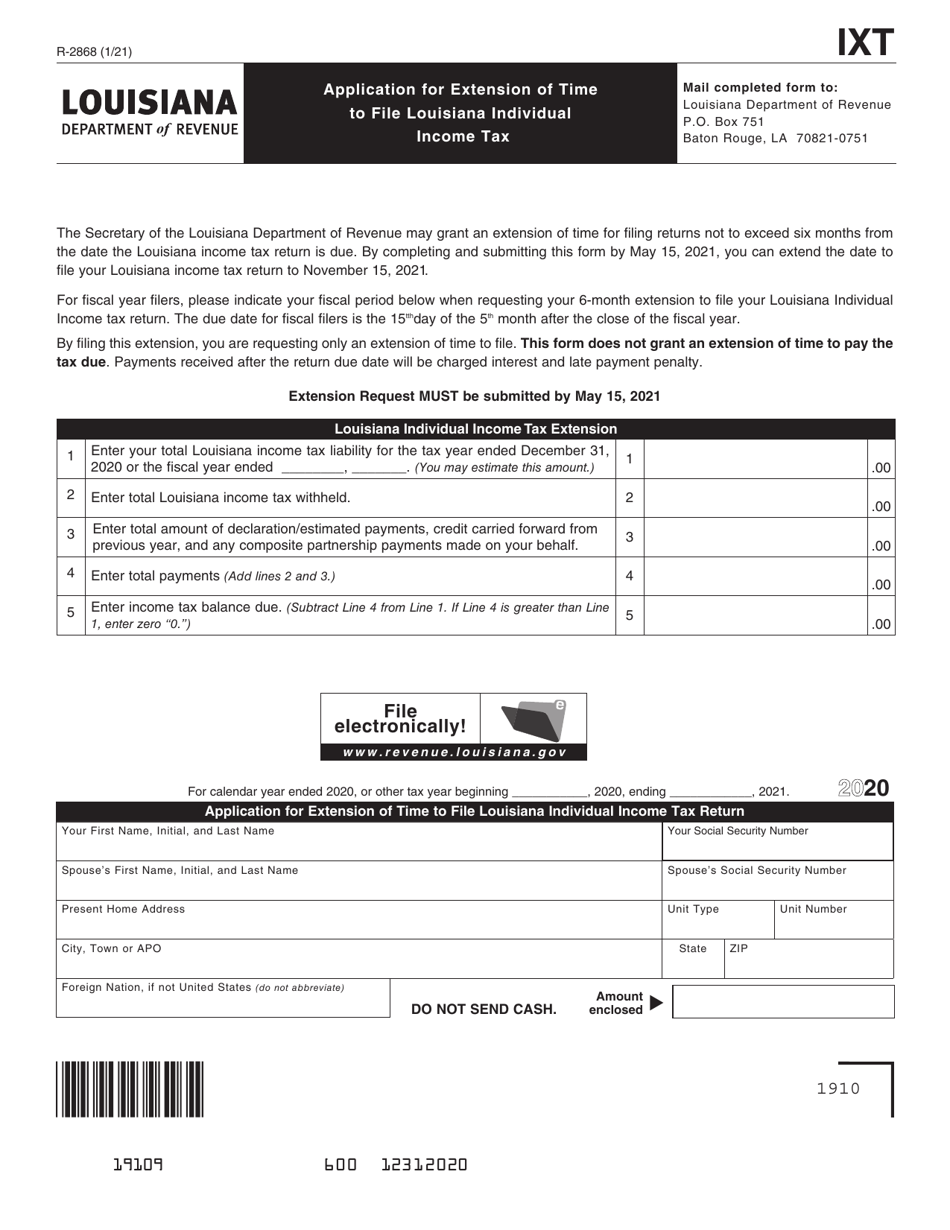

Louisiana Tax Form Schedule E

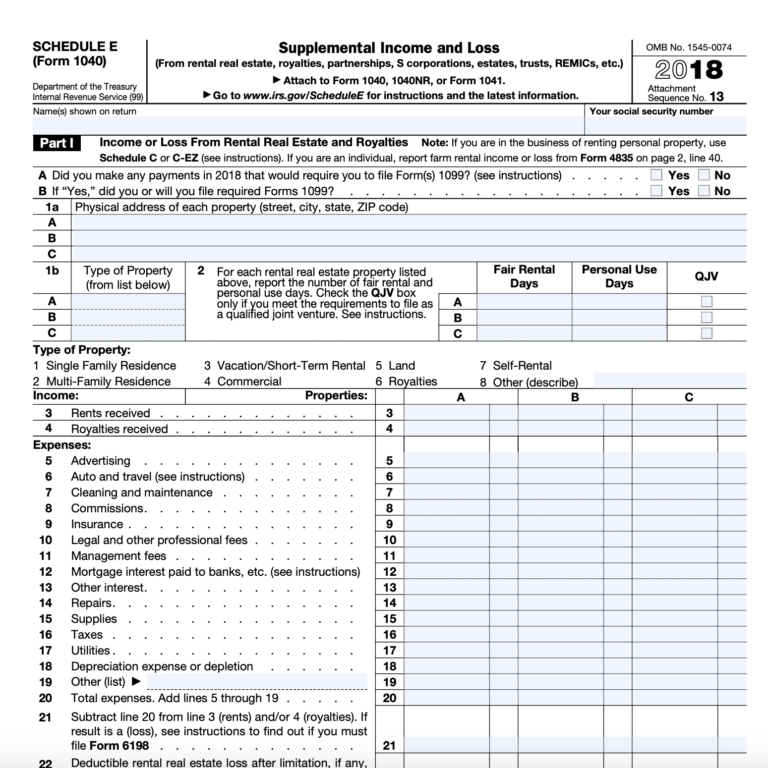

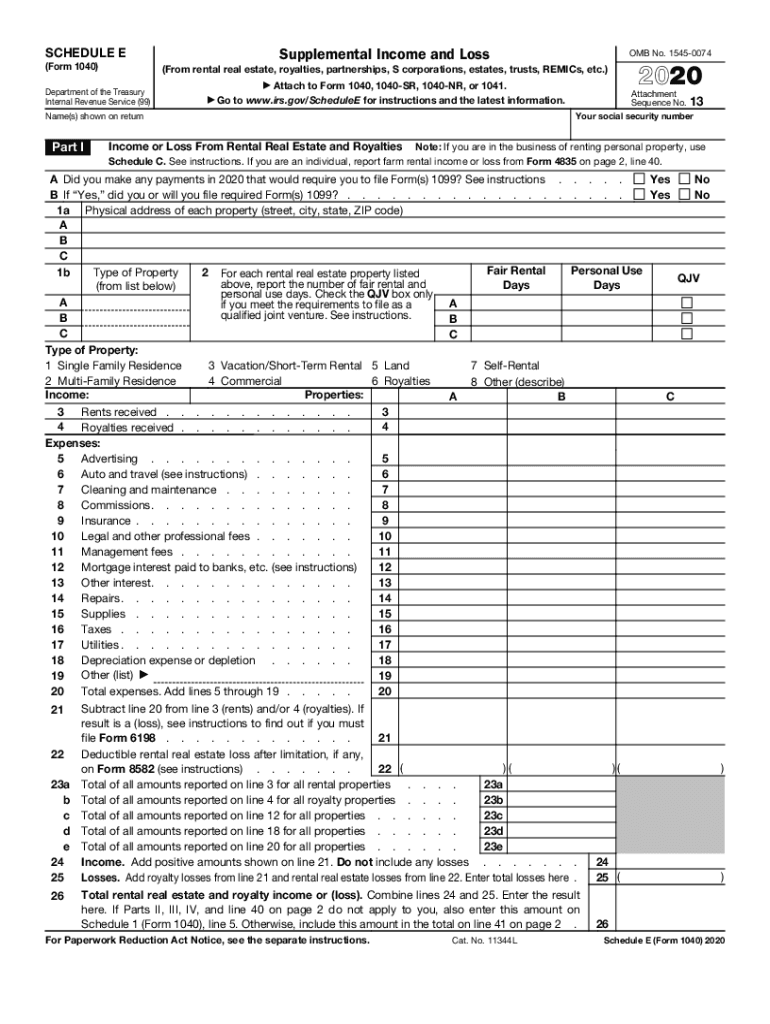

Louisiana Tax Form Schedule E - Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. If you have any exempt income or deductions other than what is reported on line 8d, you need to complete schedule e to determine your louisiana. Schedule of ad valorem tax credit claimed by manufactures, distributors and retailers for ad valorem tax paid on inventory or natural gas These 2023 forms and more are available: 33 rows louisiana has a state income tax that ranges between 1.85% and 4.25%, which is administered by the louisiana department of.

If you have any exempt income or deductions other than what is reported on line 8d, you need to complete schedule e to determine your louisiana. These 2023 forms and more are available: Schedule of ad valorem tax credit claimed by manufactures, distributors and retailers for ad valorem tax paid on inventory or natural gas 33 rows louisiana has a state income tax that ranges between 1.85% and 4.25%, which is administered by the louisiana department of. Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual.

These 2023 forms and more are available: 33 rows louisiana has a state income tax that ranges between 1.85% and 4.25%, which is administered by the louisiana department of. Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Schedule of ad valorem tax credit claimed by manufactures, distributors and retailers for ad valorem tax paid on inventory or natural gas If you have any exempt income or deductions other than what is reported on line 8d, you need to complete schedule e to determine your louisiana.

louisiana inheritance tax return form Deluxe Web Log Navigateur

Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. These 2023 forms and more are available: Schedule of ad valorem tax credit claimed by manufactures, distributors and retailers for ad valorem tax paid on inventory or natural gas If you have any exempt income or deductions other.

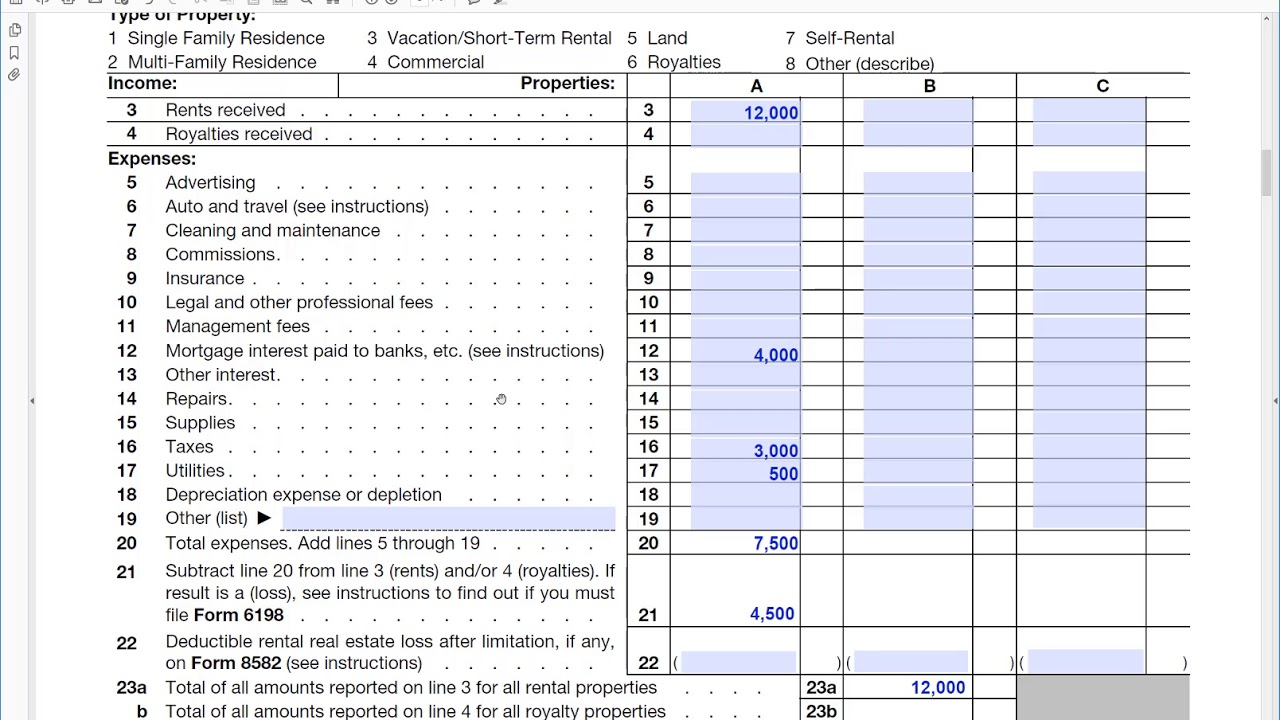

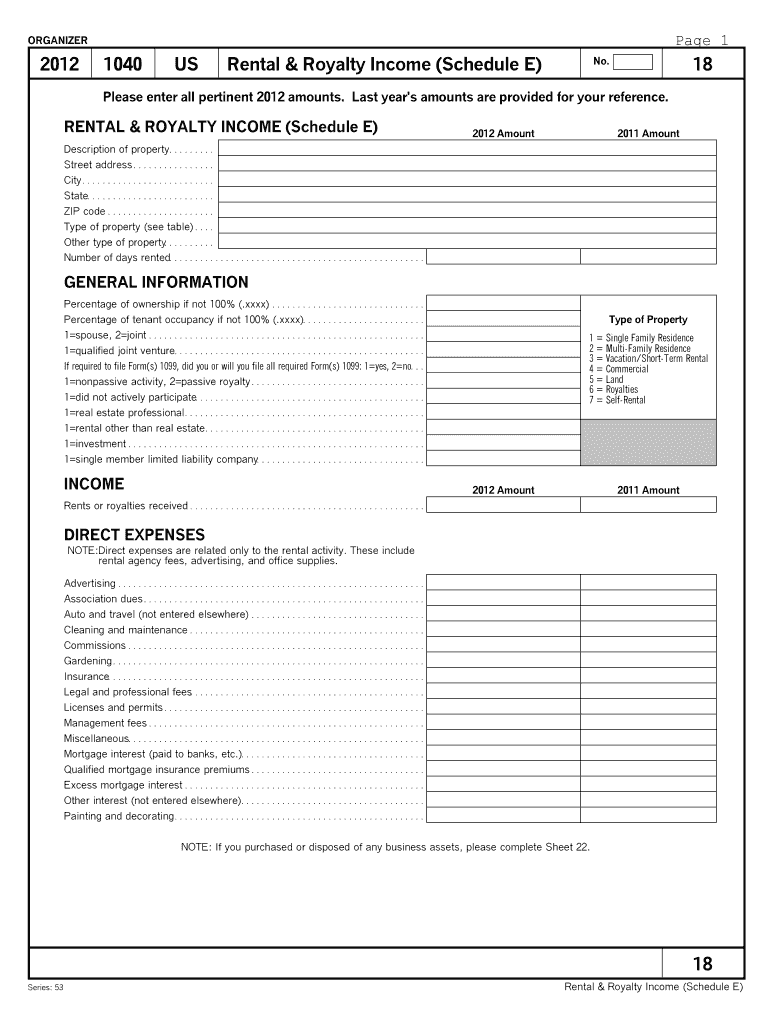

Schedule E Rental Expenses

33 rows louisiana has a state income tax that ranges between 1.85% and 4.25%, which is administered by the louisiana department of. Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Schedule of ad valorem tax credit claimed by manufactures, distributors and retailers for ad valorem tax.

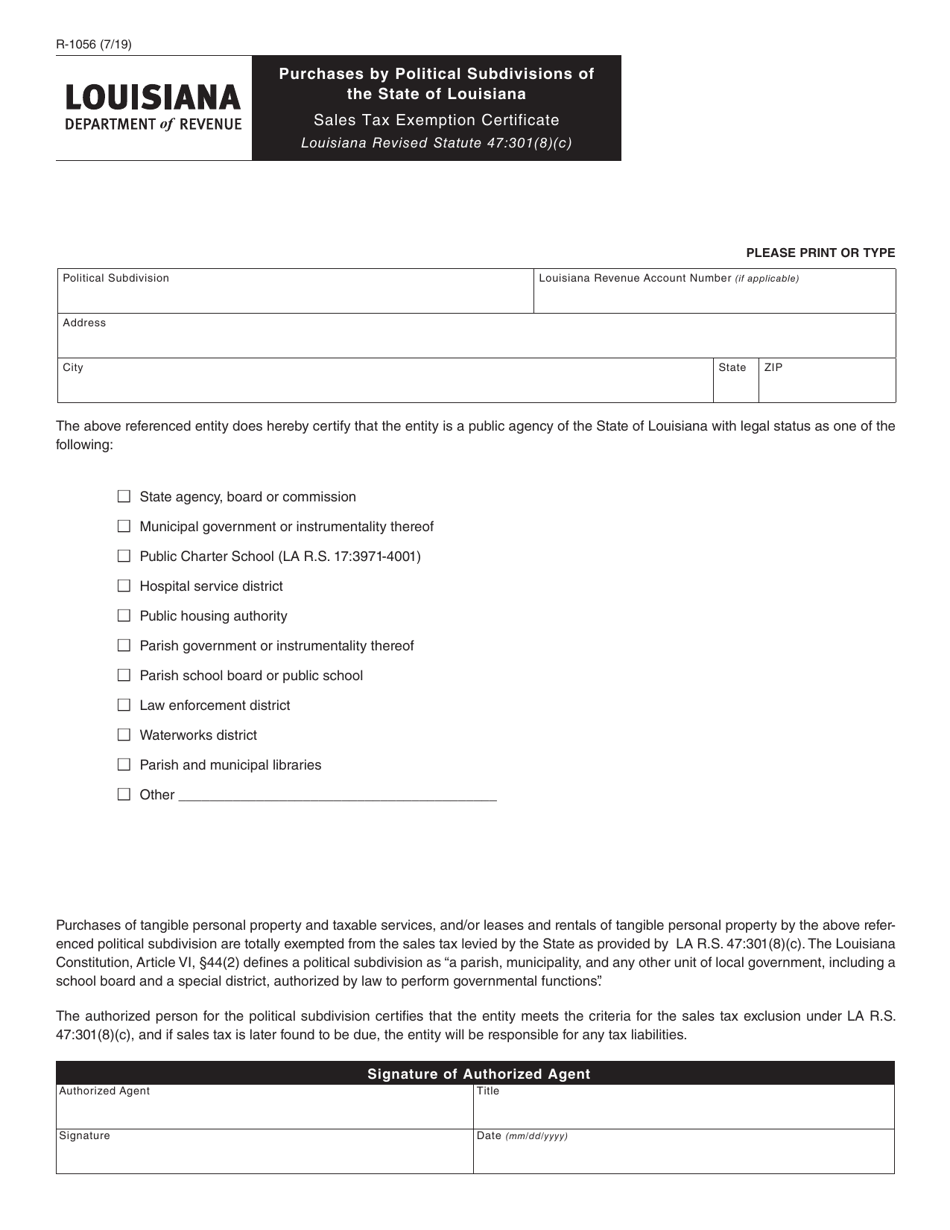

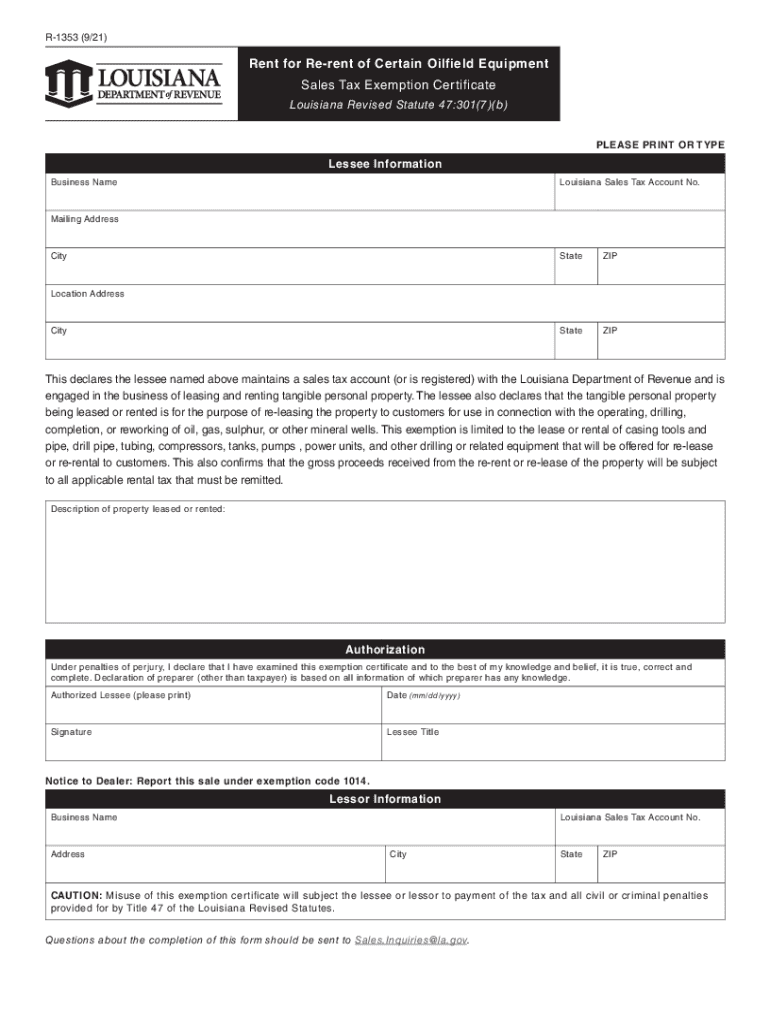

Form R1056 Download Fillable PDF or Fill Online Certificate of Sales

Schedule of ad valorem tax credit claimed by manufactures, distributors and retailers for ad valorem tax paid on inventory or natural gas 33 rows louisiana has a state income tax that ranges between 1.85% and 4.25%, which is administered by the louisiana department of. These 2023 forms and more are available: If you have any exempt income or deductions other.

Schedule E Worksheet Property Description

Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Schedule of ad valorem tax credit claimed by manufactures, distributors and retailers for ad valorem tax paid on inventory or natural gas These 2023 forms and more are available: 33 rows louisiana has a state income tax that.

Lgst 9rr Complete with ease airSlate SignNow

If you have any exempt income or deductions other than what is reported on line 8d, you need to complete schedule e to determine your louisiana. Schedule of ad valorem tax credit claimed by manufactures, distributors and retailers for ad valorem tax paid on inventory or natural gas Use schedule e (form 1040) to report income or loss from rental.

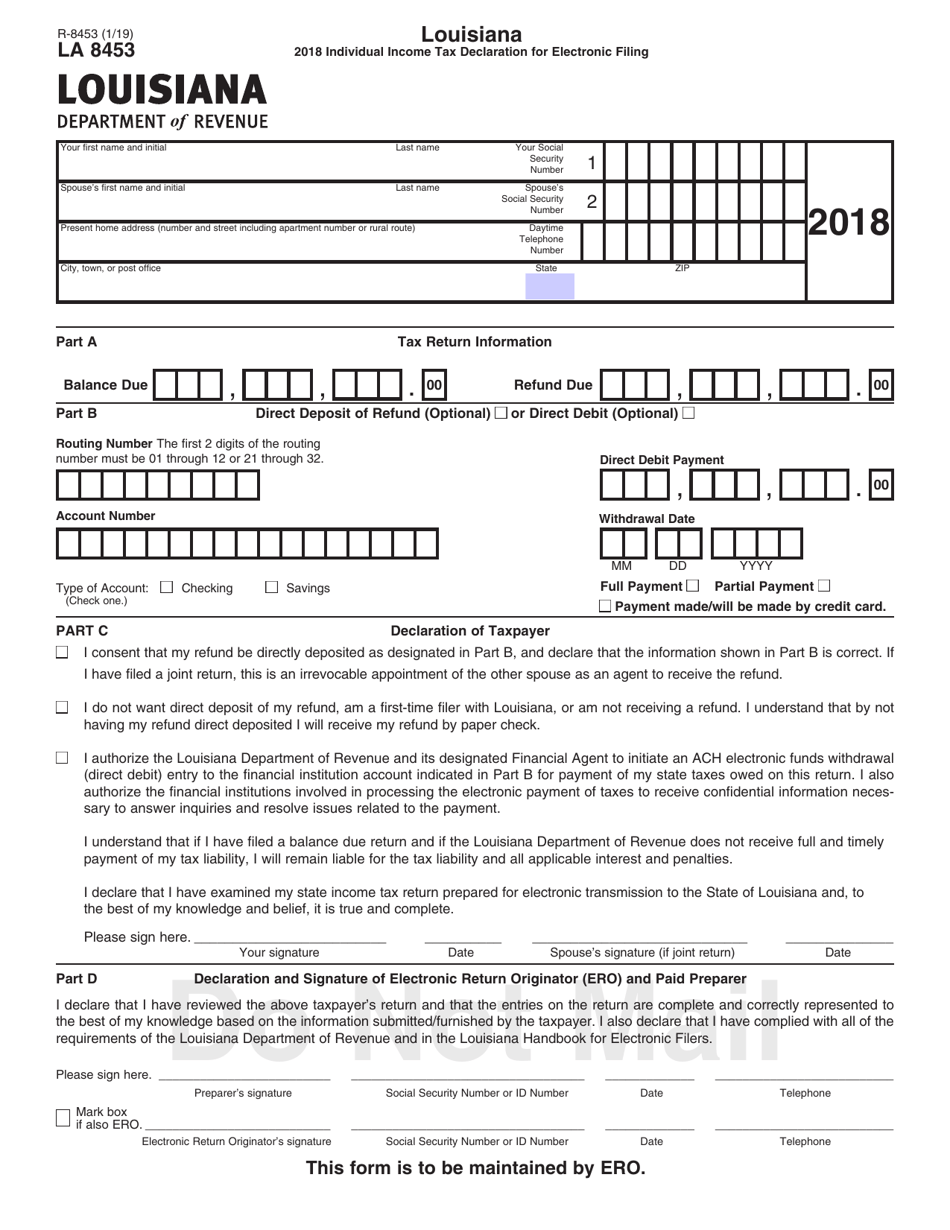

Form R8453 2018 Fill Out, Sign Online and Download Fillable PDF

Schedule of ad valorem tax credit claimed by manufactures, distributors and retailers for ad valorem tax paid on inventory or natural gas If you have any exempt income or deductions other than what is reported on line 8d, you need to complete schedule e to determine your louisiana. 33 rows louisiana has a state income tax that ranges between 1.85%.

Schedule E 1040 20202024 Form Fill Out and Sign Printable PDF

Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. 33 rows louisiana has a state income tax that ranges between 1.85% and 4.25%, which is administered by the louisiana department of. If you have any exempt income or deductions other than what is reported on line 8d,.

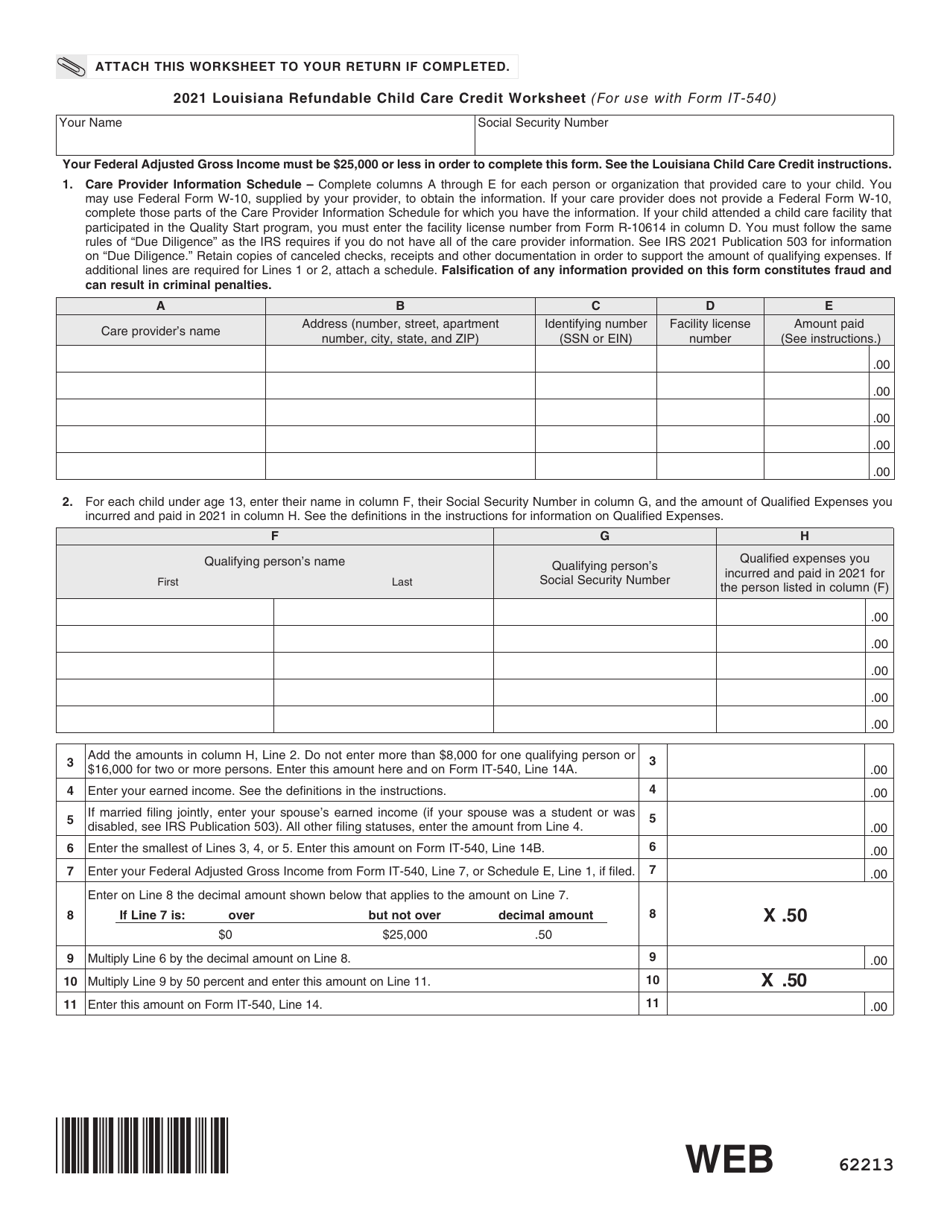

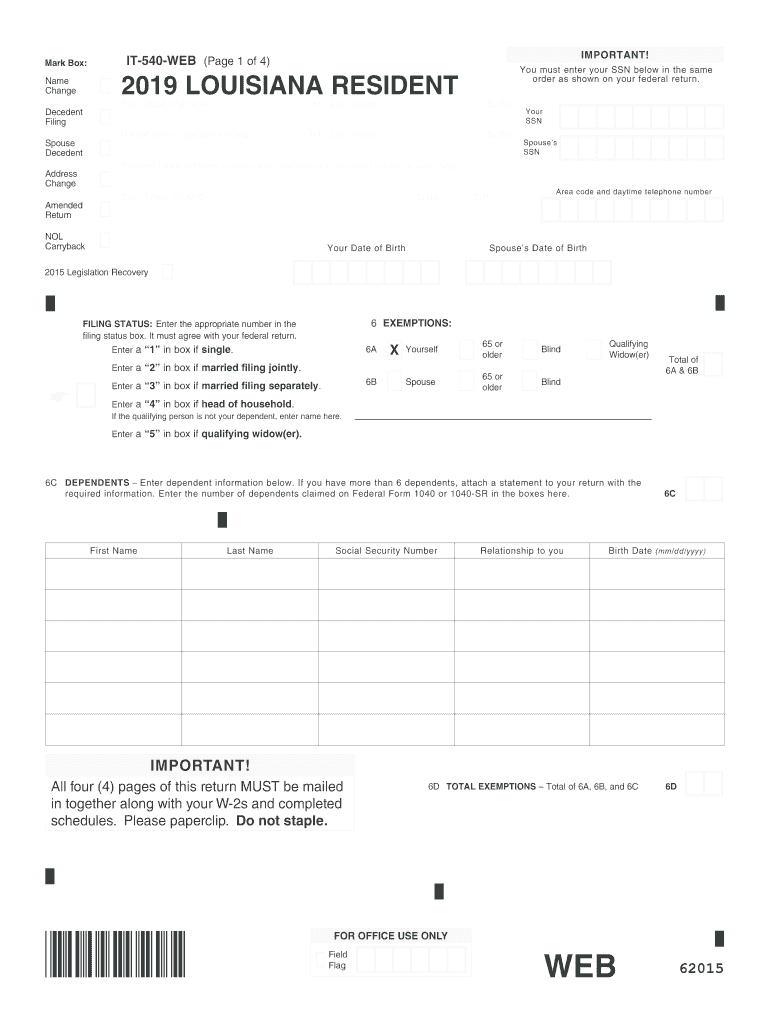

Form IT540 2021 Fill Out, Sign Online and Download Fillable PDF

Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. 33 rows louisiana has a state income tax that ranges between 1.85% and 4.25%, which is administered by the louisiana department of. These 2023 forms and more are available: If you have any exempt income or deductions other.

Printable Tax Schedule E 20122024 Form Fill Out and Sign Printable

If you have any exempt income or deductions other than what is reported on line 8d, you need to complete schedule e to determine your louisiana. These 2023 forms and more are available: 33 rows louisiana has a state income tax that ranges between 1.85% and 4.25%, which is administered by the louisiana department of. Use schedule e (form 1040).

Louisiana Amendment it 540 20192024 Form Fill Out and Sign Printable

If you have any exempt income or deductions other than what is reported on line 8d, you need to complete schedule e to determine your louisiana. Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Schedule of ad valorem tax credit claimed by manufactures, distributors and retailers.

These 2023 Forms And More Are Available:

Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. 33 rows louisiana has a state income tax that ranges between 1.85% and 4.25%, which is administered by the louisiana department of. Schedule of ad valorem tax credit claimed by manufactures, distributors and retailers for ad valorem tax paid on inventory or natural gas If you have any exempt income or deductions other than what is reported on line 8d, you need to complete schedule e to determine your louisiana.