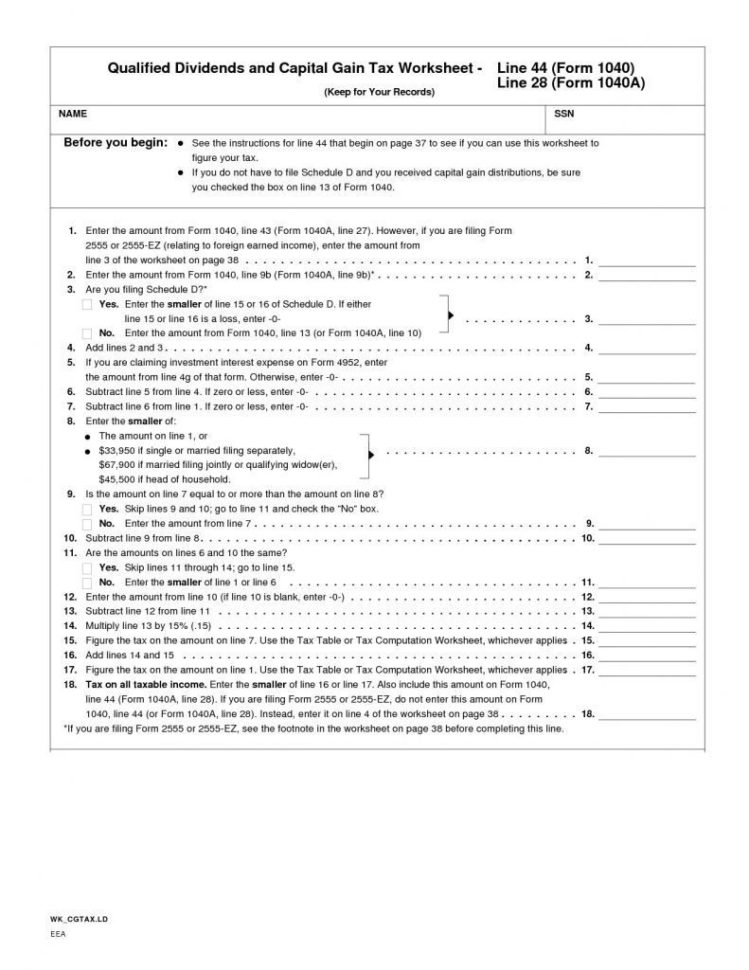

Qualified Dividends Tax Worksheet

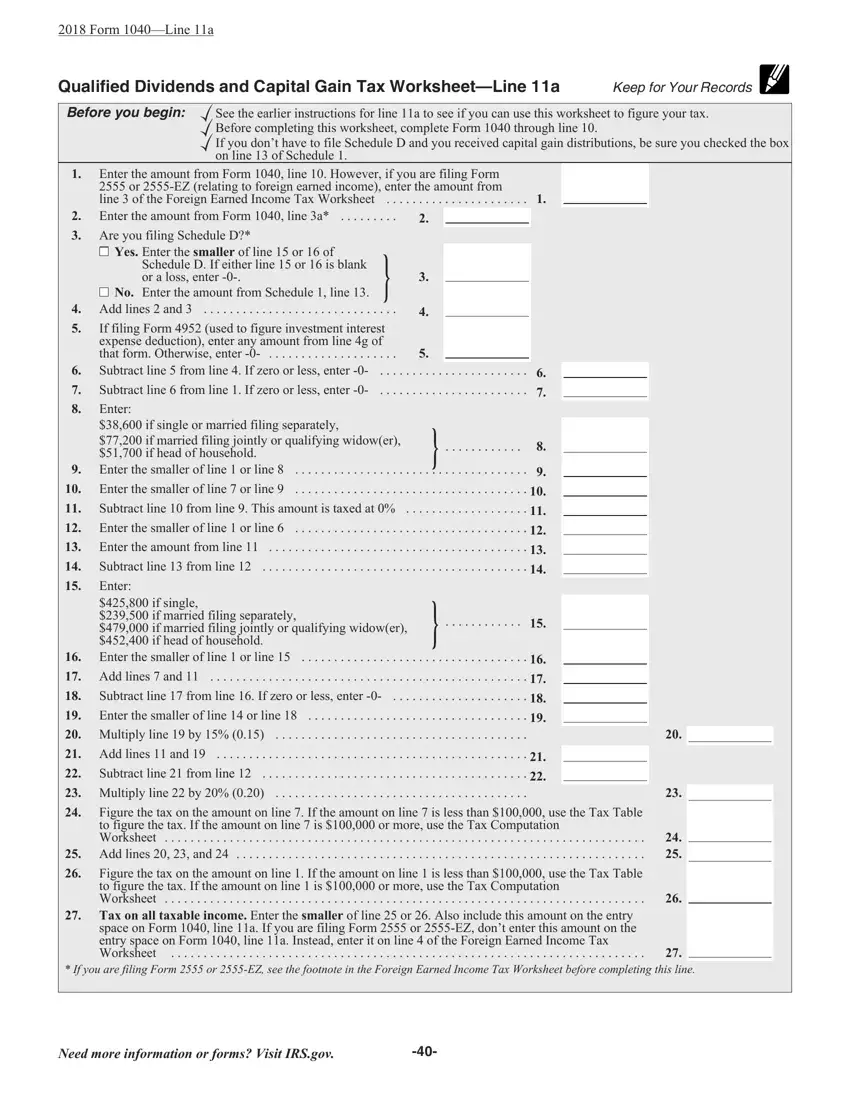

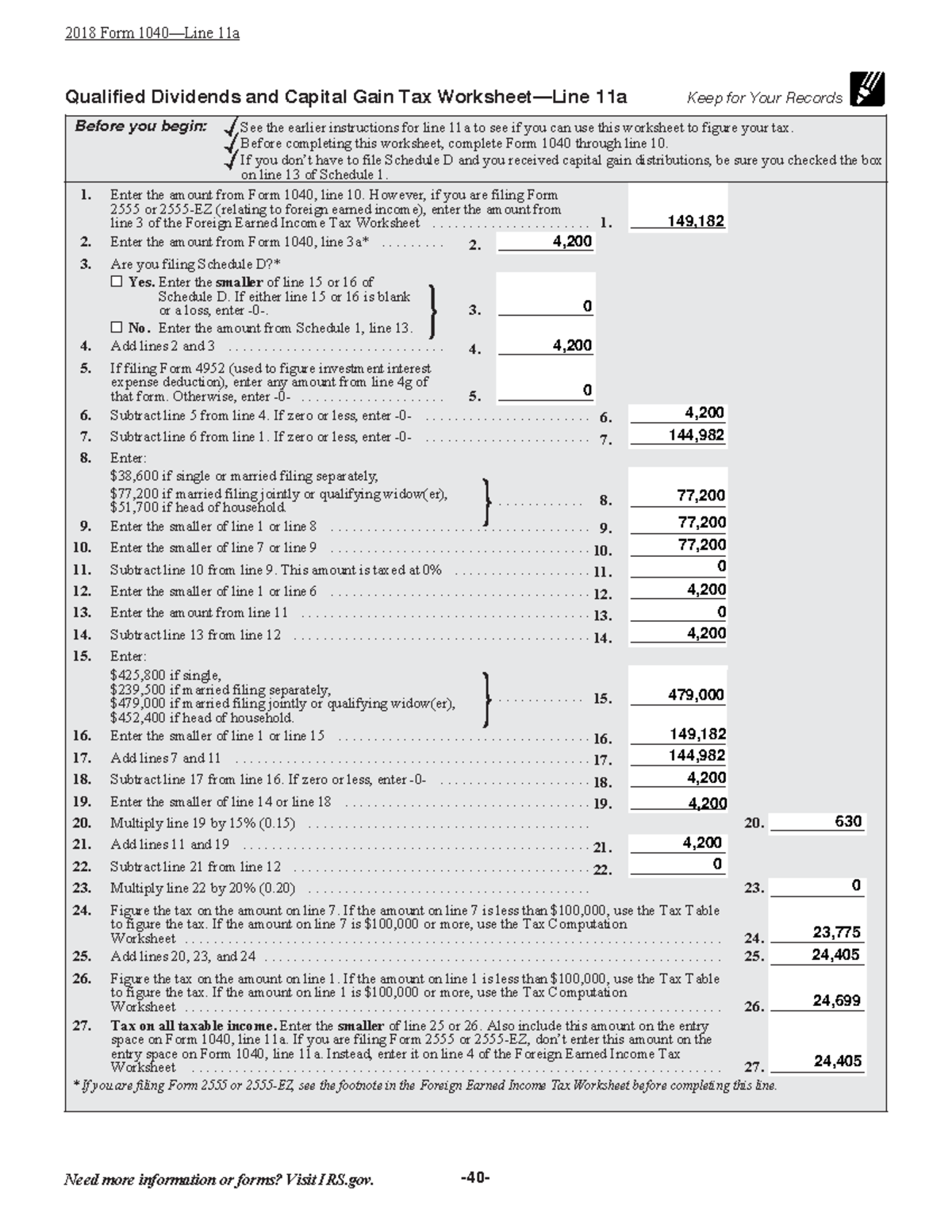

Qualified Dividends Tax Worksheet - See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. However, some dividends are special. Qualified dividends have three tax brackets: Before completing this worksheet, complete form 1040 through line 10. Dividends are generally taxed at your ordinary income tax rates. V / see the instructions for line 16 in the instructions to see if you can use this. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an amount on line 4g, even if you. 0%, 15%, and 20% (see lines 9, 18, and 21 of the worksheet). They are qualified with the irs for a special, lower tax rate. All three brackets correlate to the taxpayer’s income.

All three brackets correlate to the taxpayer’s income. Before completing this worksheet, complete form 1040 through line 10. 0%, 15%, and 20% (see lines 9, 18, and 21 of the worksheet). V / see the instructions for line 16 in the instructions to see if you can use this. However, some dividends are special. Qualified dividends have three tax brackets: They are qualified with the irs for a special, lower tax rate. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Dividends are generally taxed at your ordinary income tax rates. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an amount on line 4g, even if you.

They are qualified with the irs for a special, lower tax rate. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an amount on line 4g, even if you. However, some dividends are special. Dividends are generally taxed at your ordinary income tax rates. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Qualified dividends have three tax brackets: 0%, 15%, and 20% (see lines 9, 18, and 21 of the worksheet). Before completing this worksheet, complete form 1040 through line 10. All three brackets correlate to the taxpayer’s income. V / see the instructions for line 16 in the instructions to see if you can use this.

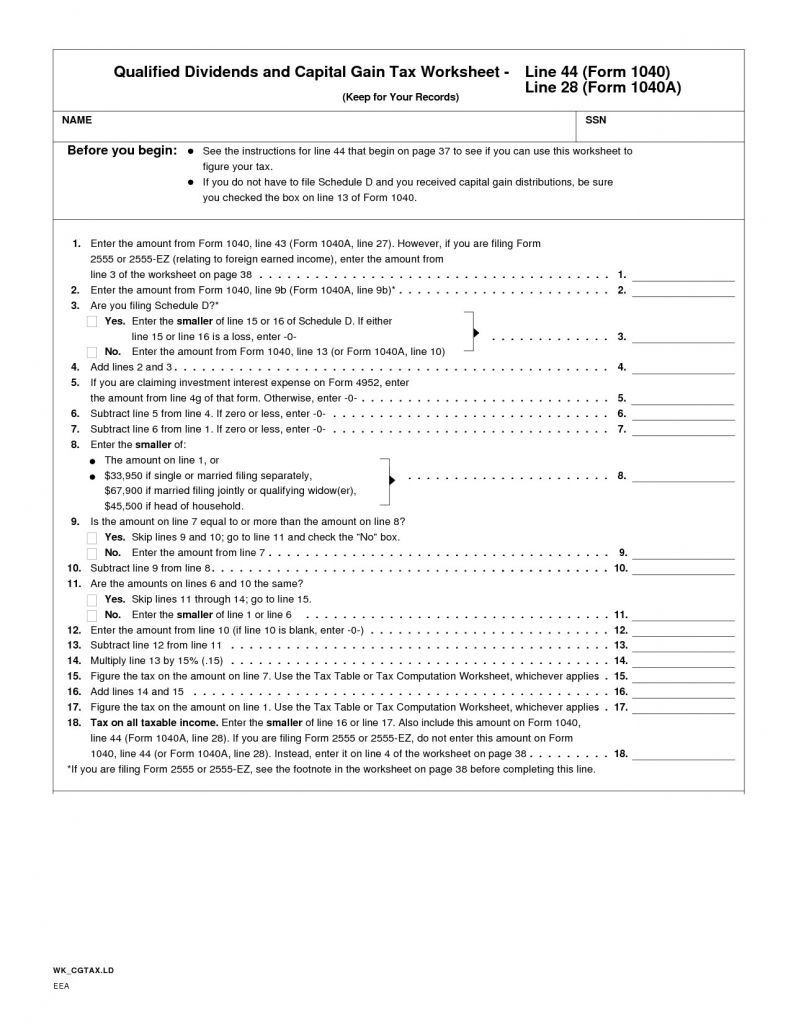

Qualified Dividends Capital Gain Tax Ws

V / see the instructions for line 16 in the instructions to see if you can use this. Dividends are generally taxed at your ordinary income tax rates. 0%, 15%, and 20% (see lines 9, 18, and 21 of the worksheet). Before completing this worksheet, complete form 1040 through line 10. They are qualified with the irs for a special,.

Qualified Dividends And Capital Gain Tax Worksheet Printable Word

V / see the instructions for line 16 in the instructions to see if you can use this. However, some dividends are special. Dividends are generally taxed at your ordinary income tax rates. Qualified dividends have three tax brackets: See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax.

What Is The Purpose Of The Qualified Dividends And Capital Gains Tax

However, some dividends are special. Qualified dividends have three tax brackets: See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. They are qualified with the irs for a special, lower tax rate. V / see the instructions for line 16 in the instructions to see if you can use this.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

All three brackets correlate to the taxpayer’s income. However, some dividends are special. Dividends are generally taxed at your ordinary income tax rates. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an.

Qualified Dividends Tax Worksheet PDF Form FormsPal

V / see the instructions for line 16 in the instructions to see if you can use this. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Qualified dividends have three tax brackets: They are qualified with the irs for a special, lower tax rate. However, some dividends are special.

What Is The Purpose Of The Qualified Dividends And Capital Gains Tax

Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an amount on line 4g, even if you. V / see the instructions for line 16 in the instructions to see if you can.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

All three brackets correlate to the taxpayer’s income. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Qualified dividends have three tax brackets: 0%, 15%, and 20% (see lines 9, 18, and 21 of the worksheet). Complete this worksheet only if line 18 or line 19 of schedule d is.

The Qualified Dividends And Capital Gains Tax Worksheet

All three brackets correlate to the taxpayer’s income. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an amount on line 4g, even if you. Before completing this worksheet, complete form 1040 through.

Qualified Dividends And Capital Gain Tax Worksheet 2020

0%, 15%, and 20% (see lines 9, 18, and 21 of the worksheet). Dividends are generally taxed at your ordinary income tax rates. However, some dividends are special. They are qualified with the irs for a special, lower tax rate. Before completing this worksheet, complete form 1040 through line 10.

Capital Gain Tax Worksheet Printable Word Searches

However, some dividends are special. Before completing this worksheet, complete form 1040 through line 10. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an amount on line 4g, even if you. Dividends.

See The Earlier Instructions For Line 11A To See If You Can Use This Worksheet To Figure Your Tax.

Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an amount on line 4g, even if you. Qualified dividends have three tax brackets: They are qualified with the irs for a special, lower tax rate. However, some dividends are special.

All Three Brackets Correlate To The Taxpayer’s Income.

V / see the instructions for line 16 in the instructions to see if you can use this. 0%, 15%, and 20% (see lines 9, 18, and 21 of the worksheet). Dividends are generally taxed at your ordinary income tax rates. Before completing this worksheet, complete form 1040 through line 10.