Notice Of Tax Lien

Notice Of Tax Lien - Notices of federal tax lien. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. It may be about a specific issue on your federal. Withdrawing the notice of federal tax lien removes irs competition with other creditors, but you remain liable for the amount. The internal revenue service (irs) will send a notice or a letter for any number of reasons.

Notices of federal tax lien. It may be about a specific issue on your federal. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. The internal revenue service (irs) will send a notice or a letter for any number of reasons. Withdrawing the notice of federal tax lien removes irs competition with other creditors, but you remain liable for the amount.

For general lien information, taxpayers may refer to the understanding a federal tax lien page on. It may be about a specific issue on your federal. The internal revenue service (irs) will send a notice or a letter for any number of reasons. Notices of federal tax lien. Withdrawing the notice of federal tax lien removes irs competition with other creditors, but you remain liable for the amount.

The Importance of Hiring a Tax Lien Attorney for Your Insurance

The internal revenue service (irs) will send a notice or a letter for any number of reasons. It may be about a specific issue on your federal. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. Notices of federal tax lien. Withdrawing the notice of federal tax lien removes irs competition with other.

Tax Lien Foreclosure Update Levitt & Slafkes, P.C.

For general lien information, taxpayers may refer to the understanding a federal tax lien page on. Withdrawing the notice of federal tax lien removes irs competition with other creditors, but you remain liable for the amount. It may be about a specific issue on your federal. The internal revenue service (irs) will send a notice or a letter for any.

EasytoUnderstand Tax Lien Code Certificates Posteezy

For general lien information, taxpayers may refer to the understanding a federal tax lien page on. The internal revenue service (irs) will send a notice or a letter for any number of reasons. Notices of federal tax lien. Withdrawing the notice of federal tax lien removes irs competition with other creditors, but you remain liable for the amount. It may.

Tax Lien Form Free Word Templates

Withdrawing the notice of federal tax lien removes irs competition with other creditors, but you remain liable for the amount. The internal revenue service (irs) will send a notice or a letter for any number of reasons. Notices of federal tax lien. It may be about a specific issue on your federal. For general lien information, taxpayers may refer to.

Tax Lien Sale PDF Tax Lien Taxes

It may be about a specific issue on your federal. Withdrawing the notice of federal tax lien removes irs competition with other creditors, but you remain liable for the amount. The internal revenue service (irs) will send a notice or a letter for any number of reasons. Notices of federal tax lien. For general lien information, taxpayers may refer to.

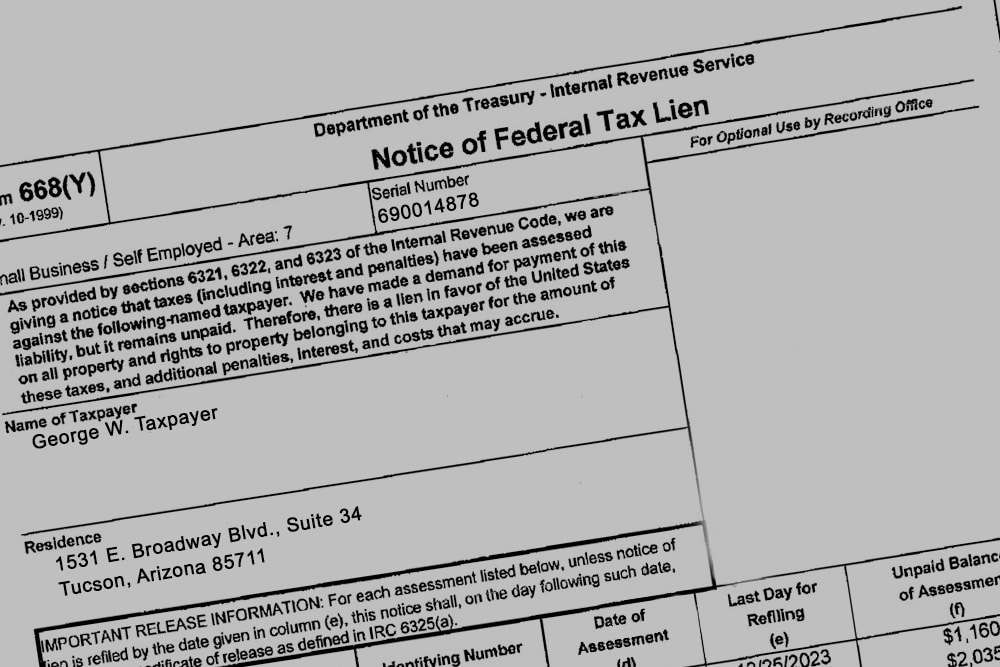

What is a Notice of Federal Tax Lien? Heartland Tax Solutions

Notices of federal tax lien. It may be about a specific issue on your federal. Withdrawing the notice of federal tax lien removes irs competition with other creditors, but you remain liable for the amount. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. The internal revenue service (irs) will send a notice.

How to Tackle IRS Tax Lien or Levy Notice? Internal Revenue Code

It may be about a specific issue on your federal. Withdrawing the notice of federal tax lien removes irs competition with other creditors, but you remain liable for the amount. Notices of federal tax lien. The internal revenue service (irs) will send a notice or a letter for any number of reasons. For general lien information, taxpayers may refer to.

Notice of Filing of Tax Lien (NFTL) Law Offices of Arthur Weiss

It may be about a specific issue on your federal. The internal revenue service (irs) will send a notice or a letter for any number of reasons. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. Notices of federal tax lien. Withdrawing the notice of federal tax lien removes irs competition with other.

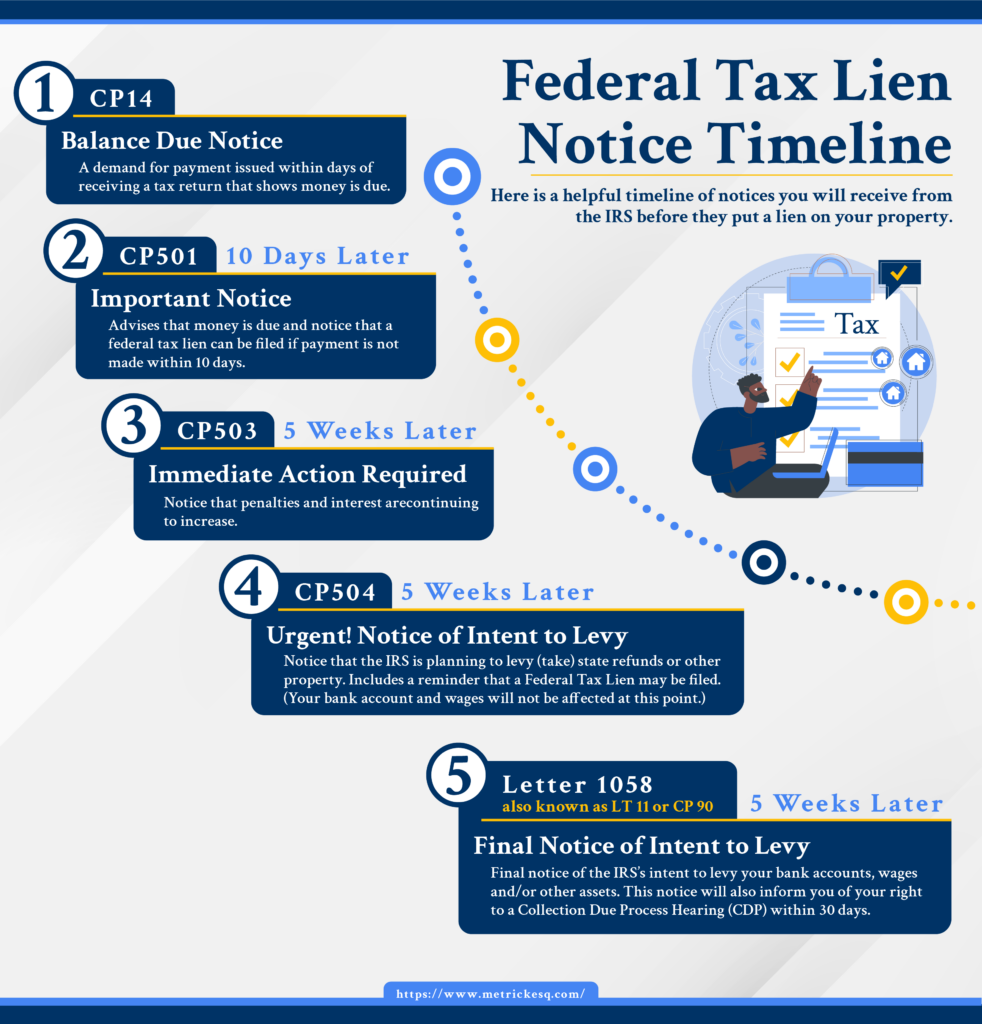

Federal Tax Lien Notice Timeline Ira J. Metrick, Esq.

Notices of federal tax lien. The internal revenue service (irs) will send a notice or a letter for any number of reasons. Withdrawing the notice of federal tax lien removes irs competition with other creditors, but you remain liable for the amount. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. It may.

Pursuant to the Tax Lien, Tax May be Collected from Estate Property in

The internal revenue service (irs) will send a notice or a letter for any number of reasons. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. Notices of federal tax lien. It may be about a specific issue on your federal. Withdrawing the notice of federal tax lien removes irs competition with other.

Notices Of Federal Tax Lien.

Withdrawing the notice of federal tax lien removes irs competition with other creditors, but you remain liable for the amount. It may be about a specific issue on your federal. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. The internal revenue service (irs) will send a notice or a letter for any number of reasons.