Kiddie Tax Form 8814

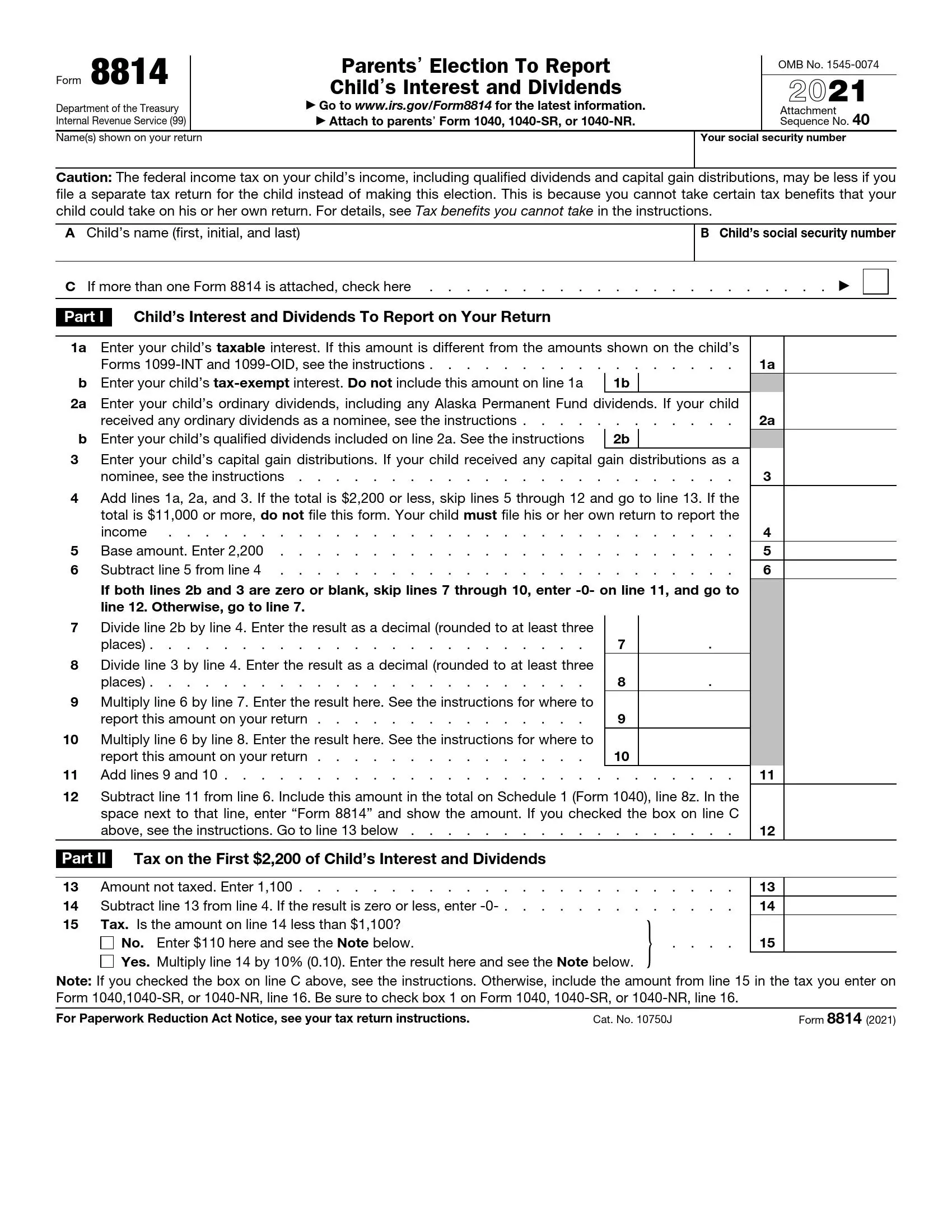

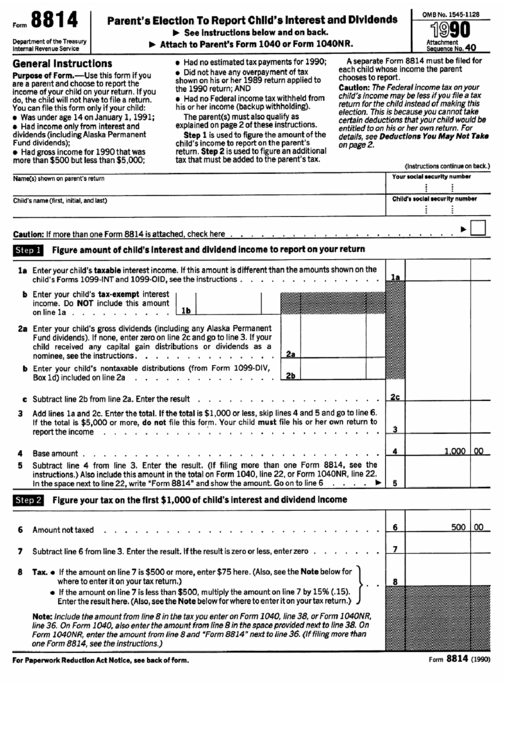

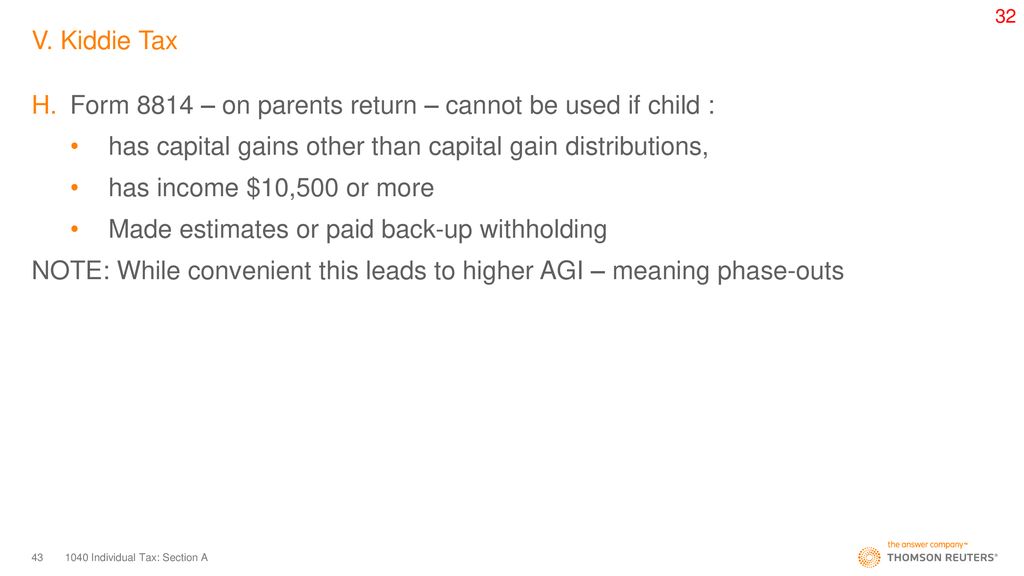

Kiddie Tax Form 8814 - Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax. Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. If your child receives passive income from investments, like dividends or interest, the irs has a way to simplify things: What is irs form 8814? If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. The form will help you.

The form will help you. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax. Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. If your child receives passive income from investments, like dividends or interest, the irs has a way to simplify things: What is irs form 8814?

Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax. The form will help you. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. If your child receives passive income from investments, like dividends or interest, the irs has a way to simplify things: What is irs form 8814?

What is the Kiddie Tax?

What is irs form 8814? If your child receives passive income from investments, like dividends or interest, the irs has a way to simplify things: If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on.

IRS Form 8814 ≡ Fill Out Printable PDF Forms Online

Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax. If your child receives.

Form 8814 A Parent's Guide to Navigating the Kiddie Tax in 2024 XOA

Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax. Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. What is irs form.

Kiddie Tax How It Works, Examples, and TaxSaving Strategies SuperMoney

What is irs form 8814? Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use. If.

Form 8814 Parents' Election To Report Child'S Interest And Dividends

Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use. If your child receives passive income from investments, like dividends or interest, the irs has a way to simplify things: Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax. What is.

Kiddie Tax Explained A Comprehensive Guide for Parents IncSight

Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. What is irs form 8814? The form will help you. If your child receives passive income from investments, like dividends or interest,.

IRS Form 8814 Instructions Your Child's Interest & Dividends

If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. What is irs form 8814? Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. The.

1040 Individual Tax Section A ppt download

If your child receives passive income from investments, like dividends or interest, the irs has a way to simplify things: Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use. What is irs form 8814? The form will help you. Irs form 8814 allows parents to report their child’s unearned income—such as.

Understanding Kiddie Tax Wendy Barlin

Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. What is irs form 8814? If your child receives passive income from investments, like dividends or interest, the irs has a way to simplify things: Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own.

Does the Kiddie Tax Affect Your Family? Roger Rossmeisl, CPA

Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. The form will help you. If.

Irs Form 8814 Allows Parents To Report Their Child’s Unearned Income—Such As Dividends, Interest, Or Capital Gains—On Their Own Tax.

Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use. What is irs form 8814? If your child receives passive income from investments, like dividends or interest, the irs has a way to simplify things: Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related.

The Form Will Help You.

If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return.