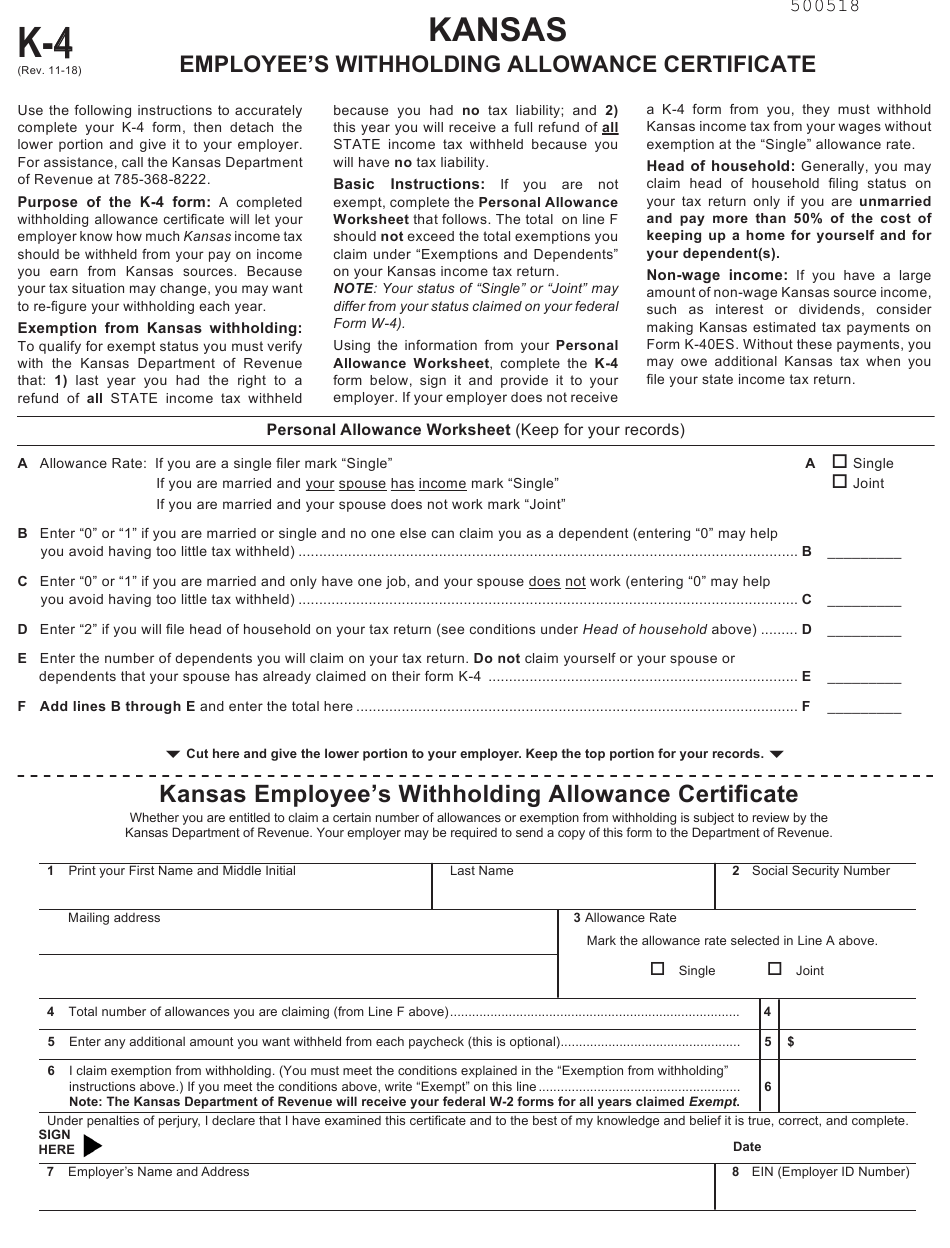

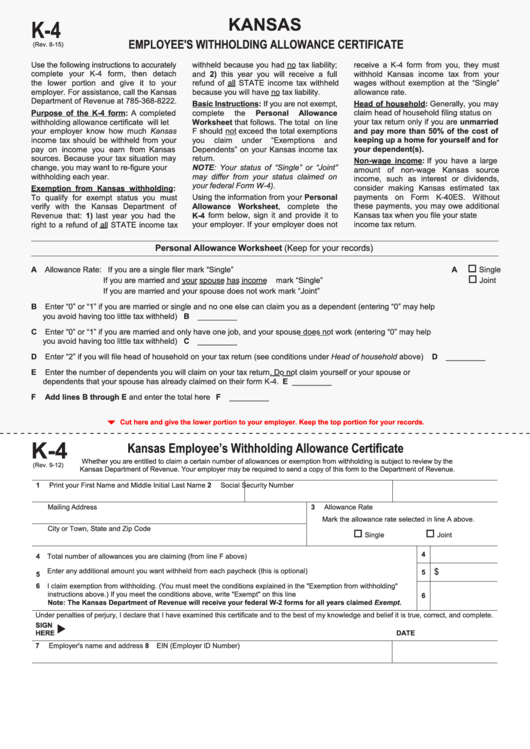

Kansas Tax Withholding Form

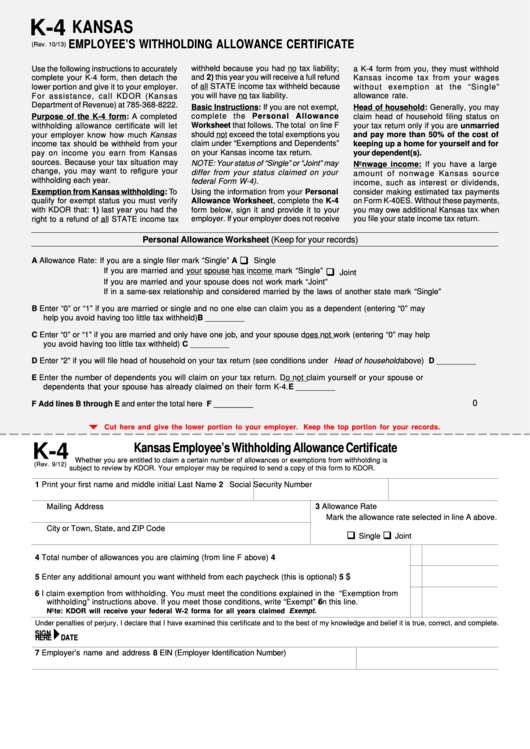

Kansas Tax Withholding Form - A completed withholding allowance certificate will let your employer know how much kansas income tax should be. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on income. A completed withholding allowance certificate will let your employer know how much kansas income tax should be. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. Use this form to report the kansas income tax withheld from wages and/or other taxable payments as required by law. For assistance, call kdor (kansas department of. An employer must withhold kansas tax if the employee is a resident of kansas, performing services inside or outside of kansas, or a.

Use this form to report the kansas income tax withheld from wages and/or other taxable payments as required by law. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. A completed withholding allowance certificate will let your employer know how much kansas income tax should be. A completed withholding allowance certificate will let your employer know how much kansas income tax should be. For assistance, call kdor (kansas department of. An employer must withhold kansas tax if the employee is a resident of kansas, performing services inside or outside of kansas, or a. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on income.

A completed withholding allowance certificate will let your employer know how much kansas income tax should be. Use this form to report the kansas income tax withheld from wages and/or other taxable payments as required by law. An employer must withhold kansas tax if the employee is a resident of kansas, performing services inside or outside of kansas, or a. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on income. For assistance, call kdor (kansas department of. A completed withholding allowance certificate will let your employer know how much kansas income tax should be. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically.

Kansas Unemployment Tax Withholding Form

A completed withholding allowance certificate will let your employer know how much kansas income tax should be. For assistance, call kdor (kansas department of. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. A completed withholding allowance certificate will let your employer know how much kansas income tax should be..

How Much Withholding You Should Claim and How to Change It

A completed withholding allowance certificate will let your employer know how much kansas income tax should be. An employer must withhold kansas tax if the employee is a resident of kansas, performing services inside or outside of kansas, or a. A completed withholding allowance certificate will let your employer know how much kansas income tax should be. For assistance, call.

Kansas State Tax 2024 Prudi Regine

Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on income. A completed withholding allowance certificate will let your employer know how much kansas income tax should be. A completed withholding allowance certificate will let your employer know how much kansas income tax should be. For assistance, call kdor (kansas.

Kansas Tax Exempt Form Lodging

A completed withholding allowance certificate will let your employer know how much kansas income tax should be. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on income. An employer must.

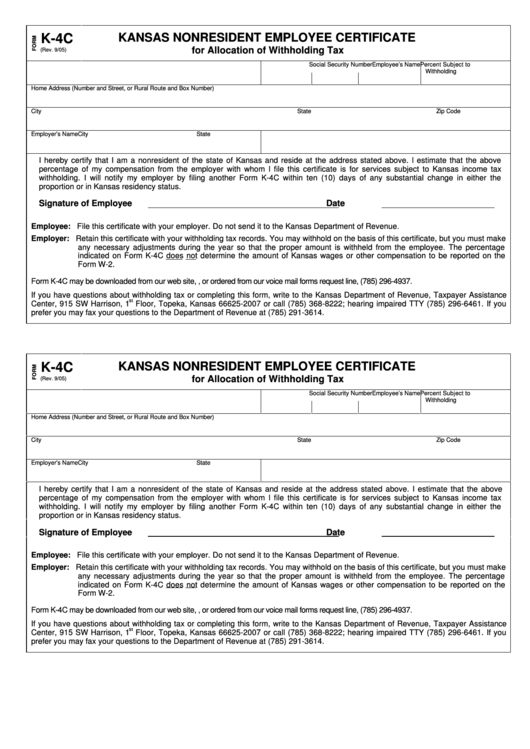

Fillable Form K4c Kansas Nonresident Employee Certificate For

Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on income. An employer must withhold kansas tax if the employee is a resident of kansas, performing services inside or outside of kansas, or a. A completed withholding allowance certificate will let your employer know how much kansas income tax should.

Kansas W4 Form 2024

Use this form to report the kansas income tax withheld from wages and/or other taxable payments as required by law. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on income. For assistance, call kdor (kansas department of. Since july 1, 2010, businesses have been required to submit retailers’ sales.

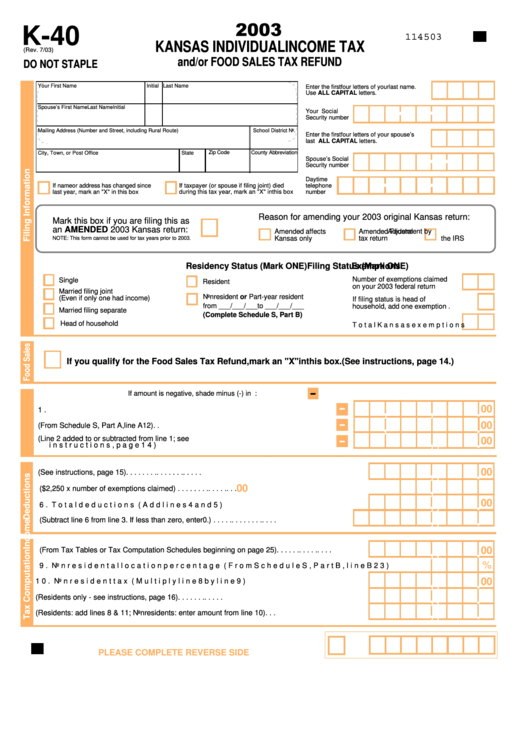

Form K40 Kansas Individual Tax And/or Food Sales Tax Refund

Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. An employer must withhold kansas tax if the employee is a resident of kansas, performing services inside or outside of kansas, or a. A completed withholding allowance certificate will let your employer know how much kansas income tax should be. A.

Kansas Withholding Form 2024 Pepi Trisha

An employer must withhold kansas tax if the employee is a resident of kansas, performing services inside or outside of kansas, or a. For assistance, call kdor (kansas department of. A completed withholding allowance certificate will let your employer know how much kansas income tax should be. Withholding allowance certificate will let your employer know how much kansas income tax.

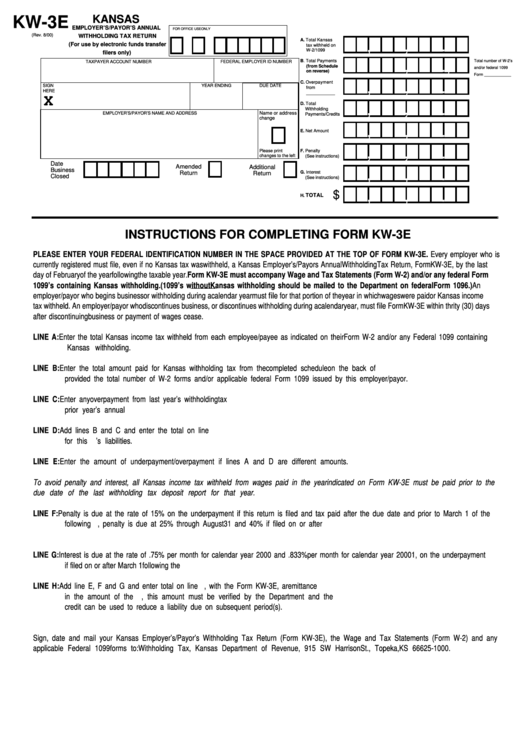

Form Kw3e Kansas Employer'S/payor'S Annual Withholding Tax Return

For assistance, call kdor (kansas department of. A completed withholding allowance certificate will let your employer know how much kansas income tax should be. A completed withholding allowance certificate will let your employer know how much kansas income tax should be. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay.

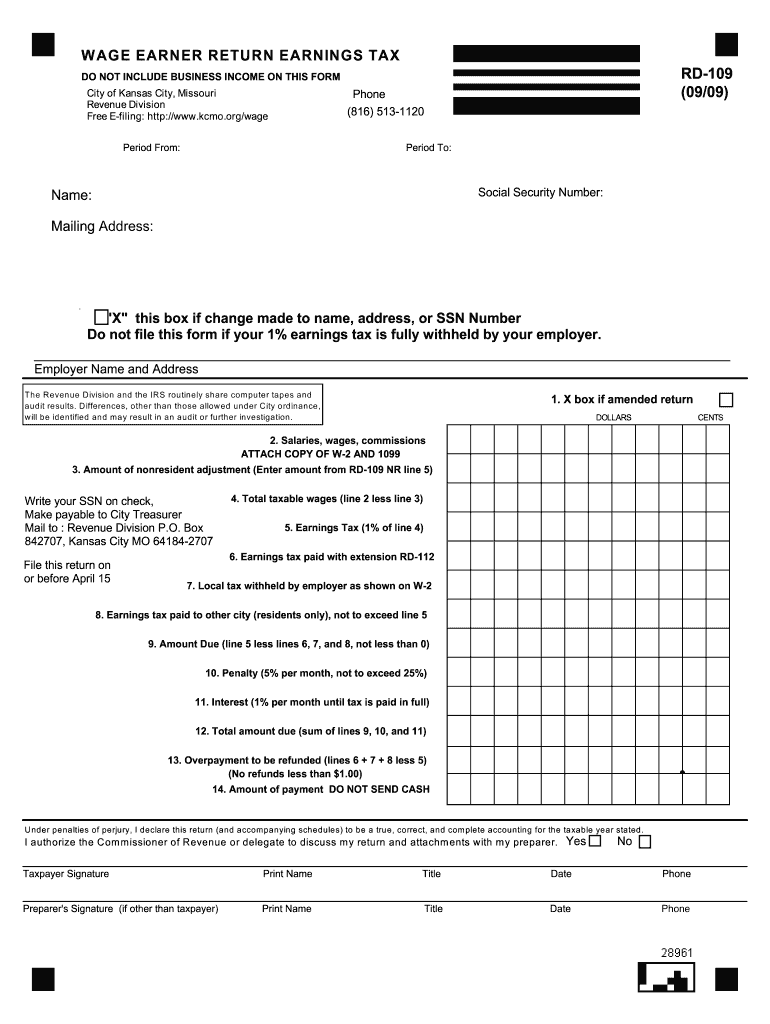

Kansas City Earnings Tax Form Rd 109 Fill Out and Sign Printable PDF

A completed withholding allowance certificate will let your employer know how much kansas income tax should be. Use this form to report the kansas income tax withheld from wages and/or other taxable payments as required by law. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on income. A completed.

Since July 1, 2010, Businesses Have Been Required To Submit Retailers’ Sales Compensating Use And Withholding Tax Returns Electronically.

An employer must withhold kansas tax if the employee is a resident of kansas, performing services inside or outside of kansas, or a. A completed withholding allowance certificate will let your employer know how much kansas income tax should be. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on income. Use this form to report the kansas income tax withheld from wages and/or other taxable payments as required by law.

For Assistance, Call Kdor (Kansas Department Of.

A completed withholding allowance certificate will let your employer know how much kansas income tax should be.