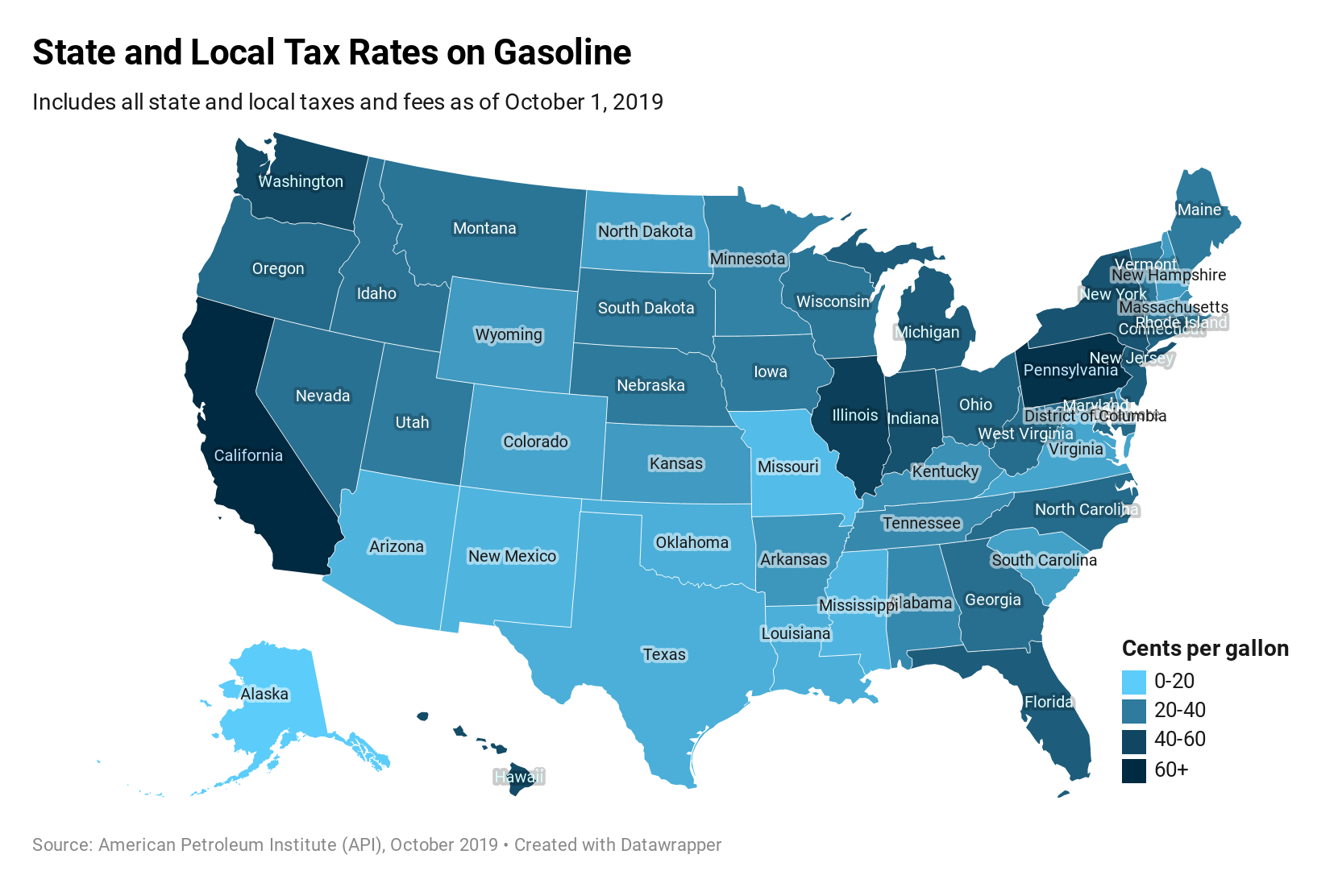

Nevada State And Local Tax Rate

Nevada State And Local Tax Rate - Nevada has $8,925 in state and local debt per capita and. Nevada sales and use tax rates in 2024 range from 4.6% to 8.265% depending on location. See the latest rate changes and. The state of nevada collects $5,080 in state and local tax collections per capita. 31 rows find the current sales tax rate for any city in nevada, including state, county and city taxes. Counties and cities in nevada are. Use our calculator to determine your exact sales tax. The nevada state sales tax rate is 6.85%, and the average nv sales tax after local surtaxes is 7.94%.

Use our calculator to determine your exact sales tax. Nevada sales and use tax rates in 2024 range from 4.6% to 8.265% depending on location. Nevada has $8,925 in state and local debt per capita and. The state of nevada collects $5,080 in state and local tax collections per capita. Counties and cities in nevada are. 31 rows find the current sales tax rate for any city in nevada, including state, county and city taxes. The nevada state sales tax rate is 6.85%, and the average nv sales tax after local surtaxes is 7.94%. See the latest rate changes and.

Nevada has $8,925 in state and local debt per capita and. Counties and cities in nevada are. The nevada state sales tax rate is 6.85%, and the average nv sales tax after local surtaxes is 7.94%. Use our calculator to determine your exact sales tax. The state of nevada collects $5,080 in state and local tax collections per capita. See the latest rate changes and. Nevada sales and use tax rates in 2024 range from 4.6% to 8.265% depending on location. 31 rows find the current sales tax rate for any city in nevada, including state, county and city taxes.

Nevada State Tax 2024 2025

31 rows find the current sales tax rate for any city in nevada, including state, county and city taxes. The state of nevada collects $5,080 in state and local tax collections per capita. The nevada state sales tax rate is 6.85%, and the average nv sales tax after local surtaxes is 7.94%. See the latest rate changes and. Counties and.

StateLocal Tax Burden Rankings Tax Foundation

Nevada has $8,925 in state and local debt per capita and. Counties and cities in nevada are. 31 rows find the current sales tax rate for any city in nevada, including state, county and city taxes. The nevada state sales tax rate is 6.85%, and the average nv sales tax after local surtaxes is 7.94%. Nevada sales and use tax.

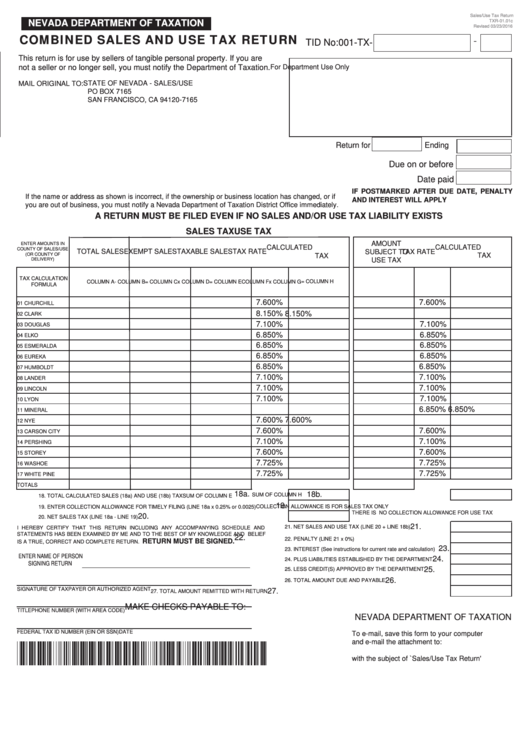

Sales Tax Rate Nevada 2019 Paul Smith

Nevada sales and use tax rates in 2024 range from 4.6% to 8.265% depending on location. Nevada has $8,925 in state and local debt per capita and. The state of nevada collects $5,080 in state and local tax collections per capita. Use our calculator to determine your exact sales tax. Counties and cities in nevada are.

nevada estate tax rate Gracia Blocker

31 rows find the current sales tax rate for any city in nevada, including state, county and city taxes. Counties and cities in nevada are. Nevada has $8,925 in state and local debt per capita and. The state of nevada collects $5,080 in state and local tax collections per capita. The nevada state sales tax rate is 6.85%, and the.

Nevada Sales Tax Rate 2018 IUCN Water

Nevada has $8,925 in state and local debt per capita and. The nevada state sales tax rate is 6.85%, and the average nv sales tax after local surtaxes is 7.94%. 31 rows find the current sales tax rate for any city in nevada, including state, county and city taxes. Nevada sales and use tax rates in 2024 range from 4.6%.

State Of Nevada Sales Tax Rates By County Paul Smith

Nevada has $8,925 in state and local debt per capita and. The state of nevada collects $5,080 in state and local tax collections per capita. 31 rows find the current sales tax rate for any city in nevada, including state, county and city taxes. Nevada sales and use tax rates in 2024 range from 4.6% to 8.265% depending on location..

StateLocal Tax Burden Rankings Tax Foundation

31 rows find the current sales tax rate for any city in nevada, including state, county and city taxes. The nevada state sales tax rate is 6.85%, and the average nv sales tax after local surtaxes is 7.94%. Use our calculator to determine your exact sales tax. Nevada has $8,925 in state and local debt per capita and. Counties and.

Nevada Sales Tax Guide for Businesses

The nevada state sales tax rate is 6.85%, and the average nv sales tax after local surtaxes is 7.94%. Use our calculator to determine your exact sales tax. See the latest rate changes and. Nevada has $8,925 in state and local debt per capita and. The state of nevada collects $5,080 in state and local tax collections per capita.

Nevada Tax Rate Advantage Explained

Nevada sales and use tax rates in 2024 range from 4.6% to 8.265% depending on location. See the latest rate changes and. Nevada has $8,925 in state and local debt per capita and. Counties and cities in nevada are. The state of nevada collects $5,080 in state and local tax collections per capita.

Monday Map Combined State and Local Sales Tax Rates

31 rows find the current sales tax rate for any city in nevada, including state, county and city taxes. Nevada sales and use tax rates in 2024 range from 4.6% to 8.265% depending on location. The state of nevada collects $5,080 in state and local tax collections per capita. Counties and cities in nevada are. Nevada has $8,925 in state.

Nevada Sales And Use Tax Rates In 2024 Range From 4.6% To 8.265% Depending On Location.

31 rows find the current sales tax rate for any city in nevada, including state, county and city taxes. Nevada has $8,925 in state and local debt per capita and. The state of nevada collects $5,080 in state and local tax collections per capita. Counties and cities in nevada are.

Use Our Calculator To Determine Your Exact Sales Tax.

The nevada state sales tax rate is 6.85%, and the average nv sales tax after local surtaxes is 7.94%. See the latest rate changes and.

.png)