Local Tax Definition

Local Tax Definition - A tax levied and collected by a state/province and or municipality. Local taxes are collected in order to fund local government services, but they. Find out the common types of local taxes, such. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Learn what local taxes are, how they work, and the pros and cons of paying them.

Find out the common types of local taxes, such. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. A tax levied and collected by a state/province and or municipality. Learn what local taxes are, how they work, and the pros and cons of paying them. Local taxes are collected in order to fund local government services, but they.

Find out the common types of local taxes, such. Local taxes are collected in order to fund local government services, but they. A tax levied and collected by a state/province and or municipality. Learn what local taxes are, how they work, and the pros and cons of paying them. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities.

State and Local Tax XB4 Tax, Assurance and Advisory Services

Find out the common types of local taxes, such. Local taxes are collected in order to fund local government services, but they. Learn what local taxes are, how they work, and the pros and cons of paying them. A tax levied and collected by a state/province and or municipality. Local tax refers to taxes imposed by local government entities such.

Dad Tax Definition SVG PNG

Local taxes are collected in order to fund local government services, but they. Find out the common types of local taxes, such. Learn what local taxes are, how they work, and the pros and cons of paying them. A tax levied and collected by a state/province and or municipality. Local tax refers to taxes imposed by local government entities such.

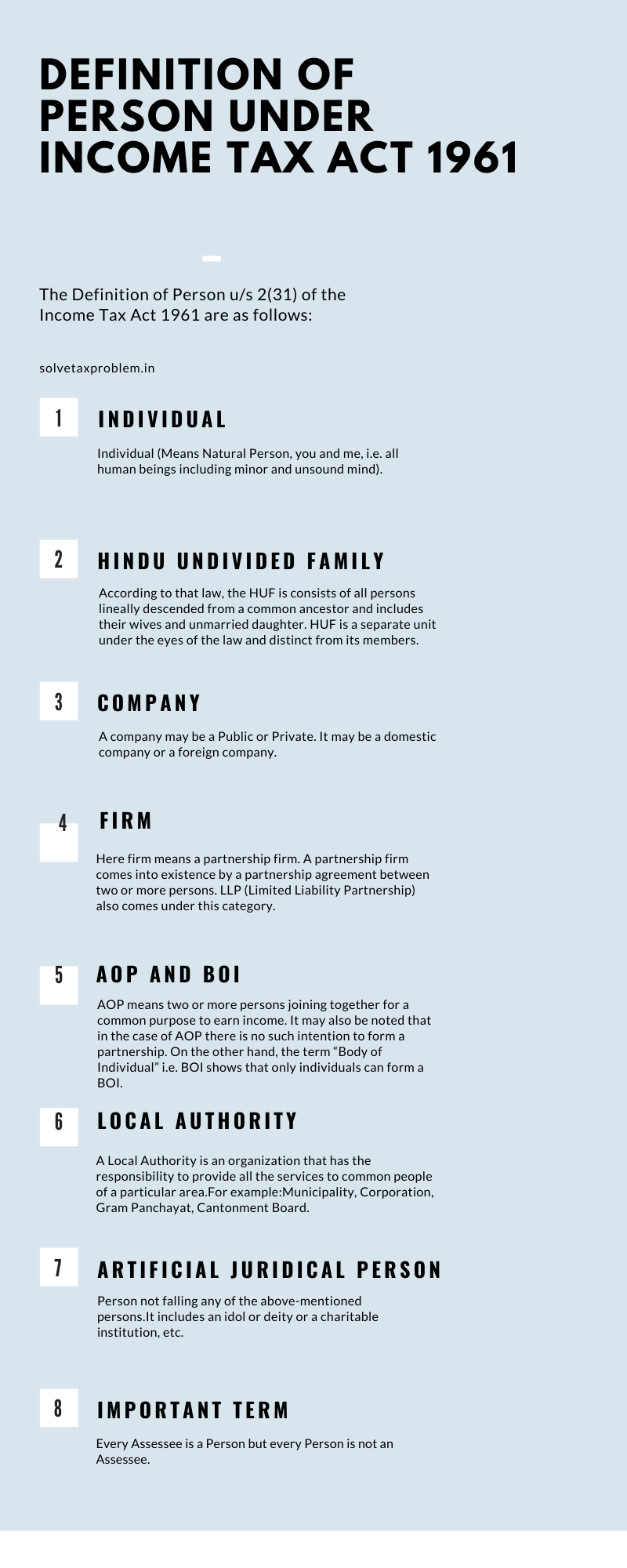

Definition of Person under the Tax Act 1961

Local taxes are collected in order to fund local government services, but they. A tax levied and collected by a state/province and or municipality. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Find out the common types of local taxes, such. Learn what local taxes are, how they work, and the pros.

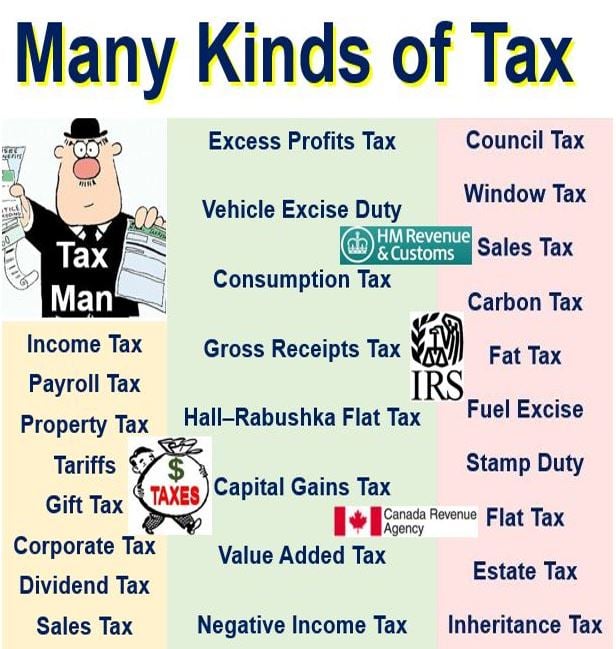

What is tax? Definition and meaning Market Business News

Learn what local taxes are, how they work, and the pros and cons of paying them. Local taxes are collected in order to fund local government services, but they. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. A tax levied and collected by a state/province and or municipality. Find out the common.

Elevated Tax & Accounting ETA always on time Tax & Accounting

Local taxes are collected in order to fund local government services, but they. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Learn what local taxes are, how they work, and the pros and cons of paying them. A tax levied and collected by a state/province and or municipality. Find out the common.

Tax Source Group Inc. Southfield MI

Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Local taxes are collected in order to fund local government services, but they. Learn what local taxes are, how they work, and the pros and cons of paying them. A tax levied and collected by a state/province and or municipality. Find out the common.

What Is A Poll Tax? Definition and Examples

Local taxes are collected in order to fund local government services, but they. Learn what local taxes are, how they work, and the pros and cons of paying them. Find out the common types of local taxes, such. A tax levied and collected by a state/province and or municipality. Local tax refers to taxes imposed by local government entities such.

Moore Tax & Financial Services Goose Creek SC

A tax levied and collected by a state/province and or municipality. Find out the common types of local taxes, such. Learn what local taxes are, how they work, and the pros and cons of paying them. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Local taxes are collected in order to fund.

Tax Preparation Business Startup

Local taxes are collected in order to fund local government services, but they. A tax levied and collected by a state/province and or municipality. Learn what local taxes are, how they work, and the pros and cons of paying them. Find out the common types of local taxes, such. Local tax refers to taxes imposed by local government entities such.

TAX Consultancy Firm Gurugram

Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Learn what local taxes are, how they work, and the pros and cons of paying them. Local taxes are collected in order to fund local government services, but they. A tax levied and collected by a state/province and or municipality. Find out the common.

Local Taxes Are Collected In Order To Fund Local Government Services, But They.

Learn what local taxes are, how they work, and the pros and cons of paying them. Find out the common types of local taxes, such. A tax levied and collected by a state/province and or municipality. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities.

:max_bytes(150000):strip_icc()/GettyImages-1397583930-d9e9db90bb514baa8223f83eac648aae.jpg)