Ohio Tax Lien

Ohio Tax Lien - Property taxes may be collected and enforced by local officials. For individual taxes call 1. You'll get notice before either. Tax certificate liens to avoid the sale of a tax certificate lien on your property, you must pay your taxes in full or enter into a payment plan. Property taxes in ohio fund essential services in your community, including public schools, emergency services like police and. Specifically, it focuses on the timing of tax payments, the potential. The tax lien sale provides immediate funding of past due tax dollars to the agencies like schools and local governments that rely on property tax. To obtain more information about the lien, contact the attorney general's office. This section explains how the county treasurer can enforce the lien for taxes against delinquent land or minerals by civil action or. If you have delinquent property taxes in ohio, you'll likely face a tax lien sale or a tax foreclosure.

If you have delinquent property taxes in ohio, you'll likely face a tax lien sale or a tax foreclosure. Tax certificate liens to avoid the sale of a tax certificate lien on your property, you must pay your taxes in full or enter into a payment plan. Specifically, it focuses on the timing of tax payments, the potential. For individual taxes call 1. You'll get notice before either. To obtain more information about the lien, contact the attorney general's office. Property taxes may be collected and enforced by local officials. This section explains how the county treasurer can enforce the lien for taxes against delinquent land or minerals by civil action or. The tax lien sale provides immediate funding of past due tax dollars to the agencies like schools and local governments that rely on property tax. Property taxes in ohio fund essential services in your community, including public schools, emergency services like police and.

Specifically, it focuses on the timing of tax payments, the potential. This section explains how the county treasurer can enforce the lien for taxes against delinquent land or minerals by civil action or. To obtain more information about the lien, contact the attorney general's office. Property taxes may be collected and enforced by local officials. You'll get notice before either. If you have delinquent property taxes in ohio, you'll likely face a tax lien sale or a tax foreclosure. Property taxes in ohio fund essential services in your community, including public schools, emergency services like police and. The tax lien sale provides immediate funding of past due tax dollars to the agencies like schools and local governments that rely on property tax. Tax certificate liens to avoid the sale of a tax certificate lien on your property, you must pay your taxes in full or enter into a payment plan. For individual taxes call 1.

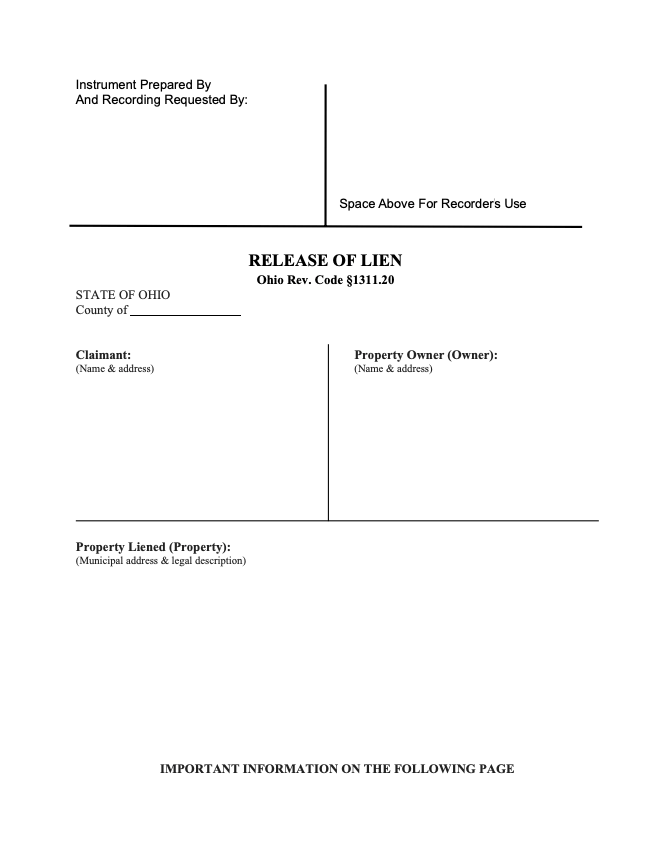

Ohio Release of Lien Form Free Template Download

Property taxes in ohio fund essential services in your community, including public schools, emergency services like police and. You'll get notice before either. The tax lien sale provides immediate funding of past due tax dollars to the agencies like schools and local governments that rely on property tax. Property taxes may be collected and enforced by local officials. This section.

Tax Lien Sale Download Free PDF Tax Lien Taxes

If you have delinquent property taxes in ohio, you'll likely face a tax lien sale or a tax foreclosure. This section explains how the county treasurer can enforce the lien for taxes against delinquent land or minerals by civil action or. Property taxes in ohio fund essential services in your community, including public schools, emergency services like police and. You'll.

Tax Lien What Is A State Tax Lien Ohio

For individual taxes call 1. Specifically, it focuses on the timing of tax payments, the potential. If you have delinquent property taxes in ohio, you'll likely face a tax lien sale or a tax foreclosure. The tax lien sale provides immediate funding of past due tax dollars to the agencies like schools and local governments that rely on property tax..

Ohio Tax Brackets 2024 Ninon Anallese

Specifically, it focuses on the timing of tax payments, the potential. To obtain more information about the lien, contact the attorney general's office. Tax certificate liens to avoid the sale of a tax certificate lien on your property, you must pay your taxes in full or enter into a payment plan. The tax lien sale provides immediate funding of past.

Tax Lien What Is A State Tax Lien Ohio

Specifically, it focuses on the timing of tax payments, the potential. If you have delinquent property taxes in ohio, you'll likely face a tax lien sale or a tax foreclosure. Tax certificate liens to avoid the sale of a tax certificate lien on your property, you must pay your taxes in full or enter into a payment plan. Property taxes.

Tax Lien Ohio State Tax Lien

To obtain more information about the lien, contact the attorney general's office. Property taxes may be collected and enforced by local officials. If you have delinquent property taxes in ohio, you'll likely face a tax lien sale or a tax foreclosure. Tax certificate liens to avoid the sale of a tax certificate lien on your property, you must pay your.

State Of Ohio Tax Rates 2024 Ginny Justinn

This section explains how the county treasurer can enforce the lien for taxes against delinquent land or minerals by civil action or. The tax lien sale provides immediate funding of past due tax dollars to the agencies like schools and local governments that rely on property tax. To obtain more information about the lien, contact the attorney general's office. For.

Ohio Mechanics Lien Guide & FAQs Levelset

Property taxes in ohio fund essential services in your community, including public schools, emergency services like police and. Specifically, it focuses on the timing of tax payments, the potential. To obtain more information about the lien, contact the attorney general's office. If you have delinquent property taxes in ohio, you'll likely face a tax lien sale or a tax foreclosure..

Property Tax Lien Sales Ohio Investor's Guide to Success

The tax lien sale provides immediate funding of past due tax dollars to the agencies like schools and local governments that rely on property tax. This section explains how the county treasurer can enforce the lien for taxes against delinquent land or minerals by civil action or. You'll get notice before either. For individual taxes call 1. If you have.

Ohio Mechanics Lien Form Fill Online, Printable, Fillable, Blank

This section explains how the county treasurer can enforce the lien for taxes against delinquent land or minerals by civil action or. You'll get notice before either. For individual taxes call 1. Property taxes may be collected and enforced by local officials. To obtain more information about the lien, contact the attorney general's office.

The Tax Lien Sale Provides Immediate Funding Of Past Due Tax Dollars To The Agencies Like Schools And Local Governments That Rely On Property Tax.

Tax certificate liens to avoid the sale of a tax certificate lien on your property, you must pay your taxes in full or enter into a payment plan. Property taxes in ohio fund essential services in your community, including public schools, emergency services like police and. This section explains how the county treasurer can enforce the lien for taxes against delinquent land or minerals by civil action or. For individual taxes call 1.

Specifically, It Focuses On The Timing Of Tax Payments, The Potential.

Property taxes may be collected and enforced by local officials. If you have delinquent property taxes in ohio, you'll likely face a tax lien sale or a tax foreclosure. To obtain more information about the lien, contact the attorney general's office. You'll get notice before either.