Local Tax Withholding In Pennsylvania

Local Tax Withholding In Pennsylvania - Employers with worksites located in pennsylvania are required to withhold and remit the local. Employers with worksites located in pennsylvania are required. Pennsylvania department of community & economic development governor's center for local government services 400 north street,. Commonwealth of pennsylvania government websites and email systems use. Local income tax requirements for employers. Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Dced local government services act 32: Local, state, and federal government websites often end in.gov.

You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Local income tax requirements for employers. Employers with worksites located in pennsylvania are required. Pennsylvania department of community & economic development governor's center for local government services 400 north street,. Commonwealth of pennsylvania government websites and email systems use. Employers with worksites located in pennsylvania are required to withhold and remit the local. Dced local government services act 32: Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. Local, state, and federal government websites often end in.gov.

You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Employers with worksites located in pennsylvania are required to withhold and remit the local. Employers with worksites located in pennsylvania are required. Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. Local, state, and federal government websites often end in.gov. Commonwealth of pennsylvania government websites and email systems use. Local income tax requirements for employers. Pennsylvania department of community & economic development governor's center for local government services 400 north street,. Dced local government services act 32:

Elevated Tax & Accounting ETA always on time Tax & Accounting

Local income tax requirements for employers. Employers with worksites located in pennsylvania are required. Pennsylvania department of community & economic development governor's center for local government services 400 north street,. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Pennsylvania law requires.

The Harms of Retaliatory Tax and Trade Policies Tax Foundation

You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Employers with worksites located in pennsylvania are required to withhold and remit the local. Dced local government services act 32: Pennsylvania department of community & economic development governor's center for local government services.

Tax Withholding is a Set Amount of Tax that an Employer

Local, state, and federal government websites often end in.gov. Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. Employers with worksites located in pennsylvania are required. Commonwealth of pennsylvania government websites and email systems use. You are required to withhold the higher of the two eit rates, as well as the local services.

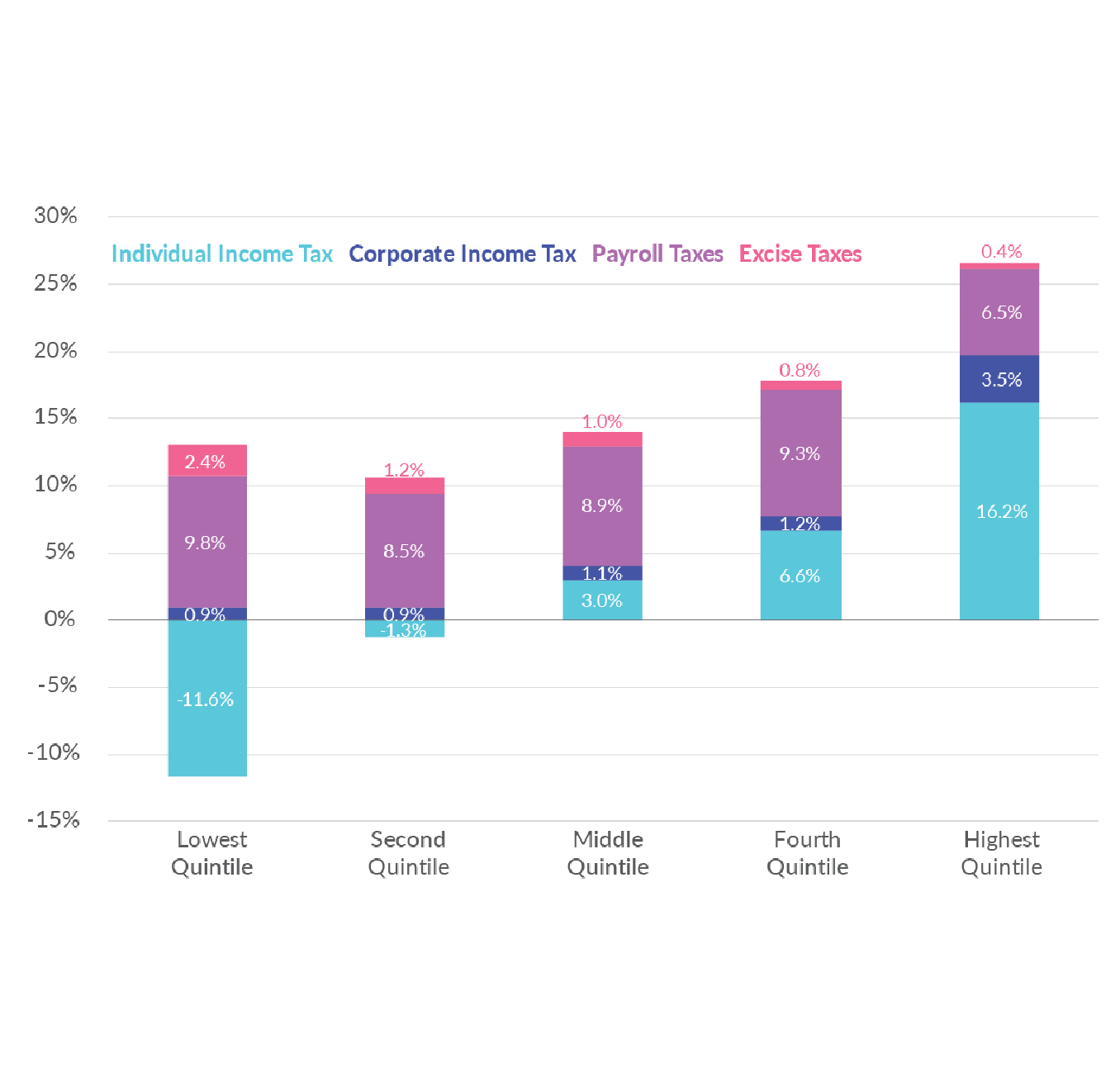

Federal Tax Rates by Group and Tax Source

You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Pennsylvania department of community & economic development governor's center for local government services 400 north street,. Employers with worksites located in pennsylvania are required to withhold and remit the local. Commonwealth of pennsylvania.

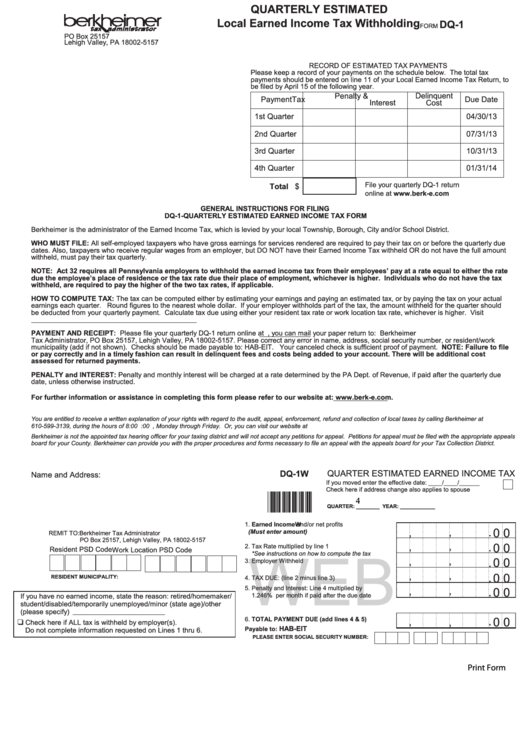

Pennsylvania Local Earned Tax Withholding Form

Employers with worksites located in pennsylvania are required to withhold and remit the local. Local income tax requirements for employers. Employers with worksites located in pennsylvania are required. Dced local government services act 32: You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local.

7 Situations State and Local Tax Deduction Not Allowed On Federal Tax

You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Commonwealth of pennsylvania government websites and email systems use. Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. Dced local government services act 32: Employers with.

Understanding State And Local Taxes Phoenix Tax Consultants

Dced local government services act 32: Commonwealth of pennsylvania government websites and email systems use. Pennsylvania department of community & economic development governor's center for local government services 400 north street,. Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. You are required to withhold the higher of the two eit rates, as.

SOLUTION Withholding tax and value added tax Studypool

Local, state, and federal government websites often end in.gov. Commonwealth of pennsylvania government websites and email systems use. Local income tax requirements for employers. Pennsylvania department of community & economic development governor's center for local government services 400 north street,. Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common.

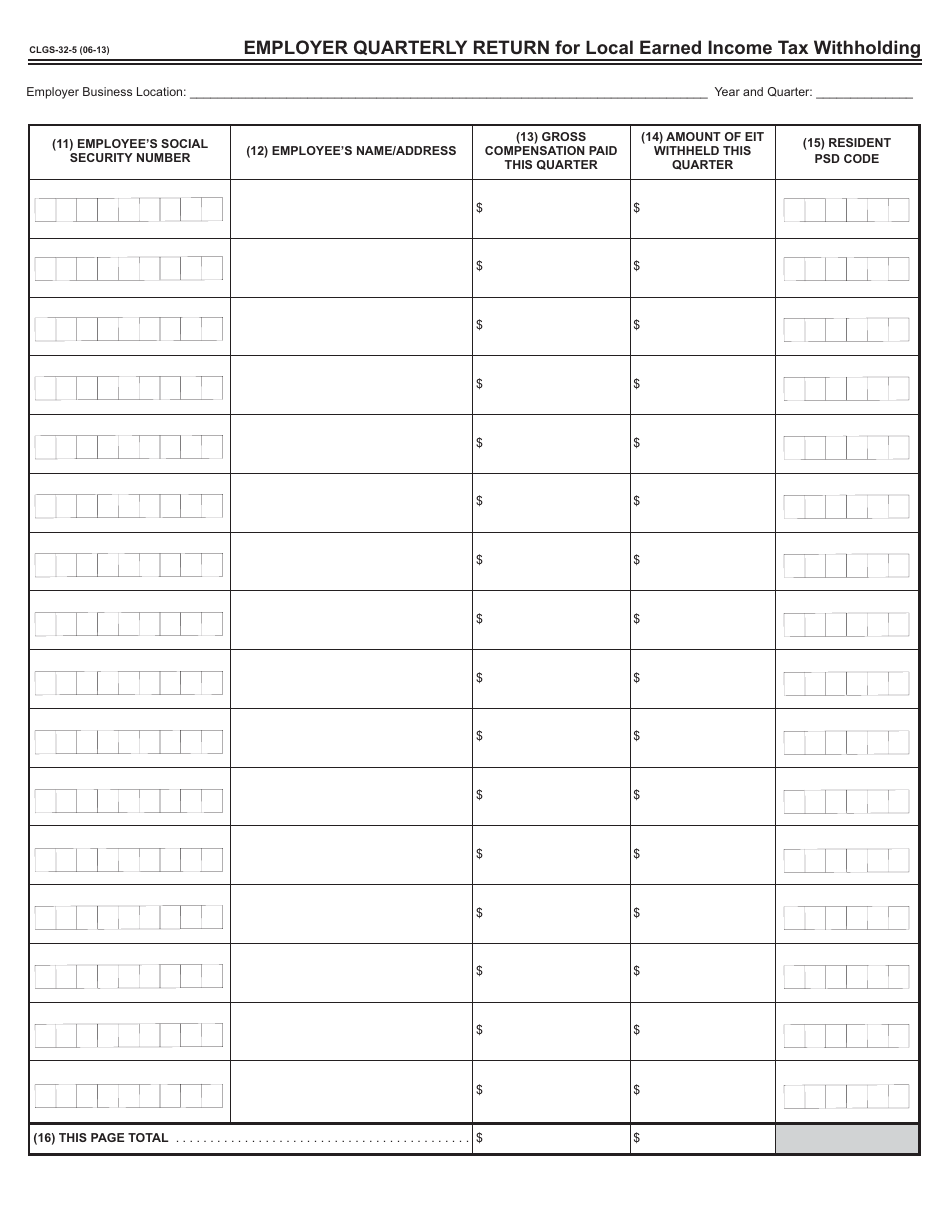

Form CLGS325 Fill Out, Sign Online and Download Fillable PDF

Local income tax requirements for employers. Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. Commonwealth of pennsylvania government websites and email systems use. Local, state, and federal government websites often end in.gov. Dced local government services act 32:

BIR Imposes 1 Withholding Tax on Online Merchants

Employers with worksites located in pennsylvania are required. Local income tax requirements for employers. Pennsylvania department of community & economic development governor's center for local government services 400 north street,. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Pennsylvania law requires.

Dced Local Government Services Act 32:

Employers with worksites located in pennsylvania are required. Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. Commonwealth of pennsylvania government websites and email systems use. Local, state, and federal government websites often end in.gov.

Employers With Worksites Located In Pennsylvania Are Required To Withhold And Remit The Local.

Pennsylvania department of community & economic development governor's center for local government services 400 north street,. Local income tax requirements for employers. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax.