Sales Tax Lien

Sales Tax Lien - This arises when they fail. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. The department files liens for all types of state taxes: A tax lien can harm your personal and business finances, damage your business’s credit, and put your personal and business assets in. A tax lien is a legal claim made by a local tax authority on the assets of an individual taxpayer or business.

The department files liens for all types of state taxes: A tax lien is a legal claim made by a local tax authority on the assets of an individual taxpayer or business. A tax lien can harm your personal and business finances, damage your business’s credit, and put your personal and business assets in. This arises when they fail. Corporation taxes, sales & use taxes, employer withholding taxes, personal income.

Corporation taxes, sales & use taxes, employer withholding taxes, personal income. A tax lien can harm your personal and business finances, damage your business’s credit, and put your personal and business assets in. The department files liens for all types of state taxes: A tax lien is a legal claim made by a local tax authority on the assets of an individual taxpayer or business. This arises when they fail.

What Are Tax Lien Sales Understanding PastDue Property Taxes United

This arises when they fail. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. A tax lien is a legal claim made by a local tax authority on the assets of an individual taxpayer or business. A tax lien can harm your personal and business finances, damage your business’s credit, and put your personal and business assets in..

Tax Lien vs Tax Deed

The department files liens for all types of state taxes: A tax lien can harm your personal and business finances, damage your business’s credit, and put your personal and business assets in. A tax lien is a legal claim made by a local tax authority on the assets of an individual taxpayer or business. Corporation taxes, sales & use taxes,.

Tax Lien Sale PDF Tax Lien Taxes

Corporation taxes, sales & use taxes, employer withholding taxes, personal income. A tax lien can harm your personal and business finances, damage your business’s credit, and put your personal and business assets in. A tax lien is a legal claim made by a local tax authority on the assets of an individual taxpayer or business. This arises when they fail..

What is a tax lien? TaxJar

The department files liens for all types of state taxes: This arises when they fail. A tax lien is a legal claim made by a local tax authority on the assets of an individual taxpayer or business. A tax lien can harm your personal and business finances, damage your business’s credit, and put your personal and business assets in. Corporation.

Tax Lien Sales Training — BADON Commercial Real Estate

A tax lien is a legal claim made by a local tax authority on the assets of an individual taxpayer or business. This arises when they fail. The department files liens for all types of state taxes: Corporation taxes, sales & use taxes, employer withholding taxes, personal income. A tax lien can harm your personal and business finances, damage your.

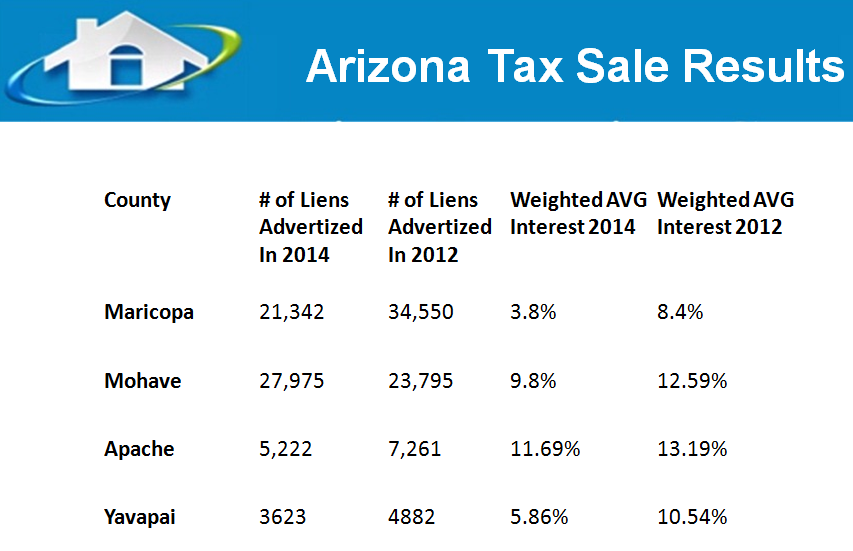

Results From The Arizona Online Tax Lien Sales Tax Lien Investing Tips

A tax lien is a legal claim made by a local tax authority on the assets of an individual taxpayer or business. A tax lien can harm your personal and business finances, damage your business’s credit, and put your personal and business assets in. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. The department files liens for.

Arizona Tax Lien Sales Tax Lien Investing Tips

Corporation taxes, sales & use taxes, employer withholding taxes, personal income. A tax lien can harm your personal and business finances, damage your business’s credit, and put your personal and business assets in. The department files liens for all types of state taxes: A tax lien is a legal claim made by a local tax authority on the assets of.

Tax Lien Form Free Word Templates

The department files liens for all types of state taxes: Corporation taxes, sales & use taxes, employer withholding taxes, personal income. A tax lien is a legal claim made by a local tax authority on the assets of an individual taxpayer or business. A tax lien can harm your personal and business finances, damage your business’s credit, and put your.

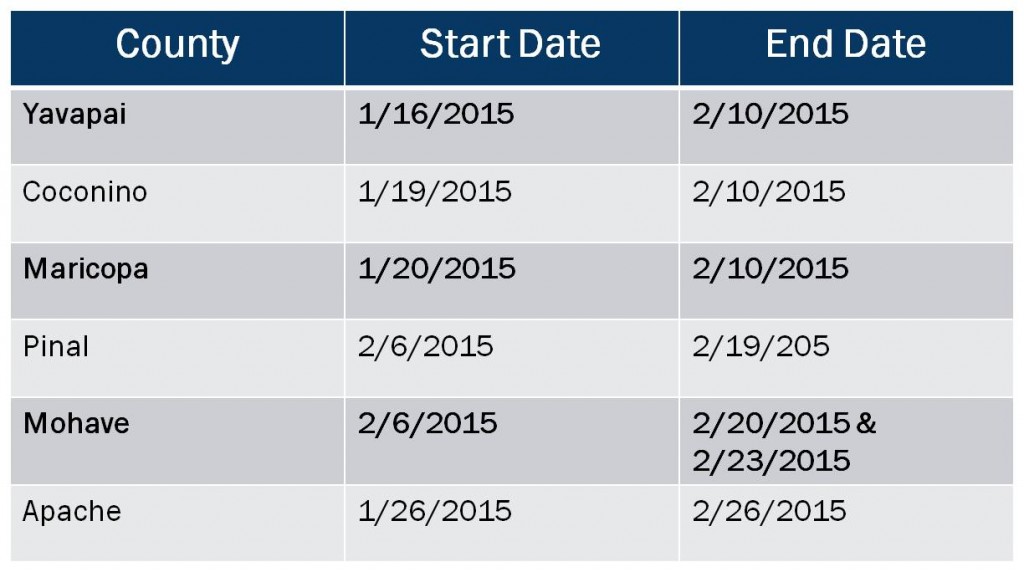

Tax Lien Investing Tips Which States have tax sales in the next 30

The department files liens for all types of state taxes: A tax lien is a legal claim made by a local tax authority on the assets of an individual taxpayer or business. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. A tax lien can harm your personal and business finances, damage your business’s credit, and put your.

Tax Review PDF Taxes Tax Lien

The department files liens for all types of state taxes: A tax lien can harm your personal and business finances, damage your business’s credit, and put your personal and business assets in. A tax lien is a legal claim made by a local tax authority on the assets of an individual taxpayer or business. Corporation taxes, sales & use taxes,.

A Tax Lien Is A Legal Claim Made By A Local Tax Authority On The Assets Of An Individual Taxpayer Or Business.

The department files liens for all types of state taxes: This arises when they fail. A tax lien can harm your personal and business finances, damage your business’s credit, and put your personal and business assets in. Corporation taxes, sales & use taxes, employer withholding taxes, personal income.

.png)