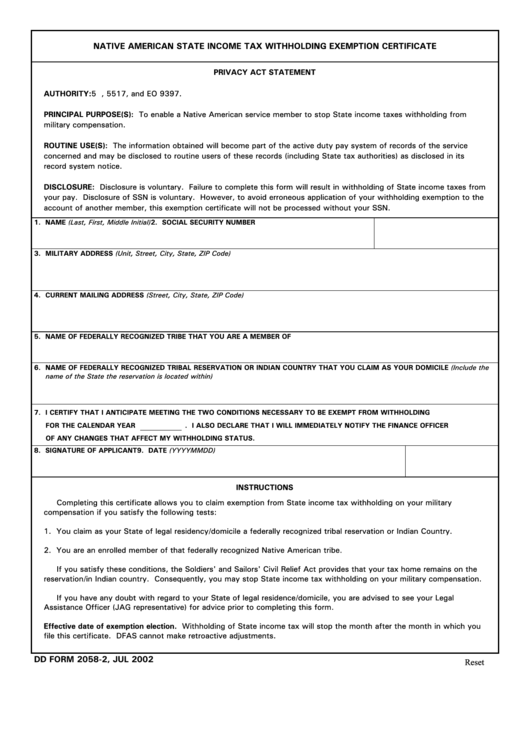

Native American Tax Exempt Form

Native American Tax Exempt Form - Indian tribes and their wholly owned entities aren’t subject to income tax. Senate bill 855 includes expansion of gross income exclusions for native americans. An exception exists for businesses incorporated under state law. You may be exempt from tax if. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. Insights into indian tribal governments being treated as states for certain federal tax purposes, i.e., contributions, excise.

Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. You may be exempt from tax if. Senate bill 855 includes expansion of gross income exclusions for native americans. Indian tribes and their wholly owned entities aren’t subject to income tax. Insights into indian tribal governments being treated as states for certain federal tax purposes, i.e., contributions, excise. An exception exists for businesses incorporated under state law.

An exception exists for businesses incorporated under state law. You may be exempt from tax if. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. Indian tribes and their wholly owned entities aren’t subject to income tax. Senate bill 855 includes expansion of gross income exclusions for native americans. Insights into indian tribal governments being treated as states for certain federal tax purposes, i.e., contributions, excise.

Fillable Dd Form 20582 Native American State Tax Withholding

Insights into indian tribal governments being treated as states for certain federal tax purposes, i.e., contributions, excise. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. Senate bill 855 includes expansion of gross income exclusions for native americans. An exception exists for businesses incorporated under state law. You may be exempt.

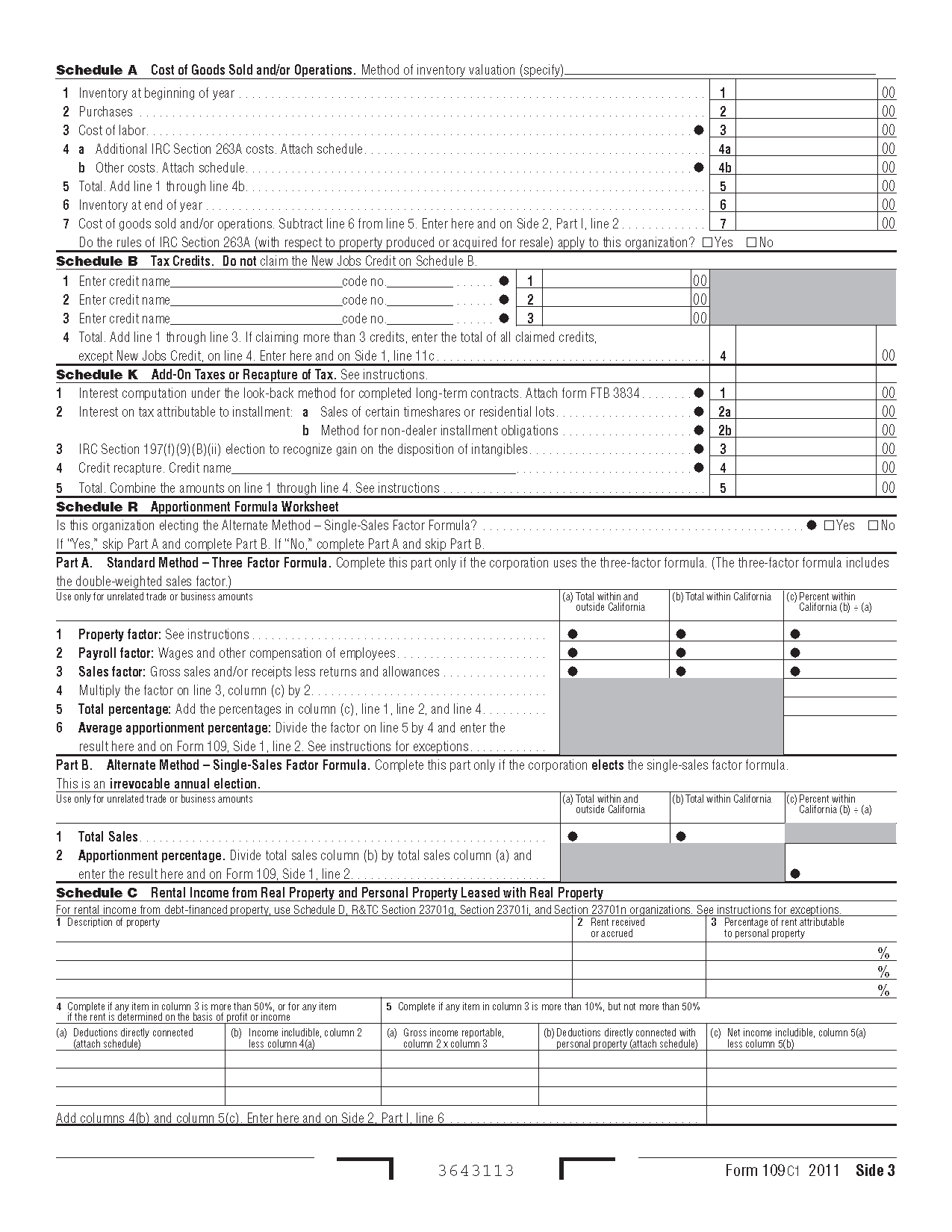

California Taxexempt Form 2023

Senate bill 855 includes expansion of gross income exclusions for native americans. An exception exists for businesses incorporated under state law. Indian tribes and their wholly owned entities aren’t subject to income tax. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. Insights into indian tribal governments being treated as states.

Exemption California State Tax Form 2024

You may be exempt from tax if. An exception exists for businesses incorporated under state law. Insights into indian tribal governments being treated as states for certain federal tax purposes, i.e., contributions, excise. Senate bill 855 includes expansion of gross income exclusions for native americans. Find tax information for native american tribal governments and members, including tax law, filing and.

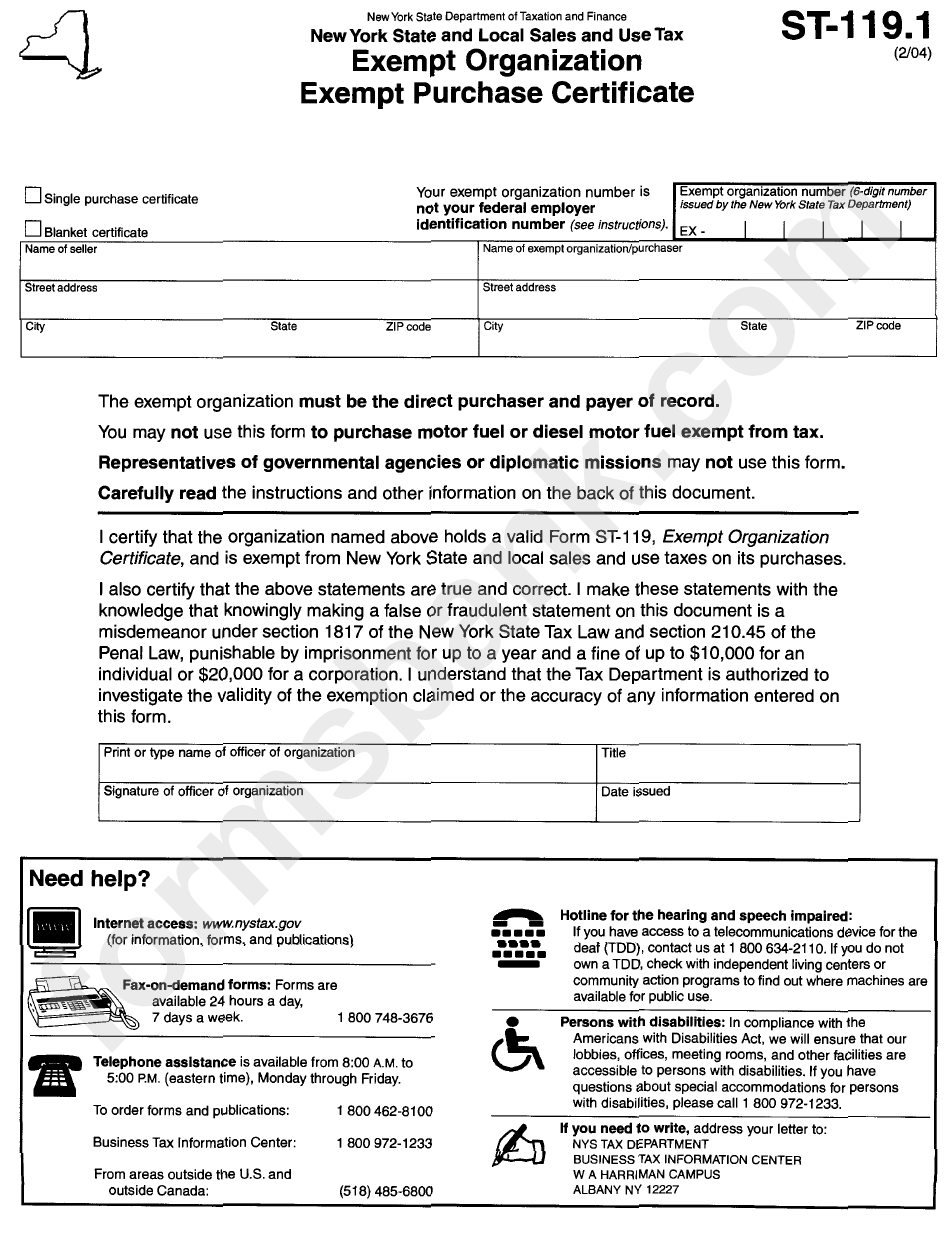

New York State Tax Exempt Certificate Form

Insights into indian tribal governments being treated as states for certain federal tax purposes, i.e., contributions, excise. Indian tribes and their wholly owned entities aren’t subject to income tax. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. You may be exempt from tax if. Senate bill 855 includes expansion of.

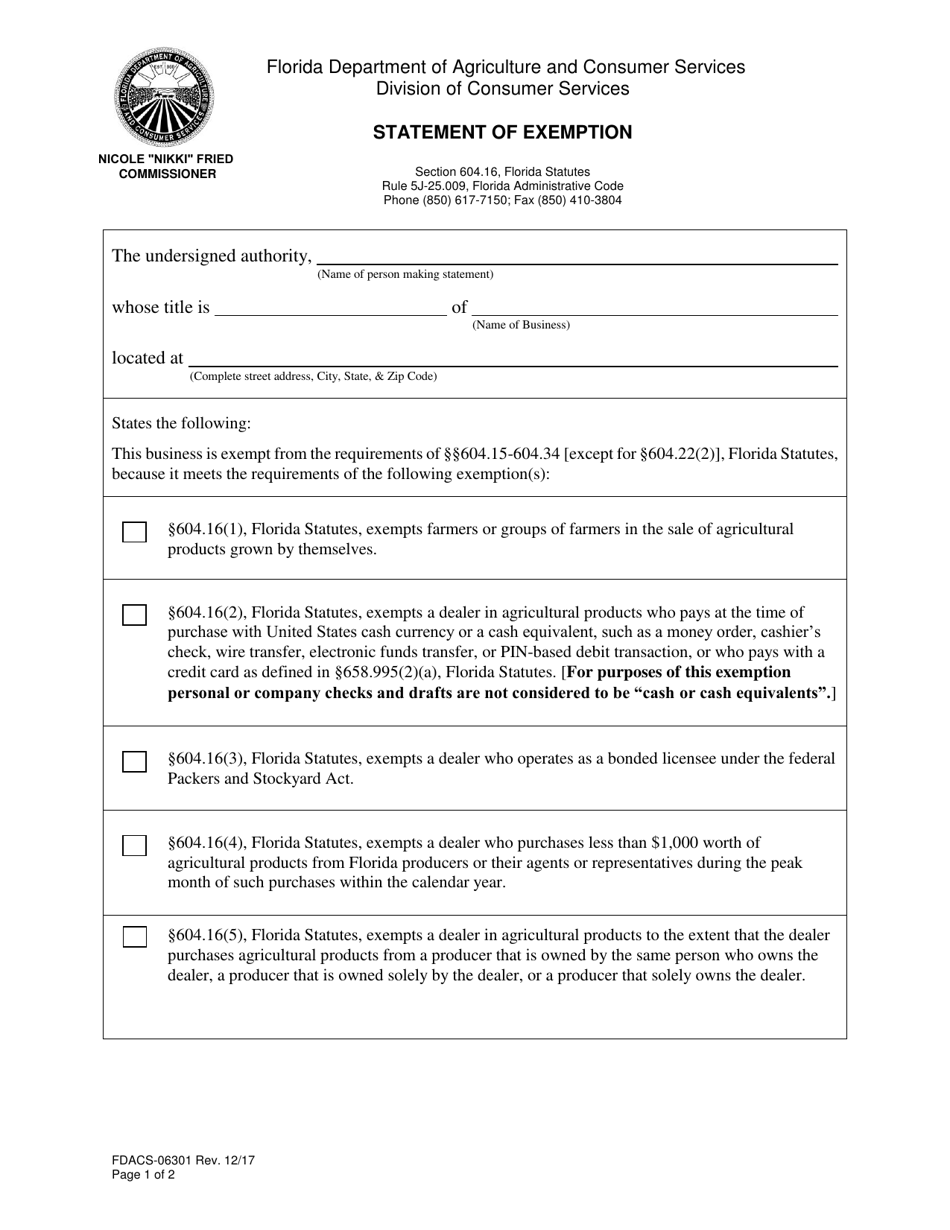

Form FDACS06301 Fill Out, Sign Online and Download Fillable PDF

Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. An exception exists for businesses incorporated under state law. You may be exempt from tax if. Insights into indian tribal governments being treated as states for certain federal tax purposes, i.e., contributions, excise. Indian tribes and their wholly owned entities aren’t subject.

St119.1 Exempt Purchase Certificate printable pdf download

Indian tribes and their wholly owned entities aren’t subject to income tax. Senate bill 855 includes expansion of gross income exclusions for native americans. An exception exists for businesses incorporated under state law. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. Insights into indian tribal governments being treated as states.

Sd Certificate Of Exemption For Sales Tax

Insights into indian tribal governments being treated as states for certain federal tax purposes, i.e., contributions, excise. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. Indian tribes and their wholly owned entities aren’t subject to income tax. An exception exists for businesses incorporated under state law. Senate bill 855 includes.

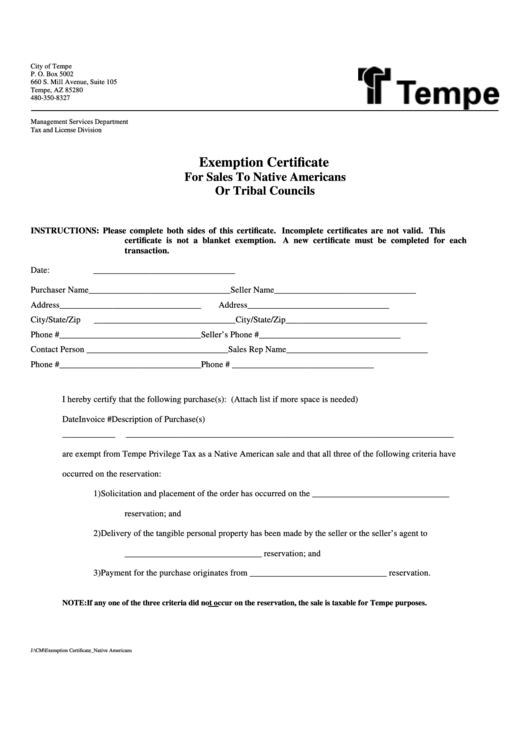

Exemption Certificate For Sales To Native Americans Or Tribal Councils

Indian tribes and their wholly owned entities aren’t subject to income tax. Senate bill 855 includes expansion of gross income exclusions for native americans. An exception exists for businesses incorporated under state law. You may be exempt from tax if. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment.

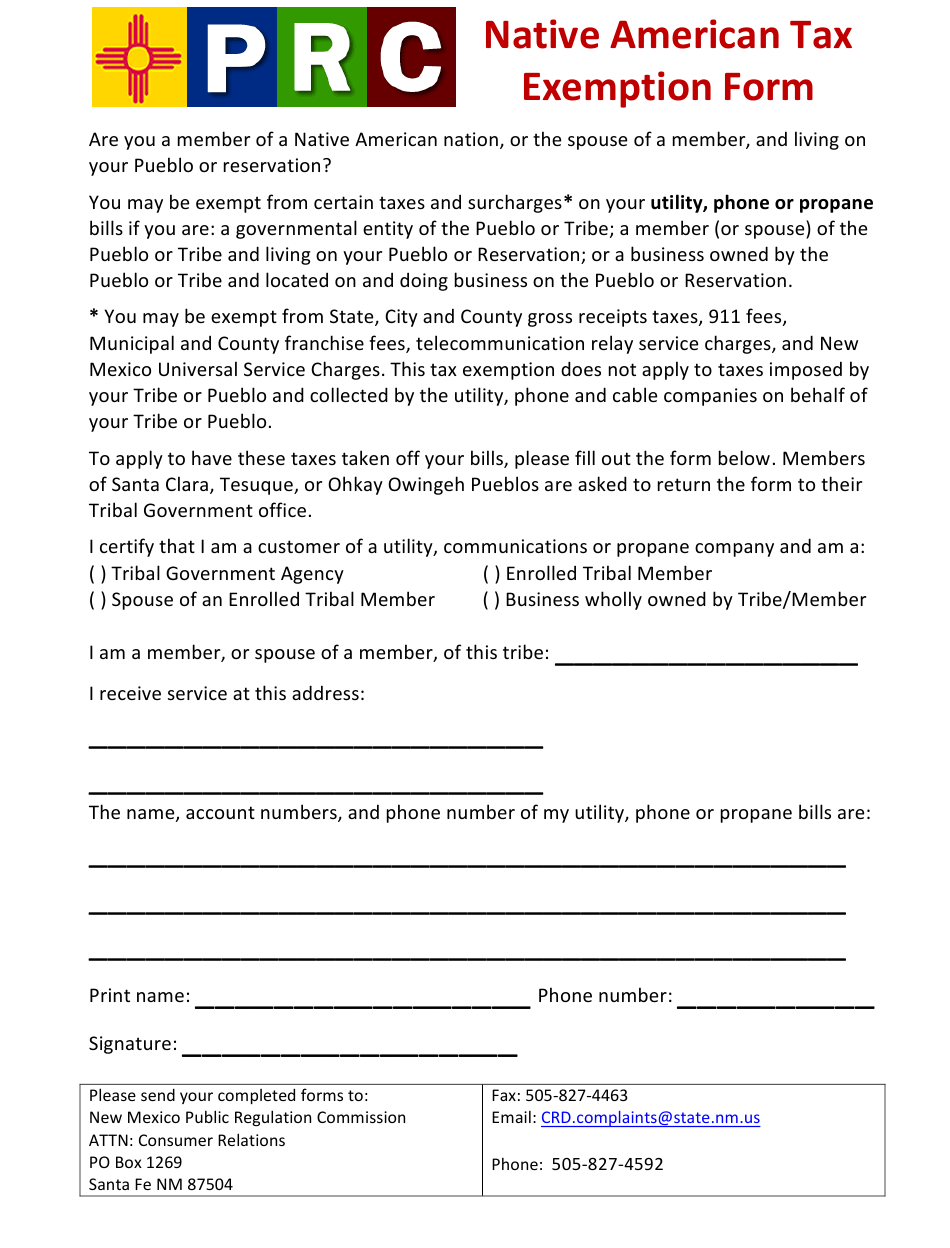

Tax Exempt Form New Mexico

Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. You may be exempt from tax if. Senate bill 855 includes expansion of gross income exclusions for native americans. Indian tribes and their wholly owned entities aren’t subject to income tax. Insights into indian tribal governments being treated as states for certain.

Tax exempt form Fill out & sign online DocHub

You may be exempt from tax if. Senate bill 855 includes expansion of gross income exclusions for native americans. An exception exists for businesses incorporated under state law. Indian tribes and their wholly owned entities aren’t subject to income tax. Insights into indian tribal governments being treated as states for certain federal tax purposes, i.e., contributions, excise.

You May Be Exempt From Tax If.

Senate bill 855 includes expansion of gross income exclusions for native americans. Indian tribes and their wholly owned entities aren’t subject to income tax. An exception exists for businesses incorporated under state law. Insights into indian tribal governments being treated as states for certain federal tax purposes, i.e., contributions, excise.