Michigan Tax Lien

Michigan Tax Lien - We auction properties located in more than 74. (1) taxes administered under this act, together with the interest and penalties on those taxes, shall be a lien in favor of the state against all. Michigan, currently has 21,544 tax liens available as of september 10. What does a state tax lien do? A michigan state tax lien is the state's legal claim to your property. Once issued, state tax liens attach to your real or personal property. A notice of state tax lien filed at a county register of deeds becomes a public record.

Michigan, currently has 21,544 tax liens available as of september 10. We auction properties located in more than 74. A michigan state tax lien is the state's legal claim to your property. Once issued, state tax liens attach to your real or personal property. What does a state tax lien do? A notice of state tax lien filed at a county register of deeds becomes a public record. (1) taxes administered under this act, together with the interest and penalties on those taxes, shall be a lien in favor of the state against all.

A michigan state tax lien is the state's legal claim to your property. (1) taxes administered under this act, together with the interest and penalties on those taxes, shall be a lien in favor of the state against all. Once issued, state tax liens attach to your real or personal property. A notice of state tax lien filed at a county register of deeds becomes a public record. What does a state tax lien do? Michigan, currently has 21,544 tax liens available as of september 10. We auction properties located in more than 74.

IRS Federal and State Tax Lien Help — Genesis Tax Consultants

What does a state tax lien do? A michigan state tax lien is the state's legal claim to your property. (1) taxes administered under this act, together with the interest and penalties on those taxes, shall be a lien in favor of the state against all. A notice of state tax lien filed at a county register of deeds becomes.

Tax Lien Sale Download Free PDF Tax Lien Taxes

What does a state tax lien do? A michigan state tax lien is the state's legal claim to your property. We auction properties located in more than 74. Michigan, currently has 21,544 tax liens available as of september 10. (1) taxes administered under this act, together with the interest and penalties on those taxes, shall be a lien in favor.

Learn Tax Lien & Tax Deed Investing

We auction properties located in more than 74. Michigan, currently has 21,544 tax liens available as of september 10. Once issued, state tax liens attach to your real or personal property. A michigan state tax lien is the state's legal claim to your property. (1) taxes administered under this act, together with the interest and penalties on those taxes, shall.

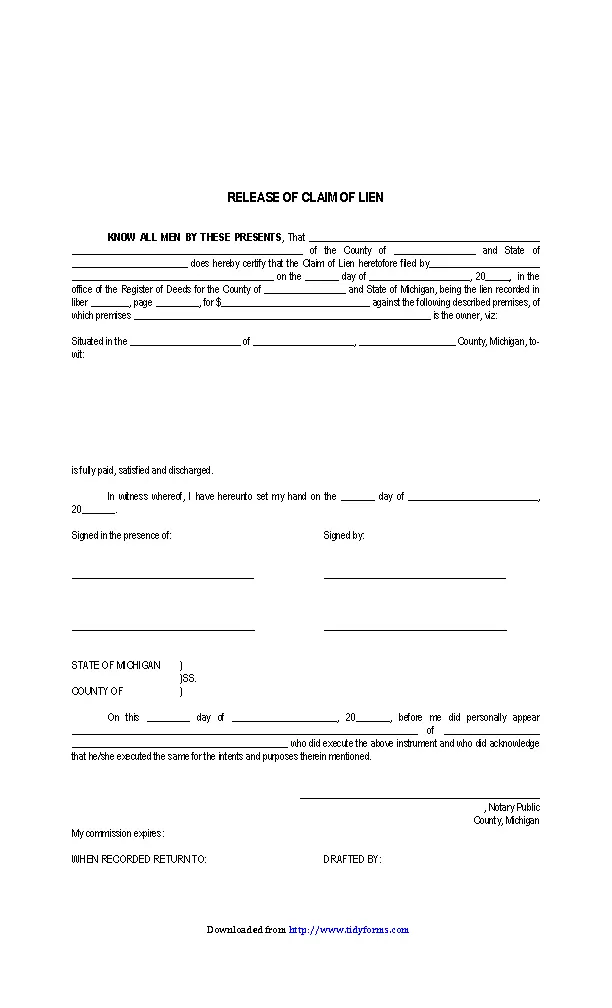

Michigan Claim of Lien Forms

(1) taxes administered under this act, together with the interest and penalties on those taxes, shall be a lien in favor of the state against all. A notice of state tax lien filed at a county register of deeds becomes a public record. What does a state tax lien do? A michigan state tax lien is the state's legal claim.

Michigan lien Fill out & sign online DocHub

What does a state tax lien do? A michigan state tax lien is the state's legal claim to your property. Michigan, currently has 21,544 tax liens available as of september 10. (1) taxes administered under this act, together with the interest and penalties on those taxes, shall be a lien in favor of the state against all. Once issued, state.

Michigan Property Tax Increase 2024 Shea Shanon

(1) taxes administered under this act, together with the interest and penalties on those taxes, shall be a lien in favor of the state against all. Michigan, currently has 21,544 tax liens available as of september 10. We auction properties located in more than 74. Once issued, state tax liens attach to your real or personal property. A notice of.

Michigan Release Of Claim Of Lien PDFSimpli

A michigan state tax lien is the state's legal claim to your property. Once issued, state tax liens attach to your real or personal property. (1) taxes administered under this act, together with the interest and penalties on those taxes, shall be a lien in favor of the state against all. What does a state tax lien do? Michigan, currently.

The Complete Guide to Michigan Lien & Notice Deadlines National Lien

A notice of state tax lien filed at a county register of deeds becomes a public record. What does a state tax lien do? Michigan, currently has 21,544 tax liens available as of september 10. Once issued, state tax liens attach to your real or personal property. (1) taxes administered under this act, together with the interest and penalties on.

Claim Of Lien Form Michigan Fill Online Printable Fillable Blank

What does a state tax lien do? A notice of state tax lien filed at a county register of deeds becomes a public record. Once issued, state tax liens attach to your real or personal property. (1) taxes administered under this act, together with the interest and penalties on those taxes, shall be a lien in favor of the state.

michigan lien Doc Template pdfFiller

A michigan state tax lien is the state's legal claim to your property. A notice of state tax lien filed at a county register of deeds becomes a public record. (1) taxes administered under this act, together with the interest and penalties on those taxes, shall be a lien in favor of the state against all. What does a state.

A Notice Of State Tax Lien Filed At A County Register Of Deeds Becomes A Public Record.

What does a state tax lien do? Once issued, state tax liens attach to your real or personal property. Michigan, currently has 21,544 tax liens available as of september 10. (1) taxes administered under this act, together with the interest and penalties on those taxes, shall be a lien in favor of the state against all.

A Michigan State Tax Lien Is The State's Legal Claim To Your Property.

We auction properties located in more than 74.