Oregon State Tax Lien

Oregon State Tax Lien - A state tax lien is the government’s legal claim. To be removed from the list, a taxpayer must. Oregon revised statutes title 29, revenue and. (a) all ad valorem property taxes. Taxes on personal property shall be a lien: However, the statute of 10 years limitation on.

A state tax lien is the government’s legal claim. (a) all ad valorem property taxes. To be removed from the list, a taxpayer must. However, the statute of 10 years limitation on. Taxes on personal property shall be a lien: Oregon revised statutes title 29, revenue and.

A state tax lien is the government’s legal claim. Taxes on personal property shall be a lien: (a) all ad valorem property taxes. However, the statute of 10 years limitation on. To be removed from the list, a taxpayer must. Oregon revised statutes title 29, revenue and.

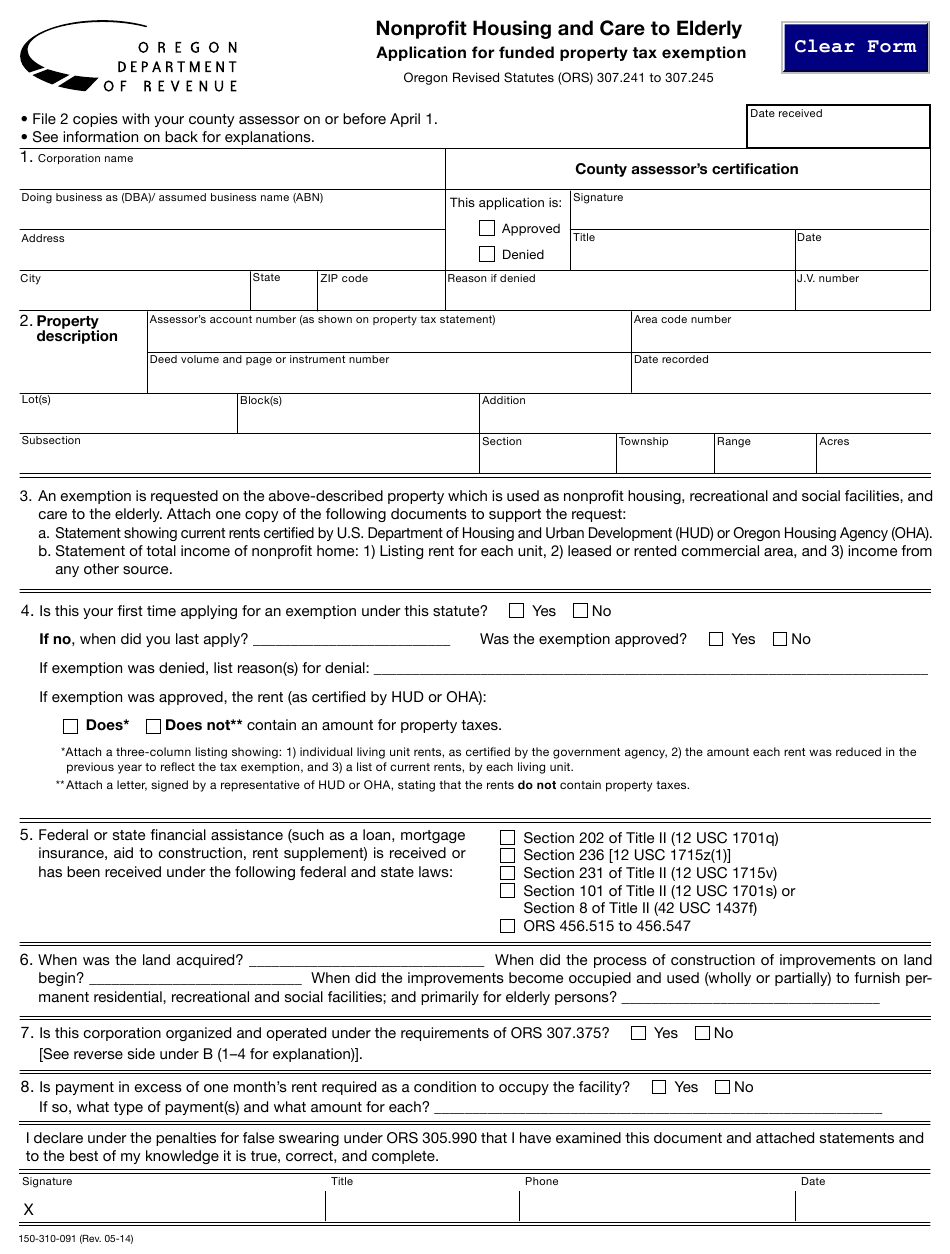

State Tax Exemption Form Oregon

To be removed from the list, a taxpayer must. However, the statute of 10 years limitation on. Taxes on personal property shall be a lien: Oregon revised statutes title 29, revenue and. (a) all ad valorem property taxes.

Tax Lien Tax Lien Washington State

To be removed from the list, a taxpayer must. (a) all ad valorem property taxes. Oregon revised statutes title 29, revenue and. However, the statute of 10 years limitation on. A state tax lien is the government’s legal claim.

Oregon Notice of Right to Lien Form Download Free With Fact Sheet

To be removed from the list, a taxpayer must. However, the statute of 10 years limitation on. Taxes on personal property shall be a lien: Oregon revised statutes title 29, revenue and. (a) all ad valorem property taxes.

Oregon Lien Service

Taxes on personal property shall be a lien: (a) all ad valorem property taxes. Oregon revised statutes title 29, revenue and. To be removed from the list, a taxpayer must. However, the statute of 10 years limitation on.

Tax Lien Sale Download Free PDF Tax Lien Taxes

However, the statute of 10 years limitation on. To be removed from the list, a taxpayer must. Oregon revised statutes title 29, revenue and. A state tax lien is the government’s legal claim. (a) all ad valorem property taxes.

tax lien PDF Free Download

A state tax lien is the government’s legal claim. However, the statute of 10 years limitation on. To be removed from the list, a taxpayer must. (a) all ad valorem property taxes. Taxes on personal property shall be a lien:

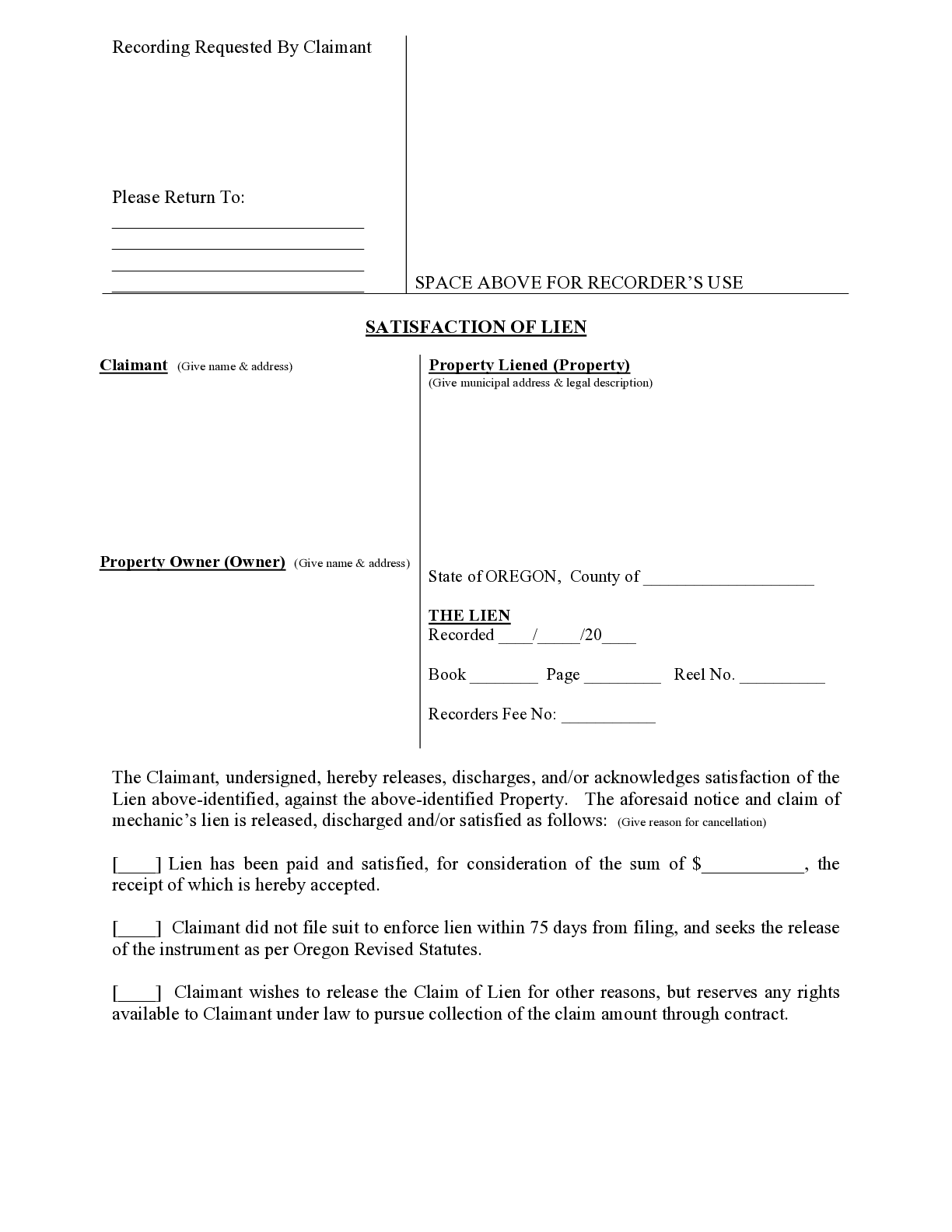

Oregon Satisfaction of Lien Form Free Template

To be removed from the list, a taxpayer must. (a) all ad valorem property taxes. A state tax lien is the government’s legal claim. Oregon revised statutes title 29, revenue and. Taxes on personal property shall be a lien:

Mechanics lien oregon Fill out & sign online DocHub

However, the statute of 10 years limitation on. A state tax lien is the government’s legal claim. Taxes on personal property shall be a lien: (a) all ad valorem property taxes. Oregon revised statutes title 29, revenue and.

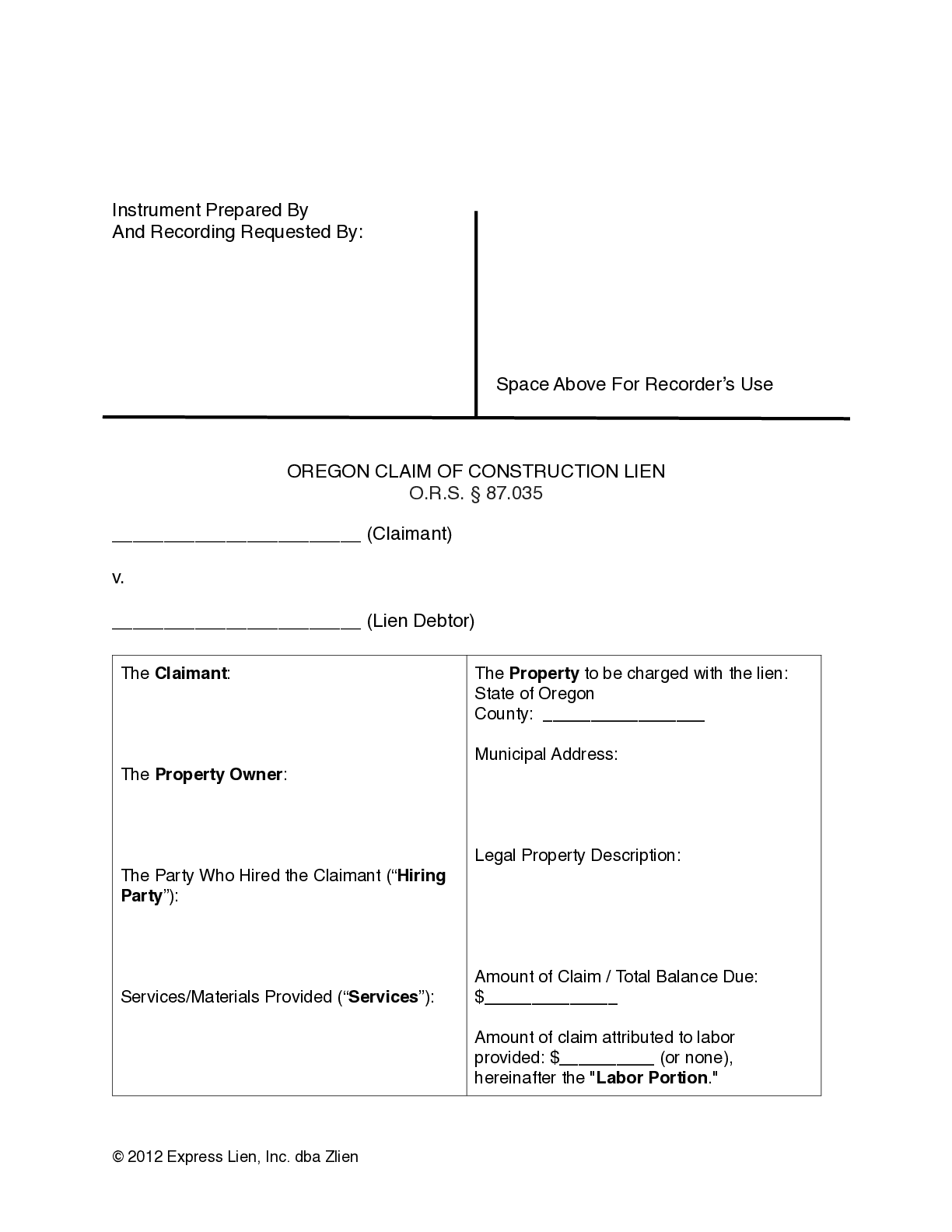

Oregon Claim of Construction Lien Form Free Template

A state tax lien is the government’s legal claim. However, the statute of 10 years limitation on. (a) all ad valorem property taxes. To be removed from the list, a taxpayer must. Oregon revised statutes title 29, revenue and.

To Be Removed From The List, A Taxpayer Must.

(a) all ad valorem property taxes. Taxes on personal property shall be a lien: Oregon revised statutes title 29, revenue and. However, the statute of 10 years limitation on.