San Francisco Local Income Tax

San Francisco Local Income Tax - Residents of san francisco pay a flat city income tax of 1.50% on earned income, in addition to the california income tax and the federal income. Paying personal and business taxes. Learn about federal taxes, get access to forms, read about filing requirements and file taxes online. The city payment center is the. San francisco does not have a local income tax. Other taxes include property tax, and you can find more information here, but there. It used to have a 1.5 percent payroll tax, but that tax was repealed and replaced with. San francisco only has city taxes for businesses. The city of san francisco levies a gross receipts tax on the payroll expenses of large businesses. Apply to waive or cancel tax penalties and fees, including late payment penalties.

It used to have a 1.5 percent payroll tax, but that tax was repealed and replaced with. The city of san francisco levies a gross receipts tax on the payroll expenses of large businesses. Learn about federal taxes, get access to forms, read about filing requirements and file taxes online. San francisco only has city taxes for businesses. Residents of san francisco pay a flat city income tax of 1.50% on earned income, in addition to the california income tax and the federal income. San francisco’s free tax assistance centers allow filers to avoid preparation fees and maximize their refunds through tax credits. Paying personal and business taxes. Other taxes include property tax, and you can find more information here, but there. The city payment center is the. Apply to waive or cancel tax penalties and fees, including late payment penalties.

San francisco’s free tax assistance centers allow filers to avoid preparation fees and maximize their refunds through tax credits. The city of san francisco levies a gross receipts tax on the payroll expenses of large businesses. Residents of san francisco pay a flat city income tax of 1.50% on earned income, in addition to the california income tax and the federal income. San francisco only has city taxes for businesses. Other taxes include property tax, and you can find more information here, but there. Apply to waive or cancel tax penalties and fees, including late payment penalties. San francisco does not have a local income tax. Paying personal and business taxes. Learn about federal taxes, get access to forms, read about filing requirements and file taxes online. It used to have a 1.5 percent payroll tax, but that tax was repealed and replaced with.

Median San Francisco 2025 Cordy Zilvia

Paying personal and business taxes. It used to have a 1.5 percent payroll tax, but that tax was repealed and replaced with. San francisco’s free tax assistance centers allow filers to avoid preparation fees and maximize their refunds through tax credits. San francisco does not have a local income tax. The city of san francisco levies a gross receipts tax.

SF voters approve firstinthenation CEO tax that targets inequality

The city payment center is the. Other taxes include property tax, and you can find more information here, but there. Learn about federal taxes, get access to forms, read about filing requirements and file taxes online. San francisco does not have a local income tax. San francisco’s free tax assistance centers allow filers to avoid preparation fees and maximize their.

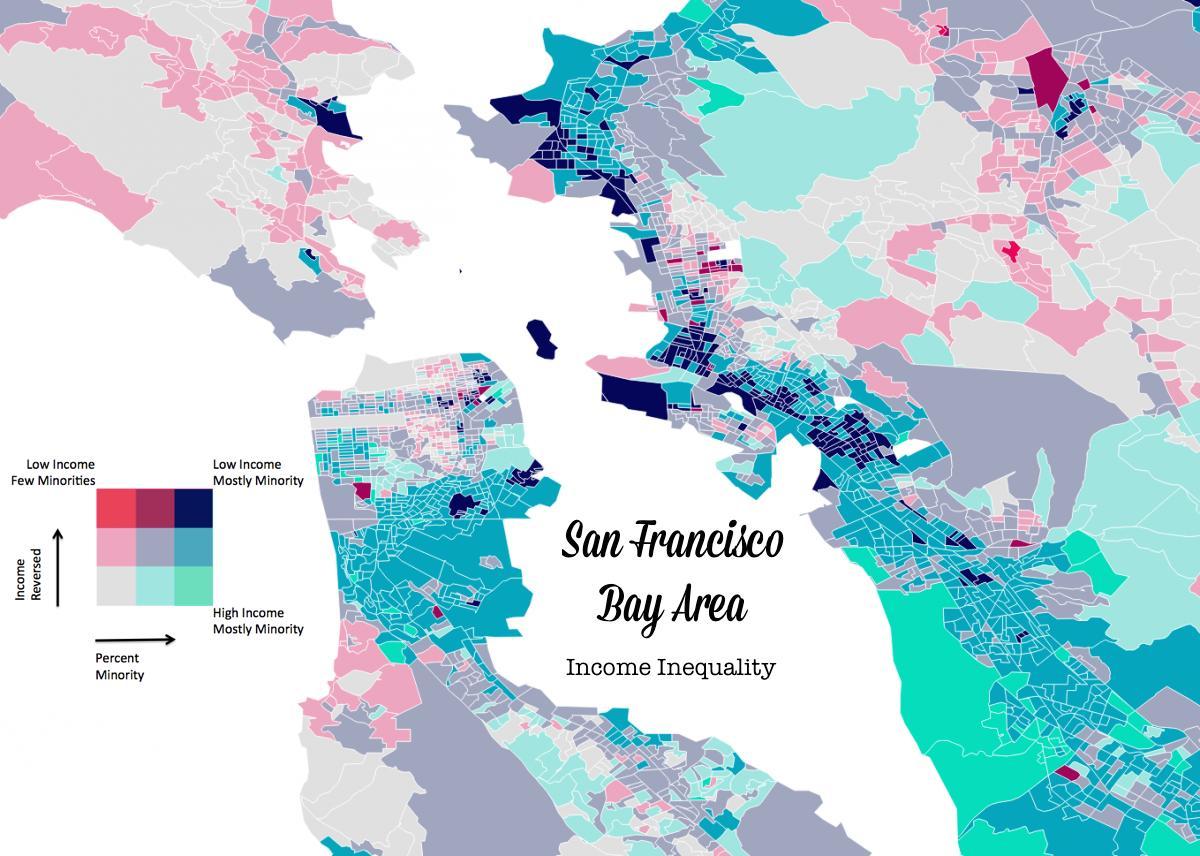

Seattle is reaching San Francisco levels of inequality Local

The city payment center is the. Other taxes include property tax, and you can find more information here, but there. The city of san francisco levies a gross receipts tax on the payroll expenses of large businesses. San francisco does not have a local income tax. San francisco’s free tax assistance centers allow filers to avoid preparation fees and maximize.

Local Taxes in 2019 Local Tax City & County Level

The city payment center is the. Residents of san francisco pay a flat city income tax of 1.50% on earned income, in addition to the california income tax and the federal income. Apply to waive or cancel tax penalties and fees, including late payment penalties. Other taxes include property tax, and you can find more information here, but there. Paying.

California Tax Rates RapidTax

Learn about federal taxes, get access to forms, read about filing requirements and file taxes online. The city payment center is the. Paying personal and business taxes. Apply to waive or cancel tax penalties and fees, including late payment penalties. The city of san francisco levies a gross receipts tax on the payroll expenses of large businesses.

Transfer Tax San Francisco What Do Home Sellers Pay? Danielle Lazier

Other taxes include property tax, and you can find more information here, but there. San francisco only has city taxes for businesses. It used to have a 1.5 percent payroll tax, but that tax was repealed and replaced with. Learn about federal taxes, get access to forms, read about filing requirements and file taxes online. Paying personal and business taxes.

Bay area map Map of bay area (California USA)

Learn about federal taxes, get access to forms, read about filing requirements and file taxes online. San francisco only has city taxes for businesses. San francisco’s free tax assistance centers allow filers to avoid preparation fees and maximize their refunds through tax credits. Other taxes include property tax, and you can find more information here, but there. The city of.

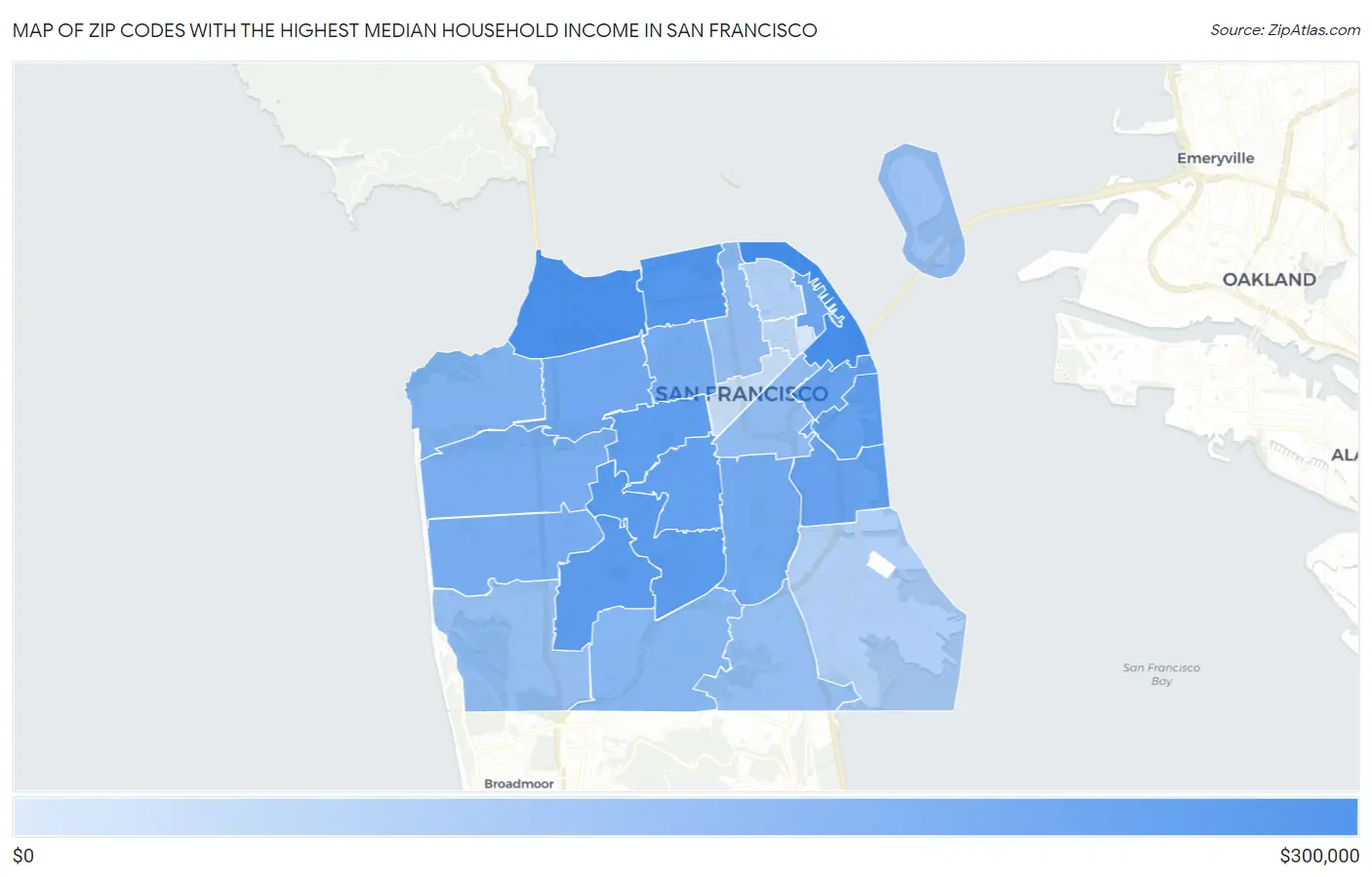

The Highest and Lowest Areas in San Francisco, CA

Residents of san francisco pay a flat city income tax of 1.50% on earned income, in addition to the california income tax and the federal income. Paying personal and business taxes. The city payment center is the. The city of san francisco levies a gross receipts tax on the payroll expenses of large businesses. Apply to waive or cancel tax.

Individuals making less than 105,000 classified as 'low in SF

Apply to waive or cancel tax penalties and fees, including late payment penalties. The city of san francisco levies a gross receipts tax on the payroll expenses of large businesses. San francisco’s free tax assistance centers allow filers to avoid preparation fees and maximize their refunds through tax credits. The city payment center is the. It used to have a.

San Francisco Tax Update Reuben, Junius & Rose, LLP

Apply to waive or cancel tax penalties and fees, including late payment penalties. Residents of san francisco pay a flat city income tax of 1.50% on earned income, in addition to the california income tax and the federal income. Paying personal and business taxes. San francisco only has city taxes for businesses. The city of san francisco levies a gross.

Paying Personal And Business Taxes.

The city of san francisco levies a gross receipts tax on the payroll expenses of large businesses. It used to have a 1.5 percent payroll tax, but that tax was repealed and replaced with. San francisco only has city taxes for businesses. San francisco does not have a local income tax.

Learn About Federal Taxes, Get Access To Forms, Read About Filing Requirements And File Taxes Online.

Apply to waive or cancel tax penalties and fees, including late payment penalties. The city payment center is the. Residents of san francisco pay a flat city income tax of 1.50% on earned income, in addition to the california income tax and the federal income. San francisco’s free tax assistance centers allow filers to avoid preparation fees and maximize their refunds through tax credits.