Local Business Tax

Local Business Tax - Pte ltd) find out when you. To pay your local business tax online as a renewal, you will need to provide your receipt number. Singapore’s corporate income tax rate is 17%. As gst is a tax on local consumption in singapore, it should apply to all goods and services consumed in the country, whether the services are obtained from local or overseas. Companies that have employed at least one local employee in 2023 (referred to as “local employee condition”) will receive $2,000 in cash payout (referred to as “cit rebate cash grant”). There are essential tax and compliance rules that every business in singapore needs to know, depending on your business structure. Your company has to file 2 corporate income tax returns with iras every year:

Companies that have employed at least one local employee in 2023 (referred to as “local employee condition”) will receive $2,000 in cash payout (referred to as “cit rebate cash grant”). Singapore’s corporate income tax rate is 17%. There are essential tax and compliance rules that every business in singapore needs to know, depending on your business structure. As gst is a tax on local consumption in singapore, it should apply to all goods and services consumed in the country, whether the services are obtained from local or overseas. To pay your local business tax online as a renewal, you will need to provide your receipt number. Your company has to file 2 corporate income tax returns with iras every year: Pte ltd) find out when you.

As gst is a tax on local consumption in singapore, it should apply to all goods and services consumed in the country, whether the services are obtained from local or overseas. Companies that have employed at least one local employee in 2023 (referred to as “local employee condition”) will receive $2,000 in cash payout (referred to as “cit rebate cash grant”). To pay your local business tax online as a renewal, you will need to provide your receipt number. Pte ltd) find out when you. Your company has to file 2 corporate income tax returns with iras every year: There are essential tax and compliance rules that every business in singapore needs to know, depending on your business structure. Singapore’s corporate income tax rate is 17%.

Tax Preparation Business Startup

To pay your local business tax online as a renewal, you will need to provide your receipt number. Pte ltd) find out when you. There are essential tax and compliance rules that every business in singapore needs to know, depending on your business structure. Your company has to file 2 corporate income tax returns with iras every year: Companies that.

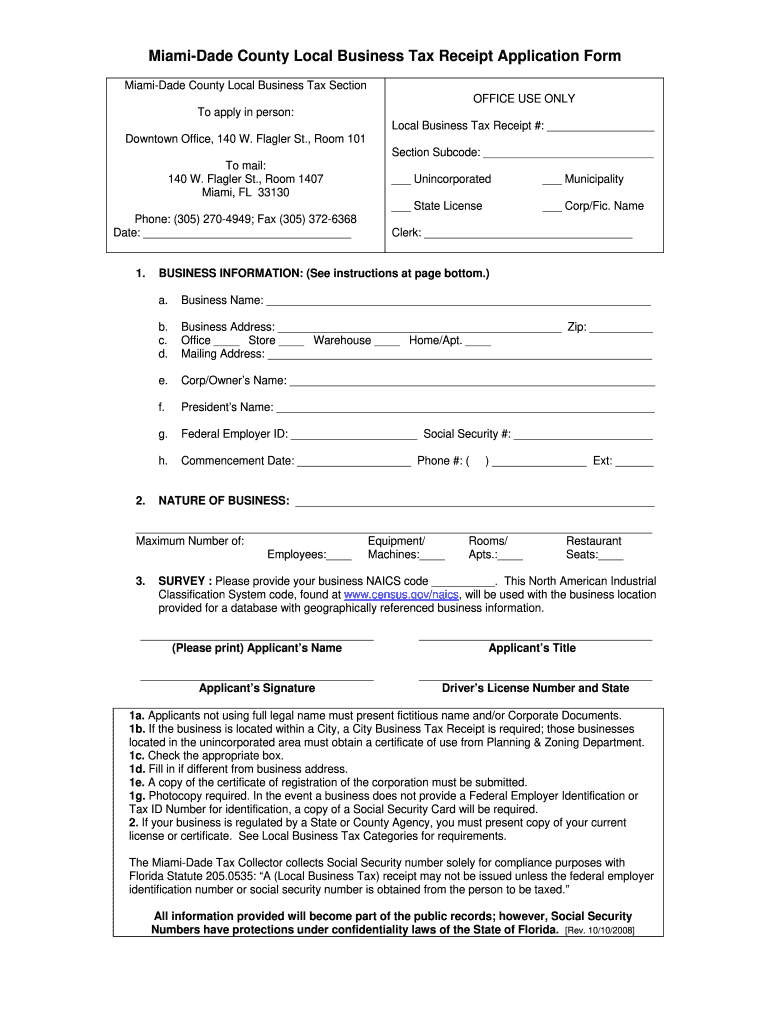

2008 FL Local Business Tax Receipt Application Form MiamiDade County

As gst is a tax on local consumption in singapore, it should apply to all goods and services consumed in the country, whether the services are obtained from local or overseas. To pay your local business tax online as a renewal, you will need to provide your receipt number. Companies that have employed at least one local employee in 2023.

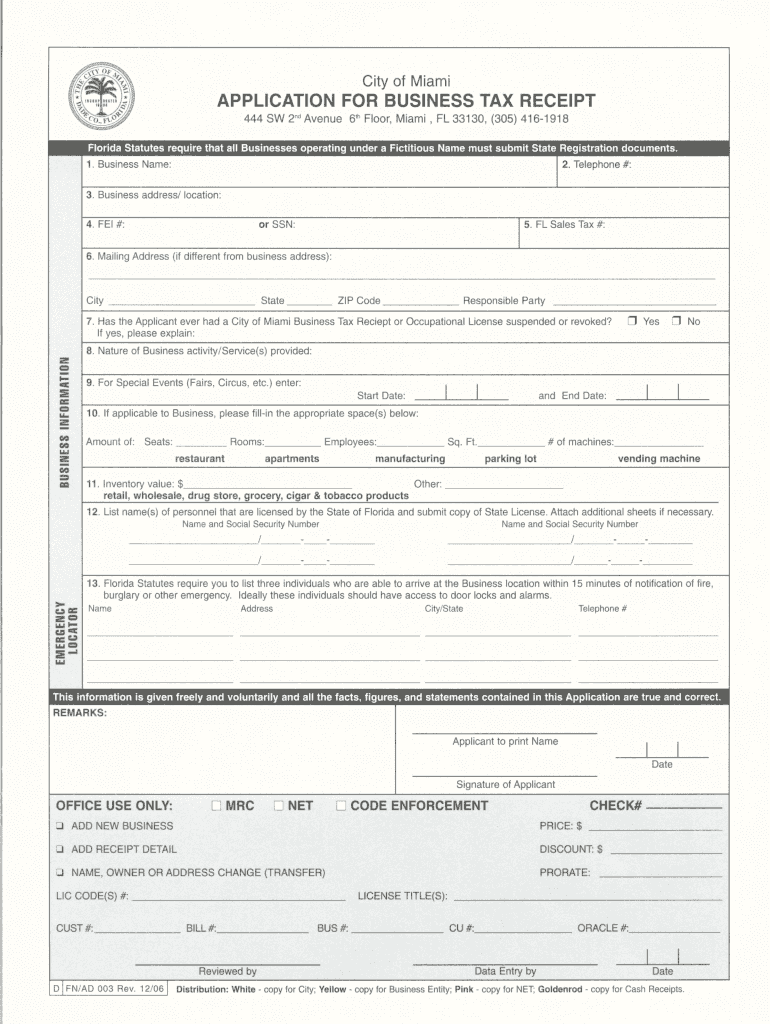

Application For Local Business Tax Receipt Application For Local

Singapore’s corporate income tax rate is 17%. Companies that have employed at least one local employee in 2023 (referred to as “local employee condition”) will receive $2,000 in cash payout (referred to as “cit rebate cash grant”). Your company has to file 2 corporate income tax returns with iras every year: As gst is a tax on local consumption in.

Know More About Local Tax Mission and Goals for Our Clients

To pay your local business tax online as a renewal, you will need to provide your receipt number. Singapore’s corporate income tax rate is 17%. As gst is a tax on local consumption in singapore, it should apply to all goods and services consumed in the country, whether the services are obtained from local or overseas. There are essential tax.

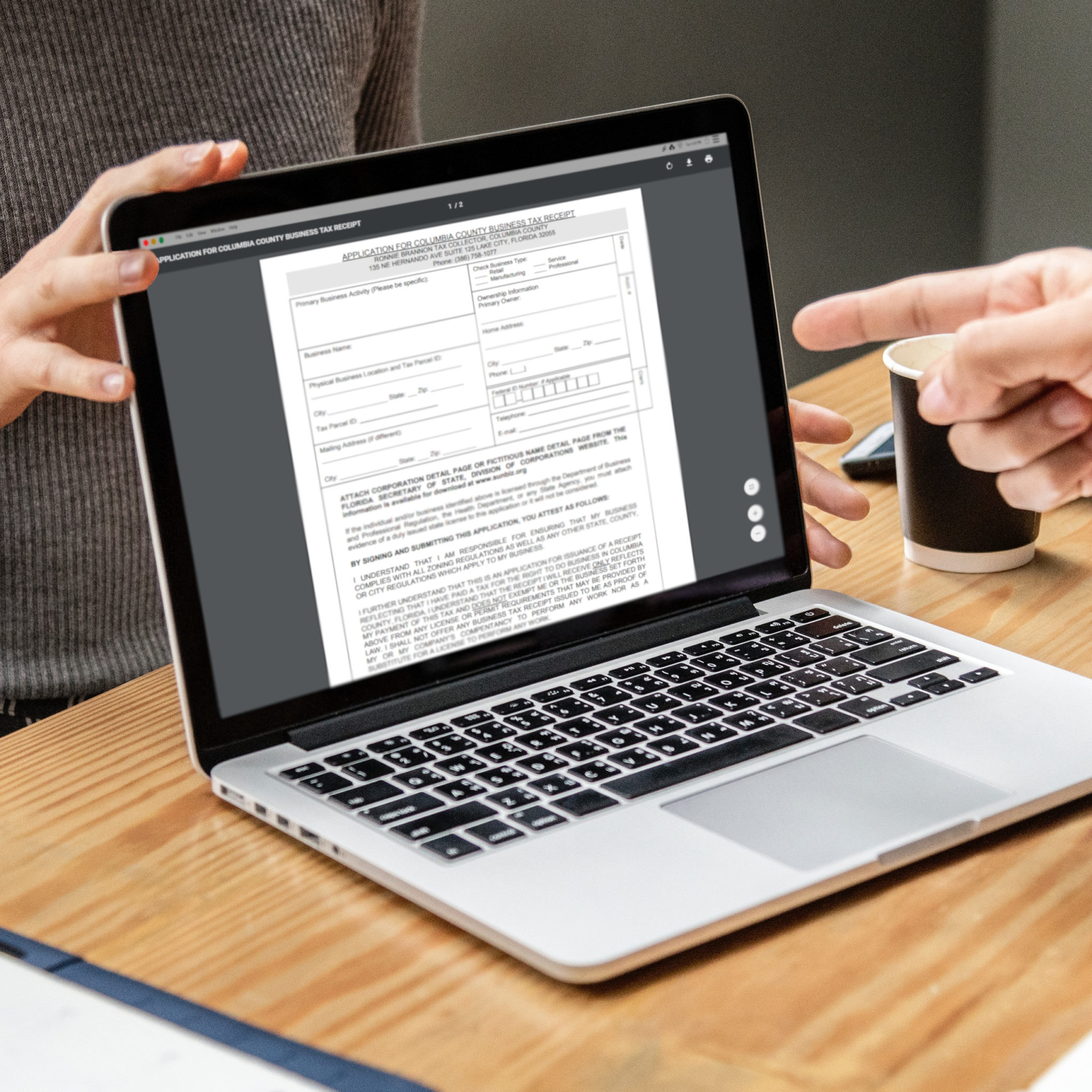

How to Register for Your Florida County's Annual Local Business Tax Receipt

Singapore’s corporate income tax rate is 17%. Your company has to file 2 corporate income tax returns with iras every year: Pte ltd) find out when you. Companies that have employed at least one local employee in 2023 (referred to as “local employee condition”) will receive $2,000 in cash payout (referred to as “cit rebate cash grant”). As gst is.

Local Tax is Shown on the Conceptual Business Photo Stock Image Image

To pay your local business tax online as a renewal, you will need to provide your receipt number. Companies that have employed at least one local employee in 2023 (referred to as “local employee condition”) will receive $2,000 in cash payout (referred to as “cit rebate cash grant”). Pte ltd) find out when you. Singapore’s corporate income tax rate is.

City Of Orlando Local Business Tax Receipt Renewal Business Walls

Companies that have employed at least one local employee in 2023 (referred to as “local employee condition”) will receive $2,000 in cash payout (referred to as “cit rebate cash grant”). Singapore’s corporate income tax rate is 17%. As gst is a tax on local consumption in singapore, it should apply to all goods and services consumed in the country, whether.

Tax Prep Fraim, Cawley & Company, CPAs

Your company has to file 2 corporate income tax returns with iras every year: Pte ltd) find out when you. Companies that have employed at least one local employee in 2023 (referred to as “local employee condition”) will receive $2,000 in cash payout (referred to as “cit rebate cash grant”). There are essential tax and compliance rules that every business.

Business Tax Receipts Monroe County Tax Collector

As gst is a tax on local consumption in singapore, it should apply to all goods and services consumed in the country, whether the services are obtained from local or overseas. There are essential tax and compliance rules that every business in singapore needs to know, depending on your business structure. Companies that have employed at least one local employee.

Local Business Tax Receipts what are they and when are they renewed

There are essential tax and compliance rules that every business in singapore needs to know, depending on your business structure. Pte ltd) find out when you. To pay your local business tax online as a renewal, you will need to provide your receipt number. Singapore’s corporate income tax rate is 17%. Companies that have employed at least one local employee.

To Pay Your Local Business Tax Online As A Renewal, You Will Need To Provide Your Receipt Number.

Companies that have employed at least one local employee in 2023 (referred to as “local employee condition”) will receive $2,000 in cash payout (referred to as “cit rebate cash grant”). Singapore’s corporate income tax rate is 17%. As gst is a tax on local consumption in singapore, it should apply to all goods and services consumed in the country, whether the services are obtained from local or overseas. Pte ltd) find out when you.

Your Company Has To File 2 Corporate Income Tax Returns With Iras Every Year:

There are essential tax and compliance rules that every business in singapore needs to know, depending on your business structure.