Local Income Tax Pennsylvania York

Local Income Tax Pennsylvania York - We have information on the local income tax rates in 12 localities in pennsylvania. The york adams tax bureau collects and distributes earned income tax for 124 municipalities and school districts in york and. Employers with worksites located in pennsylvania are required. Residents of york pay a flat city income tax of 1.00% on earned income, in addition to the pennsylvania income tax and the federal. The first two (2) digits of a psd code represent the tax. Dced local government services act 32: View and sort psd codes & eit rates by county, municipality, and school district. You can click on any city or county for more details, including.

You can click on any city or county for more details, including. Employers with worksites located in pennsylvania are required. We have information on the local income tax rates in 12 localities in pennsylvania. Dced local government services act 32: The first two (2) digits of a psd code represent the tax. The york adams tax bureau collects and distributes earned income tax for 124 municipalities and school districts in york and. Residents of york pay a flat city income tax of 1.00% on earned income, in addition to the pennsylvania income tax and the federal. View and sort psd codes & eit rates by county, municipality, and school district.

View and sort psd codes & eit rates by county, municipality, and school district. You can click on any city or county for more details, including. The york adams tax bureau collects and distributes earned income tax for 124 municipalities and school districts in york and. Residents of york pay a flat city income tax of 1.00% on earned income, in addition to the pennsylvania income tax and the federal. Employers with worksites located in pennsylvania are required. Dced local government services act 32: The first two (2) digits of a psd code represent the tax. We have information on the local income tax rates in 12 localities in pennsylvania.

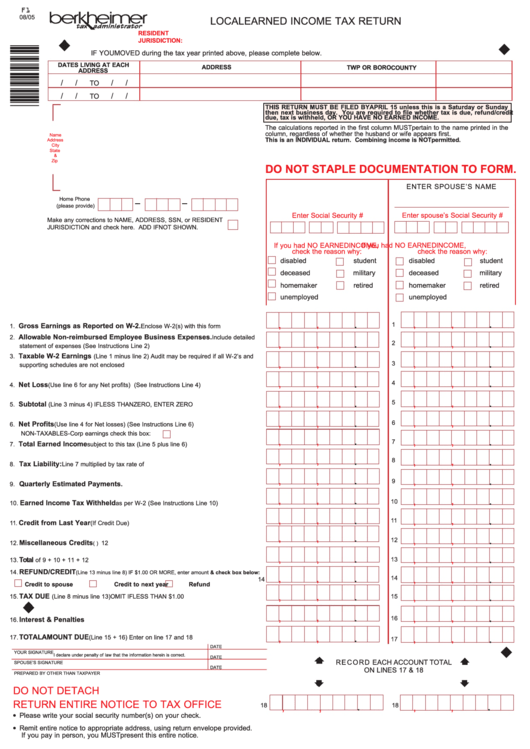

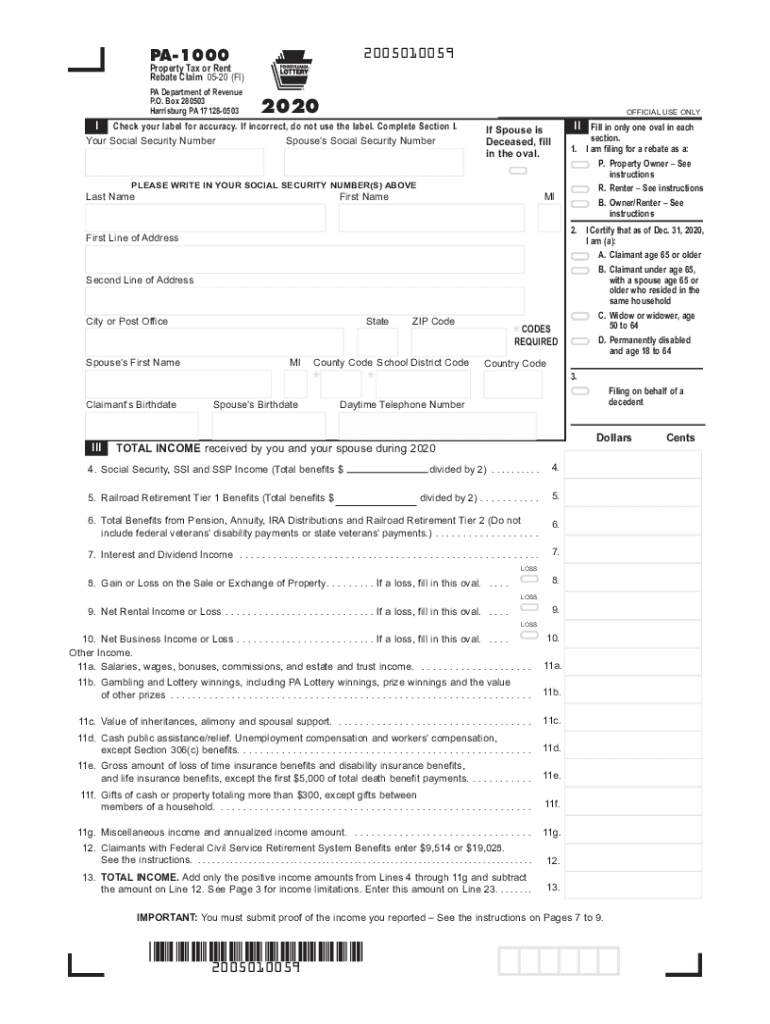

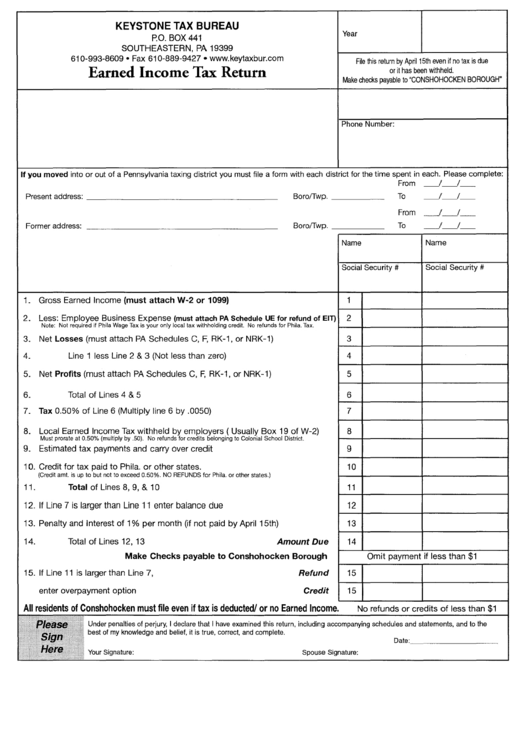

Fillable Online Local Earned Tax Return Form Fax Email Print

Dced local government services act 32: The york adams tax bureau collects and distributes earned income tax for 124 municipalities and school districts in york and. View and sort psd codes & eit rates by county, municipality, and school district. Residents of york pay a flat city income tax of 1.00% on earned income, in addition to the pennsylvania income.

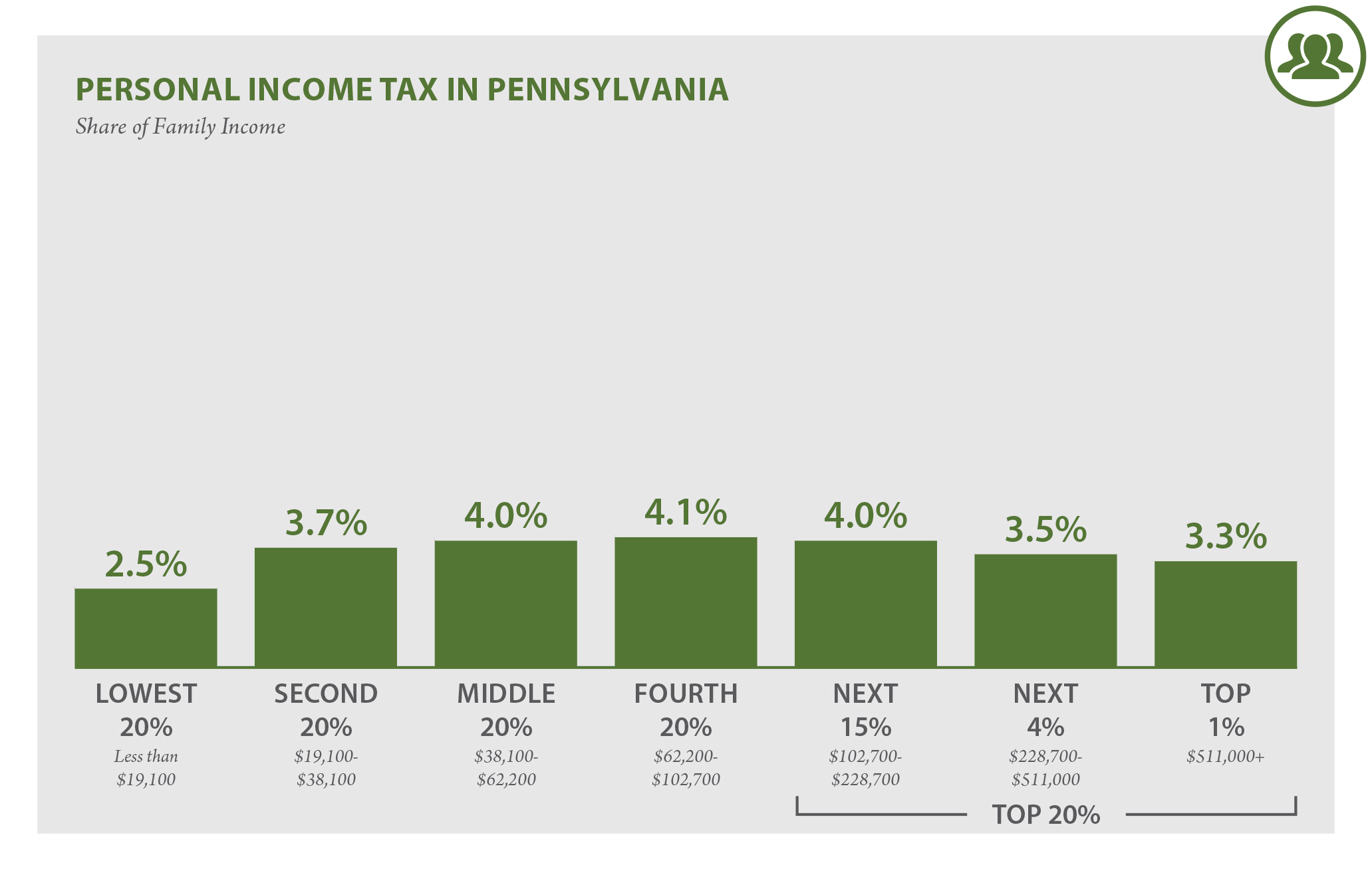

Pennsylvania Who Pays? 6th Edition ITEP

We have information on the local income tax rates in 12 localities in pennsylvania. The york adams tax bureau collects and distributes earned income tax for 124 municipalities and school districts in york and. You can click on any city or county for more details, including. View and sort psd codes & eit rates by county, municipality, and school district..

Pennsylvania State Tax 2024 2025

Employers with worksites located in pennsylvania are required. The york adams tax bureau collects and distributes earned income tax for 124 municipalities and school districts in york and. You can click on any city or county for more details, including. Residents of york pay a flat city income tax of 1.00% on earned income, in addition to the pennsylvania income.

Pennsylvania Tax

We have information on the local income tax rates in 12 localities in pennsylvania. Residents of york pay a flat city income tax of 1.00% on earned income, in addition to the pennsylvania income tax and the federal. Dced local government services act 32: The first two (2) digits of a psd code represent the tax. View and sort psd.

Fillable Local Earned Tax Form Pa Printable Forms Free Online

We have information on the local income tax rates in 12 localities in pennsylvania. Employers with worksites located in pennsylvania are required. View and sort psd codes & eit rates by county, municipality, and school district. Dced local government services act 32: Residents of york pay a flat city income tax of 1.00% on earned income, in addition to the.

Pennsylvania personal tax returns deadline extended

Dced local government services act 32: The york adams tax bureau collects and distributes earned income tax for 124 municipalities and school districts in york and. The first two (2) digits of a psd code represent the tax. View and sort psd codes & eit rates by county, municipality, and school district. You can click on any city or county.

Form F1 Local Earned Tax Return Pennsylvania printable pdf

You can click on any city or county for more details, including. Employers with worksites located in pennsylvania are required. View and sort psd codes & eit rates by county, municipality, and school district. Residents of york pay a flat city income tax of 1.00% on earned income, in addition to the pennsylvania income tax and the federal. The first.

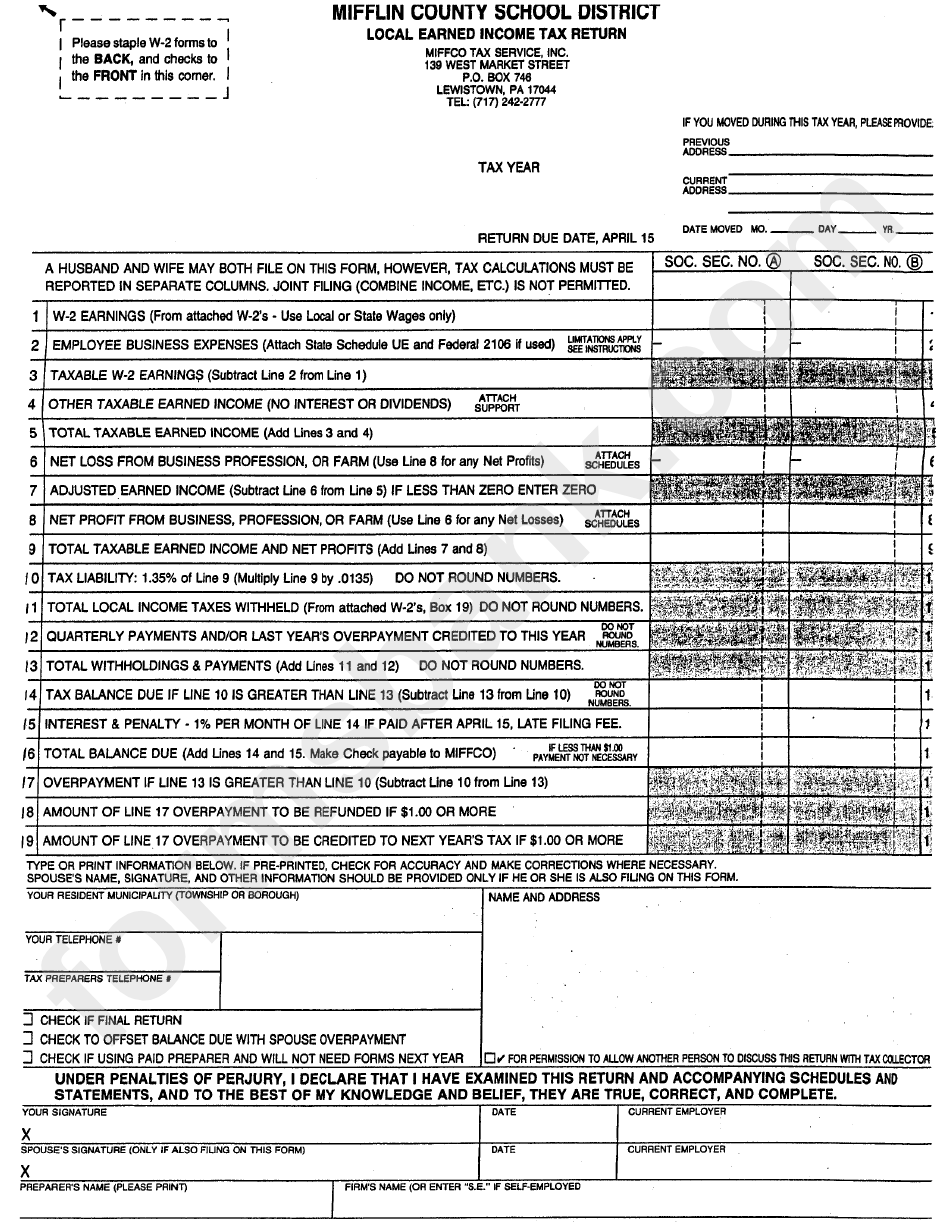

Local Earned Tax Return Form Pennsylvania Mifflin County

We have information on the local income tax rates in 12 localities in pennsylvania. You can click on any city or county for more details, including. Employers with worksites located in pennsylvania are required. Residents of york pay a flat city income tax of 1.00% on earned income, in addition to the pennsylvania income tax and the federal. Dced local.

Export Pa Local Tax at Eleanor Redd blog

We have information on the local income tax rates in 12 localities in pennsylvania. View and sort psd codes & eit rates by county, municipality, and school district. You can click on any city or county for more details, including. Employers with worksites located in pennsylvania are required. Dced local government services act 32:

Earned Tax Return Form Pennsylvania printable pdf download

Employers with worksites located in pennsylvania are required. View and sort psd codes & eit rates by county, municipality, and school district. The first two (2) digits of a psd code represent the tax. Dced local government services act 32: We have information on the local income tax rates in 12 localities in pennsylvania.

The First Two (2) Digits Of A Psd Code Represent The Tax.

View and sort psd codes & eit rates by county, municipality, and school district. The york adams tax bureau collects and distributes earned income tax for 124 municipalities and school districts in york and. Employers with worksites located in pennsylvania are required. We have information on the local income tax rates in 12 localities in pennsylvania.

Dced Local Government Services Act 32:

Residents of york pay a flat city income tax of 1.00% on earned income, in addition to the pennsylvania income tax and the federal. You can click on any city or county for more details, including.