Pa Tax Waiver Form

Pa Tax Waiver Form - However, if you are the surviving. Inheritance tax payments are due upon the death of the decedent and become delinquent nine months after the individual's death. Local, state, and federal government websites often end in.gov. You do not need to draft another document. Commonwealth of pennsylvania government websites and email systems use. What schedules are required for filing an inheritance tax return? To effectuate the waiver you must complete the pa form rev 516; What is the file number for completing the inheritance tax.

Inheritance tax payments are due upon the death of the decedent and become delinquent nine months after the individual's death. Local, state, and federal government websites often end in.gov. What is the file number for completing the inheritance tax. What schedules are required for filing an inheritance tax return? To effectuate the waiver you must complete the pa form rev 516; However, if you are the surviving. You do not need to draft another document. Commonwealth of pennsylvania government websites and email systems use.

However, if you are the surviving. To effectuate the waiver you must complete the pa form rev 516; Inheritance tax payments are due upon the death of the decedent and become delinquent nine months after the individual's death. What schedules are required for filing an inheritance tax return? You do not need to draft another document. Commonwealth of pennsylvania government websites and email systems use. Local, state, and federal government websites often end in.gov. What is the file number for completing the inheritance tax.

Pa Inheritance Tax Waiver Form Rev 516 Tax Preparation Classes

Commonwealth of pennsylvania government websites and email systems use. What schedules are required for filing an inheritance tax return? Local, state, and federal government websites often end in.gov. However, if you are the surviving. Inheritance tax payments are due upon the death of the decedent and become delinquent nine months after the individual's death.

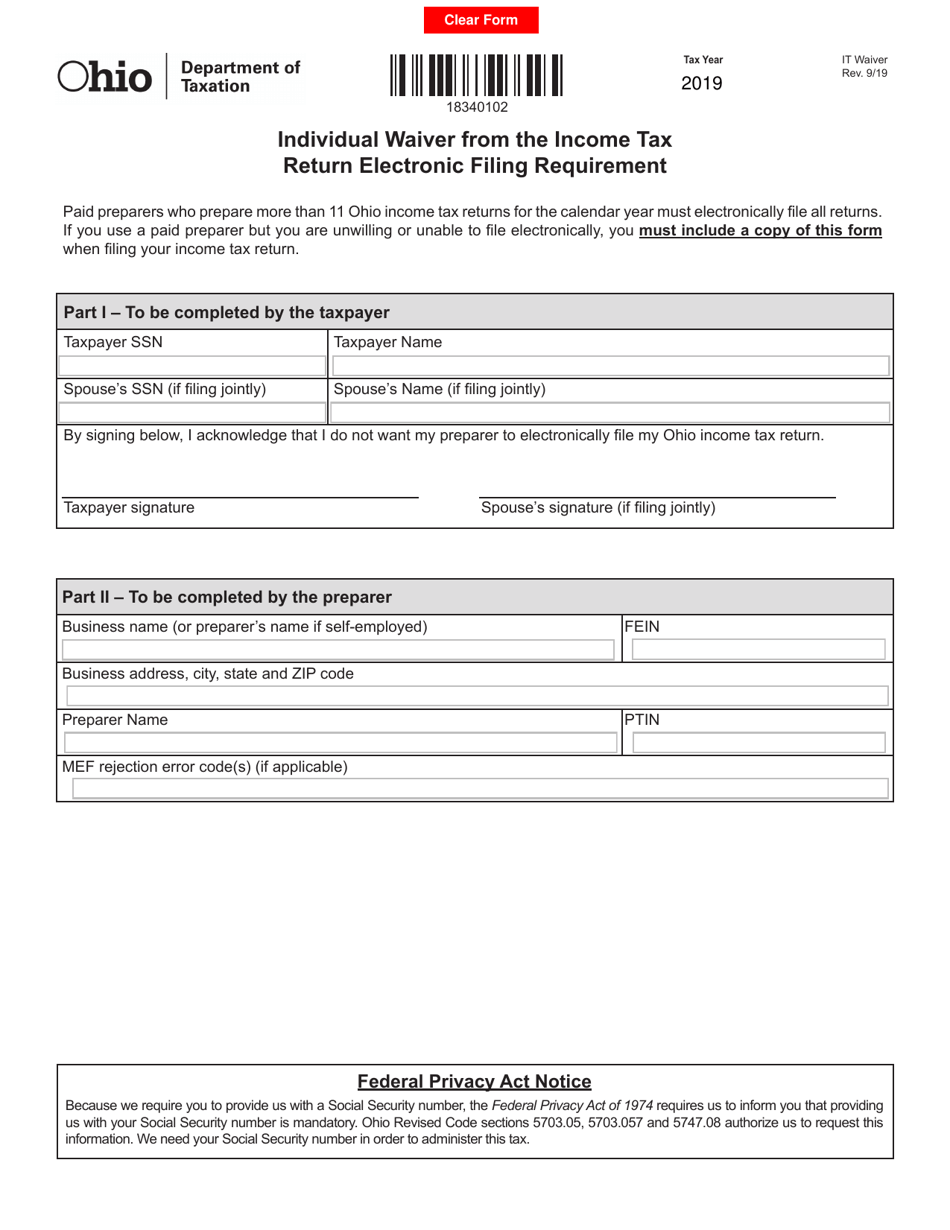

Form IT WAIVER Fill Out, Sign Online and Download Fillable PDF, Ohio

You do not need to draft another document. Local, state, and federal government websites often end in.gov. What schedules are required for filing an inheritance tax return? What is the file number for completing the inheritance tax. However, if you are the surviving.

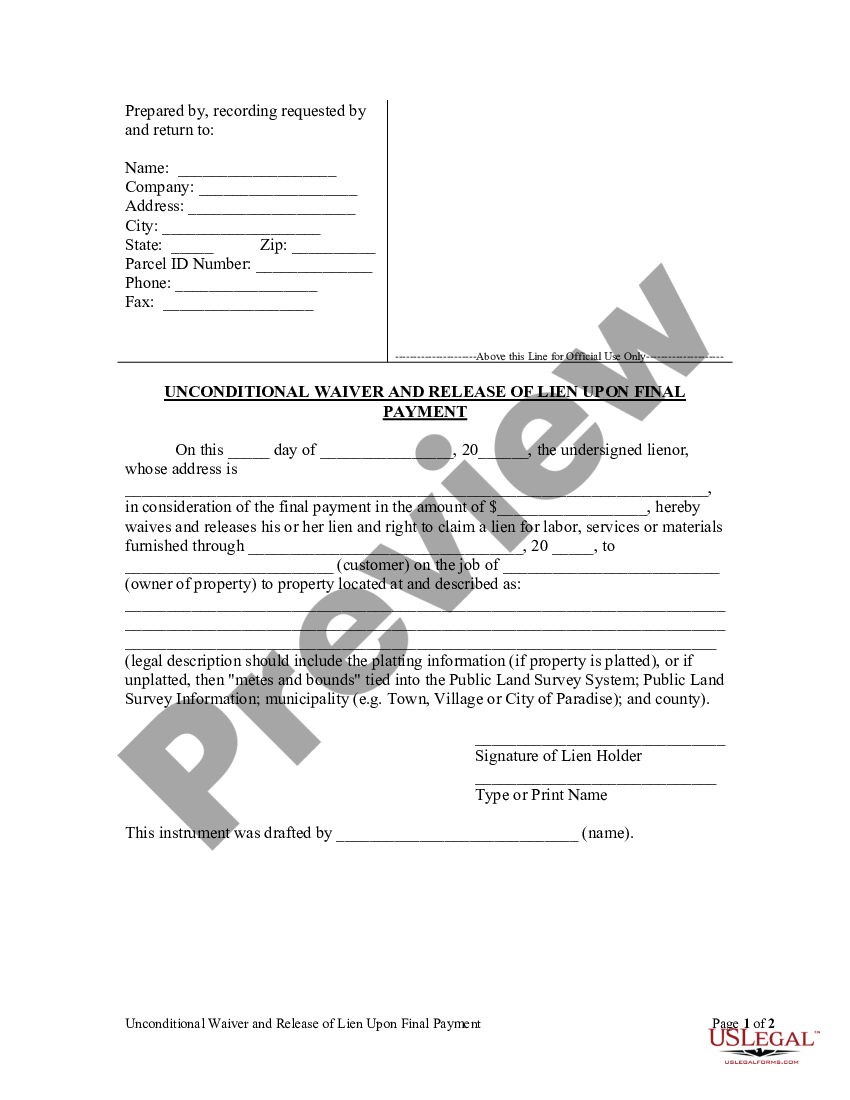

Lien Waiver Form Wisconsin With Notary US Legal Forms

What is the file number for completing the inheritance tax. However, if you are the surviving. Local, state, and federal government websites often end in.gov. You do not need to draft another document. Inheritance tax payments are due upon the death of the decedent and become delinquent nine months after the individual's death.

Final Lien Waiver Template Fill Online, Printable, Fillable, Blank

Commonwealth of pennsylvania government websites and email systems use. Inheritance tax payments are due upon the death of the decedent and become delinquent nine months after the individual's death. However, if you are the surviving. You do not need to draft another document. To effectuate the waiver you must complete the pa form rev 516;

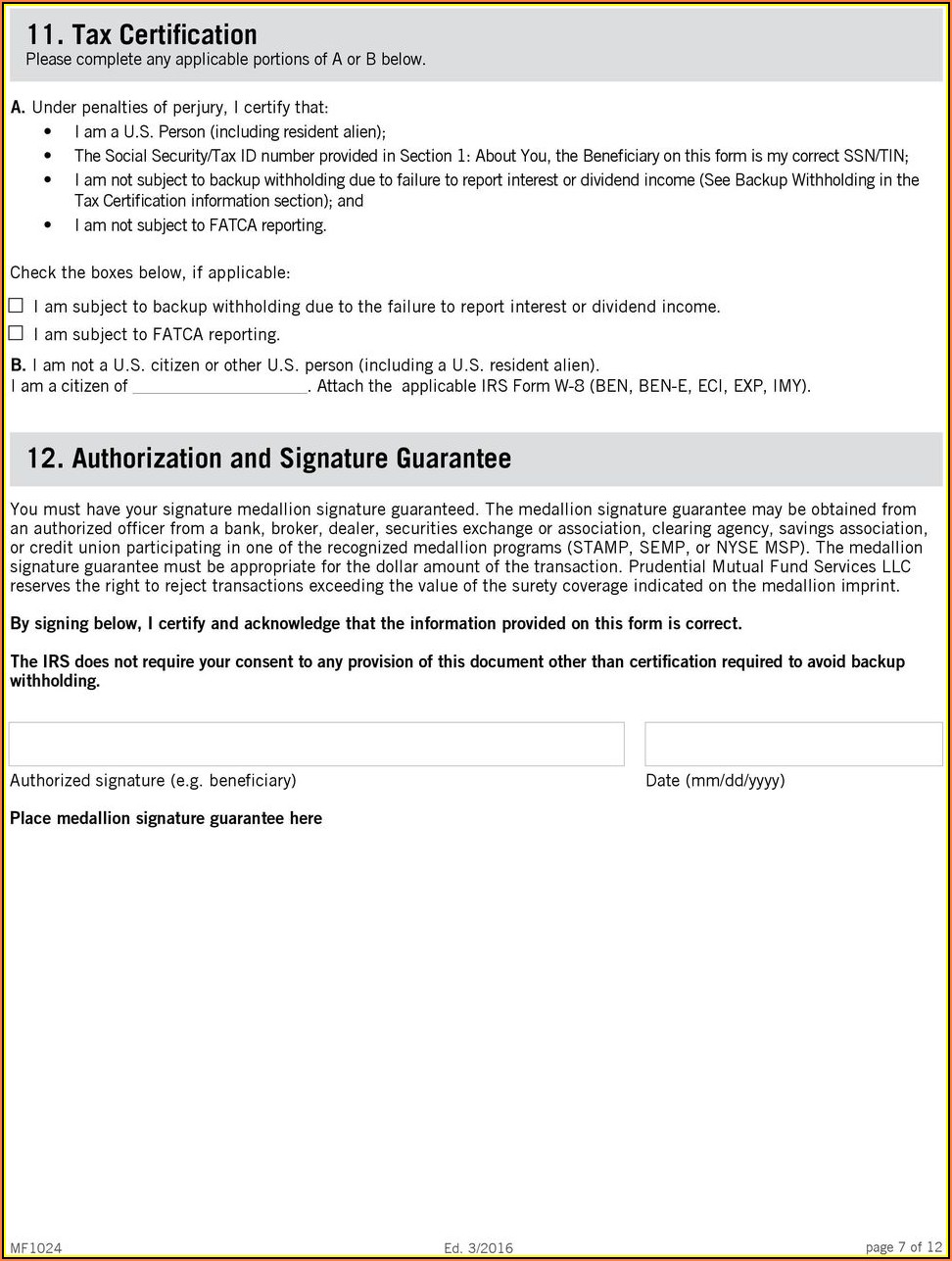

Pa Tax Exempt Form 20202022 Fill and Sign Printable Template Online

What schedules are required for filing an inheritance tax return? Inheritance tax payments are due upon the death of the decedent and become delinquent nine months after the individual's death. You do not need to draft another document. Local, state, and federal government websites often end in.gov. Commonwealth of pennsylvania government websites and email systems use.

Pa Inheritance Tax Waiver Form Rev 516 Tax Preparation Classes

Inheritance tax payments are due upon the death of the decedent and become delinquent nine months after the individual's death. Commonwealth of pennsylvania government websites and email systems use. What schedules are required for filing an inheritance tax return? What is the file number for completing the inheritance tax. However, if you are the surviving.

Inheritance Tax Waiver Form Pa Form Resume Examples kLYrL0326a

Commonwealth of pennsylvania government websites and email systems use. To effectuate the waiver you must complete the pa form rev 516; What schedules are required for filing an inheritance tax return? Inheritance tax payments are due upon the death of the decedent and become delinquent nine months after the individual's death. What is the file number for completing the inheritance.

Illinois Inheritance Tax Waiver Form Fill Online, Printable, Fillable

Local, state, and federal government websites often end in.gov. You do not need to draft another document. What is the file number for completing the inheritance tax. Commonwealth of pennsylvania government websites and email systems use. However, if you are the surviving.

Pa Inheritance Tax Waiver Form Rev 516 Tax Preparation Classes

Local, state, and federal government websites often end in.gov. What is the file number for completing the inheritance tax. What schedules are required for filing an inheritance tax return? You do not need to draft another document. Inheritance tax payments are due upon the death of the decedent and become delinquent nine months after the individual's death.

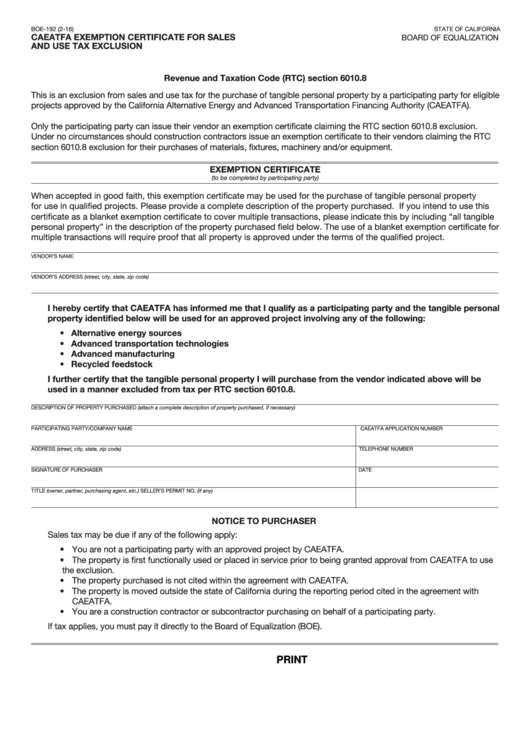

Sales And Use Tax Exemption Form California

However, if you are the surviving. What is the file number for completing the inheritance tax. You do not need to draft another document. Inheritance tax payments are due upon the death of the decedent and become delinquent nine months after the individual's death. Local, state, and federal government websites often end in.gov.

You Do Not Need To Draft Another Document.

Commonwealth of pennsylvania government websites and email systems use. To effectuate the waiver you must complete the pa form rev 516; Inheritance tax payments are due upon the death of the decedent and become delinquent nine months after the individual's death. What is the file number for completing the inheritance tax.

What Schedules Are Required For Filing An Inheritance Tax Return?

Local, state, and federal government websites often end in.gov. However, if you are the surviving.