Irs Tax Lien Search

Irs Tax Lien Search - Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. To get the total amount due on a tax. For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov. Get tax relief from a tax. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Results include the debtor’s name, address, corporate fein (optional), the lien’s status and the type of filing (flr lien) for each record.

Get tax relief from a tax. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. To get the total amount due on a tax. Results include the debtor’s name, address, corporate fein (optional), the lien’s status and the type of filing (flr lien) for each record. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov.

Results include the debtor’s name, address, corporate fein (optional), the lien’s status and the type of filing (flr lien) for each record. Get tax relief from a tax. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. To get the total amount due on a tax. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov.

Tax Lien Sale Download Free PDF Tax Lien Taxes

Get tax relief from a tax. For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov. To get the total amount due on a tax. Results include the debtor’s name, address, corporate fein (optional), the lien’s status and the type of filing (flr lien) for each record. Learn what a federal tax lien.

What Is IRS Tax Lien? Serving Food That Rocks

For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. To get the total amount due on a tax. Get tax relief from a tax. Results include the debtor’s name,.

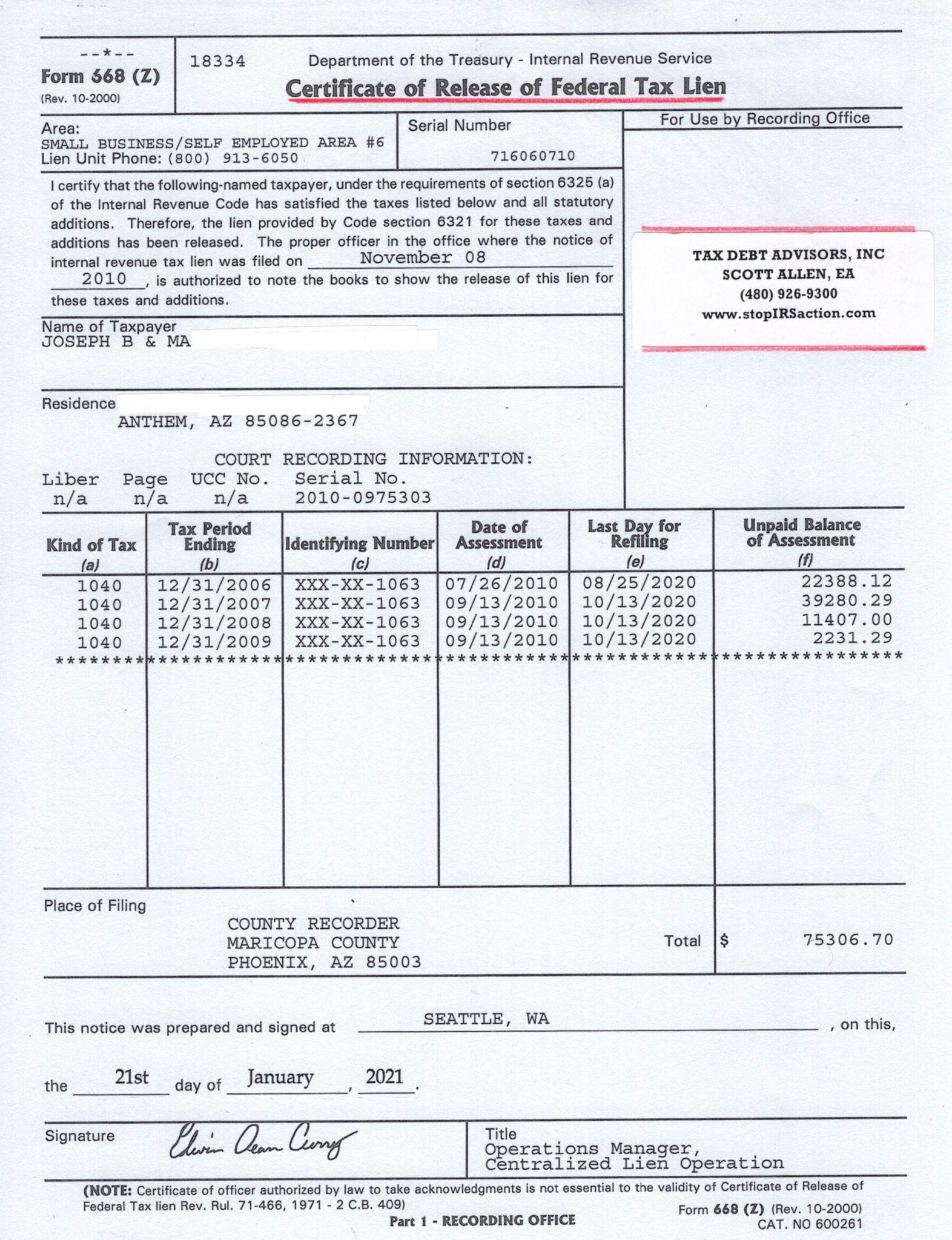

IRS Tax Lien in Arizona IRS help from Tax Debt Advisors, Inc Tax

Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. Results include the debtor’s name, address, corporate fein (optional), the lien’s status and the type of filing (flr lien) for each record. To get the total amount due on a tax. If a property owner fails to pay federal taxes, the.

When Does The Irs File A Tax Lien?

Results include the debtor’s name, address, corporate fein (optional), the lien’s status and the type of filing (flr lien) for each record. Get tax relief from a tax. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. For general lien information, taxpayers may refer to the understanding a federal tax.

How to Tackle IRS Tax Lien or Levy Notice? Internal Revenue Code

Results include the debtor’s name, address, corporate fein (optional), the lien’s status and the type of filing (flr lien) for each record. For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you.

Tax Lien Irs Lien On House House Information Center

Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. Get tax relief from a tax. For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov. Results include the debtor’s name, address, corporate fein (optional), the lien’s status and the.

Tax Lien Records Search Online Background Check Services a la Carte

If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Results include the debtor’s name, address, corporate fein (optional), the lien’s status and the type of filing (flr lien) for each record. To get the total amount due on a tax. Learn what a federal.

IRS Federal and State Tax Lien Help — Genesis Tax Consultants

For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Learn what a federal tax lien is, how it affects your credit and assets, and how to find.

Notice of Tax Lien IRS RJS LAW Best Tax Attorney San Diego

If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. For general lien information, taxpayers may refer to the understanding a federal.

IRS Liens Archives IRS Office Near Me

If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Results include the debtor’s name, address, corporate fein (optional), the lien’s status and the type of filing (flr lien) for each record. For general lien information, taxpayers may refer to the understanding a federal tax.

Learn What A Federal Tax Lien Is, How It Affects Your Credit And Assets, And How To Find Out If You Have One.

Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. To get the total amount due on a tax. Results include the debtor’s name, address, corporate fein (optional), the lien’s status and the type of filing (flr lien) for each record.

Get Tax Relief From A Tax.

For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov.