Property Tax Liens In Texas

Property Tax Liens In Texas - In texas, property tax liens are established by state law, which mandates that property taxes are a personal obligation of the. (a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. Tax liability secured by lien. (a) on january 1 of each year, a tax lien attaches to property to secure the payment of all taxes, penalties, and interest ultimately imposed for. If you fall behind on your property taxes, the local taxing authority can foreclosure on the property. Restrictions on personal property tax lien.

If you fall behind on your property taxes, the local taxing authority can foreclosure on the property. (a) on january 1 of each year, a tax lien attaches to property to secure the payment of all taxes, penalties, and interest ultimately imposed for. (a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. Tax liability secured by lien. In texas, property tax liens are established by state law, which mandates that property taxes are a personal obligation of the. Restrictions on personal property tax lien.

In texas, property tax liens are established by state law, which mandates that property taxes are a personal obligation of the. (a) on january 1 of each year, a tax lien attaches to property to secure the payment of all taxes, penalties, and interest ultimately imposed for. (a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. Tax liability secured by lien. If you fall behind on your property taxes, the local taxing authority can foreclosure on the property. Restrictions on personal property tax lien.

GMC Property Tax All You Need to Know TimesProperty

In texas, property tax liens are established by state law, which mandates that property taxes are a personal obligation of the. Tax liability secured by lien. If you fall behind on your property taxes, the local taxing authority can foreclosure on the property. (a) on january 1 of each year, a tax lien attaches to property to secure the payment.

How to Find Tax Liens on a Property? Clean Slate Tax

(a) on january 1 of each year, a tax lien attaches to property to secure the payment of all taxes, penalties, and interest ultimately imposed for. Tax liability secured by lien. Restrictions on personal property tax lien. If you fall behind on your property taxes, the local taxing authority can foreclosure on the property. (a) all taxes, fines, interest, and.

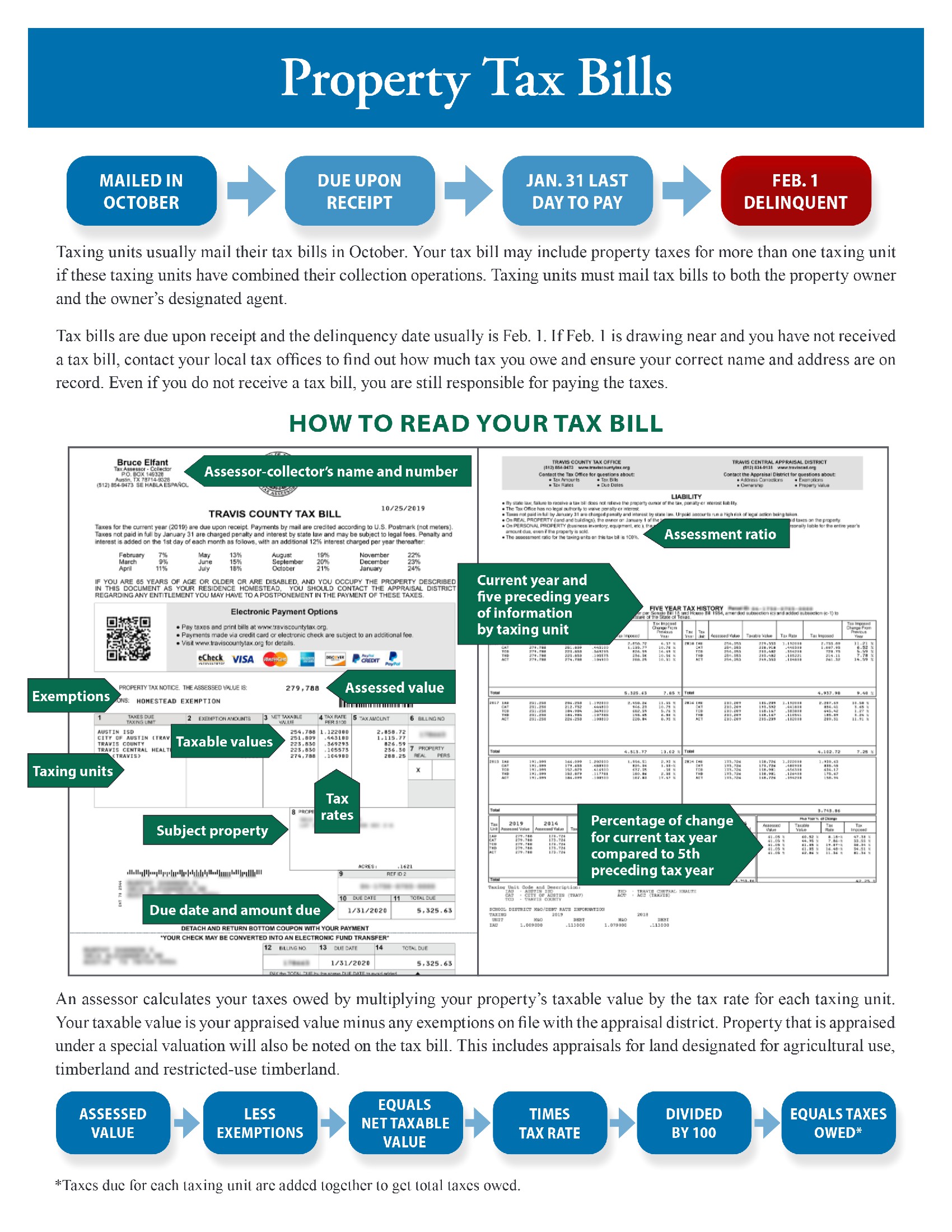

Texas Property Tax Bill Forms Docs 2023

(a) on january 1 of each year, a tax lien attaches to property to secure the payment of all taxes, penalties, and interest ultimately imposed for. If you fall behind on your property taxes, the local taxing authority can foreclosure on the property. Restrictions on personal property tax lien. Tax liability secured by lien. (a) all taxes, fines, interest, and.

What Are Texas Property Tax Liens and How They Affect Homeowners?

(a) on january 1 of each year, a tax lien attaches to property to secure the payment of all taxes, penalties, and interest ultimately imposed for. In texas, property tax liens are established by state law, which mandates that property taxes are a personal obligation of the. (a) all taxes, fines, interest, and penalties due by a person to the.

Navigating Texas Property Tax Rendition Leveraging Fair Market Value

(a) on january 1 of each year, a tax lien attaches to property to secure the payment of all taxes, penalties, and interest ultimately imposed for. If you fall behind on your property taxes, the local taxing authority can foreclosure on the property. In texas, property tax liens are established by state law, which mandates that property taxes are a.

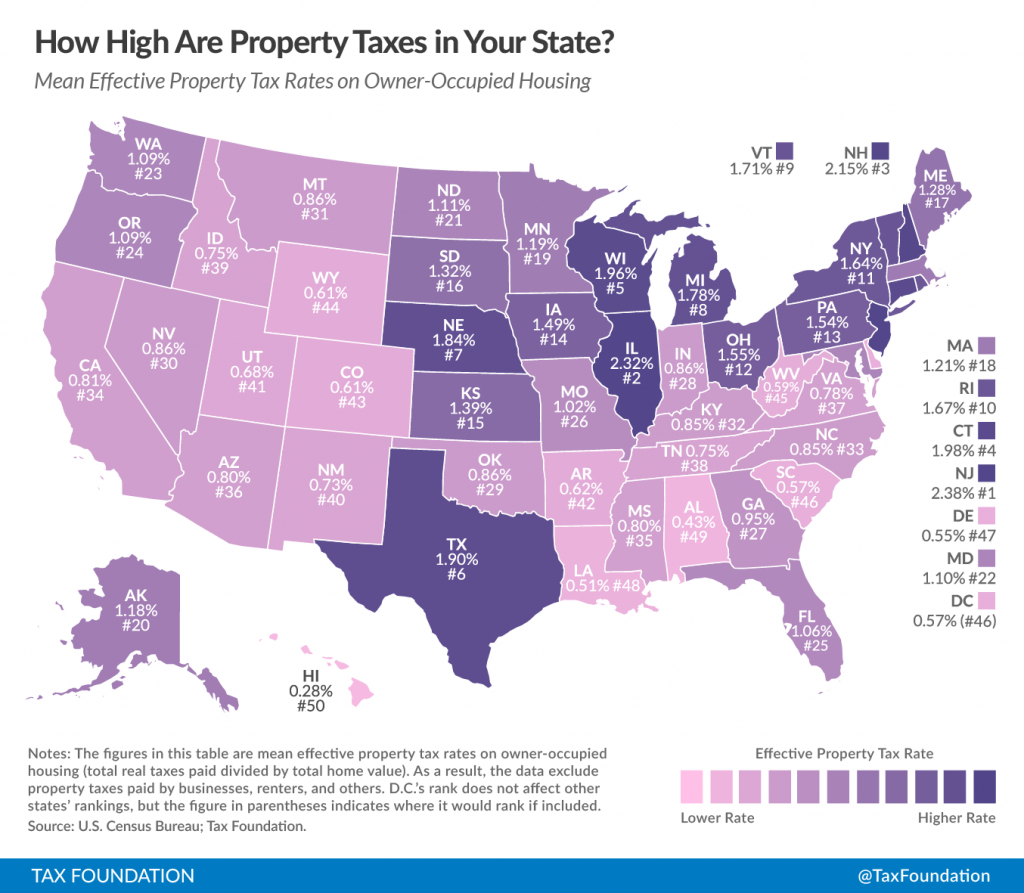

How High Are Property Taxes In Your State? Tax Foundation Texas

Restrictions on personal property tax lien. If you fall behind on your property taxes, the local taxing authority can foreclosure on the property. (a) on january 1 of each year, a tax lien attaches to property to secure the payment of all taxes, penalties, and interest ultimately imposed for. (a) all taxes, fines, interest, and penalties due by a person.

Here's why you could have property tax liens in your portfolio

In texas, property tax liens are established by state law, which mandates that property taxes are a personal obligation of the. (a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. If you fall behind on your property taxes, the local taxing authority can foreclosure on the property..

AM Tax Solutions LLC Albuquerque NM

Restrictions on personal property tax lien. If you fall behind on your property taxes, the local taxing authority can foreclosure on the property. Tax liability secured by lien. (a) on january 1 of each year, a tax lien attaches to property to secure the payment of all taxes, penalties, and interest ultimately imposed for. (a) all taxes, fines, interest, and.

How To Sell Your Property With Tax Liens in Raleigh NC

In texas, property tax liens are established by state law, which mandates that property taxes are a personal obligation of the. Tax liability secured by lien. If you fall behind on your property taxes, the local taxing authority can foreclosure on the property. Restrictions on personal property tax lien. (a) on january 1 of each year, a tax lien attaches.

10 Fun Facts About Federal Tax Liens Texas National Title

(a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. Restrictions on personal property tax lien. (a) on january 1 of each year, a tax lien attaches to property to secure the payment of all taxes, penalties, and interest ultimately imposed for. If you fall behind on your.

(A) All Taxes, Fines, Interest, And Penalties Due By A Person To The State Under This Title Are Secured By A Lien.

Tax liability secured by lien. Restrictions on personal property tax lien. If you fall behind on your property taxes, the local taxing authority can foreclosure on the property. In texas, property tax liens are established by state law, which mandates that property taxes are a personal obligation of the.