Pa State Tax Lien

Pa State Tax Lien - If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. (a) (1) all municipal claims, municipal liens, taxes, tax claims and tax liens which may hereafter be lawfully imposed or. If there is a department of revenue lien filed against you or your business, and you want to resolve your tax liability, please go to. (1) the department may forward for filing a certified copy of such lien, interest, penalties, additions, and prothonotary's costs and fees. The department files liens for all types of state taxes:

If there is a department of revenue lien filed against you or your business, and you want to resolve your tax liability, please go to. (1) the department may forward for filing a certified copy of such lien, interest, penalties, additions, and prothonotary's costs and fees. The department files liens for all types of state taxes: Corporation taxes, sales & use taxes, employer withholding taxes, personal income. (a) (1) all municipal claims, municipal liens, taxes, tax claims and tax liens which may hereafter be lawfully imposed or. If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of.

The department files liens for all types of state taxes: If there is a department of revenue lien filed against you or your business, and you want to resolve your tax liability, please go to. (1) the department may forward for filing a certified copy of such lien, interest, penalties, additions, and prothonotary's costs and fees. If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of. (a) (1) all municipal claims, municipal liens, taxes, tax claims and tax liens which may hereafter be lawfully imposed or. Corporation taxes, sales & use taxes, employer withholding taxes, personal income.

Federal tax lien on foreclosed property laderdriver

The department files liens for all types of state taxes: If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of. (1) the department may forward for filing a certified copy of such lien, interest, penalties, additions, and prothonotary's costs and fees. If there is a department.

IRS Federal and State Tax Lien Help — Genesis Tax Consultants

If there is a department of revenue lien filed against you or your business, and you want to resolve your tax liability, please go to. (a) (1) all municipal claims, municipal liens, taxes, tax claims and tax liens which may hereafter be lawfully imposed or. If a person liable to pay a tax, interest, addition or penalty neglects or refuses.

Tax Lien Truths The Mountain Jackpot News

If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of. If there is a department of revenue lien filed against you or your business, and you want to resolve your tax liability, please go to. (a) (1) all municipal claims, municipal liens, taxes, tax claims and.

Tax Lien Foreclosure Update Levitt & Slafkes, P.C.

(a) (1) all municipal claims, municipal liens, taxes, tax claims and tax liens which may hereafter be lawfully imposed or. If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of. If there is a department of revenue lien filed against you or your business, and you.

Pursuant to the Tax Lien, Tax May be Collected from Estate Property in

Corporation taxes, sales & use taxes, employer withholding taxes, personal income. The department files liens for all types of state taxes: If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of. (a) (1) all municipal claims, municipal liens, taxes, tax claims and tax liens which may.

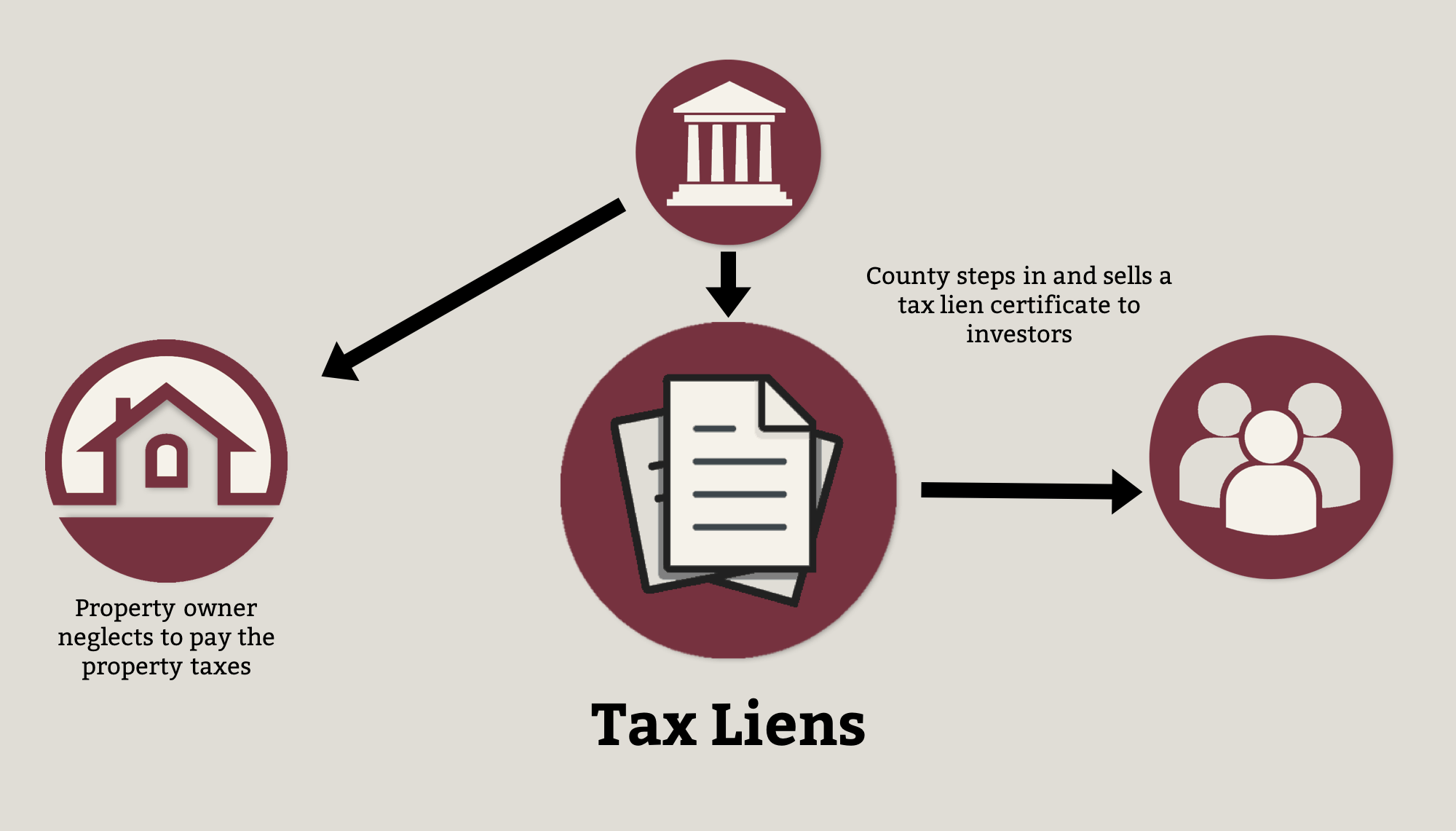

EasytoUnderstand Tax Lien Code Certificates Posteezy

Corporation taxes, sales & use taxes, employer withholding taxes, personal income. If there is a department of revenue lien filed against you or your business, and you want to resolve your tax liability, please go to. (a) (1) all municipal claims, municipal liens, taxes, tax claims and tax liens which may hereafter be lawfully imposed or. The department files liens.

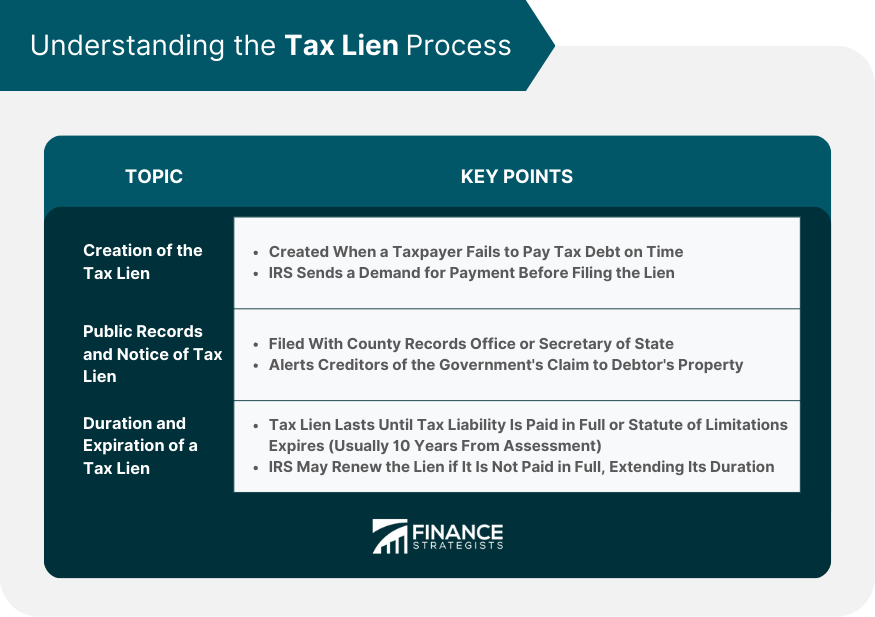

Tax Lien Definition, Process, Consequences, How to Handle

If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. The department files liens for all types of state taxes: (a) (1) all municipal claims, municipal liens, taxes, tax claims and tax liens which may.

Tax Lien Sale PDF Tax Lien Taxes

(1) the department may forward for filing a certified copy of such lien, interest, penalties, additions, and prothonotary's costs and fees. If there is a department of revenue lien filed against you or your business, and you want to resolve your tax liability, please go to. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. The department files.

State Tax Lien vs. Federal Tax Lien How to Remove Them

If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of. (1) the department may forward for filing a certified copy of such lien, interest, penalties, additions, and prothonotary's costs and fees. The department files liens for all types of state taxes: If there is a department.

Tax lien Finschool By 5paisa

(a) (1) all municipal claims, municipal liens, taxes, tax claims and tax liens which may hereafter be lawfully imposed or. (1) the department may forward for filing a certified copy of such lien, interest, penalties, additions, and prothonotary's costs and fees. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. The department files liens for all types of.

(A) (1) All Municipal Claims, Municipal Liens, Taxes, Tax Claims And Tax Liens Which May Hereafter Be Lawfully Imposed Or.

(1) the department may forward for filing a certified copy of such lien, interest, penalties, additions, and prothonotary's costs and fees. If there is a department of revenue lien filed against you or your business, and you want to resolve your tax liability, please go to. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of.