Is Form 941 Required To Be Filed Electronically

Is Form 941 Required To Be Filed Electronically - Therefore, paper filings will be accepted if an employer is required to file a final form 941. Under the final ruling, businesses that file at least 10 tax returns, notifications, reports, or statements to the tax agency will. Partnerships with more than 100.

Under the final ruling, businesses that file at least 10 tax returns, notifications, reports, or statements to the tax agency will. Therefore, paper filings will be accepted if an employer is required to file a final form 941. Partnerships with more than 100.

Therefore, paper filings will be accepted if an employer is required to file a final form 941. Under the final ruling, businesses that file at least 10 tax returns, notifications, reports, or statements to the tax agency will. Partnerships with more than 100.

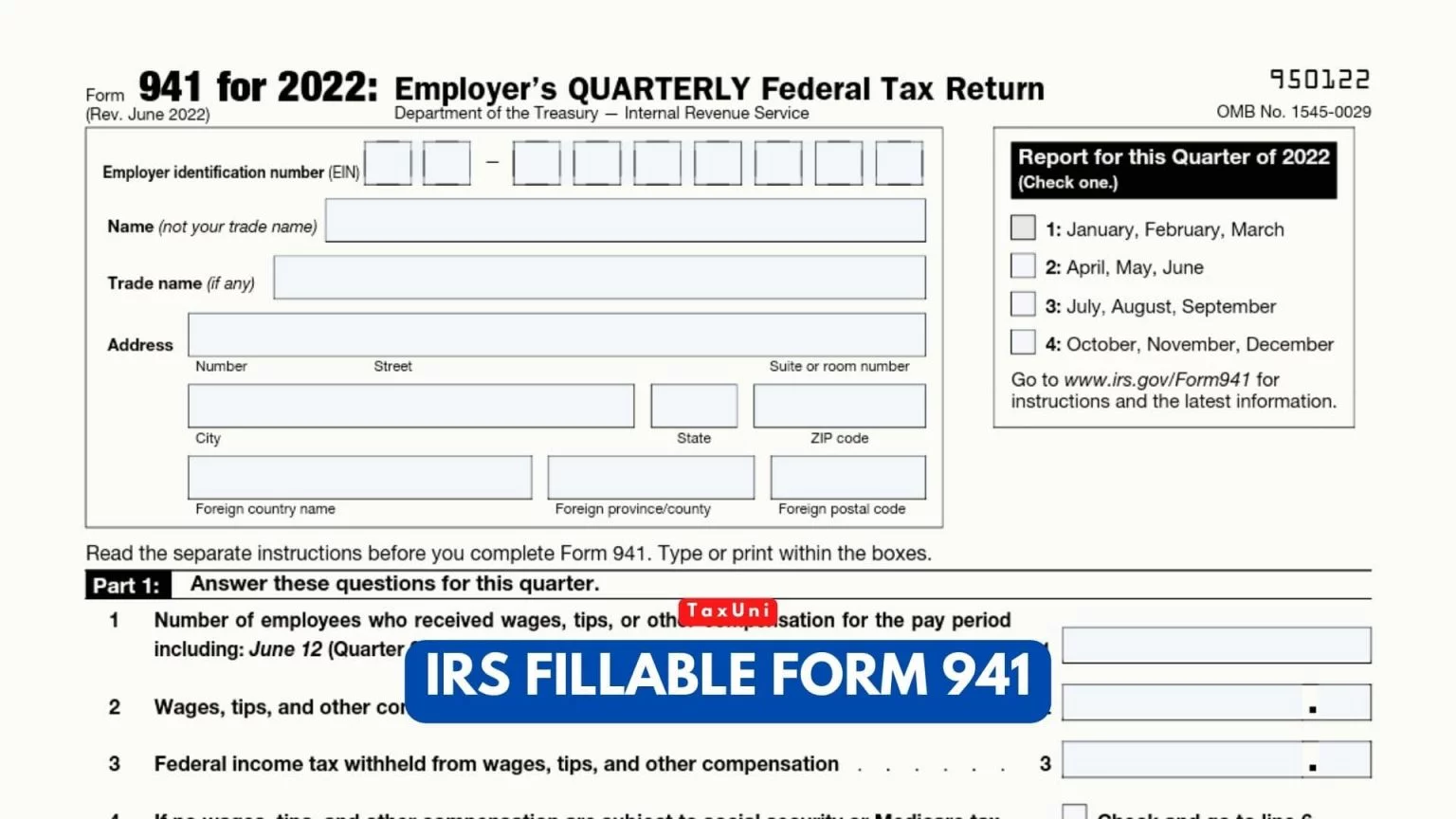

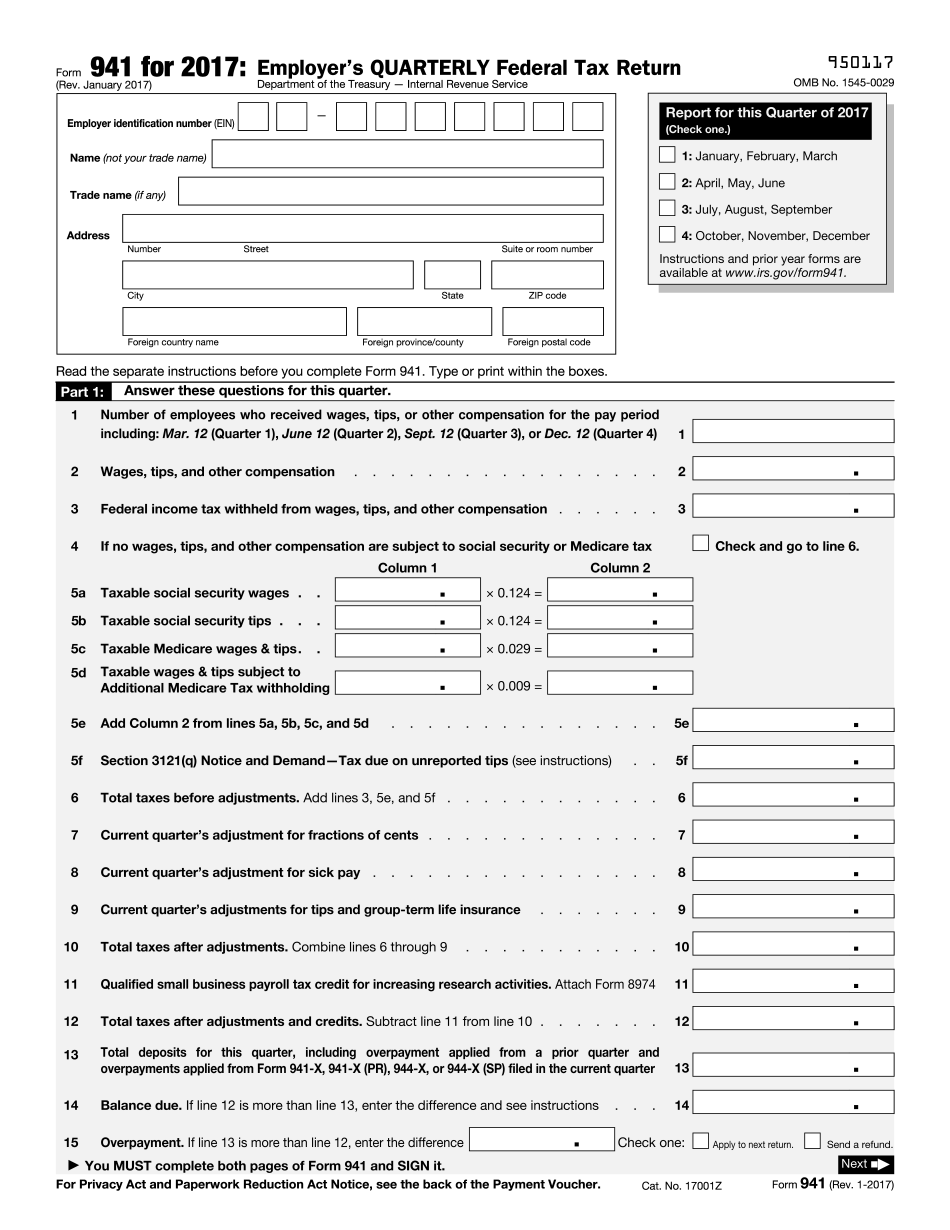

IRS Fillable Form 941 2024

Under the final ruling, businesses that file at least 10 tax returns, notifications, reports, or statements to the tax agency will. Partnerships with more than 100. Therefore, paper filings will be accepted if an employer is required to file a final form 941.

How To Use Form 941 To Claim The ERC ERC

Under the final ruling, businesses that file at least 10 tax returns, notifications, reports, or statements to the tax agency will. Therefore, paper filings will be accepted if an employer is required to file a final form 941. Partnerships with more than 100.

Form 941 FAQs Kwik Ledgers

Therefore, paper filings will be accepted if an employer is required to file a final form 941. Under the final ruling, businesses that file at least 10 tax returns, notifications, reports, or statements to the tax agency will. Partnerships with more than 100.

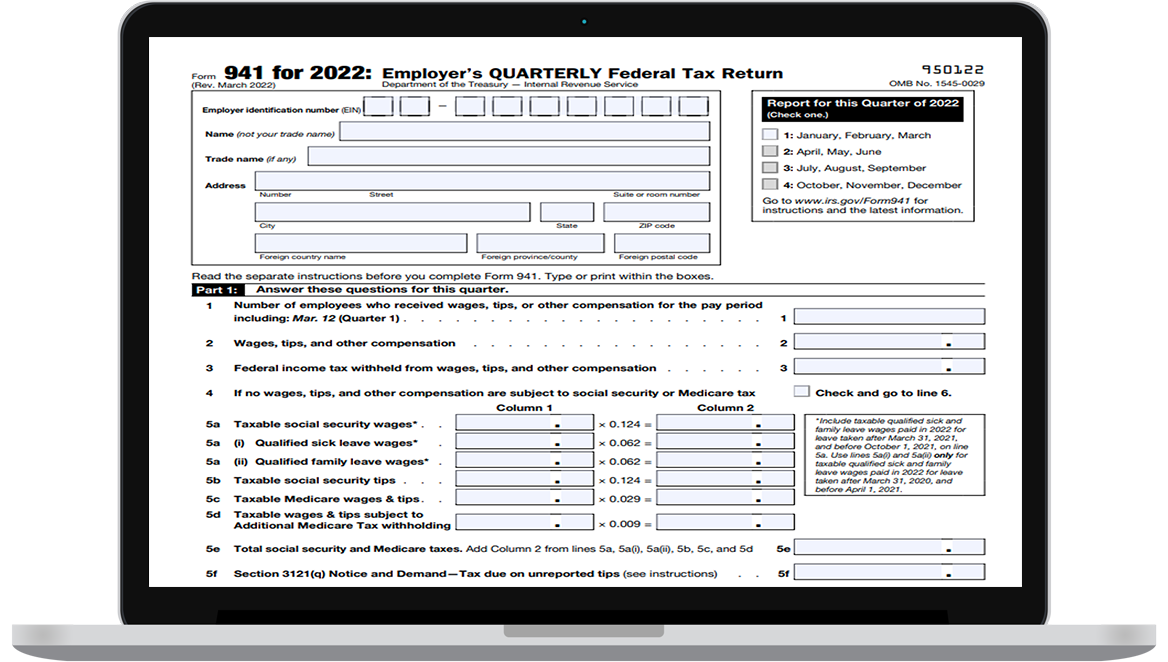

941 Form 2022 Printable Pdf Template Form example download

Therefore, paper filings will be accepted if an employer is required to file a final form 941. Partnerships with more than 100. Under the final ruling, businesses that file at least 10 tax returns, notifications, reports, or statements to the tax agency will.

Which IRS Form Can Be Filed Electronically?

Partnerships with more than 100. Under the final ruling, businesses that file at least 10 tax returns, notifications, reports, or statements to the tax agency will. Therefore, paper filings will be accepted if an employer is required to file a final form 941.

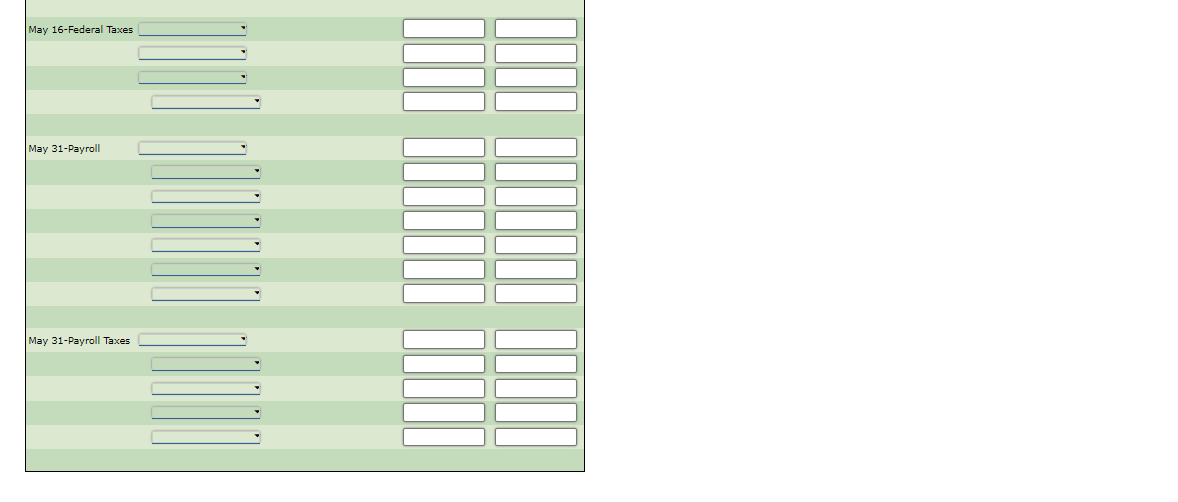

Solved Narrative of Transactions Apr. 1. Paid the treasurer

Therefore, paper filings will be accepted if an employer is required to file a final form 941. Under the final ruling, businesses that file at least 10 tax returns, notifications, reports, or statements to the tax agency will. Partnerships with more than 100.

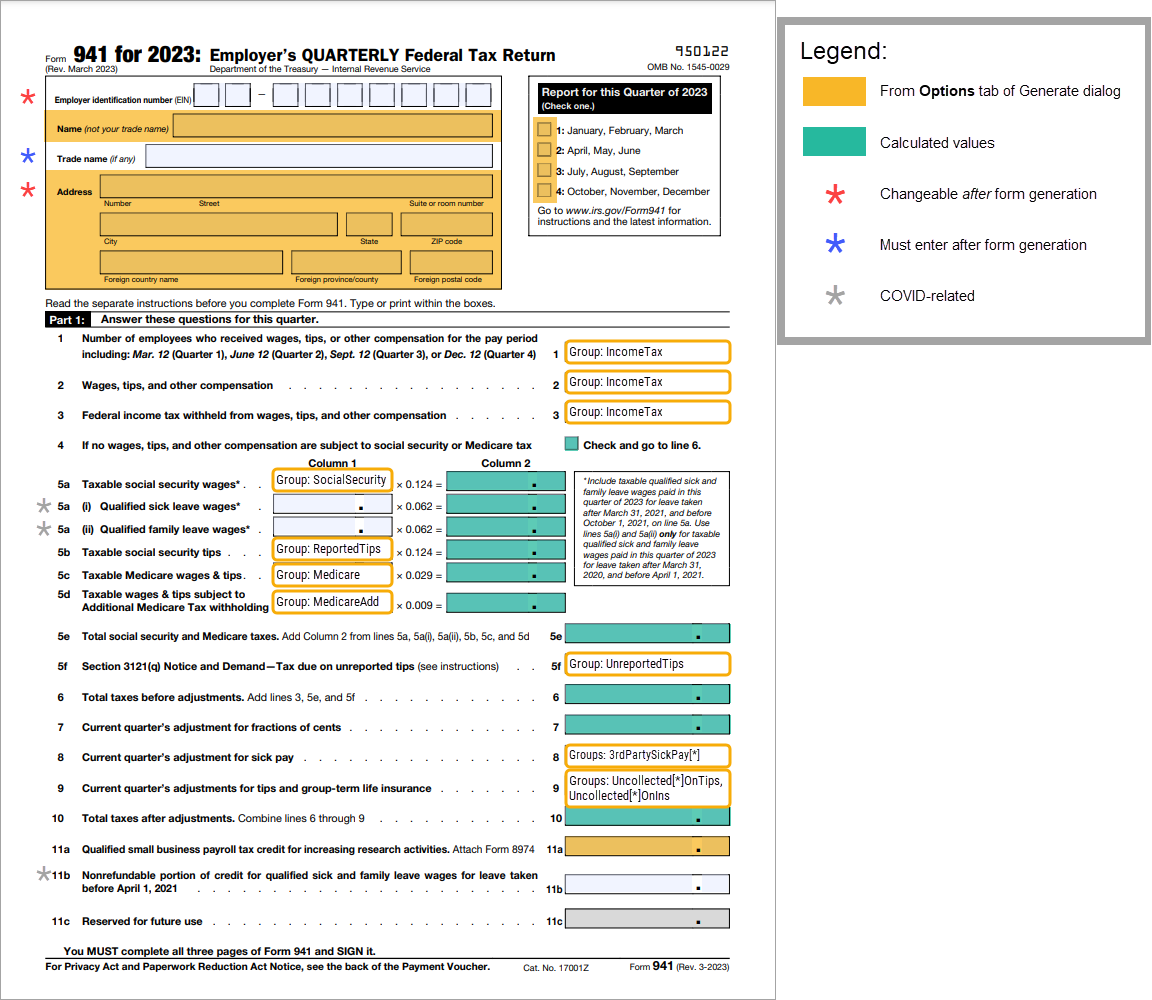

Printable Form 941

Therefore, paper filings will be accepted if an employer is required to file a final form 941. Partnerships with more than 100. Under the final ruling, businesses that file at least 10 tax returns, notifications, reports, or statements to the tax agency will.

Get IRS 941 Schedule B 20172023 US Legal Forms Fill Online

Under the final ruling, businesses that file at least 10 tax returns, notifications, reports, or statements to the tax agency will. Partnerships with more than 100. Therefore, paper filings will be accepted if an employer is required to file a final form 941.

What are the Advantages of Filing Form 941 for Q3 Electronically

Therefore, paper filings will be accepted if an employer is required to file a final form 941. Partnerships with more than 100. Under the final ruling, businesses that file at least 10 tax returns, notifications, reports, or statements to the tax agency will.

Under The Final Ruling, Businesses That File At Least 10 Tax Returns, Notifications, Reports, Or Statements To The Tax Agency Will.

Partnerships with more than 100. Therefore, paper filings will be accepted if an employer is required to file a final form 941.