Real Estate Tax Lien Investing

Real Estate Tax Lien Investing - A homeowner or landowner defaults. To trigger a tax lien on a. To do tax lien investing, the following events must take place: Tax lien investing is a unique real estate strategy offering high returns, portfolio diversification, and the potential to acquire.

A homeowner or landowner defaults. To do tax lien investing, the following events must take place: Tax lien investing is a unique real estate strategy offering high returns, portfolio diversification, and the potential to acquire. To trigger a tax lien on a.

Tax lien investing is a unique real estate strategy offering high returns, portfolio diversification, and the potential to acquire. To trigger a tax lien on a. A homeowner or landowner defaults. To do tax lien investing, the following events must take place:

Tax Lien Properties Texas Real Estate Tax Lien Investing for Beginners

A homeowner or landowner defaults. To trigger a tax lien on a. Tax lien investing is a unique real estate strategy offering high returns, portfolio diversification, and the potential to acquire. To do tax lien investing, the following events must take place:

Tax Lien Investing For Massive Returns With Melanie Finnegan

To do tax lien investing, the following events must take place: Tax lien investing is a unique real estate strategy offering high returns, portfolio diversification, and the potential to acquire. A homeowner or landowner defaults. To trigger a tax lien on a.

Tax Lien Investing Guide Real Estate Investing

To do tax lien investing, the following events must take place: Tax lien investing is a unique real estate strategy offering high returns, portfolio diversification, and the potential to acquire. To trigger a tax lien on a. A homeowner or landowner defaults.

Tax Lien Properties Texas Real Estate Tax Lien Investing for Beginners

To do tax lien investing, the following events must take place: To trigger a tax lien on a. A homeowner or landowner defaults. Tax lien investing is a unique real estate strategy offering high returns, portfolio diversification, and the potential to acquire.

Bundle The Complete Guide to Investing in Real Estate Tax Liens & Deeds

Tax lien investing is a unique real estate strategy offering high returns, portfolio diversification, and the potential to acquire. To do tax lien investing, the following events must take place: To trigger a tax lien on a. A homeowner or landowner defaults.

How Tax Lien Investing Can Complement Your Real Estate Strategy

To trigger a tax lien on a. To do tax lien investing, the following events must take place: Tax lien investing is a unique real estate strategy offering high returns, portfolio diversification, and the potential to acquire. A homeowner or landowner defaults.

Tax Lien Investing Top Real Estate Hack in 2021

Tax lien investing is a unique real estate strategy offering high returns, portfolio diversification, and the potential to acquire. To do tax lien investing, the following events must take place: To trigger a tax lien on a. A homeowner or landowner defaults.

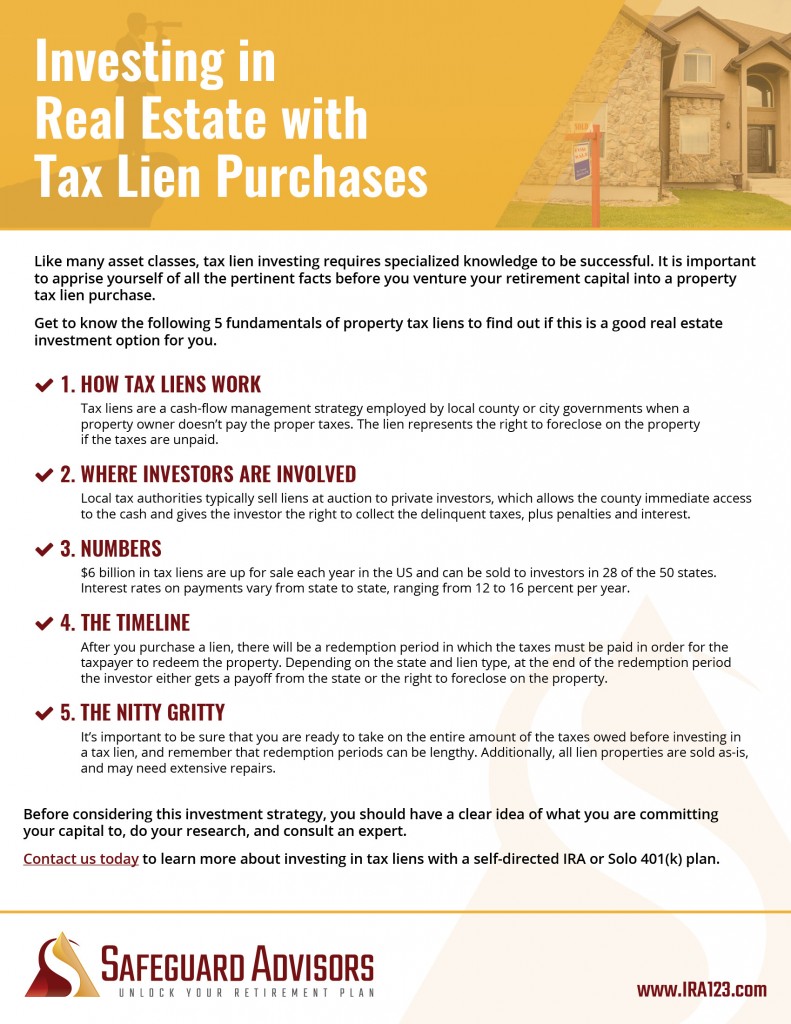

Invest in Tax Liens with a Real Estate IRA

To do tax lien investing, the following events must take place: To trigger a tax lien on a. Tax lien investing is a unique real estate strategy offering high returns, portfolio diversification, and the potential to acquire. A homeowner or landowner defaults.

Real Estate Tax Lien Investing for Beginners Secrets to Find

A homeowner or landowner defaults. To trigger a tax lien on a. To do tax lien investing, the following events must take place: Tax lien investing is a unique real estate strategy offering high returns, portfolio diversification, and the potential to acquire.

Tax Lien Properties Texas Real Estate Tax Lien Investing for Beginners

Tax lien investing is a unique real estate strategy offering high returns, portfolio diversification, and the potential to acquire. To trigger a tax lien on a. A homeowner or landowner defaults. To do tax lien investing, the following events must take place:

To Do Tax Lien Investing, The Following Events Must Take Place:

A homeowner or landowner defaults. To trigger a tax lien on a. Tax lien investing is a unique real estate strategy offering high returns, portfolio diversification, and the potential to acquire.