Liability Insurance Coverage

Liability Insurance Coverage - Get a business liability insurance policy for protection from bodily injuries, medical payments, advertising injuries, and more. Geico can help small business owners and contractors get the coverage they need with a general liability. Liability insurance is an insurance product that provides protection against claims resulting from injuries and damage to other people or property. Liability insurance coverage protects you financially if you're responsible for someone else's injuries or property damage. Liability coverage comes standard with most vehicle and property insurance policies, including auto and. By understanding the various types of liability insurance, considering key factors when selecting coverage, and implementing strategies to minimize liability risks, businesses can protect their financial stability and ensure. Liability coverage is a type of insurance that provides financial protection to an individual or business if they are found legally responsible for causing harm or damage to another person or their property.

Liability insurance coverage protects you financially if you're responsible for someone else's injuries or property damage. Get a business liability insurance policy for protection from bodily injuries, medical payments, advertising injuries, and more. Liability coverage comes standard with most vehicle and property insurance policies, including auto and. Liability insurance is an insurance product that provides protection against claims resulting from injuries and damage to other people or property. Geico can help small business owners and contractors get the coverage they need with a general liability. Liability coverage is a type of insurance that provides financial protection to an individual or business if they are found legally responsible for causing harm or damage to another person or their property. By understanding the various types of liability insurance, considering key factors when selecting coverage, and implementing strategies to minimize liability risks, businesses can protect their financial stability and ensure.

By understanding the various types of liability insurance, considering key factors when selecting coverage, and implementing strategies to minimize liability risks, businesses can protect their financial stability and ensure. Geico can help small business owners and contractors get the coverage they need with a general liability. Liability insurance coverage protects you financially if you're responsible for someone else's injuries or property damage. Liability coverage is a type of insurance that provides financial protection to an individual or business if they are found legally responsible for causing harm or damage to another person or their property. Liability insurance is an insurance product that provides protection against claims resulting from injuries and damage to other people or property. Liability coverage comes standard with most vehicle and property insurance policies, including auto and. Get a business liability insurance policy for protection from bodily injuries, medical payments, advertising injuries, and more.

What Does Liability Insurance Cover? Here's What You Need to Know

Liability coverage is a type of insurance that provides financial protection to an individual or business if they are found legally responsible for causing harm or damage to another person or their property. Liability coverage comes standard with most vehicle and property insurance policies, including auto and. Get a business liability insurance policy for protection from bodily injuries, medical payments,.

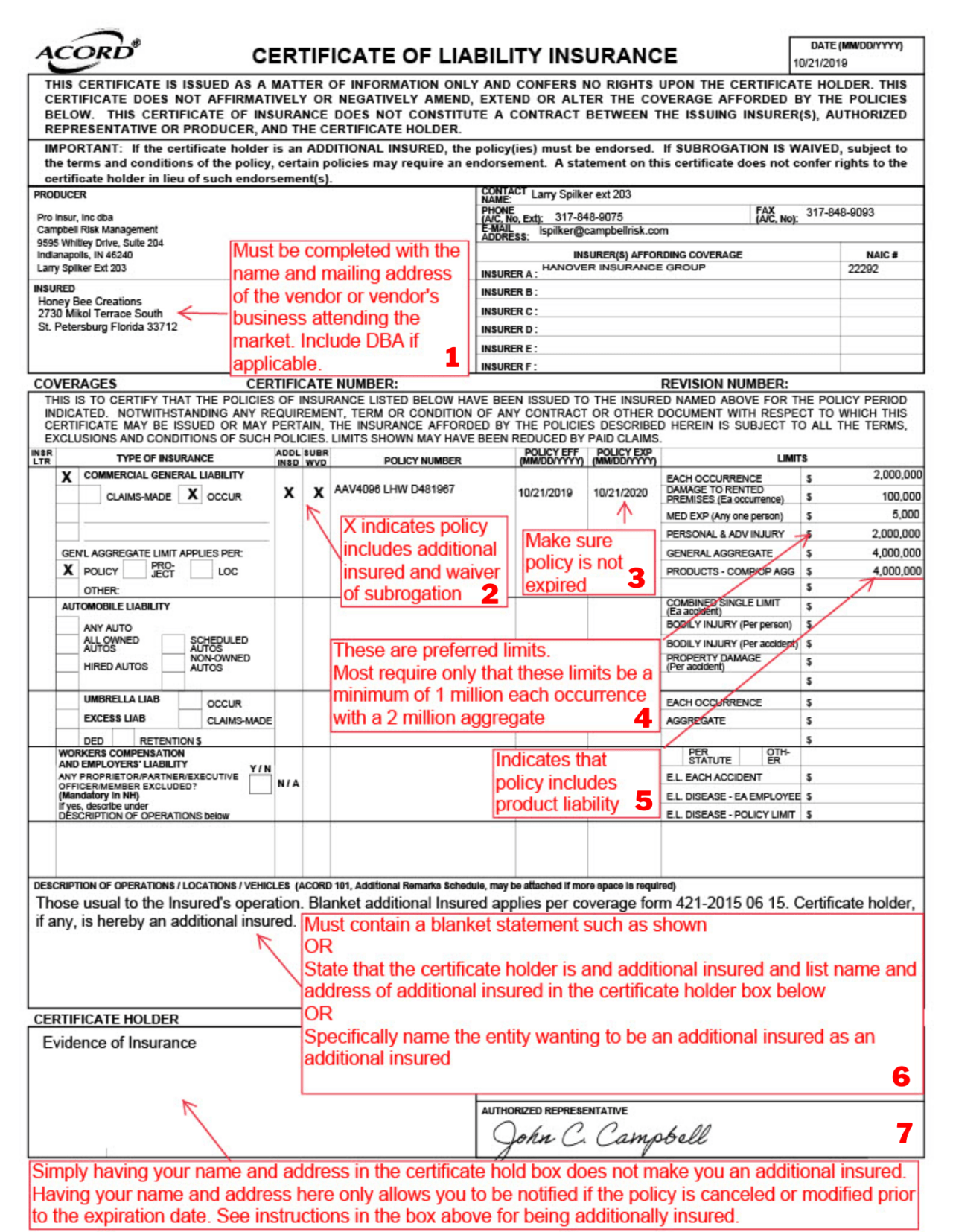

How to Read Your Certificate of Liability Insurance Campbell Risk

Geico can help small business owners and contractors get the coverage they need with a general liability. By understanding the various types of liability insurance, considering key factors when selecting coverage, and implementing strategies to minimize liability risks, businesses can protect their financial stability and ensure. Liability coverage comes standard with most vehicle and property insurance policies, including auto and..

Auto Liability Insurance What is it & Why You Need it!

Liability insurance is an insurance product that provides protection against claims resulting from injuries and damage to other people or property. Liability coverage is a type of insurance that provides financial protection to an individual or business if they are found legally responsible for causing harm or damage to another person or their property. Liability coverage comes standard with most.

Limit of Liability What you should know Insurance Dictionary by

Liability insurance is an insurance product that provides protection against claims resulting from injuries and damage to other people or property. Liability insurance coverage protects you financially if you're responsible for someone else's injuries or property damage. Get a business liability insurance policy for protection from bodily injuries, medical payments, advertising injuries, and more. By understanding the various types of.

Liability coverage protects you if you injure or kill someone or damage

By understanding the various types of liability insurance, considering key factors when selecting coverage, and implementing strategies to minimize liability risks, businesses can protect their financial stability and ensure. Liability coverage comes standard with most vehicle and property insurance policies, including auto and. Liability insurance is an insurance product that provides protection against claims resulting from injuries and damage to.

Employers’ Liability Insurance explained Small Business UK

By understanding the various types of liability insurance, considering key factors when selecting coverage, and implementing strategies to minimize liability risks, businesses can protect their financial stability and ensure. Liability insurance is an insurance product that provides protection against claims resulting from injuries and damage to other people or property. Liability insurance coverage protects you financially if you're responsible for.

All the Different Types of Car Insurance Coverage & Policies Explained

Get a business liability insurance policy for protection from bodily injuries, medical payments, advertising injuries, and more. Liability insurance coverage protects you financially if you're responsible for someone else's injuries or property damage. Liability coverage comes standard with most vehicle and property insurance policies, including auto and. Liability coverage is a type of insurance that provides financial protection to an.

What Is General Liability Insurance and How Much Does It Cost?

Geico can help small business owners and contractors get the coverage they need with a general liability. Liability coverage comes standard with most vehicle and property insurance policies, including auto and. Liability coverage is a type of insurance that provides financial protection to an individual or business if they are found legally responsible for causing harm or damage to another.

General Liability and Professional Liability Insurance

Liability coverage is a type of insurance that provides financial protection to an individual or business if they are found legally responsible for causing harm or damage to another person or their property. Liability insurance coverage protects you financially if you're responsible for someone else's injuries or property damage. Liability coverage comes standard with most vehicle and property insurance policies,.

What Is Liability Insurance? Allstate

Get a business liability insurance policy for protection from bodily injuries, medical payments, advertising injuries, and more. Liability coverage comes standard with most vehicle and property insurance policies, including auto and. Liability insurance coverage protects you financially if you're responsible for someone else's injuries or property damage. Liability coverage is a type of insurance that provides financial protection to an.

Liability Coverage Is A Type Of Insurance That Provides Financial Protection To An Individual Or Business If They Are Found Legally Responsible For Causing Harm Or Damage To Another Person Or Their Property.

Liability insurance coverage protects you financially if you're responsible for someone else's injuries or property damage. Liability coverage comes standard with most vehicle and property insurance policies, including auto and. Geico can help small business owners and contractors get the coverage they need with a general liability. Liability insurance is an insurance product that provides protection against claims resulting from injuries and damage to other people or property.

By Understanding The Various Types Of Liability Insurance, Considering Key Factors When Selecting Coverage, And Implementing Strategies To Minimize Liability Risks, Businesses Can Protect Their Financial Stability And Ensure.

Get a business liability insurance policy for protection from bodily injuries, medical payments, advertising injuries, and more.

.png/690aeaf3-b1a6-df76-ef4a-aa219024e6e4?imagePreview=1)