Pennsylvania Local Withholding Tax

Pennsylvania Local Withholding Tax - Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. The local tax filing deadline is april 18, 2022, matching the federal and state filing dates. Psd codes (political subdivision codes).

You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Psd codes (political subdivision codes). Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. The local tax filing deadline is april 18, 2022, matching the federal and state filing dates. We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm.

The local tax filing deadline is april 18, 2022, matching the federal and state filing dates. Psd codes (political subdivision codes). Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax.

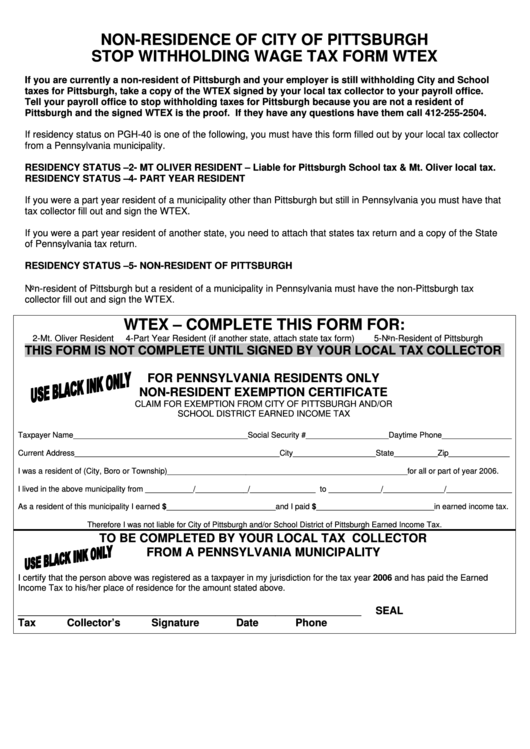

Nonresidence Of City Of Pittsburgh Stop Withholding Wage Tax Form Wtex

Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. We recommend you contact the county, municipality and/or school district provided as a match for the address.

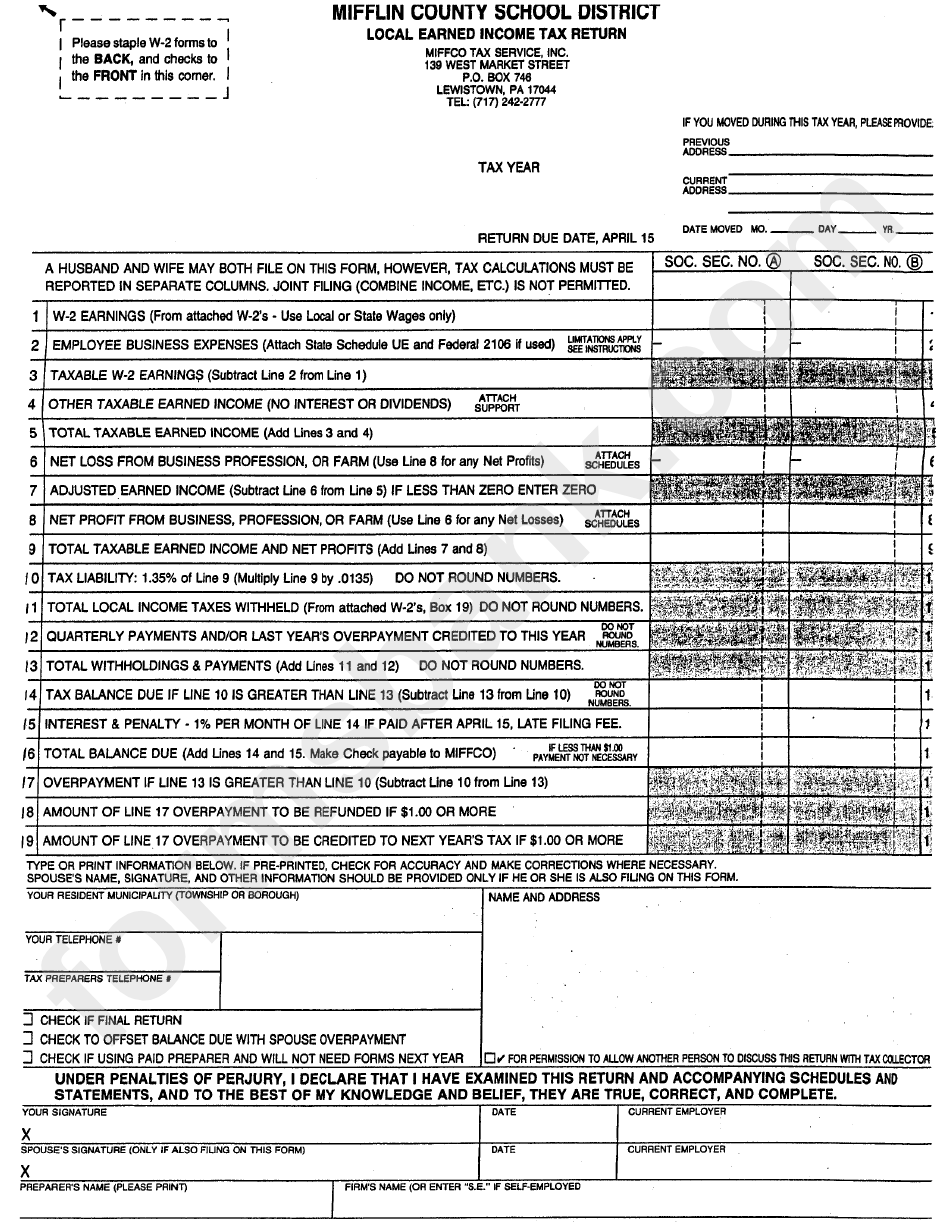

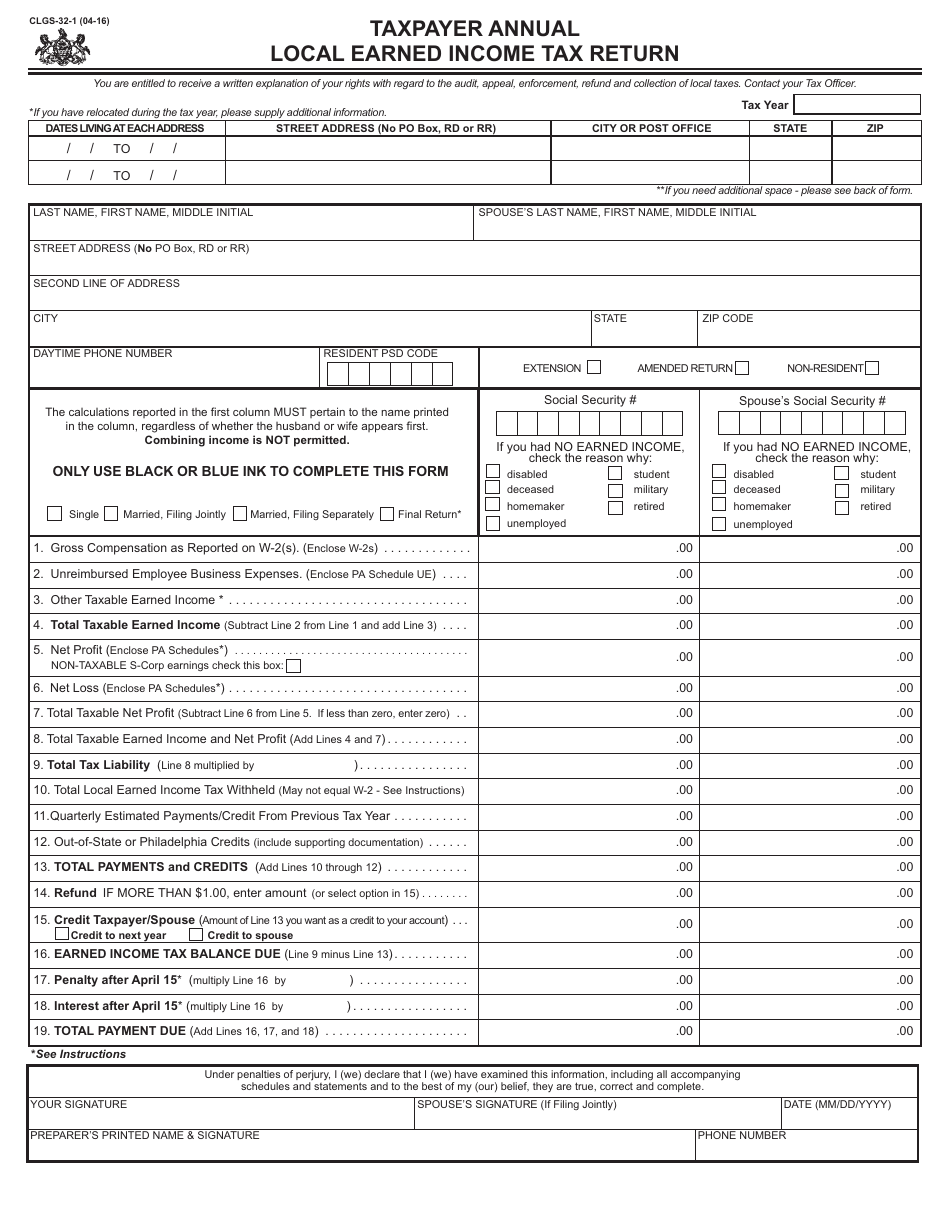

Local Earned Tax Return Form Pennsylvania Mifflin County

The local tax filing deadline is april 18, 2022, matching the federal and state filing dates. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. We.

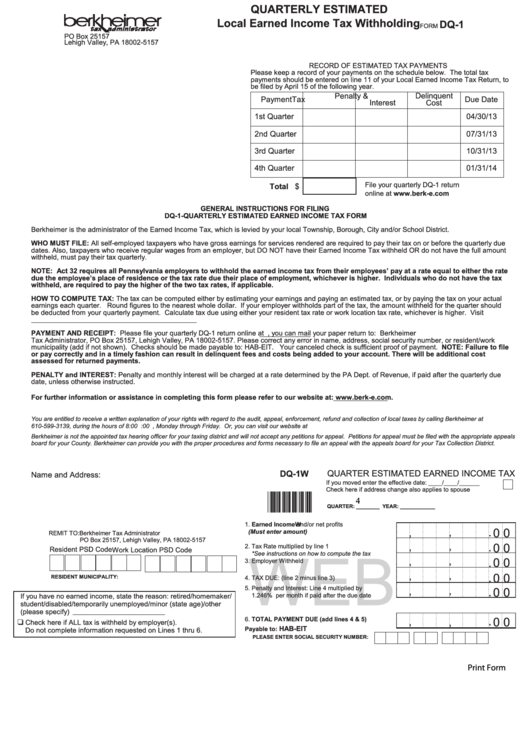

Pennsylvania Local Earned Tax Withholding Form

Psd codes (political subdivision codes). We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. The local tax filing deadline is april 18, 2022, matching the federal and state filing dates. You are.

BIR Imposes 1 Withholding Tax on Online Merchants

Psd codes (political subdivision codes). We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. The local tax filing deadline is april 18, 2022, matching the federal and state filing dates. You are required to withhold the higher of the two eit rates, as well as the local services.

Local Pa Resident Tax Withholding Form

You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Psd codes (political subdivision codes). Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. We recommend you contact the county, municipality and/or school district provided as.

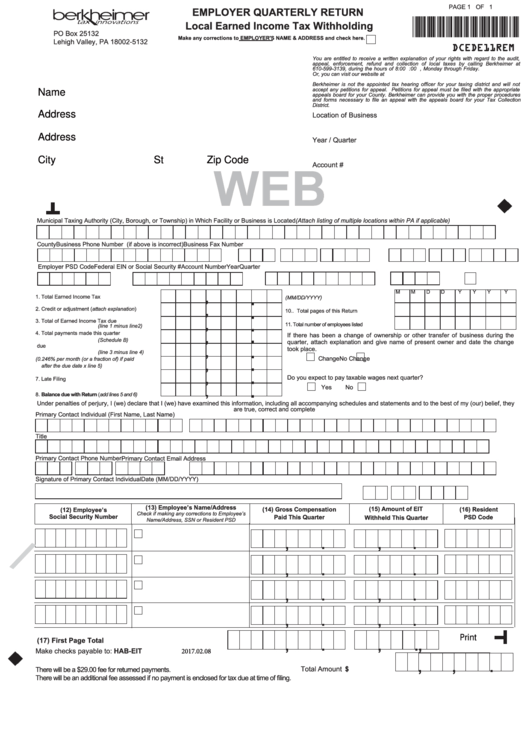

Top 21 Berkheimer Tax Forms And Templates free to download in PDF format

The local tax filing deadline is april 18, 2022, matching the federal and state filing dates. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. We recommend you contact the county, municipality and/or school district provided as a match for the address.

State Of Ohio Employer Withholding Tax Tables

Psd codes (political subdivision codes). We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Pennsylvania law requires employers to withhold pennsylvania.

Form CLGS321 Fill Out, Sign Online and Download Fillable PDF

Psd codes (political subdivision codes). The local tax filing deadline is april 18, 2022, matching the federal and state filing dates. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. We recommend you contact the county, municipality and/or school district provided as.

Whats The Deal With Withholding Tax ISCA Chartered Accountants Lab

You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Psd codes (political subdivision codes). Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. We recommend you contact the county, municipality and/or school district provided as.

Pennsylvania Employer Withholding 14 Free Templates in PDF, Word

Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. Psd codes (political subdivision codes). The local tax filing deadline is april 18, 2022, matching the federal and state filing dates. You are.

We Recommend You Contact The County, Municipality And/Or School District Provided As A Match For The Address You Entered To Confirm.

The local tax filing deadline is april 18, 2022, matching the federal and state filing dates. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Psd codes (political subdivision codes). Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common.