Schedule C Tax Form Instructions

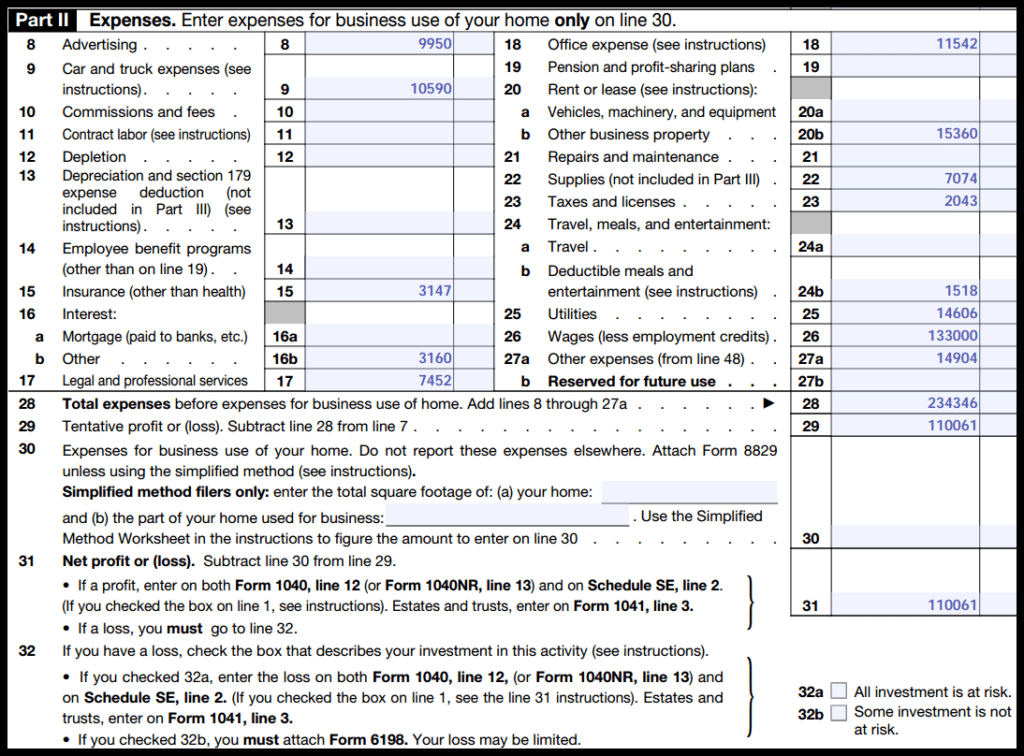

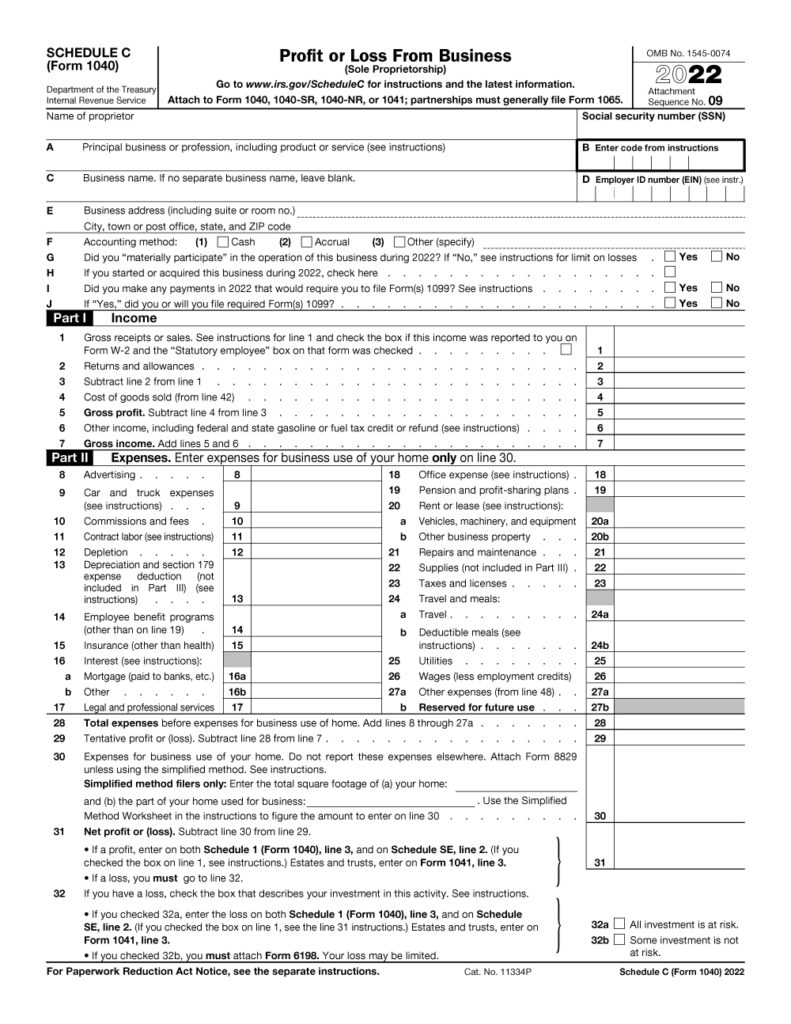

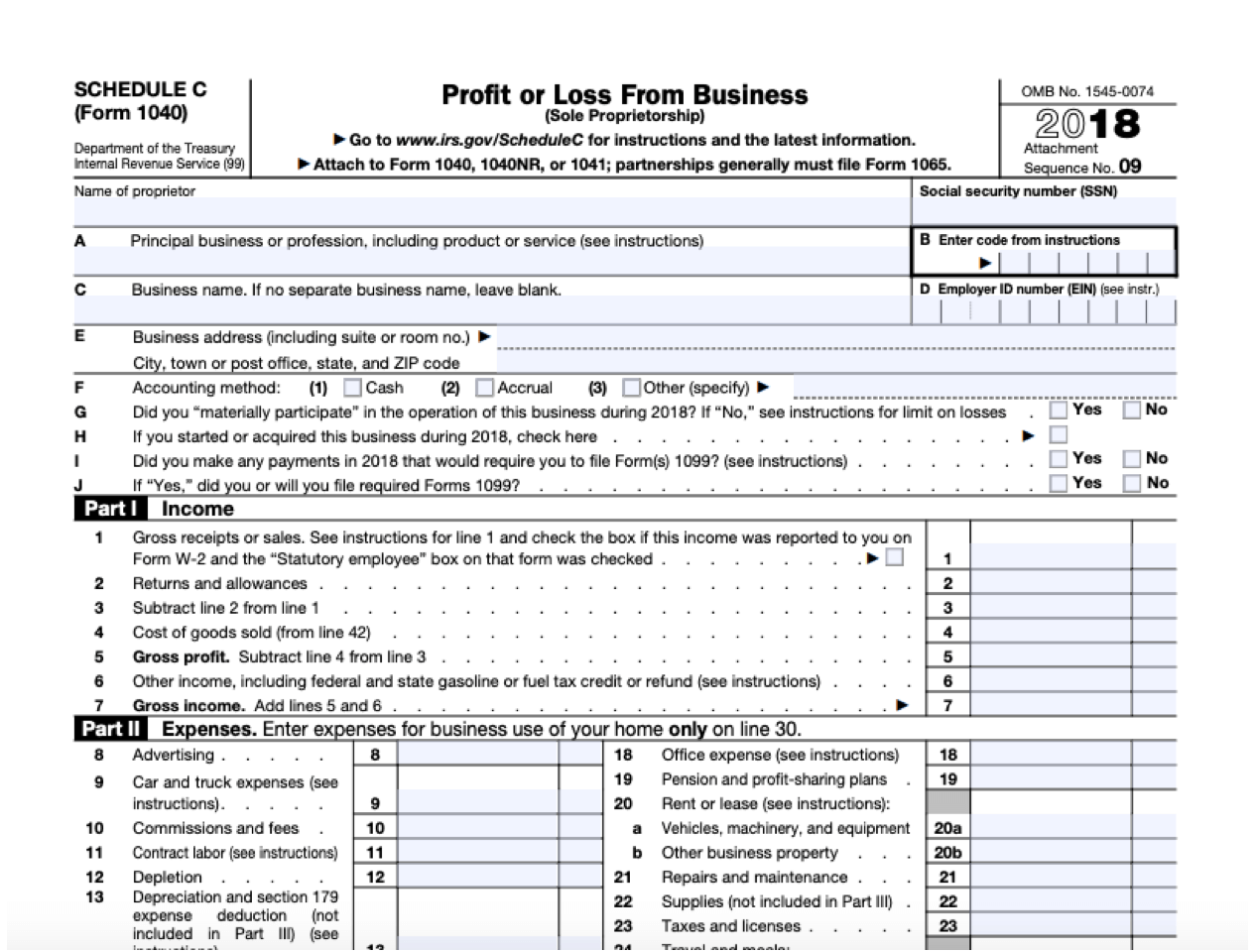

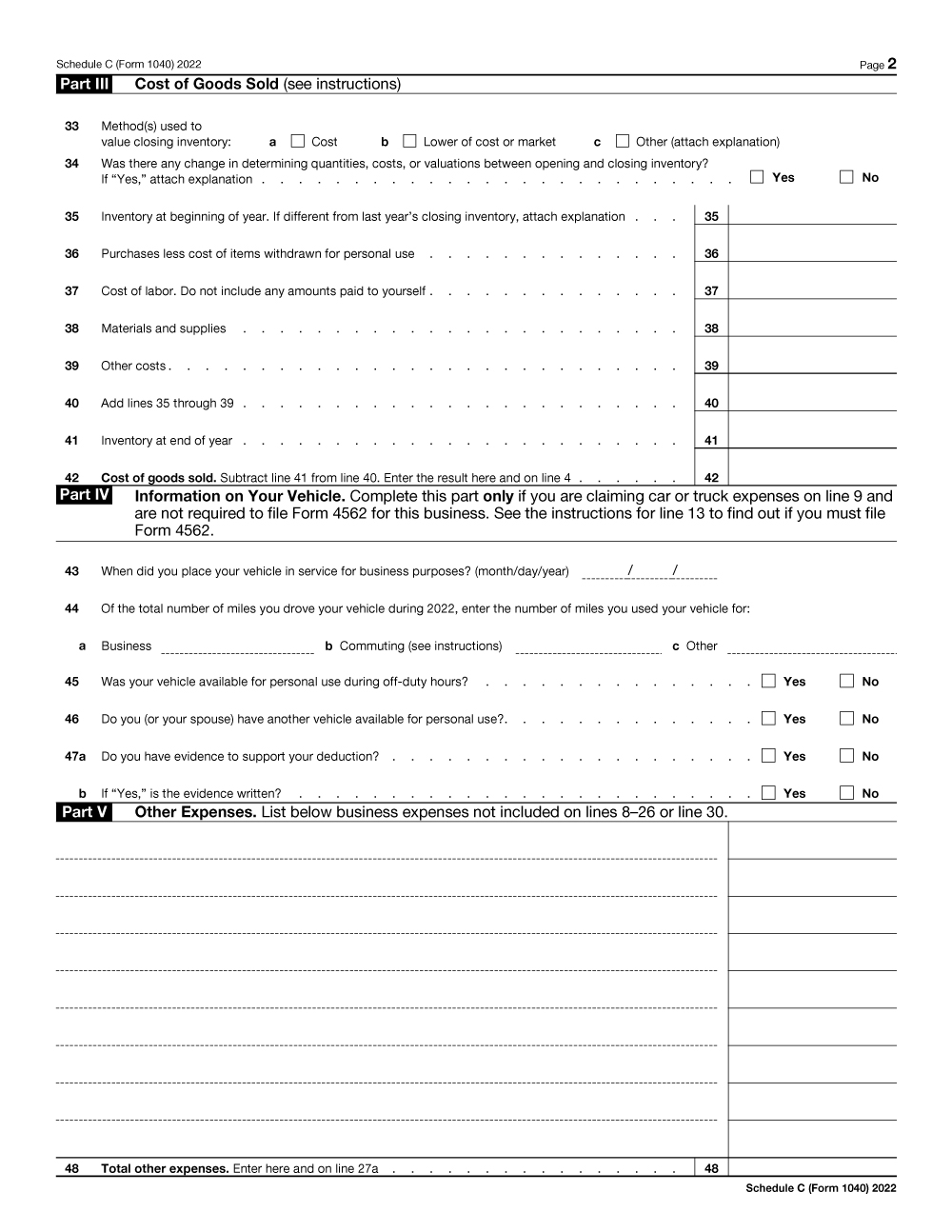

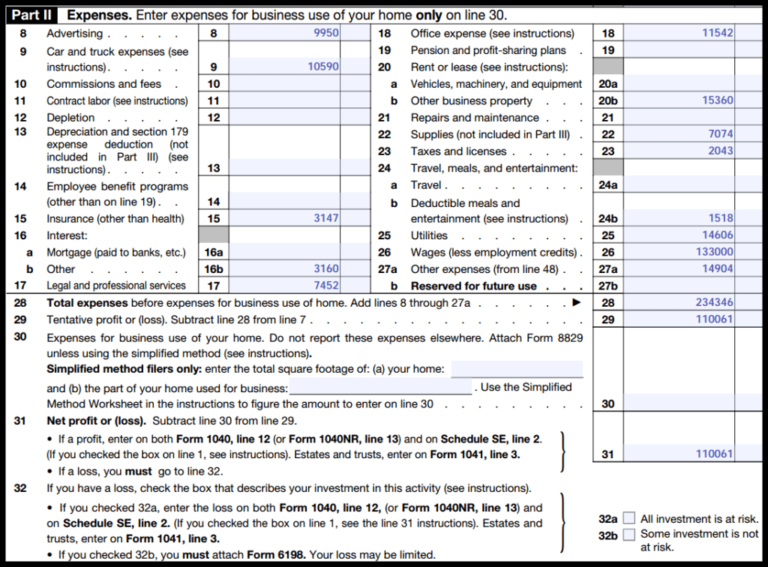

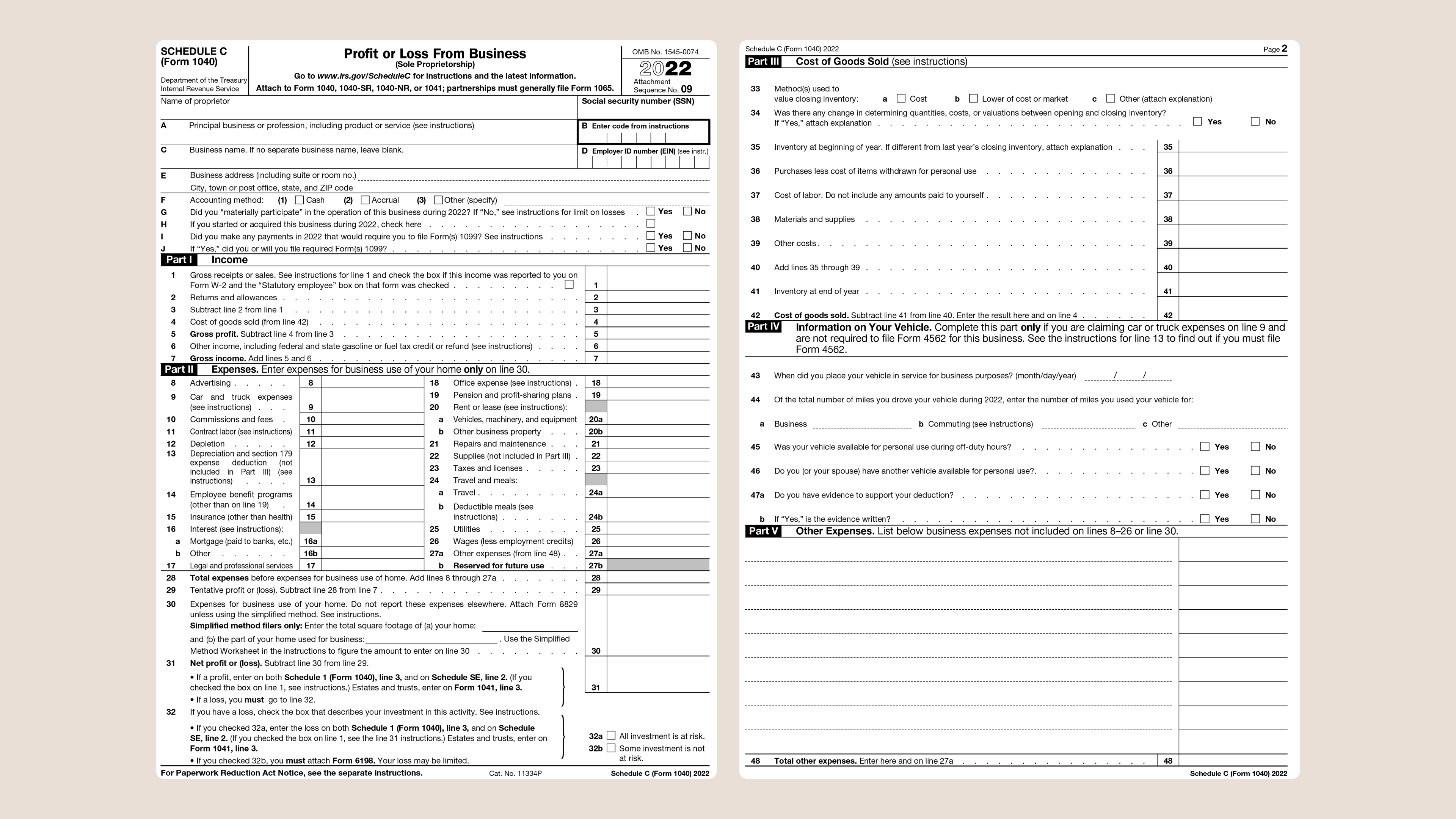

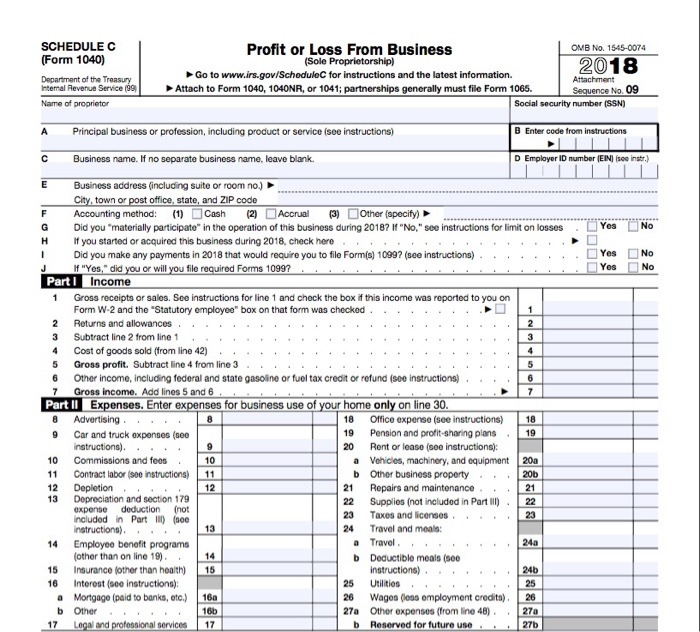

Schedule C Tax Form Instructions - This document allows you to report income, deductions, profits, and losses for your business. Your ssn (social security number) your ein (employer. Before you fill it out, you’ll need: An activity qualifies as a business if your primary purpose for. Here is what schedule c form 1040 looks like. The irs’s instructions for schedule c; Schedule c must be submitted with. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor.

Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Schedule c must be submitted with. The irs’s instructions for schedule c; Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; Here is what schedule c form 1040 looks like. Before you fill it out, you’ll need: This document allows you to report income, deductions, profits, and losses for your business. Your ssn (social security number) your ein (employer. An activity qualifies as a business if your primary purpose for.

Schedule c must be submitted with. The irs’s instructions for schedule c; An activity qualifies as a business if your primary purpose for. Your ssn (social security number) your ein (employer. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; This document allows you to report income, deductions, profits, and losses for your business. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Here is what schedule c form 1040 looks like. Before you fill it out, you’ll need:

Irs Schedule C Form 2023 Printable Forms Free Online

Your ssn (social security number) your ein (employer. This document allows you to report income, deductions, profits, and losses for your business. Here is what schedule c form 1040 looks like. An activity qualifies as a business if your primary purpose for. Schedule c must be submitted with.

Do I Have To Fill Out A Schedule C For 2024 Mlb Schedule 2024

Your ssn (social security number) your ein (employer. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; An activity qualifies as a business if your primary purpose for. This document allows you to report income, deductions, profits, and losses for your.

Schedule C Instructions 2024 Tax Form Aurie Carissa

This document allows you to report income, deductions, profits, and losses for your business. Your ssn (social security number) your ein (employer. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Before you fill it out, you’ll need: Information about schedule c (form 1040), profit.

Schedule C (Form 1040) 2023 Instructions

An activity qualifies as a business if your primary purpose for. Schedule c must be submitted with. Your ssn (social security number) your ein (employer. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Before you fill it out, you’ll need:

What is an IRS Schedule C Form?

An activity qualifies as a business if your primary purpose for. Before you fill it out, you’ll need: Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; Here is what schedule c form 1040 looks like. Your ssn (social security number).

Free Printable Schedule C Form

Here is what schedule c form 1040 looks like. Schedule c must be submitted with. The irs’s instructions for schedule c; This document allows you to report income, deductions, profits, and losses for your business. An activity qualifies as a business if your primary purpose for.

Schedule C (Form 1040) 2023 Instructions

Your ssn (social security number) your ein (employer. Here is what schedule c form 1040 looks like. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; This document allows you to report income, deductions, profits, and losses for your business. Before.

IRS Schedule C Instructions Step By Step Including C EZ 1040 Form

Here is what schedule c form 1040 looks like. Your ssn (social security number) your ein (employer. The irs’s instructions for schedule c; An activity qualifies as a business if your primary purpose for. This document allows you to report income, deductions, profits, and losses for your business.

Understanding the Schedule C Tax Form

Here is what schedule c form 1040 looks like. This document allows you to report income, deductions, profits, and losses for your business. Your ssn (social security number) your ein (employer. Before you fill it out, you’ll need: Schedule c must be submitted with.

ACE 346 Homework 1 Schedule C Dave Sanders does

Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Your ssn (social security number) your ein (employer. The irs’s instructions for schedule c; This document allows you to report income, deductions, profits, and losses for your business. Here is what schedule c form 1040 looks.

Schedule C Must Be Submitted With.

Here is what schedule c form 1040 looks like. The irs’s instructions for schedule c; Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; Your ssn (social security number) your ein (employer.

Use Schedule C (Form 1040) To Report Income Or (Loss) From A Business You Operated Or A Profession You Practiced As A Sole Proprietor.

Before you fill it out, you’ll need: This document allows you to report income, deductions, profits, and losses for your business. An activity qualifies as a business if your primary purpose for.

:max_bytes(150000):strip_icc()/ScreenShot2022-12-14at2.10.22PM-ed1958c9bbb642398aec3cacd721b244.png)