Local State Tax Rate Texas

Local State Tax Rate Texas - If you have questions about local sales and use tax rate information,. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. In the tabs below, discover new map and latitude/longitude search options alongside the. If you cannot find the tax rate for the address you've entered, or if you received an error message or have a technical question, contact. View the printable version of city rates (pdf). Welcome to the new sales tax rate locator. The state sales tax rate in texas is 6.250%. With local taxes, the total sales tax rate is between 6.250% and 8.250%.

If you have questions about local sales and use tax rate information,. With local taxes, the total sales tax rate is between 6.250% and 8.250%. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. The state sales tax rate in texas is 6.250%. View the printable version of city rates (pdf). In the tabs below, discover new map and latitude/longitude search options alongside the. If you cannot find the tax rate for the address you've entered, or if you received an error message or have a technical question, contact. Welcome to the new sales tax rate locator.

View the printable version of city rates (pdf). If you have questions about local sales and use tax rate information,. With local taxes, the total sales tax rate is between 6.250% and 8.250%. The state sales tax rate in texas is 6.250%. In the tabs below, discover new map and latitude/longitude search options alongside the. Welcome to the new sales tax rate locator. If you cannot find the tax rate for the address you've entered, or if you received an error message or have a technical question, contact. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services.

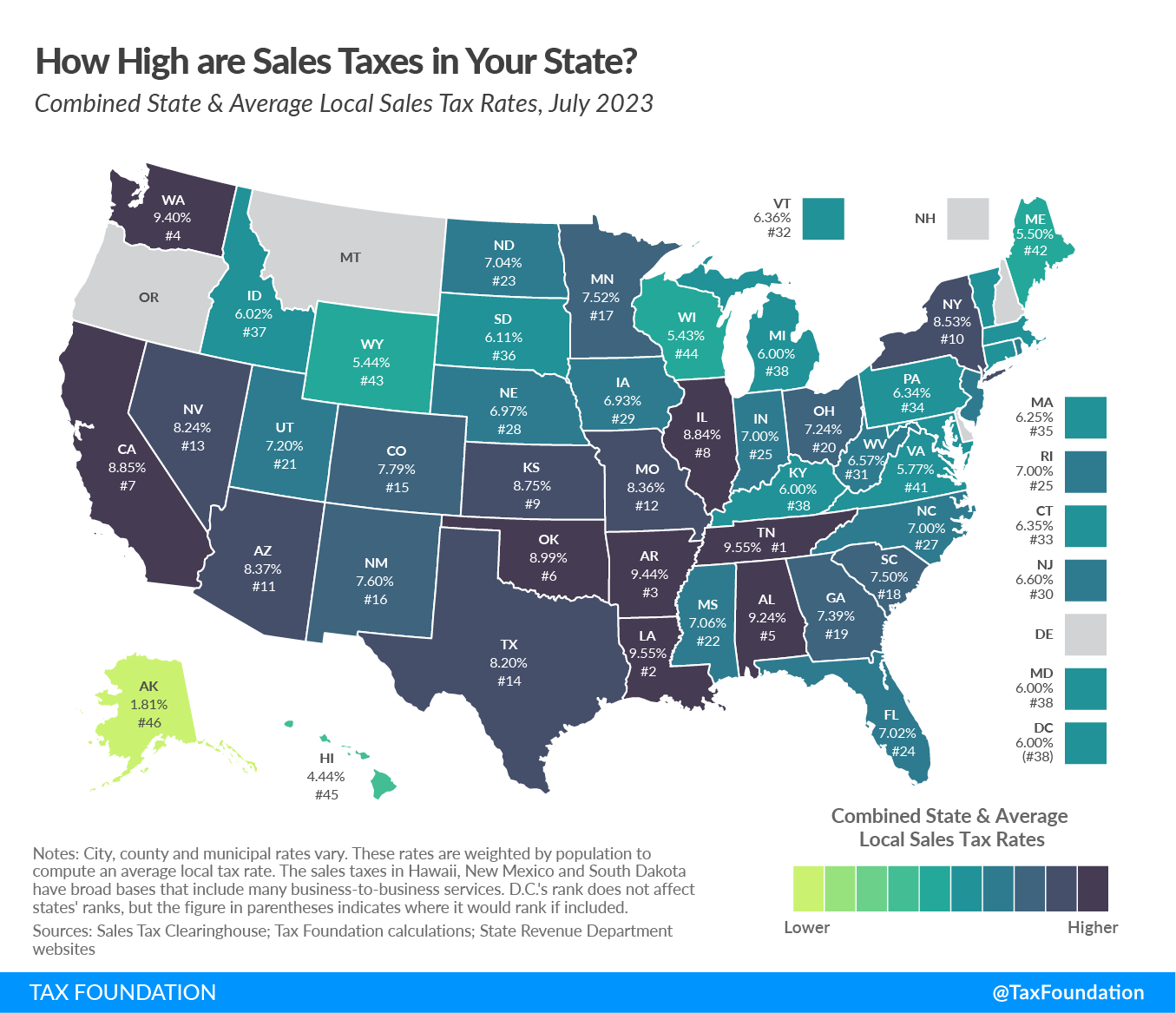

Monday Map Combined State and Local Sales Tax Rates

The state sales tax rate in texas is 6.250%. If you have questions about local sales and use tax rate information,. If you cannot find the tax rate for the address you've entered, or if you received an error message or have a technical question, contact. In the tabs below, discover new map and latitude/longitude search options alongside the. With.

How Liberals Explain the Decision to Leave California WSJ

With local taxes, the total sales tax rate is between 6.250% and 8.250%. In the tabs below, discover new map and latitude/longitude search options alongside the. If you have questions about local sales and use tax rate information,. View the printable version of city rates (pdf). If you cannot find the tax rate for the address you've entered, or if.

Effective State Tax Rate at Various Household Levels by State

With local taxes, the total sales tax rate is between 6.250% and 8.250%. In the tabs below, discover new map and latitude/longitude search options alongside the. Welcome to the new sales tax rate locator. The state sales tax rate in texas is 6.250%. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals.

State and Local Sales Tax Rates Sales Taxes Tax Foundation

View the printable version of city rates (pdf). If you have questions about local sales and use tax rate information,. In the tabs below, discover new map and latitude/longitude search options alongside the. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. The state.

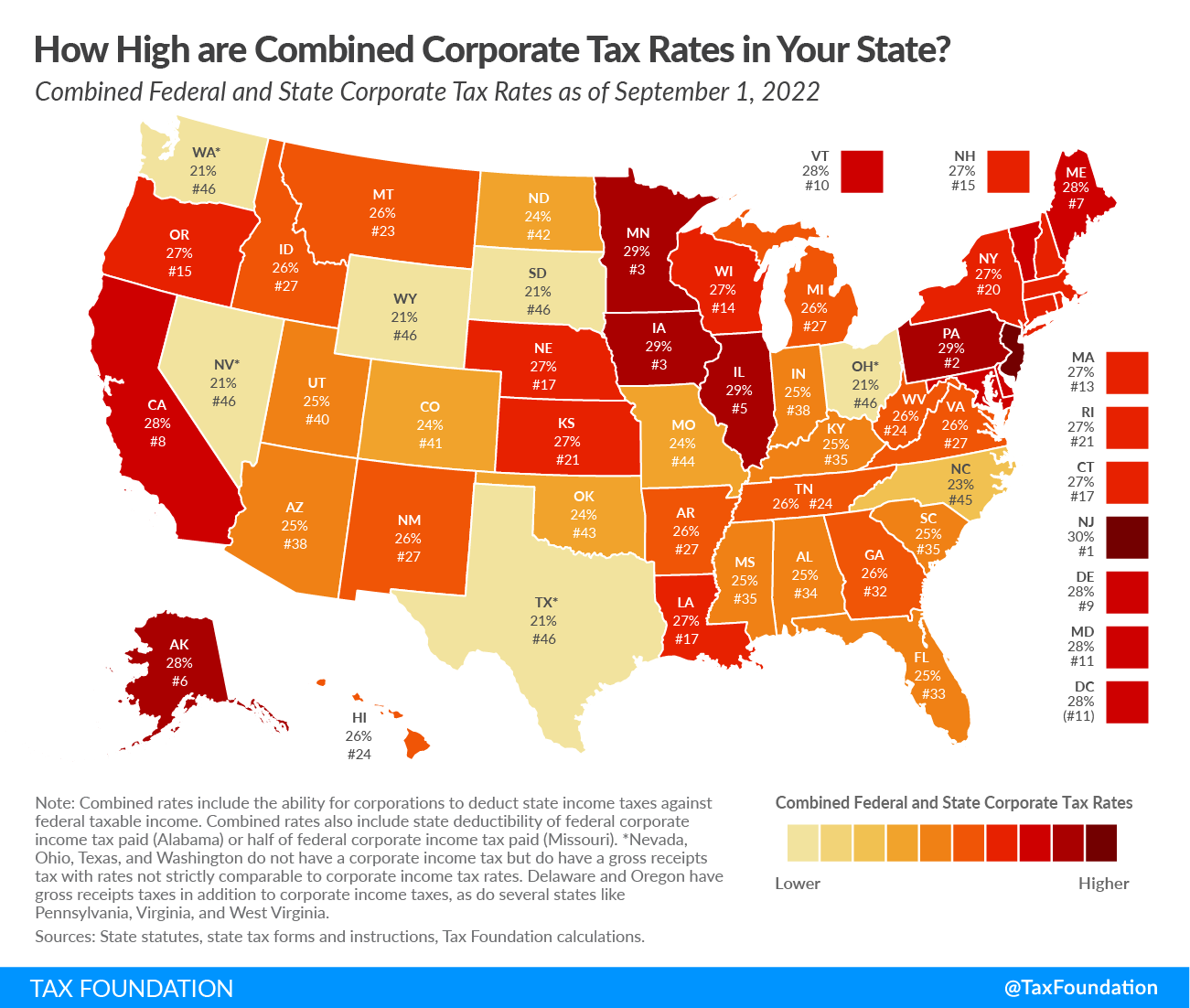

How High are Combined Corporate Tax Rates in Your State? Tax

View the printable version of city rates (pdf). In the tabs below, discover new map and latitude/longitude search options alongside the. With local taxes, the total sales tax rate is between 6.250% and 8.250%. If you have questions about local sales and use tax rate information,. The state sales tax rate in texas is 6.250%.

2024 State Corporate Tax Rates & Brackets

Welcome to the new sales tax rate locator. If you cannot find the tax rate for the address you've entered, or if you received an error message or have a technical question, contact. With local taxes, the total sales tax rate is between 6.250% and 8.250%. View the printable version of city rates (pdf). In the tabs below, discover new.

State Corporate Tax Rates and Brackets for 2023 CashReview

The state sales tax rate in texas is 6.250%. If you have questions about local sales and use tax rate information,. In the tabs below, discover new map and latitude/longitude search options alongside the. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. With.

How to Solve Clients’ Sales Tax Compliance Headaches with Smart

In the tabs below, discover new map and latitude/longitude search options alongside the. If you have questions about local sales and use tax rate information,. View the printable version of city rates (pdf). The state sales tax rate in texas is 6.250%. With local taxes, the total sales tax rate is between 6.250% and 8.250%.

State And Local Sales Tax Rates Midyear 2013 Tax Foundation Texas

In the tabs below, discover new map and latitude/longitude search options alongside the. The state sales tax rate in texas is 6.250%. View the printable version of city rates (pdf). If you cannot find the tax rate for the address you've entered, or if you received an error message or have a technical question, contact. Texas imposes a 6.25 percent.

taxes scolaires granby

If you cannot find the tax rate for the address you've entered, or if you received an error message or have a technical question, contact. In the tabs below, discover new map and latitude/longitude search options alongside the. View the printable version of city rates (pdf). With local taxes, the total sales tax rate is between 6.250% and 8.250%. Texas.

In The Tabs Below, Discover New Map And Latitude/Longitude Search Options Alongside The.

With local taxes, the total sales tax rate is between 6.250% and 8.250%. If you cannot find the tax rate for the address you've entered, or if you received an error message or have a technical question, contact. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. The state sales tax rate in texas is 6.250%.

If You Have Questions About Local Sales And Use Tax Rate Information,.

View the printable version of city rates (pdf). Welcome to the new sales tax rate locator.

.png)