Local Sales Tax Washington

Local Sales Tax Washington - 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. You’ll find rates for sales and use tax, motor. The state of washington imposes a 6.5% sales tax on all retail sales as defined by statute (rcw 82.08.020). Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. Updates and tax rate liability for technical questions about searching for your address or improving the results, contact the gis team.

Use our tax rate lookup tool to find tax rates and location codes for any location in washington. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. The state of washington imposes a 6.5% sales tax on all retail sales as defined by statute (rcw 82.08.020). Updates and tax rate liability for technical questions about searching for your address or improving the results, contact the gis team. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. You’ll find rates for sales and use tax, motor.

You’ll find rates for sales and use tax, motor. Updates and tax rate liability for technical questions about searching for your address or improving the results, contact the gis team. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. The state of washington imposes a 6.5% sales tax on all retail sales as defined by statute (rcw 82.08.020). 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and.

Total Sales Tax Rate Washington 2024 Jonie Magdaia

Use our tax rate lookup tool to find tax rates and location codes for any location in washington. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. You’ll find rates for sales and use tax, motor. The state of washington imposes a 6.5% sales tax.

Tax Foundation Washington has nation's 4th highest combined state

Use our tax rate lookup tool to find tax rates and location codes for any location in washington. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. You’ll find rates for sales and use tax, motor. Updates and tax rate liability for technical questions about.

Ultimate Washington Sales Tax Guide Zamp

Use our tax rate lookup tool to find tax rates and location codes for any location in washington. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. The state of washington imposes a 6.5% sales tax on all retail sales as defined by statute (rcw.

Tax Foundation Washington state/local sales tax ranks 4th in the

Updates and tax rate liability for technical questions about searching for your address or improving the results, contact the gis team. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of.

State and Local Sales Tax Rates Midyear 2013 Tax Foundation

Use our tax rate lookup tool to find tax rates and location codes for any location in washington. The state of washington imposes a 6.5% sales tax on all retail sales as defined by statute (rcw 82.08.020). 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to.

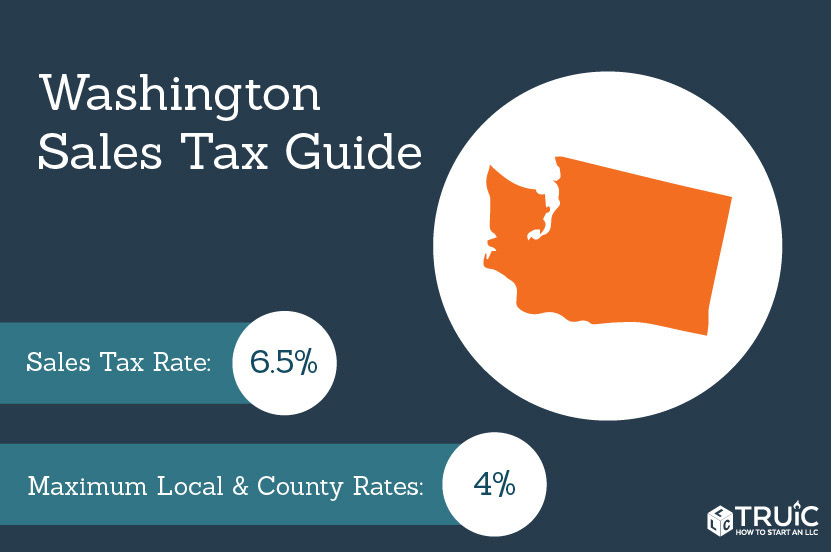

Washington Sales Tax Small Business Guide TRUiC

The state of washington imposes a 6.5% sales tax on all retail sales as defined by statute (rcw 82.08.020). Use our tax rate lookup tool to find tax rates and location codes for any location in washington. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and..

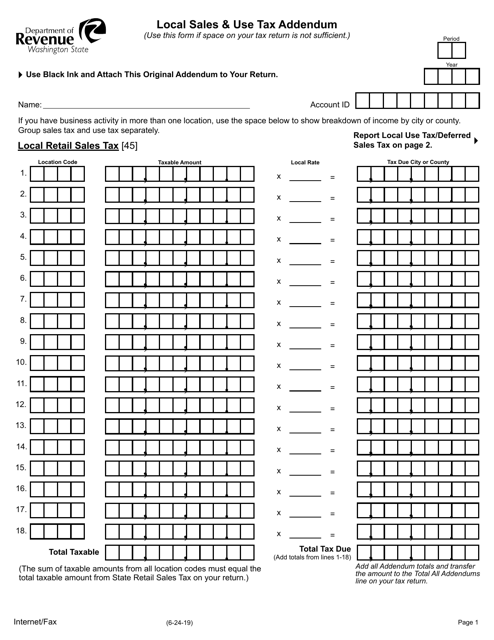

Washington Local Sales & Use Tax Addendum Fill Out, Sign Online and

The state of washington imposes a 6.5% sales tax on all retail sales as defined by statute (rcw 82.08.020). Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. You’ll find rates for sales and use tax, motor. Use our tax rate lookup tool to find tax.

Washington Car Sales Tax!

Updates and tax rate liability for technical questions about searching for your address or improving the results, contact the gis team. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. You’ll find rates for sales and use tax, motor. Use our tax rate lookup tool.

Tax Sales Carroll County Tax Commissioner

The state of washington imposes a 6.5% sales tax on all retail sales as defined by statute (rcw 82.08.020). Use our tax rate lookup tool to find tax rates and location codes for any location in washington. You’ll find rates for sales and use tax, motor. 536 rows washington has state sales tax of 6.5%, and allows local governments to.

Washington ranks highest in nation for reliance on sales tax 790 KGMI

You’ll find rates for sales and use tax, motor. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. The state of washington imposes a 6.5% sales tax on all retail sales as defined by statute (rcw 82.08.020). Updates and tax rate liability for technical questions.

Lists Of Local Sales & Use Tax Rates And Changes, As Well As Information For Lodging Sales, Motor Vehicles Sales Or Leases, And.

You’ll find rates for sales and use tax, motor. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. The state of washington imposes a 6.5% sales tax on all retail sales as defined by statute (rcw 82.08.020). 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%.

.png)