Maryland Local Tax Rates

Maryland Local Tax Rates - Counties are responsible for the county tax rates, local towns and cities are responsible. 27 rows local officials set the rates, which range between 2.25% and 3.20% for the current tax year. You can click on any city or county for more details, including the. Fy 2023 hotel rental fy 2023. Every august, new tax rates are posted on this website. Local tax is based on taxable income and not on maryland state tax. Withholding is a combination of the state income tax, which has rates. The department of assessments and taxation does its best to ensure that this document is complete and accurate, but this information is. Median local tax rates of maryland’s 23 counties and baltimore city. We have information on the local income tax rates in 24 localities in maryland.

27 rows local officials set the rates, which range between 2.25% and 3.20% for the current tax year. Every august, new tax rates are posted on this website. The department of assessments and taxation does its best to ensure that this document is complete and accurate, but this information is. Listed below are the actual 2025 local income tax rates. Local tax is based on taxable income and not on maryland state tax. Listed below are the actual 2024 local income tax rates. Withholding is a combination of the state income tax, which has rates. You can click on any city or county for more details, including the. Counties are responsible for the county tax rates, local towns and cities are responsible. Fy 2023 hotel rental fy 2023.

You should report your local income tax amount. Median local tax rates of maryland’s 23 counties and baltimore city. The department of assessments and taxation does its best to ensure that this document is complete and accurate, but this information is. Every august, new tax rates are posted on this website. Local tax is based on taxable income and not on maryland state tax. Listed below are the actual 2024 local income tax rates. We have information on the local income tax rates in 24 localities in maryland. 27 rows local officials set the rates, which range between 2.25% and 3.20% for the current tax year. Listed below are the actual 2025 local income tax rates. Other local tax rates in maryland.

State local effective tax rates map Infogram

We have information on the local income tax rates in 24 localities in maryland. You can click on any city or county for more details, including the. Listed below are the actual 2025 local income tax rates. Local tax is based on taxable income and not on maryland state tax. Local tax is based on taxable income and not on.

The Free State Foundation Maryland Should Lower Tax Rates to Attract

Other local tax rates in maryland. The department of assessments and taxation does its best to ensure that this document is complete and accurate, but this information is. Local tax is based on taxable income and not on maryland state tax. Every august, new tax rates are posted on this website. Listed below are the actual 2025 local income tax.

Maryland Tax Tables 2018

Withholding is a combination of the state income tax, which has rates. Every august, new tax rates are posted on this website. 27 rows local officials set the rates, which range between 2.25% and 3.20% for the current tax year. Local tax is based on taxable income and not on maryland state tax. The department of assessments and taxation does.

Maryland County Tax Rates 2024 Amil Maddie

Listed below are the actual 2025 local income tax rates. 27 rows local officials set the rates, which range between 2.25% and 3.20% for the current tax year. Other local tax rates in maryland. The department of assessments and taxation does its best to ensure that this document is complete and accurate, but this information is. Every august, new tax.

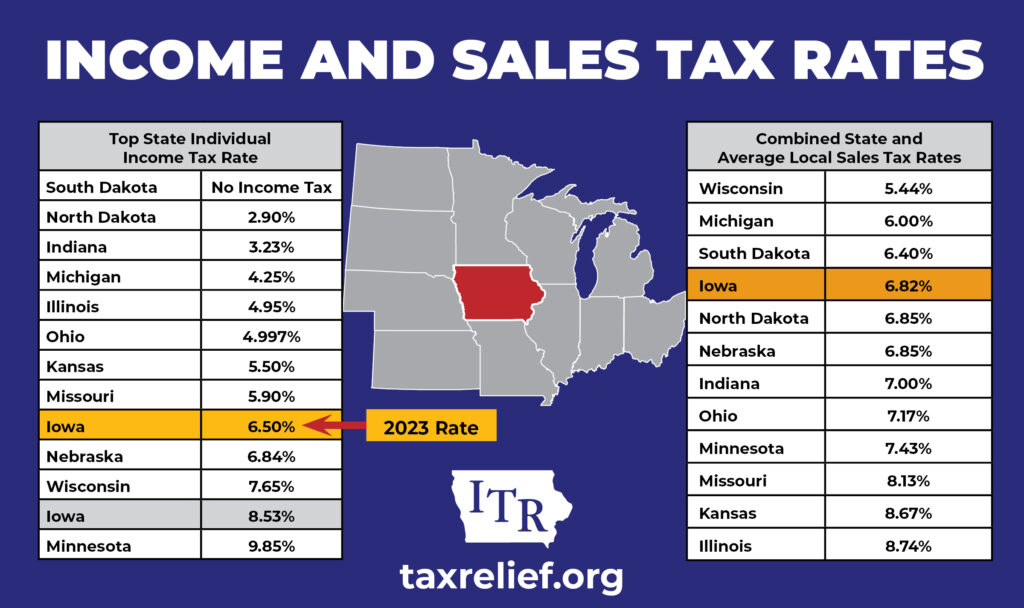

State and Local Sales Tax Rates Midyear 2013 Tax Foundation

Other local tax rates in maryland. Listed below are the actual 2025 local income tax rates. 27 rows local officials set the rates, which range between 2.25% and 3.20% for the current tax year. Median local tax rates of maryland’s 23 counties and baltimore city. You should report your local income tax amount.

State and Local Sales Tax Rates, Midyear 2016 Tax Foundation

Counties are responsible for the county tax rates, local towns and cities are responsible. Local tax is based on taxable income and not on maryland state tax. Listed below are the actual 2024 local income tax rates. Median local tax rates of maryland’s 23 counties and baltimore city. Withholding is a combination of the state income tax, which has rates.

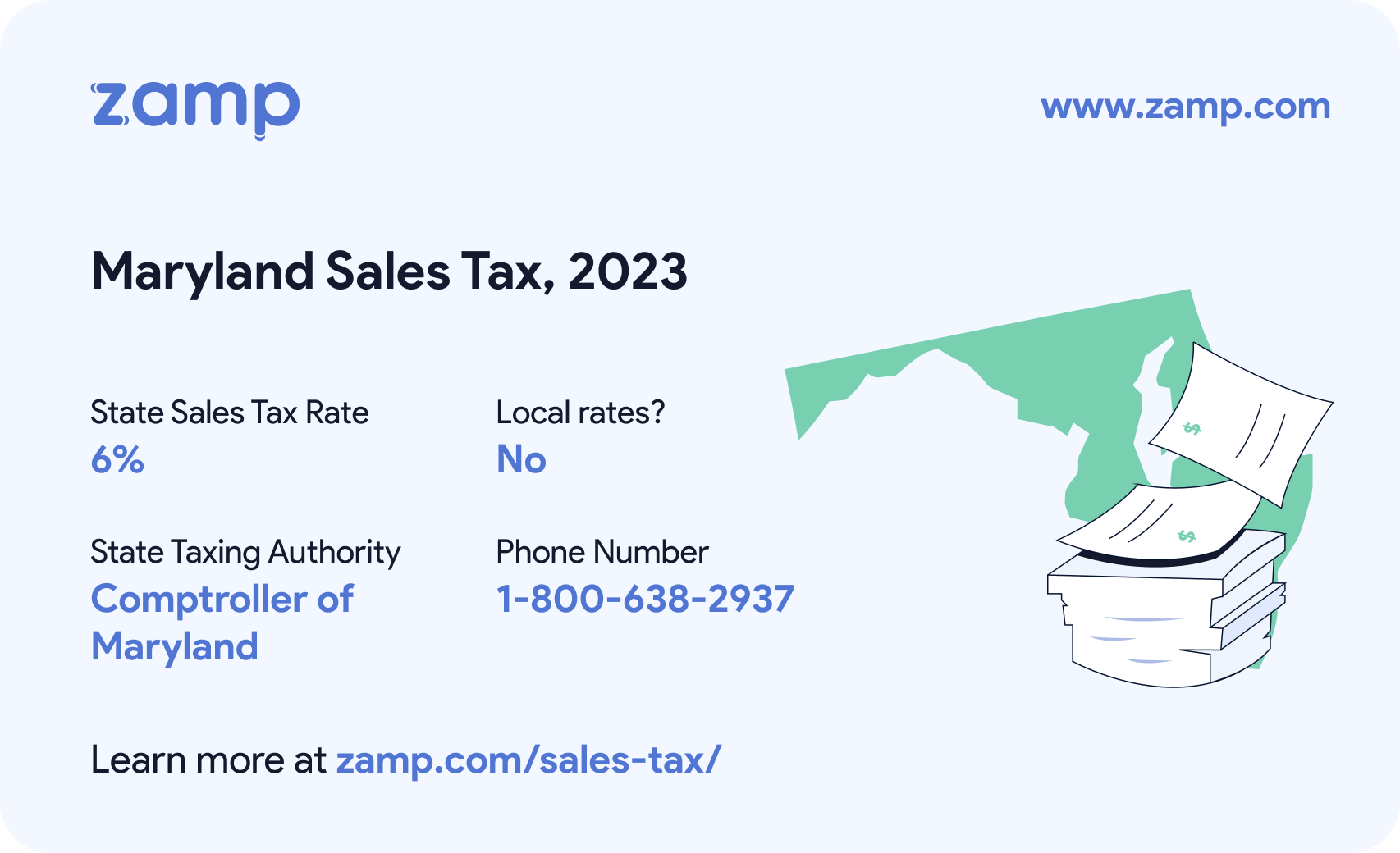

Ultimate Maryland Sales Tax Guide Zamp

Listed below are the actual 2024 local income tax rates. You can click on any city or county for more details, including the. You should report your local income tax amount. Local tax is based on taxable income and not on maryland state tax. Counties are responsible for the county tax rates, local towns and cities are responsible.

Maryland Tax Calculator 2024 2025

We have information on the local income tax rates in 24 localities in maryland. Counties are responsible for the county tax rates, local towns and cities are responsible. Listed below are the actual 2024 local income tax rates. You can click on any city or county for more details, including the. Other local tax rates in maryland.

Where Could Interest and Tax Rates Be Headed? SouthPark Capital Tax

27 rows local officials set the rates, which range between 2.25% and 3.20% for the current tax year. Local tax is based on taxable income and not on maryland state tax. Listed below are the actual 2024 local income tax rates. Local tax is based on taxable income and not on maryland state tax. Other local tax rates in maryland.

Monday Map State and Local Sales Tax Rates, 2011 Tax Foundation

27 rows local officials set the rates, which range between 2.25% and 3.20% for the current tax year. Every august, new tax rates are posted on this website. Local tax is based on taxable income and not on maryland state tax. Fy 2023 hotel rental fy 2023. The department of assessments and taxation does its best to ensure that this.

Listed Below Are The Actual 2025 Local Income Tax Rates.

Local tax is based on taxable income and not on maryland state tax. The department of assessments and taxation does its best to ensure that this document is complete and accurate, but this information is. Listed below are the actual 2024 local income tax rates. Withholding is a combination of the state income tax, which has rates.

You Should Report Your Local Income Tax Amount.

We have information on the local income tax rates in 24 localities in maryland. 27 rows local officials set the rates, which range between 2.25% and 3.20% for the current tax year. Every august, new tax rates are posted on this website. Counties are responsible for the county tax rates, local towns and cities are responsible.

Other Local Tax Rates In Maryland.

Local tax is based on taxable income and not on maryland state tax. Fy 2023 hotel rental fy 2023. Median local tax rates of maryland’s 23 counties and baltimore city. You can click on any city or county for more details, including the.

.png)