Partner Basis Worksheet

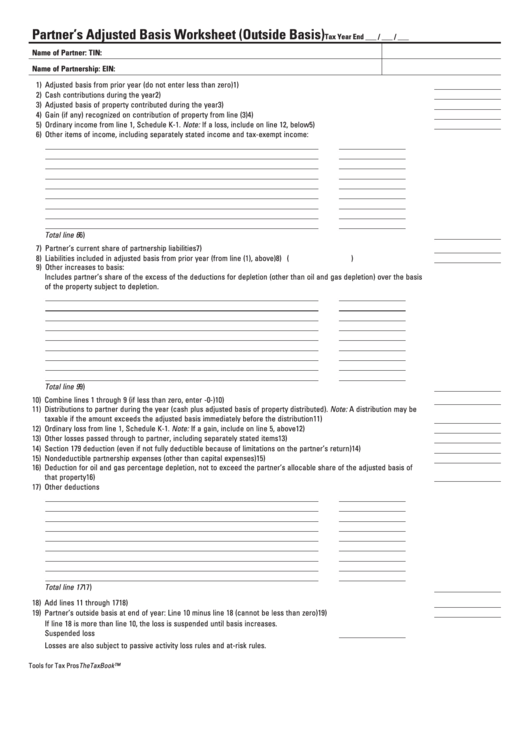

Partner Basis Worksheet - To help you track basis,. The 1065 basis worksheet is calculated using only the basis rules. The following information refers to the partner’s adjusted basis worksheet in a partnership return. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. A partner’s distributive share of the adjusted basis of a partnership’s property donation to charity. To assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the. Therefore, for all partners, ultratax cs uses the total of all liabilities on. Here is the worksheet for. The worksheet for adjusting the basis of a partner’s interest in the partnership has been changed to provide more details.

The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. The worksheet for adjusting the basis of a partner’s interest in the partnership has been changed to provide more details. To assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the. Therefore, for all partners, ultratax cs uses the total of all liabilities on. The 1065 basis worksheet is calculated using only the basis rules. The following information refers to the partner’s adjusted basis worksheet in a partnership return. Here is the worksheet for. A partner’s distributive share of the adjusted basis of a partnership’s property donation to charity. To help you track basis,.

To help you track basis,. To assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the. The following information refers to the partner’s adjusted basis worksheet in a partnership return. The 1065 basis worksheet is calculated using only the basis rules. A partner’s distributive share of the adjusted basis of a partnership’s property donation to charity. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. Therefore, for all partners, ultratax cs uses the total of all liabilities on. The worksheet for adjusting the basis of a partner’s interest in the partnership has been changed to provide more details. Here is the worksheet for.

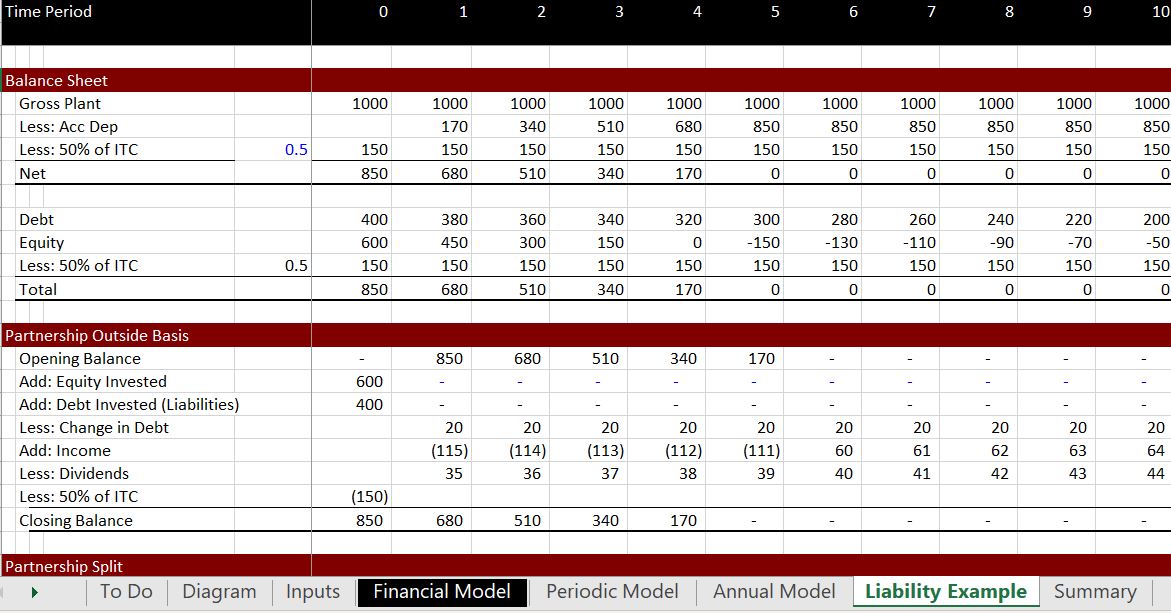

Partnership Basis Worksheet Excel

To assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the. The 1065 basis worksheet is calculated using only the basis rules. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. The worksheet for adjusting the.

Partner Basis Worksheet Template Excel

Therefore, for all partners, ultratax cs uses the total of all liabilities on. The worksheet for adjusting the basis of a partner’s interest in the partnership has been changed to provide more details. A partner’s distributive share of the adjusted basis of a partnership’s property donation to charity. Here is the worksheet for. To assist the partners in determining their.

Partner Basis Worksheet Excel

The worksheet for adjusting the basis of a partner’s interest in the partnership has been changed to provide more details. To help you track basis,. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. A partner’s distributive share of the adjusted basis of a partnership’s property donation to.

Partner's Adjusted Basis Worksheets

Here is the worksheet for. A partner’s distributive share of the adjusted basis of a partnership’s property donation to charity. The 1065 basis worksheet is calculated using only the basis rules. To assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the. The worksheet for adjusting the basis.

Partner Basis Worksheet Template Excel

The worksheet for adjusting the basis of a partner’s interest in the partnership has been changed to provide more details. The following information refers to the partner’s adjusted basis worksheet in a partnership return. The 1065 basis worksheet is calculated using only the basis rules. To assist the partners in determining their basis in the partnership, a worksheet for adjusting.

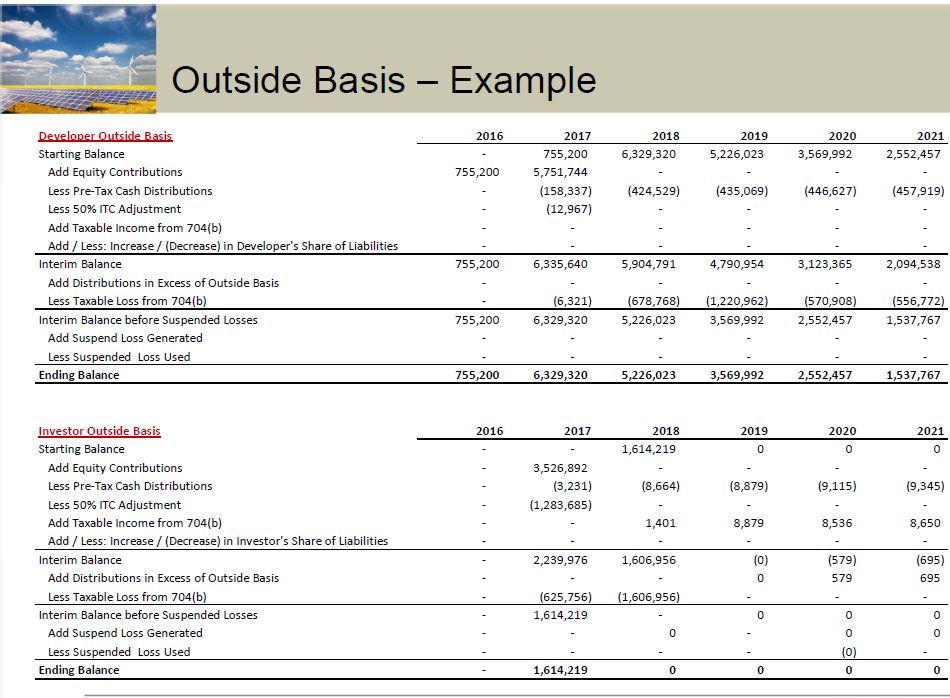

REV999 Partner's Outside Tax Basis in a Partnership Worksheet Free

To help you track basis,. Therefore, for all partners, ultratax cs uses the total of all liabilities on. Here is the worksheet for. A partner’s distributive share of the adjusted basis of a partnership’s property donation to charity. The worksheet for adjusting the basis of a partner’s interest in the partnership has been changed to provide more details.

Partner Basis Worksheet Template Excel

The worksheet for adjusting the basis of a partner’s interest in the partnership has been changed to provide more details. Therefore, for all partners, ultratax cs uses the total of all liabilities on. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. A partner’s distributive share of the.

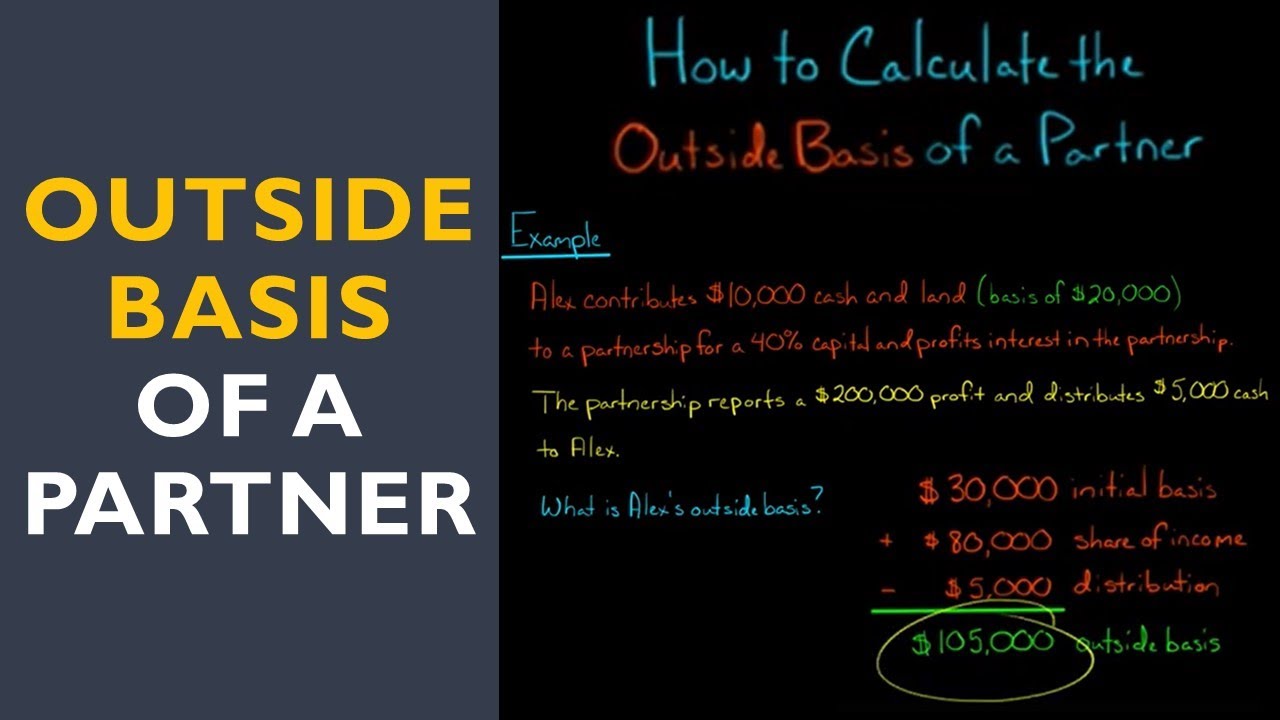

How To Calculate Outside Basis In Partnership

The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. Therefore, for all partners, ultratax cs uses the total of all liabilities on. The worksheet for adjusting the basis of a partner’s interest in the partnership has been changed to provide more details. To assist the partners in determining.

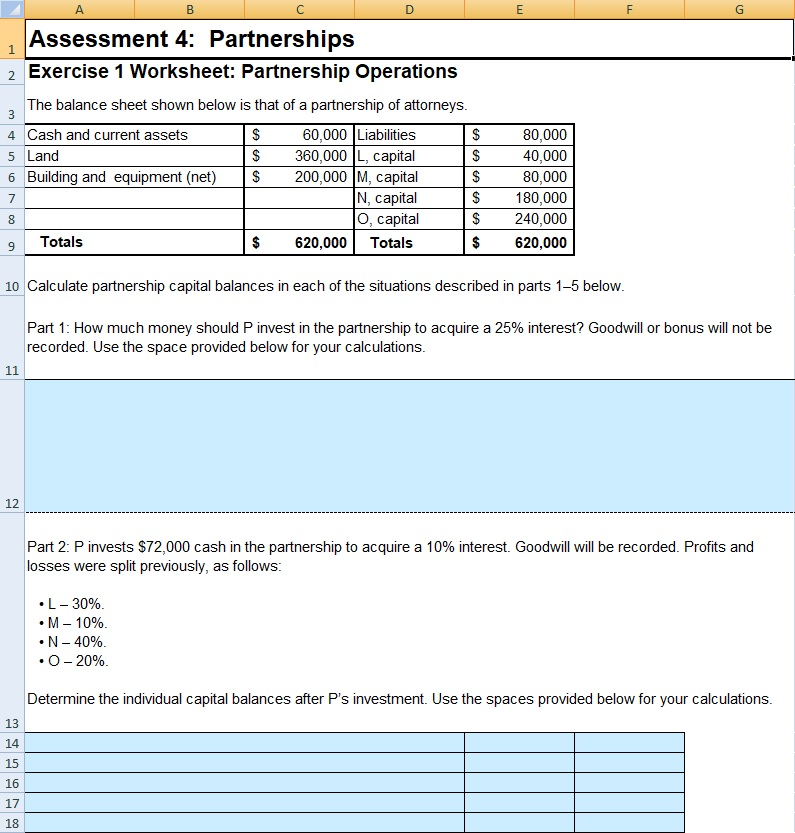

Fillable Partner'S Adjusted Basis Worksheet (Outside Basis) Template

To help you track basis,. Therefore, for all partners, ultratax cs uses the total of all liabilities on. To assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the. The worksheet for adjusting the basis of a partner’s interest in the partnership has been changed to provide more.

Partner Basis Worksheet Template Excel

To assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the. The following information refers to the partner’s adjusted basis worksheet in a partnership return. A partner’s distributive share of the adjusted basis of a partnership’s property donation to charity. To help you track basis,. The adjusted partnership.

A Partner’s Distributive Share Of The Adjusted Basis Of A Partnership’s Property Donation To Charity.

The worksheet for adjusting the basis of a partner’s interest in the partnership has been changed to provide more details. To help you track basis,. Here is the worksheet for. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest.

To Assist The Partners In Determining Their Basis In The Partnership, A Worksheet For Adjusting The Basis Of A Partner’s Interest In The.

The 1065 basis worksheet is calculated using only the basis rules. Therefore, for all partners, ultratax cs uses the total of all liabilities on. The following information refers to the partner’s adjusted basis worksheet in a partnership return.