Nh Tax Liens

Nh Tax Liens - This combines all principal, interest, and costs due into one new. The process is completely regulated by nh state laws (aka rsas). Tax liens are placed on property if all or any portion of your taxes are not paid by march following your december bill. The town, to protect its ability to collect all taxes due, must proceed to perfect a lien on your property if all taxes for a year are. Liens may be placed upon your real estate, personal property, and property interests including bank accounts, accounts receivable, security. Is new hampshire a tax lien state? A tax lien is placed on any property with an overdue tax balance. If taxes remain unpaid on the lien date, a lien will be placed on the property. New hampshire, currently has 732 tax liens available as of january 5.

If taxes remain unpaid on the lien date, a lien will be placed on the property. This combines all principal, interest, and costs due into one new. Liens may be placed upon your real estate, personal property, and property interests including bank accounts, accounts receivable, security. Is new hampshire a tax lien state? The town, to protect its ability to collect all taxes due, must proceed to perfect a lien on your property if all taxes for a year are. New hampshire, currently has 732 tax liens available as of january 5. A tax lien is placed on any property with an overdue tax balance. Tax liens are placed on property if all or any portion of your taxes are not paid by march following your december bill. The process is completely regulated by nh state laws (aka rsas).

New hampshire, currently has 732 tax liens available as of january 5. Is new hampshire a tax lien state? A tax lien is placed on any property with an overdue tax balance. If taxes remain unpaid on the lien date, a lien will be placed on the property. The town, to protect its ability to collect all taxes due, must proceed to perfect a lien on your property if all taxes for a year are. This combines all principal, interest, and costs due into one new. Tax liens are placed on property if all or any portion of your taxes are not paid by march following your december bill. The process is completely regulated by nh state laws (aka rsas). Liens may be placed upon your real estate, personal property, and property interests including bank accounts, accounts receivable, security.

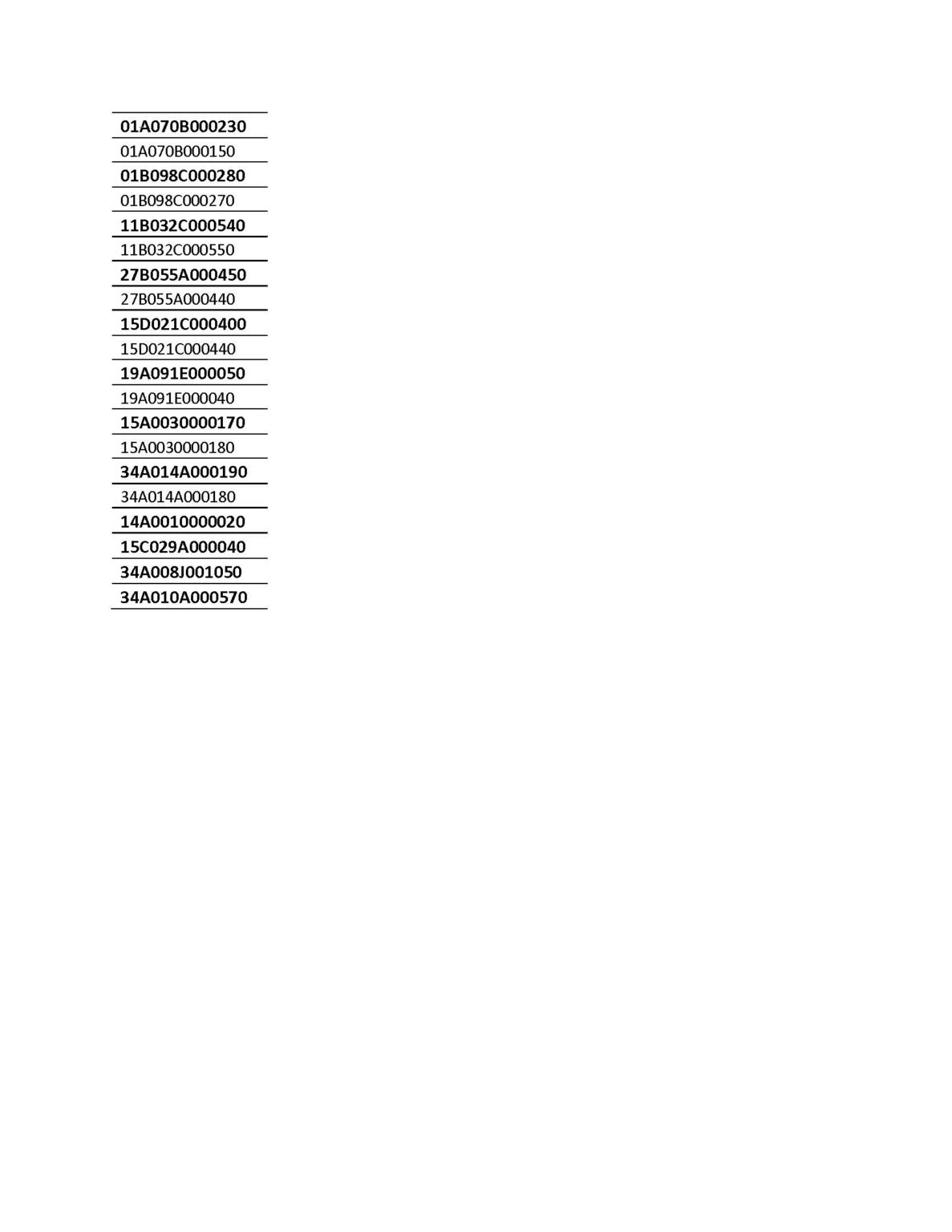

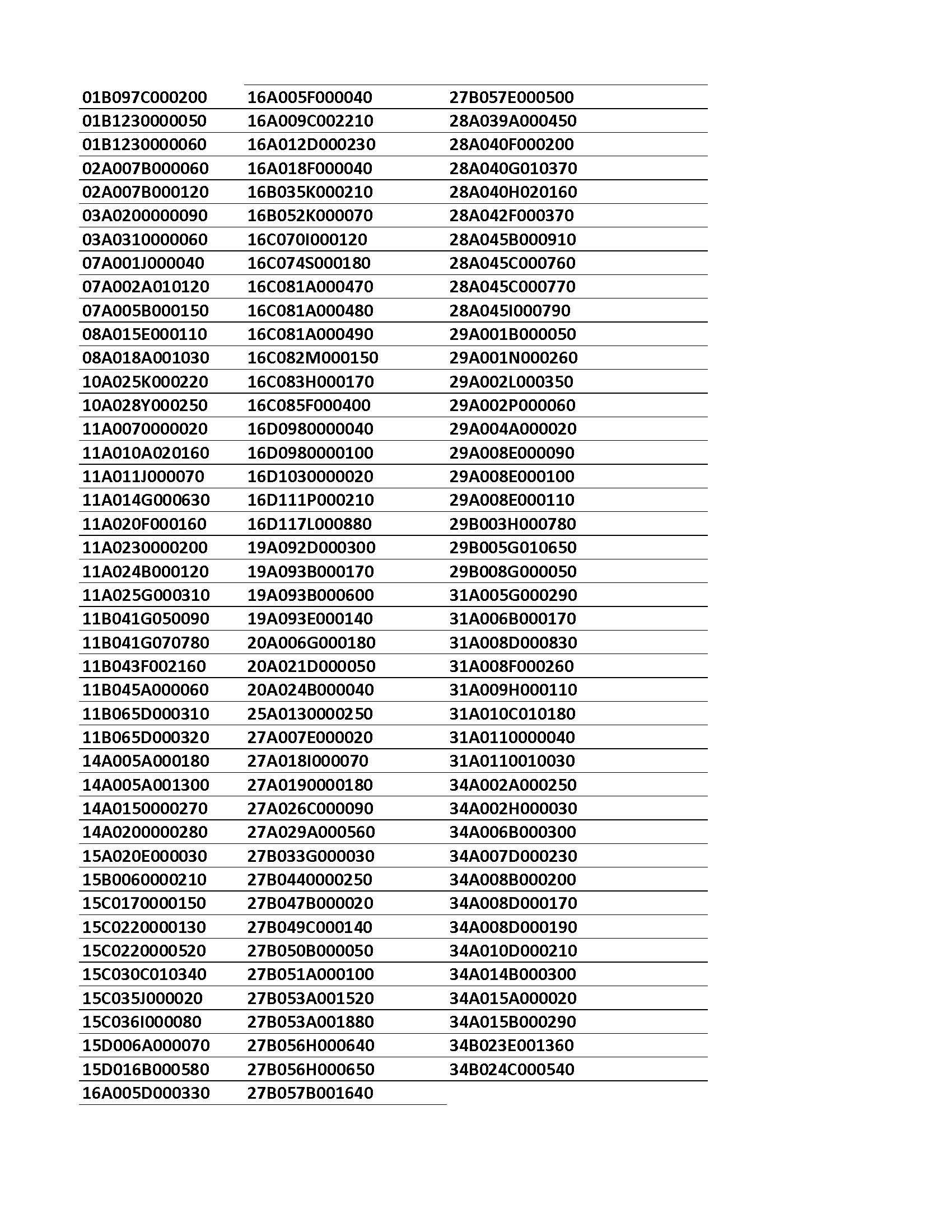

TAX LIENS PENDING CERTIFICATE FILING Treasurer

The town, to protect its ability to collect all taxes due, must proceed to perfect a lien on your property if all taxes for a year are. Is new hampshire a tax lien state? This combines all principal, interest, and costs due into one new. A tax lien is placed on any property with an overdue tax balance. New hampshire,.

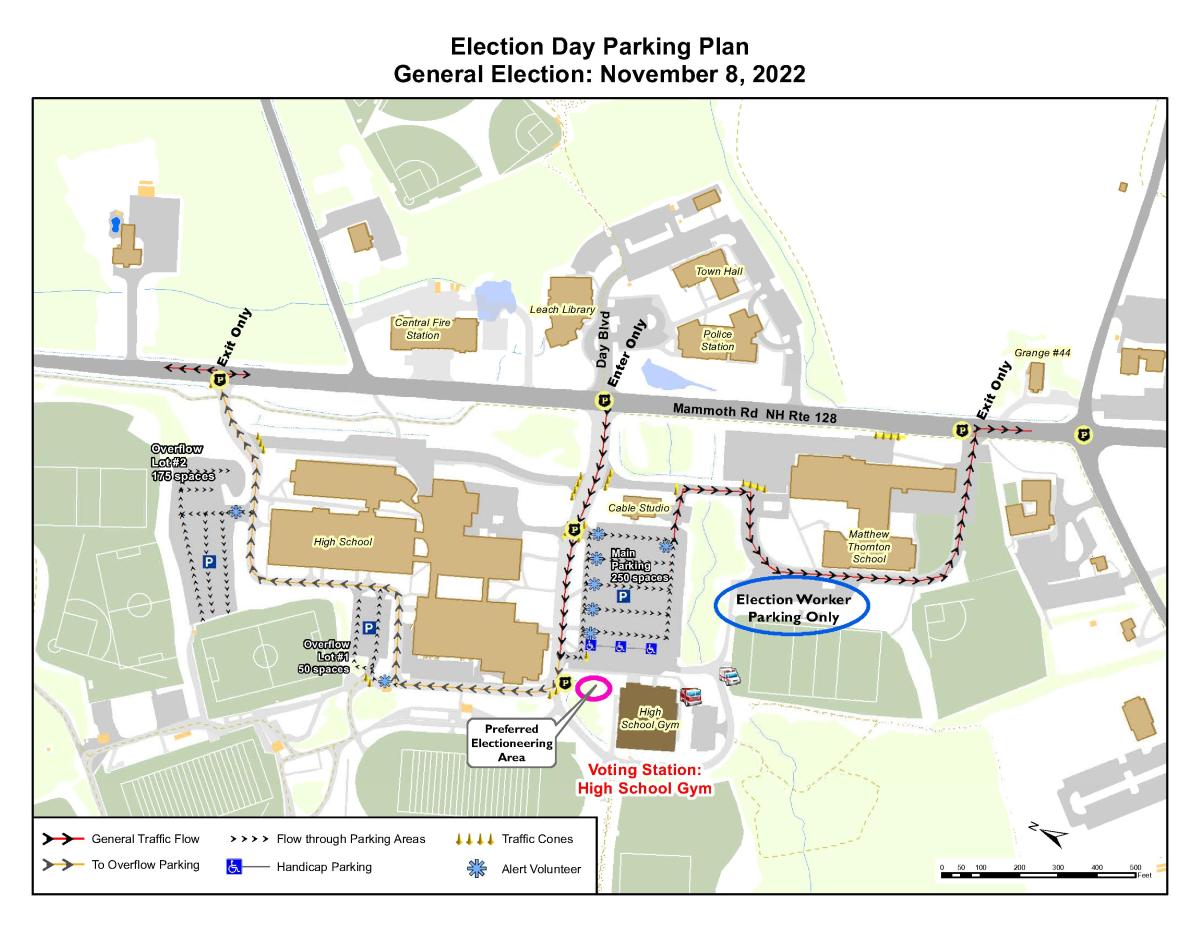

Grafton, NH Auction Dec. 3, 2022 NH Tax Deed & Property Auctions

Tax liens are placed on property if all or any portion of your taxes are not paid by march following your december bill. New hampshire, currently has 732 tax liens available as of january 5. This combines all principal, interest, and costs due into one new. A tax lien is placed on any property with an overdue tax balance. Is.

New Hampshire Tax Collectors Association tax collector New

This combines all principal, interest, and costs due into one new. Tax liens are placed on property if all or any portion of your taxes are not paid by march following your december bill. Is new hampshire a tax lien state? A tax lien is placed on any property with an overdue tax balance. New hampshire, currently has 732 tax.

Town Clerk/Tax Collector Londonderry, NH

This combines all principal, interest, and costs due into one new. Tax liens are placed on property if all or any portion of your taxes are not paid by march following your december bill. A tax lien is placed on any property with an overdue tax balance. Liens may be placed upon your real estate, personal property, and property interests.

Grafton, NH Auction Dec. 3, 2022 NH Tax Deed & Property Auctions

This combines all principal, interest, and costs due into one new. If taxes remain unpaid on the lien date, a lien will be placed on the property. New hampshire, currently has 732 tax liens available as of january 5. Tax liens are placed on property if all or any portion of your taxes are not paid by march following your.

Grafton, NH Auction Dec. 3, 2022 NH Tax Deed & Property Auctions

The town, to protect its ability to collect all taxes due, must proceed to perfect a lien on your property if all taxes for a year are. This combines all principal, interest, and costs due into one new. Is new hampshire a tax lien state? New hampshire, currently has 732 tax liens available as of january 5. Liens may be.

Tax Liens An Overview CheckBook IRA LLC

Is new hampshire a tax lien state? A tax lien is placed on any property with an overdue tax balance. The process is completely regulated by nh state laws (aka rsas). This combines all principal, interest, and costs due into one new. New hampshire, currently has 732 tax liens available as of january 5.

Tax Liens and Deeds Live Class Pips Path

This combines all principal, interest, and costs due into one new. The process is completely regulated by nh state laws (aka rsas). Liens may be placed upon your real estate, personal property, and property interests including bank accounts, accounts receivable, security. If taxes remain unpaid on the lien date, a lien will be placed on the property. New hampshire, currently.

Tax Collector Town of Lancaster, NH Life as You Make it.

Liens may be placed upon your real estate, personal property, and property interests including bank accounts, accounts receivable, security. The town, to protect its ability to collect all taxes due, must proceed to perfect a lien on your property if all taxes for a year are. Is new hampshire a tax lien state? New hampshire, currently has 732 tax liens.

TAX LIENS PENDING CERTIFICATE FILING Treasurer

A tax lien is placed on any property with an overdue tax balance. New hampshire, currently has 732 tax liens available as of january 5. This combines all principal, interest, and costs due into one new. The process is completely regulated by nh state laws (aka rsas). Liens may be placed upon your real estate, personal property, and property interests.

Tax Liens Are Placed On Property If All Or Any Portion Of Your Taxes Are Not Paid By March Following Your December Bill.

Liens may be placed upon your real estate, personal property, and property interests including bank accounts, accounts receivable, security. This combines all principal, interest, and costs due into one new. The process is completely regulated by nh state laws (aka rsas). If taxes remain unpaid on the lien date, a lien will be placed on the property.

Is New Hampshire A Tax Lien State?

A tax lien is placed on any property with an overdue tax balance. The town, to protect its ability to collect all taxes due, must proceed to perfect a lien on your property if all taxes for a year are. New hampshire, currently has 732 tax liens available as of january 5.