Nebraska Sales Tax Form 10

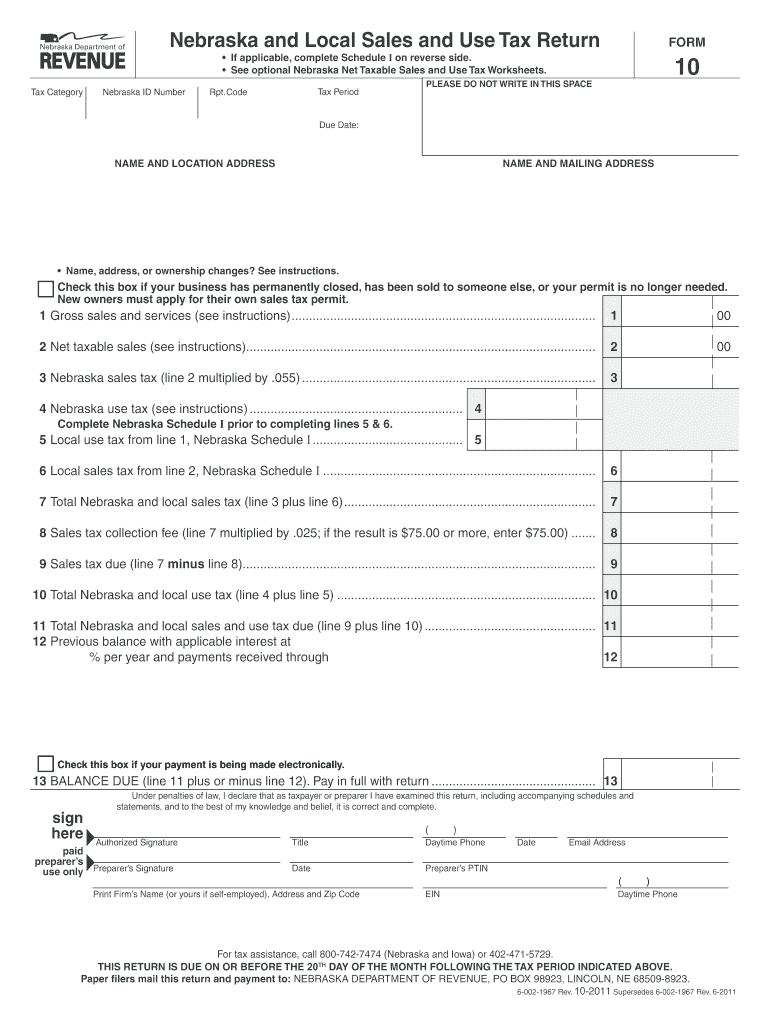

Nebraska Sales Tax Form 10 - Every person collecting nebraska sales and use tax is required to hold a nebraska sales and use tax permit and must file a nebraska and local. Every retailer must file a nebraska and local sales and use tax return, form 10, on or before the due. 64 rows find the forms you need to file your nebraska sales and use tax returns, claim refunds, or apply for exemptions. You need to enter the requested information. The form includes instructions, worksheets, and. Learn how to file and pay nebraska sales and use tax online using form 10 and schedules for amended returns and prior tax periods. Log in with your nebraska id and pin to file various taxes online, including sales and use tax. Must hold a nebraska sales tax permit. Download and print the official form for reporting and paying nebraska sales and use tax.

64 rows find the forms you need to file your nebraska sales and use tax returns, claim refunds, or apply for exemptions. You need to enter the requested information. Every retailer must file a nebraska and local sales and use tax return, form 10, on or before the due. Every person collecting nebraska sales and use tax is required to hold a nebraska sales and use tax permit and must file a nebraska and local. Log in with your nebraska id and pin to file various taxes online, including sales and use tax. The form includes instructions, worksheets, and. Learn how to file and pay nebraska sales and use tax online using form 10 and schedules for amended returns and prior tax periods. Download and print the official form for reporting and paying nebraska sales and use tax. Must hold a nebraska sales tax permit.

The form includes instructions, worksheets, and. Must hold a nebraska sales tax permit. Every retailer must file a nebraska and local sales and use tax return, form 10, on or before the due. Download and print the official form for reporting and paying nebraska sales and use tax. Log in with your nebraska id and pin to file various taxes online, including sales and use tax. Every person collecting nebraska sales and use tax is required to hold a nebraska sales and use tax permit and must file a nebraska and local. Learn how to file and pay nebraska sales and use tax online using form 10 and schedules for amended returns and prior tax periods. You need to enter the requested information. 64 rows find the forms you need to file your nebraska sales and use tax returns, claim refunds, or apply for exemptions.

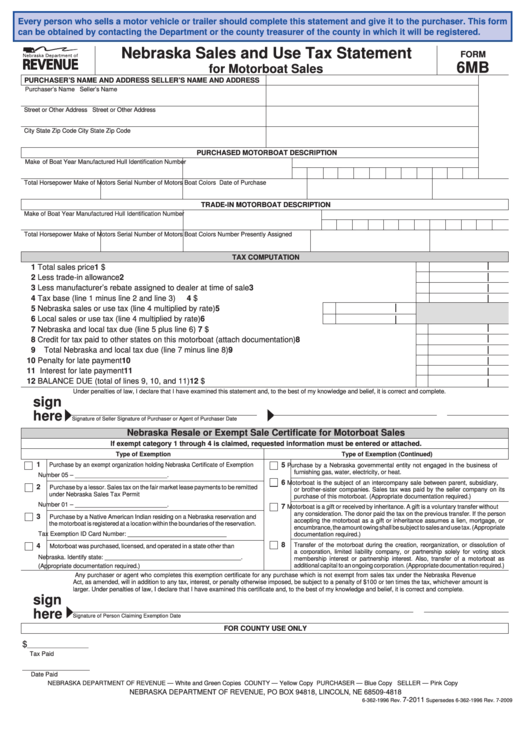

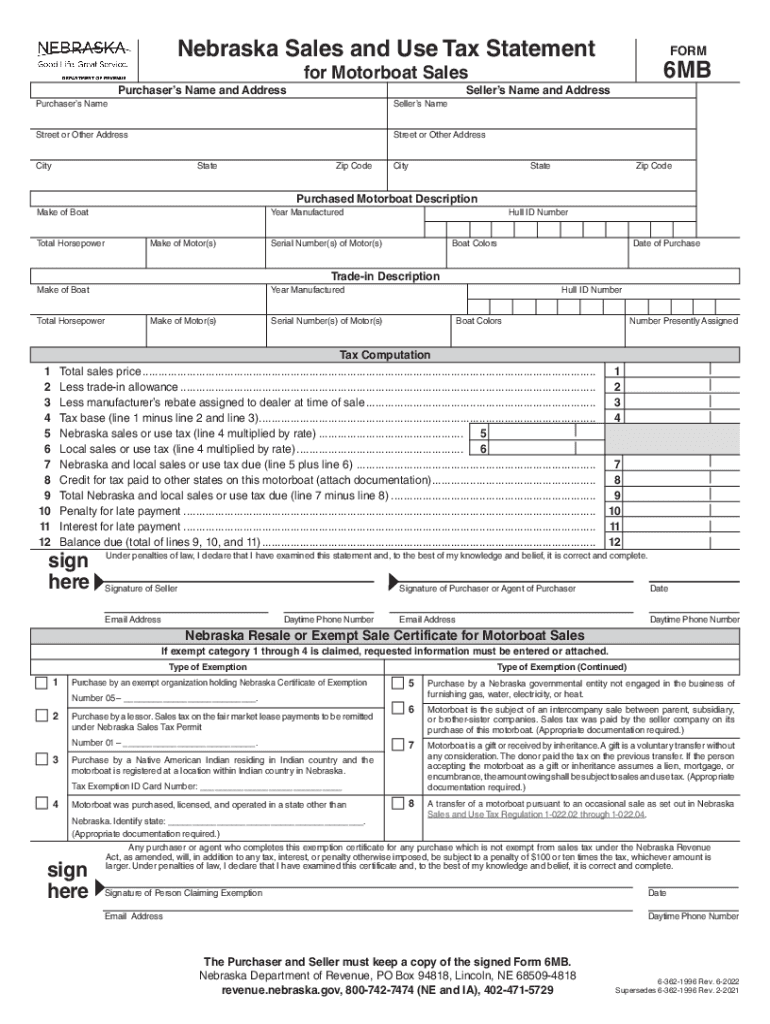

Form 6mb Nebraska Sales And Use Tax Statement printable pdf download

Every retailer must file a nebraska and local sales and use tax return, form 10, on or before the due. 64 rows find the forms you need to file your nebraska sales and use tax returns, claim refunds, or apply for exemptions. Must hold a nebraska sales tax permit. The form includes instructions, worksheets, and. You need to enter the.

Nebraska Sales Tax Form ≡ Fill Out Printable PDF Forms Online

You need to enter the requested information. Every retailer must file a nebraska and local sales and use tax return, form 10, on or before the due. Log in with your nebraska id and pin to file various taxes online, including sales and use tax. The form includes instructions, worksheets, and. 64 rows find the forms you need to file.

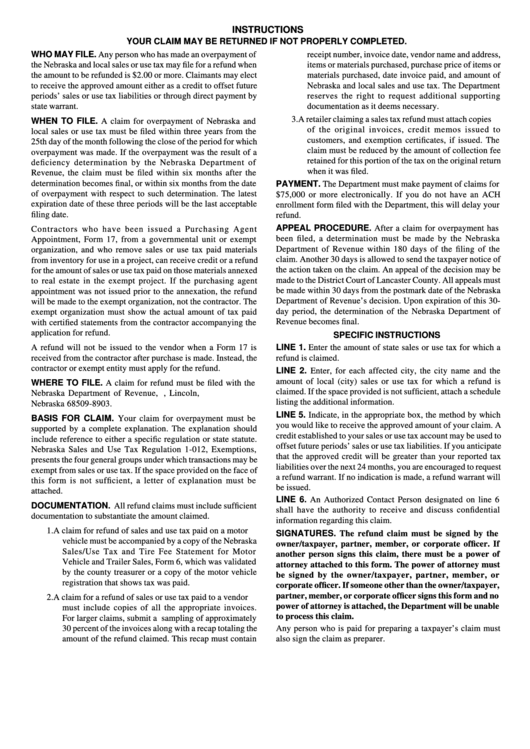

Instructions For Form 10 Nebraska And Local Sales And Use Tax Return

Download and print the official form for reporting and paying nebraska sales and use tax. Every person collecting nebraska sales and use tax is required to hold a nebraska sales and use tax permit and must file a nebraska and local. The form includes instructions, worksheets, and. Log in with your nebraska id and pin to file various taxes online,.

Nebraska Sales Tax 2024 2025

Learn how to file and pay nebraska sales and use tax online using form 10 and schedules for amended returns and prior tax periods. Must hold a nebraska sales tax permit. 64 rows find the forms you need to file your nebraska sales and use tax returns, claim refunds, or apply for exemptions. The form includes instructions, worksheets, and. Download.

Nebraska Sales and Use Tax Statement for Motorboat Sales 6MB Fill Out

64 rows find the forms you need to file your nebraska sales and use tax returns, claim refunds, or apply for exemptions. Must hold a nebraska sales tax permit. Learn how to file and pay nebraska sales and use tax online using form 10 and schedules for amended returns and prior tax periods. The form includes instructions, worksheets, and. You.

20202022 NE 7AG (Formerly 13AG) Fill Online, Printable, Fillable

Log in with your nebraska id and pin to file various taxes online, including sales and use tax. Download and print the official form for reporting and paying nebraska sales and use tax. You need to enter the requested information. The form includes instructions, worksheets, and. Learn how to file and pay nebraska sales and use tax online using form.

Nebraska Sales Tax Rate Finder

Download and print the official form for reporting and paying nebraska sales and use tax. Learn how to file and pay nebraska sales and use tax online using form 10 and schedules for amended returns and prior tax periods. Log in with your nebraska id and pin to file various taxes online, including sales and use tax. Every retailer must.

nebraska sales tax form 6 Fill Online, Printable, Fillable, Blank

64 rows find the forms you need to file your nebraska sales and use tax returns, claim refunds, or apply for exemptions. The form includes instructions, worksheets, and. You need to enter the requested information. Every person collecting nebraska sales and use tax is required to hold a nebraska sales and use tax permit and must file a nebraska and.

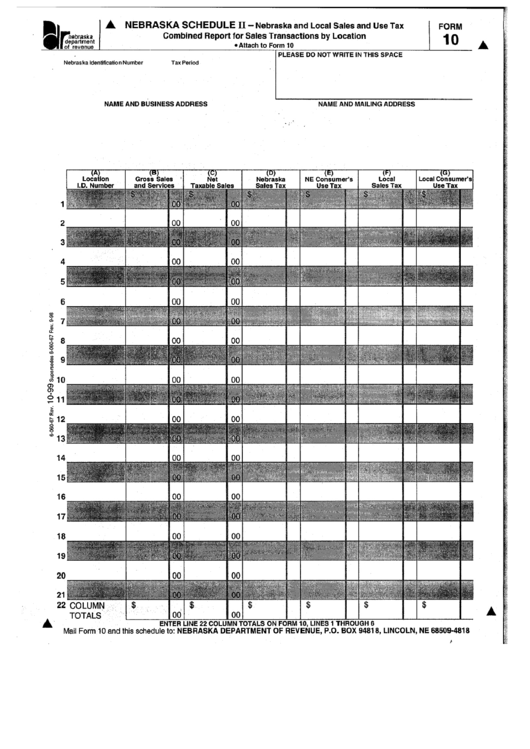

Form 10 Nebraska Schedule Ii Nebraska And Local Sales And Use Tax

64 rows find the forms you need to file your nebraska sales and use tax returns, claim refunds, or apply for exemptions. Every person collecting nebraska sales and use tax is required to hold a nebraska sales and use tax permit and must file a nebraska and local. Every retailer must file a nebraska and local sales and use tax.

2011 NE Form 10 Fill Online, Printable, Fillable, Blank pdfFiller

Every person collecting nebraska sales and use tax is required to hold a nebraska sales and use tax permit and must file a nebraska and local. Learn how to file and pay nebraska sales and use tax online using form 10 and schedules for amended returns and prior tax periods. You need to enter the requested information. Download and print.

Every Retailer Must File A Nebraska And Local Sales And Use Tax Return, Form 10, On Or Before The Due.

Must hold a nebraska sales tax permit. Learn how to file and pay nebraska sales and use tax online using form 10 and schedules for amended returns and prior tax periods. 64 rows find the forms you need to file your nebraska sales and use tax returns, claim refunds, or apply for exemptions. The form includes instructions, worksheets, and.

You Need To Enter The Requested Information.

Log in with your nebraska id and pin to file various taxes online, including sales and use tax. Every person collecting nebraska sales and use tax is required to hold a nebraska sales and use tax permit and must file a nebraska and local. Download and print the official form for reporting and paying nebraska sales and use tax.