Permanent Establishment Malaysia

Permanent Establishment Malaysia - Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income accruing. Tax authorities are adapting beyond. This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in malaysia.

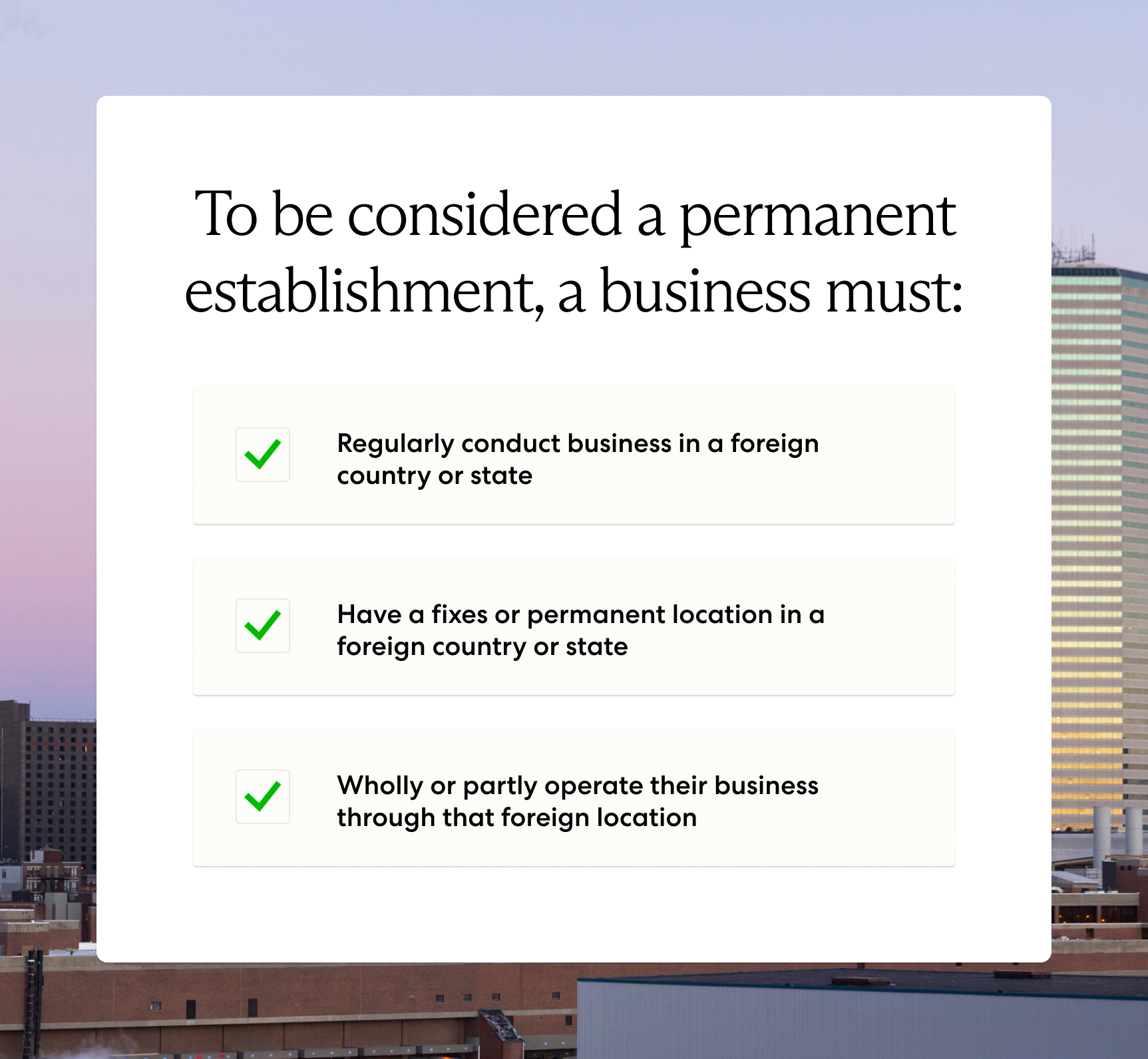

Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in malaysia. Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income accruing. Tax authorities are adapting beyond.

Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income accruing. Tax authorities are adapting beyond. This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in malaysia.

An Overview of the 3 Types of Permanent Establishment—With Examples

This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in malaysia. Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income accruing. Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. Tax authorities are adapting.

Permanent Resident Malaysia

Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income accruing. Tax authorities are adapting beyond. Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in.

Malaysia Permanent establishment a total revamp or just a formality?

This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in malaysia. Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income accruing. Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. Tax authorities are adapting.

Permanent establishment playbook Vistra

Tax authorities are adapting beyond. Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in malaysia. Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income.

What Is Permanent Establishment? Learn the Risks to Avoid

Tax authorities are adapting beyond. This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in malaysia. Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income.

What Is Permanent Establishment? Learn the Risks to Avoid

Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income accruing. Tax authorities are adapting beyond. This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in.

The Tax Implications of Permanent Establishment in Mexico

Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income accruing. Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. Tax authorities are adapting beyond. This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in.

How to avoid Permanent Establishment in India IndiaConnected

Tax authorities are adapting beyond. Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income accruing. This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in.

Permanent Establishment Checklist for Global Companies iiPay

This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in malaysia. Tax authorities are adapting beyond. Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income accruing. Permanent establishment (pe) means having a taxable presence outside your company’s state of.

Permanent Establishment Anteo

This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in malaysia. Tax authorities are adapting beyond. Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. Liable to malaysian tax when it carries on a business through a permanent establishment in malaysia and assessable on income.

Liable To Malaysian Tax When It Carries On A Business Through A Permanent Establishment In Malaysia And Assessable On Income Accruing.

Tax authorities are adapting beyond. Permanent establishment (pe) means having a taxable presence outside your company’s state of residence. This public ruling explains the criteria and procedures for determining the residence status of companies and bodies of persons in malaysia.