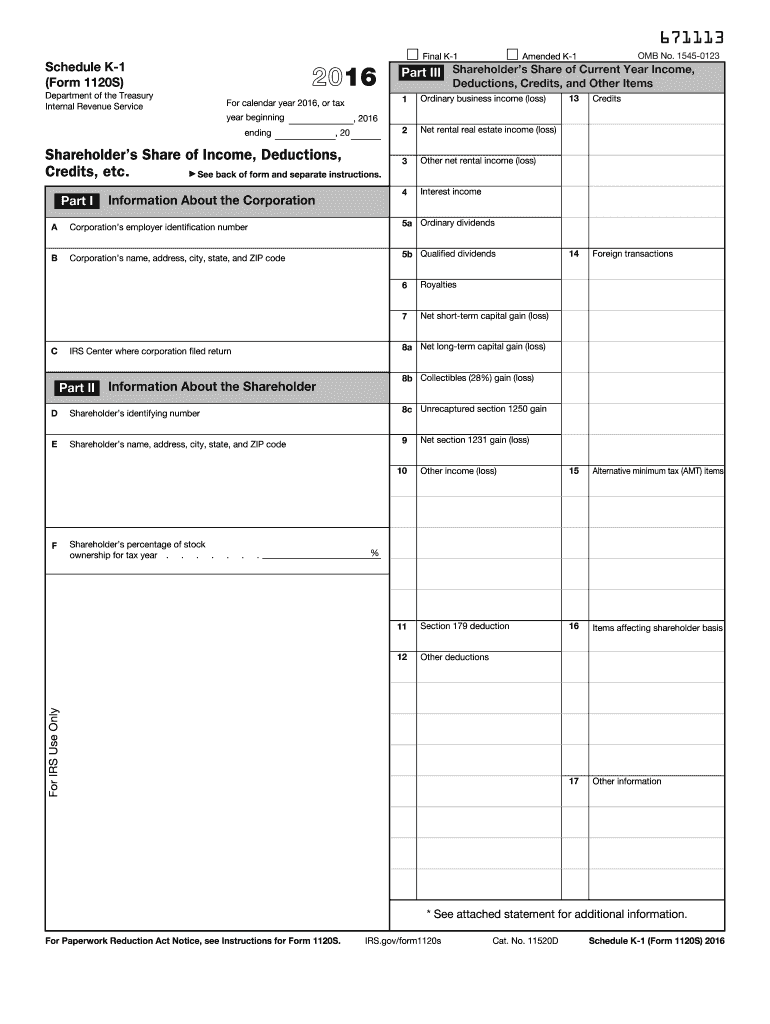

IRS 1120S Schedule K1 2016 Fill out Tax Template Online US Legal

This article will walk you through irs form 4952 so you can better understand: • your investment income from interest and ordinary dividends minus any. How you can identify investment interest expense. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. Form 4952 is used to determine the amount of investment interest expense you.

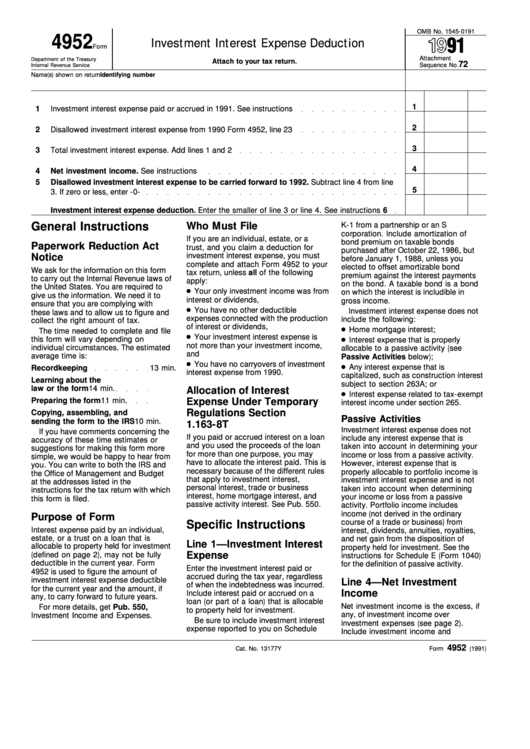

Form 4952 Investment Interest Expense Deduction printable pdf download

You don’t have to file form 4952 if all of the following apply. This article will walk you through irs form 4952 so you can better understand: • your investment income from interest and ordinary dividends minus any. Form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount.

Irs tax forms Artofit

This article will walk you through irs form 4952 so you can better understand: Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. • your investment income from interest and ordinary dividends minus any. How you can identify investment interest expense. Form 4952 is used to determine the amount of investment interest expense you.

Irs Form W4V Printable IRS Form 4952 Download Fillable PDF or Fill

How you can identify investment interest expense. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. You don’t have to file form 4952 if all of the following apply. Form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry..

IRS Form 4952 Instructions Investment Interest Deduction

You don’t have to file form 4952 if all of the following apply. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. How you can identify investment interest expense. Form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry..

Form 4952 Investment Interest Expense Deduction (2015) Free Download

How you can identify investment interest expense. You don’t have to file form 4952 if all of the following apply. • your investment income from interest and ordinary dividends minus any. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. Form 4952 is used to determine the amount of investment interest expense you can.

Form 4952 Fillable Printable Forms Free Online

Form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. • your investment income from interest and ordinary dividends minus any. How you can identify investment interest expense. You don’t.

How Far Back Can The IRS Audit? Polston Tax

How you can identify investment interest expense. You don’t have to file form 4952 if all of the following apply. • your investment income from interest and ordinary dividends minus any. Form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry. This article will walk.

IRS Form 6251 walkthrough (Alternative Minimum Tax For Individuals

This article will walk you through irs form 4952 so you can better understand: Form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry. • your investment income from interest and ordinary dividends minus any. Learn how to use form 4952 to calculate your investment.

How You Can Identify Investment Interest Expense.

Form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry. • your investment income from interest and ordinary dividends minus any. This article will walk you through irs form 4952 so you can better understand: Learn how to use form 4952 to calculate your investment interest expense deduction and carryover.