Short Sale Vs Foreclosure

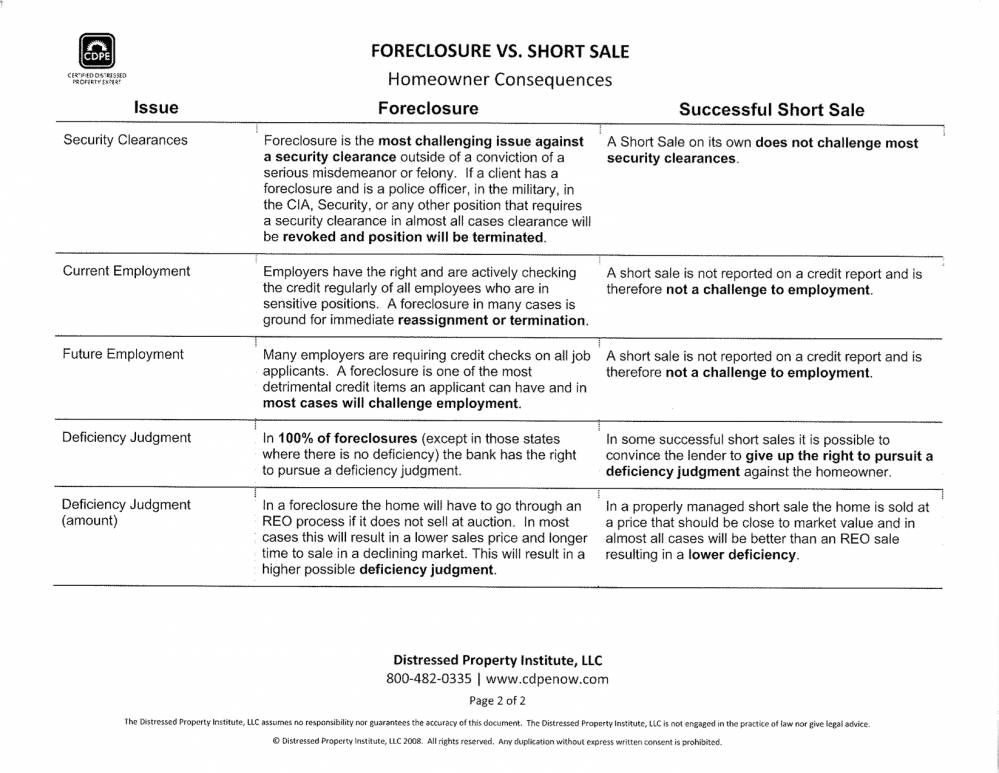

Short Sale Vs Foreclosure - Short sales are voluntary actions by the homeowner; But short sales and foreclosures differ greatly in process. Which option is better for you? Foreclosures are involuntary for the homeowner; Foreclosure is the process by which a lender repossesses a home. Both a foreclosure and a short sale hurt your credit, but they’re not the same thing. Although short sales might have better bones, you’ll almost always save more money on the home. The lender takes legal action to take control of and. If a financial hardship situation has put you in a position where you cannot remain in your home any longer, you have two options: A short sale transaction occurs when mortgage lenders allow the borrower to sell the house for less than the amount owed on the.

They require approval from the lender. Short sales are voluntary actions by the homeowner; Foreclosures are involuntary for the homeowner; The lender takes legal action to take control of and. Which option is better for you? If a financial hardship situation has put you in a position where you cannot remain in your home any longer, you have two options: Which is better for a home buyer: Although short sales might have better bones, you’ll almost always save more money on the home. Foreclosure is the process by which a lender repossesses a home. Both a foreclosure and a short sale hurt your credit, but they’re not the same thing.

Foreclosure is the process by which a lender repossesses a home. They require approval from the lender. The lender takes legal action to take control of and. Although short sales might have better bones, you’ll almost always save more money on the home. Foreclosures are involuntary for the homeowner; A short sale transaction occurs when mortgage lenders allow the borrower to sell the house for less than the amount owed on the. But short sales and foreclosures differ greatly in process. If a financial hardship situation has put you in a position where you cannot remain in your home any longer, you have two options: Both a foreclosure and a short sale hurt your credit, but they’re not the same thing. Which option is better for you?

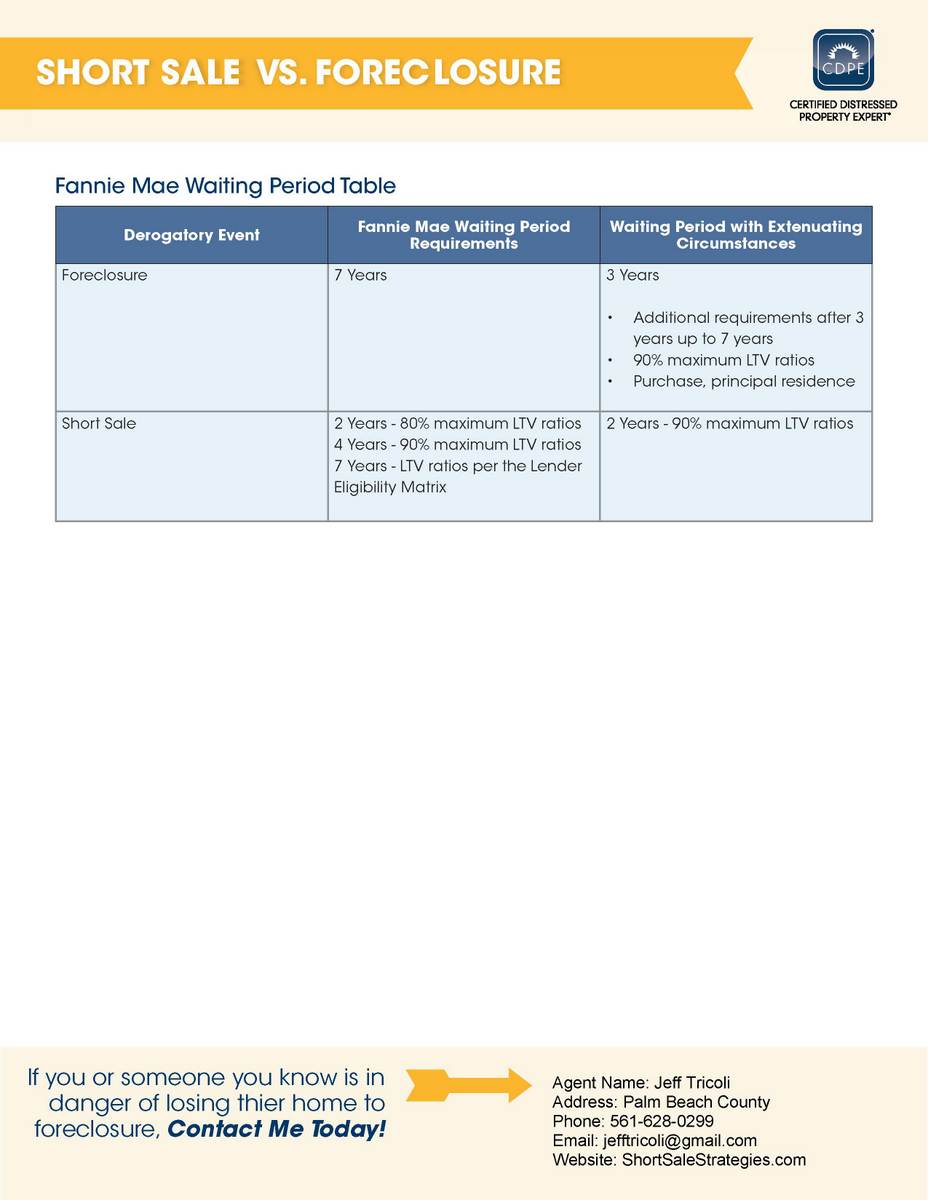

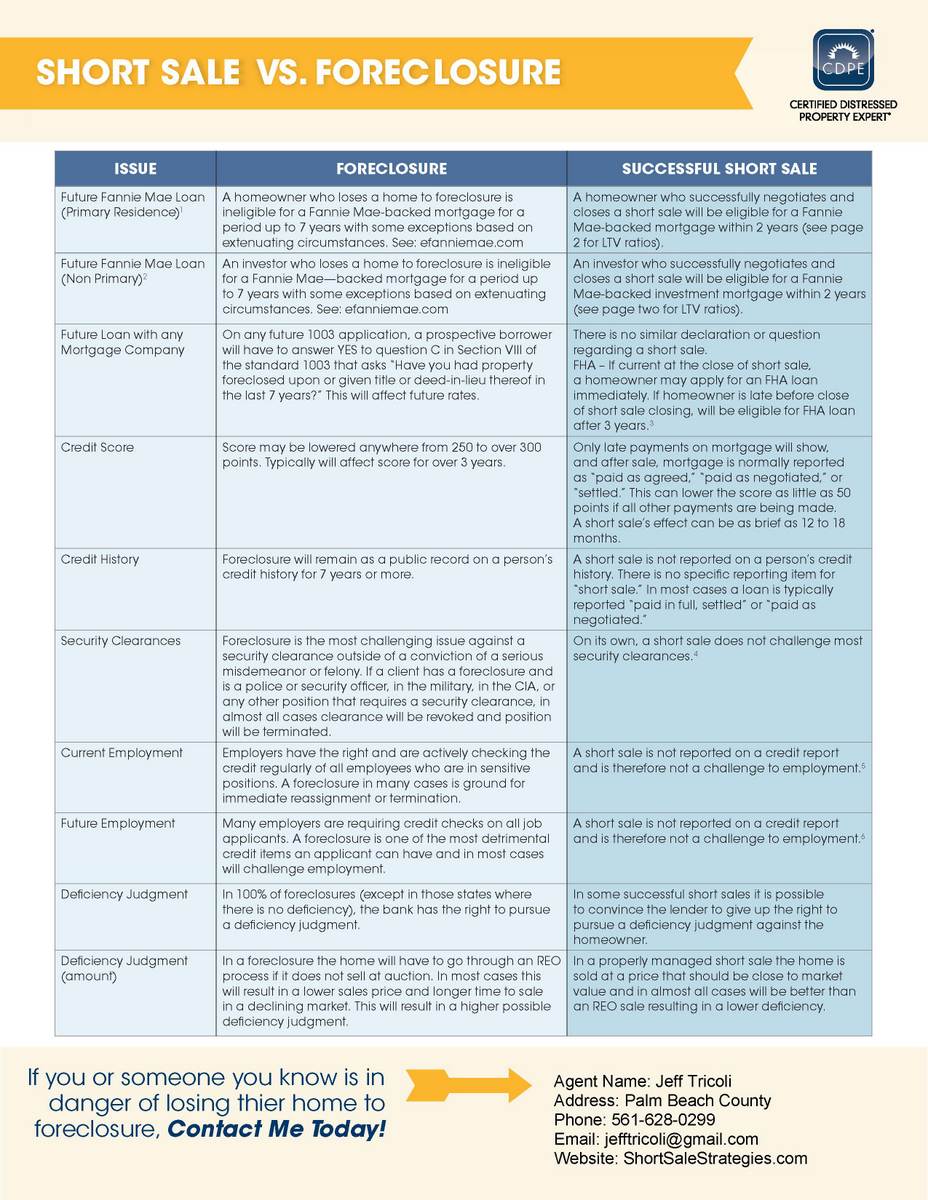

Short Sale vs. Foreclosure What Is the Difference?

If a financial hardship situation has put you in a position where you cannot remain in your home any longer, you have two options: Although short sales might have better bones, you’ll almost always save more money on the home. But short sales and foreclosures differ greatly in process. Which is better for a home buyer: Short sales are voluntary.

Foreclosure vs Short Sale

A short sale transaction occurs when mortgage lenders allow the borrower to sell the house for less than the amount owed on the. Which option is better for you? Both a foreclosure and a short sale hurt your credit, but they’re not the same thing. But short sales and foreclosures differ greatly in process. Foreclosure is the process by which.

Gilbert Homes for Sale Shortsale vs Foreclosure

Which is better for a home buyer: Both a foreclosure and a short sale hurt your credit, but they’re not the same thing. A short sale transaction occurs when mortgage lenders allow the borrower to sell the house for less than the amount owed on the. The lender takes legal action to take control of and. They require approval from.

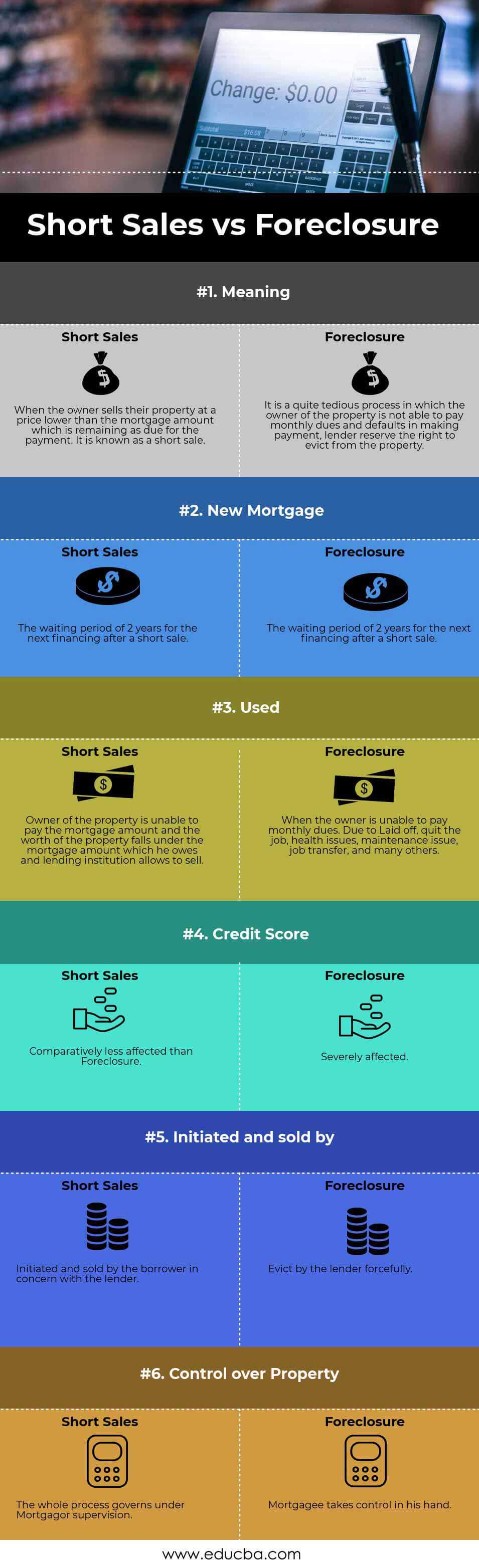

Short Sale vs Foreclosure Top 6 Best Differences (With Infographics)

Foreclosures are involuntary for the homeowner; If a financial hardship situation has put you in a position where you cannot remain in your home any longer, you have two options: A short sale transaction occurs when mortgage lenders allow the borrower to sell the house for less than the amount owed on the. Foreclosure is the process by which a.

Advantages of Short Sale vs. Foreclosure Western Equity Partners

If a financial hardship situation has put you in a position where you cannot remain in your home any longer, you have two options: Foreclosures are involuntary for the homeowner; Short sales are voluntary actions by the homeowner; A short sale transaction occurs when mortgage lenders allow the borrower to sell the house for less than the amount owed on.

Foreclosure vs. Short Sale Westmarq

If a financial hardship situation has put you in a position where you cannot remain in your home any longer, you have two options: Foreclosure is the process by which a lender repossesses a home. Although short sales might have better bones, you’ll almost always save more money on the home. Foreclosures are involuntary for the homeowner; But short sales.

Foreclosure or Short Sale Which Is Better?

Foreclosure is the process by which a lender repossesses a home. But short sales and foreclosures differ greatly in process. A short sale transaction occurs when mortgage lenders allow the borrower to sell the house for less than the amount owed on the. Although short sales might have better bones, you’ll almost always save more money on the home. Short.

Foreclosure vs Short Sale

Which is better for a home buyer: The lender takes legal action to take control of and. Foreclosure is the process by which a lender repossesses a home. Foreclosures are involuntary for the homeowner; Short sales are voluntary actions by the homeowner;

Short Sale vs. Foreclosure How to Get Out of Both Successfully

They require approval from the lender. If a financial hardship situation has put you in a position where you cannot remain in your home any longer, you have two options: Which is better for a home buyer: But short sales and foreclosures differ greatly in process. Short sales are voluntary actions by the homeowner;

Which Is Better For A Home Buyer:

Which option is better for you? They require approval from the lender. A short sale transaction occurs when mortgage lenders allow the borrower to sell the house for less than the amount owed on the. Short sales are voluntary actions by the homeowner;

But Short Sales And Foreclosures Differ Greatly In Process.

Although short sales might have better bones, you’ll almost always save more money on the home. Both a foreclosure and a short sale hurt your credit, but they’re not the same thing. The lender takes legal action to take control of and. Foreclosures are involuntary for the homeowner;

Foreclosure Is The Process By Which A Lender Repossesses A Home.

If a financial hardship situation has put you in a position where you cannot remain in your home any longer, you have two options: