Michigan Local Income Tax

Michigan Local Income Tax - The state of michigan assesses a 4.25% flat tax on the income of all individuals, businesses, estates and trusts residing or doing. As of 2021, the following michigan cities levy an income tax: We have information on the local income tax rates in 22 localities in michigan. What cities impose an income tax? Links to some michigan cities are available on. List of cities in michigan that impose income taxes with information about rates. We have information on the local income tax rates for most localities across the fourteen states where local income taxes are permitted. What michigan cities impose an income tax? For 2023 the following michigan cities levy an income tax: You can click on any city or county for more details, including the.

You can click on any city or county for more details, including the. What michigan cities impose an income tax? Links to some michigan cities are available on. List of cities in michigan that impose income taxes with information about rates. We have information on the local income tax rates for most localities across the fourteen states where local income taxes are permitted. We have information on the local income tax rates in 22 localities in michigan. As of 2021, the following michigan cities levy an income tax: The state of michigan assesses a 4.25% flat tax on the income of all individuals, businesses, estates and trusts residing or doing. What cities impose an income tax? For 2023 the following michigan cities levy an income tax:

List of cities in michigan that impose income taxes with information about rates. For 2023 the following michigan cities levy an income tax: What cities impose an income tax? The state of michigan assesses a 4.25% flat tax on the income of all individuals, businesses, estates and trusts residing or doing. We have information on the local income tax rates in 22 localities in michigan. What michigan cities impose an income tax? We have information on the local income tax rates for most localities across the fourteen states where local income taxes are permitted. Links to some michigan cities are available on. You can click on any city or county for more details, including the. As of 2021, the following michigan cities levy an income tax:

Michigan Tax Cut Temporary or Permanent?

We have information on the local income tax rates for most localities across the fourteen states where local income taxes are permitted. You can click on any city or county for more details, including the. For 2023 the following michigan cities levy an income tax: As of 2021, the following michigan cities levy an income tax: What cities impose an.

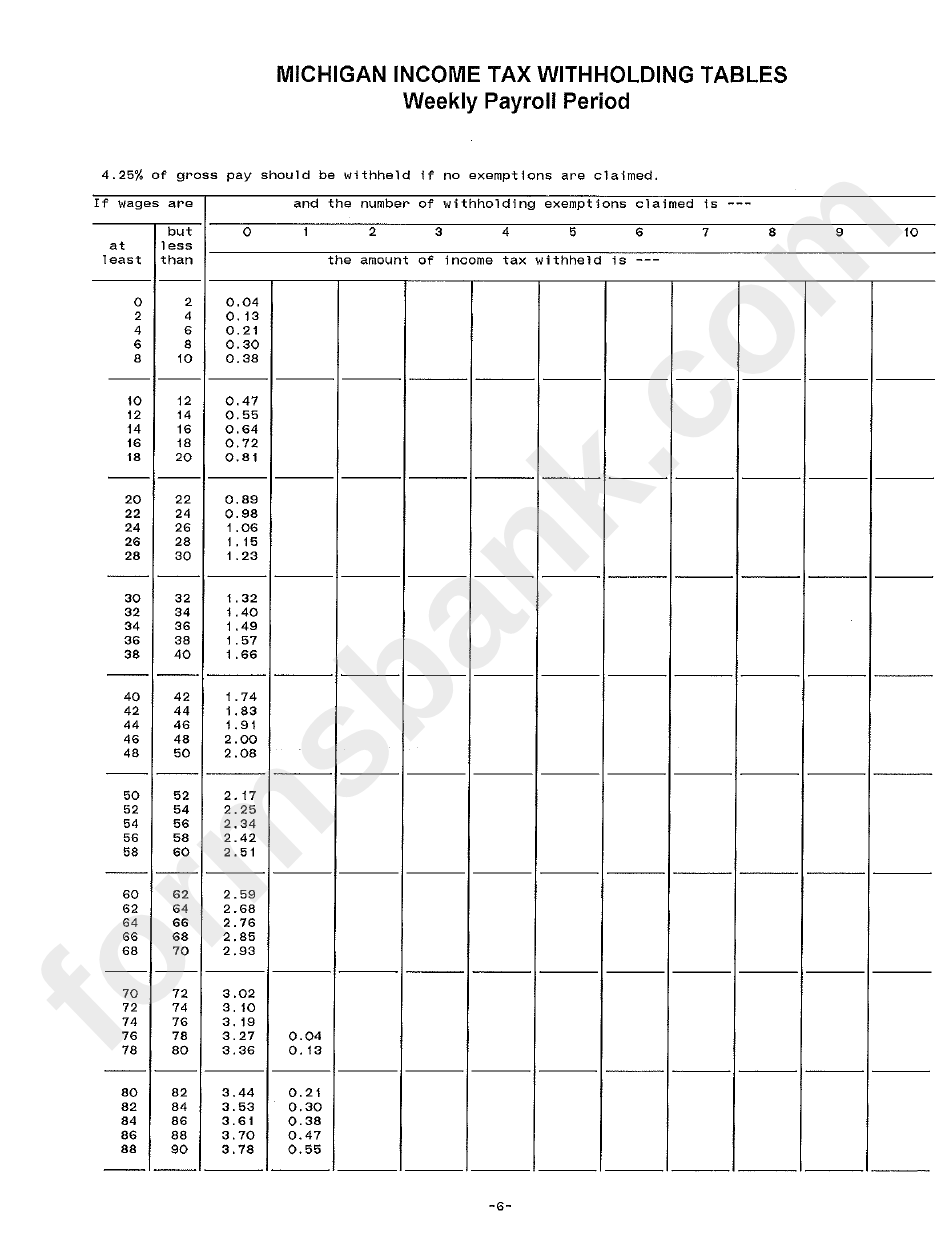

Michigan Tax Withholding Tables printable pdf download

For 2023 the following michigan cities levy an income tax: We have information on the local income tax rates for most localities across the fourteen states where local income taxes are permitted. What michigan cities impose an income tax? We have information on the local income tax rates in 22 localities in michigan. You can click on any city or.

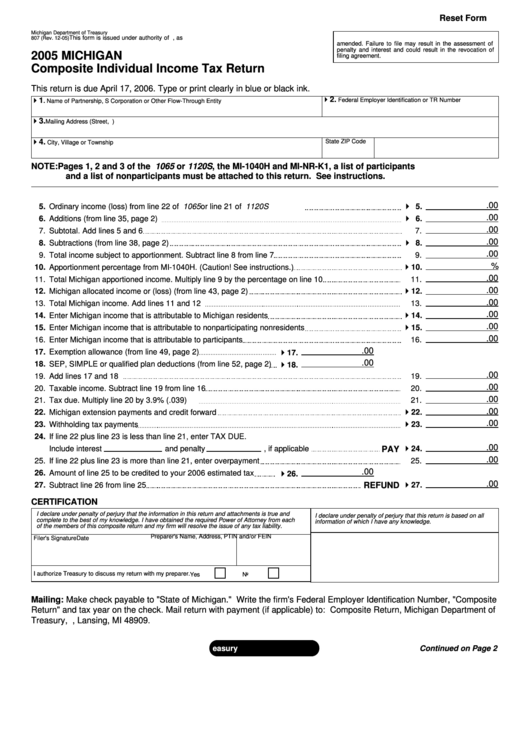

2016 Michigan Tax Rate

For 2023 the following michigan cities levy an income tax: As of 2021, the following michigan cities levy an income tax: What cities impose an income tax? You can click on any city or county for more details, including the. The state of michigan assesses a 4.25% flat tax on the income of all individuals, businesses, estates and trusts residing.

Michigan Tax Rate 2024 Janaye Corabel

You can click on any city or county for more details, including the. Links to some michigan cities are available on. The state of michigan assesses a 4.25% flat tax on the income of all individuals, businesses, estates and trusts residing or doing. As of 2021, the following michigan cities levy an income tax: For 2023 the following michigan cities.

Mifflin County Local Tax Forms

We have information on the local income tax rates in 22 localities in michigan. You can click on any city or county for more details, including the. List of cities in michigan that impose income taxes with information about rates. What cities impose an income tax? The state of michigan assesses a 4.25% flat tax on the income of all.

Local Taxes in 2019 Local Tax City & County Level

List of cities in michigan that impose income taxes with information about rates. What cities impose an income tax? What michigan cities impose an income tax? We have information on the local income tax rates in 22 localities in michigan. For 2023 the following michigan cities levy an income tax:

Should Michigan Eliminate State Tax?

List of cities in michigan that impose income taxes with information about rates. We have information on the local income tax rates for most localities across the fourteen states where local income taxes are permitted. As of 2021, the following michigan cities levy an income tax: The state of michigan assesses a 4.25% flat tax on the income of all.

Michigan Tax Refund Status 2024 Dulcia Robbie

What cities impose an income tax? The state of michigan assesses a 4.25% flat tax on the income of all individuals, businesses, estates and trusts residing or doing. What michigan cities impose an income tax? You can click on any city or county for more details, including the. We have information on the local income tax rates for most localities.

Michigan Tax Brackets 2024 Dacie Dorothy

List of cities in michigan that impose income taxes with information about rates. What michigan cities impose an income tax? The state of michigan assesses a 4.25% flat tax on the income of all individuals, businesses, estates and trusts residing or doing. For 2023 the following michigan cities levy an income tax: As of 2021, the following michigan cities levy.

State and Local Tax Deduction by State Tax Policy Center

What cities impose an income tax? We have information on the local income tax rates for most localities across the fourteen states where local income taxes are permitted. List of cities in michigan that impose income taxes with information about rates. We have information on the local income tax rates in 22 localities in michigan. What michigan cities impose an.

Links To Some Michigan Cities Are Available On.

The state of michigan assesses a 4.25% flat tax on the income of all individuals, businesses, estates and trusts residing or doing. You can click on any city or county for more details, including the. For 2023 the following michigan cities levy an income tax: We have information on the local income tax rates for most localities across the fourteen states where local income taxes are permitted.

What Michigan Cities Impose An Income Tax?

List of cities in michigan that impose income taxes with information about rates. What cities impose an income tax? We have information on the local income tax rates in 22 localities in michigan. As of 2021, the following michigan cities levy an income tax: