Sales Tax Exempt Form Michigan

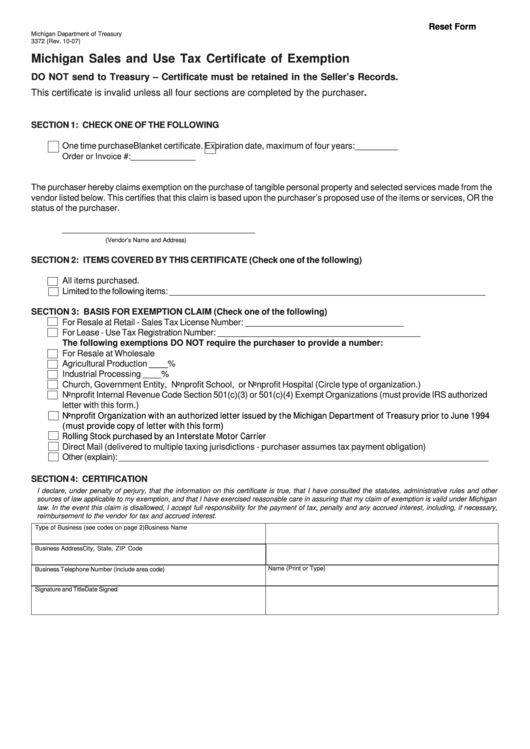

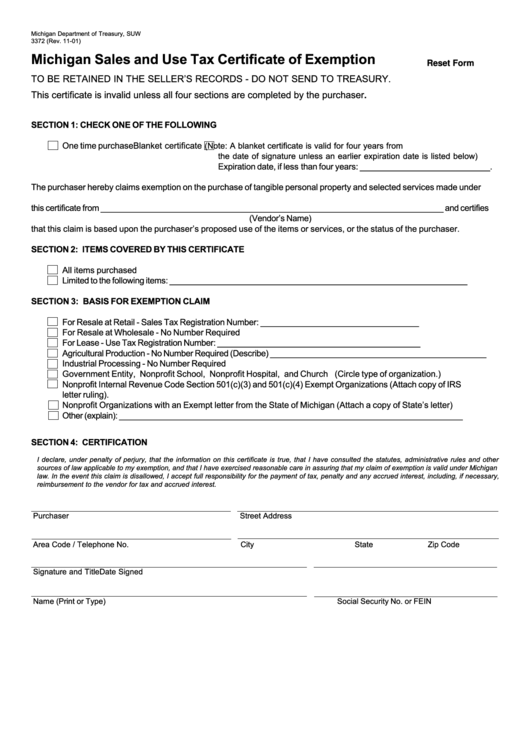

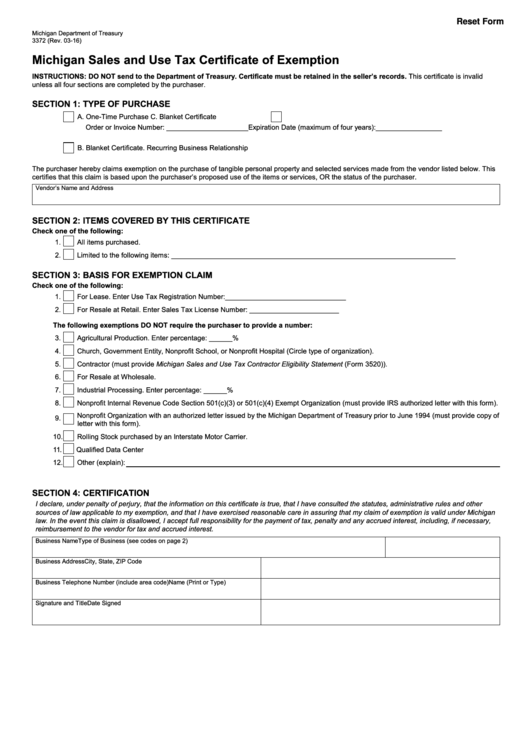

Sales Tax Exempt Form Michigan - It is the purchaser’s responsibility. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from. The purchaser hereby claims exemption on the purchase of tangible personal property and selected services made from the vendor listed. All fields must be completed;. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Michigan department of treasury, suw 3372 (rev. Learn how to complete the form,. Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions.

Michigan department of treasury, suw 3372 (rev. It is the purchaser’s responsibility. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from. The purchaser hereby claims exemption on the purchase of tangible personal property and selected services made from the vendor listed. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Learn how to complete the form,. Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. All fields must be completed;.

Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from. It is the purchaser’s responsibility. The purchaser hereby claims exemption on the purchase of tangible personal property and selected services made from the vendor listed. Learn how to complete the form,. Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions. All fields must be completed;. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. Michigan department of treasury, suw 3372 (rev.

Michigan tax exempt form Fill out & sign online DocHub

Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Learn how to complete the form,. It is the purchaser’s responsibility. The purchaser hereby claims exemption on the purchase of tangible personal property and selected services made from the vendor listed. Purchasers may use this form to claim exemption from michigan sales.

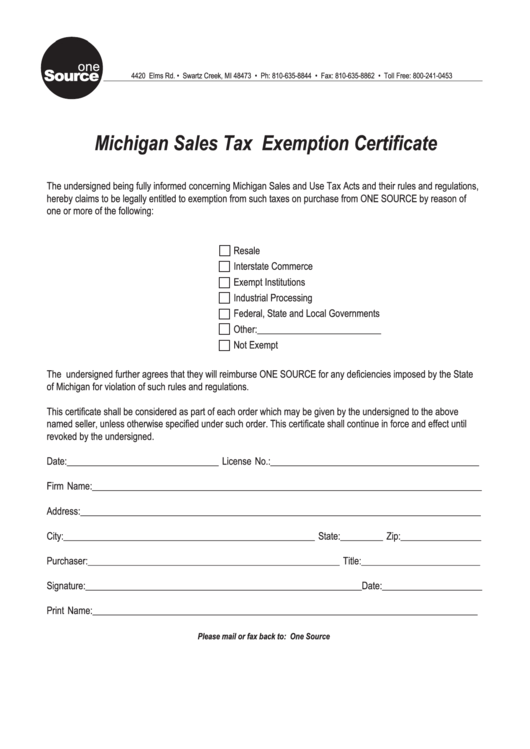

Michigan Sales Tax Exemption Certificate printable pdf download

It is the purchaser’s responsibility. All fields must be completed;. Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions. Michigan department of treasury, suw 3372 (rev. Learn how to complete the form,.

Mi State Tax Exemption Form

Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions. It is the purchaser’s responsibility. Learn how to complete the form,. The purchaser hereby claims exemption on the purchase of tangible personal property and selected services made from the vendor listed. All fields must be completed;.

Michigan michigan Fill out & sign online DocHub

Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. It is the purchaser’s responsibility. Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased.

How To Fill Out A Michigan Sales Tax Exemption Form

Learn how to complete the form,. It is the purchaser’s responsibility. Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from. All fields must be completed;.

Michigan Form 3372 Fillable Printable Forms Free Online

Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from. Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions. All fields must be.

State Of Michigan Tax Exempt Form 2024 Fredia Susanne

The purchaser hereby claims exemption on the purchase of tangible personal property and selected services made from the vendor listed. It is the purchaser’s responsibility. Michigan department of treasury, suw 3372 (rev. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from. Purchasers may use this form to claim.

Michigan Sales Tax Exemption Form 2024 Ryann Wileen

All fields must be completed;. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. The purchaser hereby claims exemption on the purchase of tangible personal property and selected services made from the vendor listed. It is the purchaser’s responsibility. The purchaser completing this form hereby claims exemption from tax on the purchase.

Top 19 Michigan Tax Exempt Form Templates free to download in PDF format

Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. All fields must be completed;. It is the purchaser’s responsibility. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from. Download and print form 3372 to claim exemption from michigan sales and.

Michigan Sales Tax Exempt Form Fillable

Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Learn how to complete the form,. Michigan department of treasury, suw 3372 (rev. The purchaser hereby claims exemption on the purchase of tangible personal property and selected services made from the vendor listed. The purchaser completing this form hereby claims exemption from.

Learn How To Complete The Form,.

The purchaser hereby claims exemption on the purchase of tangible personal property and selected services made from the vendor listed. All fields must be completed;. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions.

Michigan Department Of Treasury, Suw 3372 (Rev.

Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. It is the purchaser’s responsibility. Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions.