State Of Pa Tax Liens

State Of Pa Tax Liens - (a) (1) all municipal claims, municipal liens, taxes, tax claims and tax liens which may hereafter be lawfully imposed or. Commonwealth of pennsylvania government websites and email systems use. If there is a department of revenue lien filed against you or your business, and you want to resolve your tax liability, please go to. Local, state, and federal government websites often end in.gov. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. On november 27, 2019, pennsylvania governor tom wolf signed act 90 of 2019, a bipartisan piece of legislation which, among other things,. (a) if any person liable for any tax including interest, penalties, and addition neglects or for any reason refuses to pay the same on the date. If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of record by the. The department files liens for all types of state taxes:

(a) if any person liable for any tax including interest, penalties, and addition neglects or for any reason refuses to pay the same on the date. Local, state, and federal government websites often end in.gov. On november 27, 2019, pennsylvania governor tom wolf signed act 90 of 2019, a bipartisan piece of legislation which, among other things,. (a) (1) all municipal claims, municipal liens, taxes, tax claims and tax liens which may hereafter be lawfully imposed or. If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of record by the. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. If there is a department of revenue lien filed against you or your business, and you want to resolve your tax liability, please go to. Commonwealth of pennsylvania government websites and email systems use. The department files liens for all types of state taxes:

If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of record by the. (a) (1) all municipal claims, municipal liens, taxes, tax claims and tax liens which may hereafter be lawfully imposed or. Local, state, and federal government websites often end in.gov. The department files liens for all types of state taxes: Corporation taxes, sales & use taxes, employer withholding taxes, personal income. If there is a department of revenue lien filed against you or your business, and you want to resolve your tax liability, please go to. Commonwealth of pennsylvania government websites and email systems use. (a) if any person liable for any tax including interest, penalties, and addition neglects or for any reason refuses to pay the same on the date. On november 27, 2019, pennsylvania governor tom wolf signed act 90 of 2019, a bipartisan piece of legislation which, among other things,.

TAX Consultancy Firm Gurugram

On november 27, 2019, pennsylvania governor tom wolf signed act 90 of 2019, a bipartisan piece of legislation which, among other things,. Commonwealth of pennsylvania government websites and email systems use. Local, state, and federal government websites often end in.gov. (a) (1) all municipal claims, municipal liens, taxes, tax claims and tax liens which may hereafter be lawfully imposed or..

How to Eliminate State Tax Liens Free Litigation Advice

If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of record by the. The department files liens for all types of state taxes: Local, state, and federal government websites often end in.gov. On november 27, 2019, pennsylvania governor tom wolf signed act 90 of 2019, a.

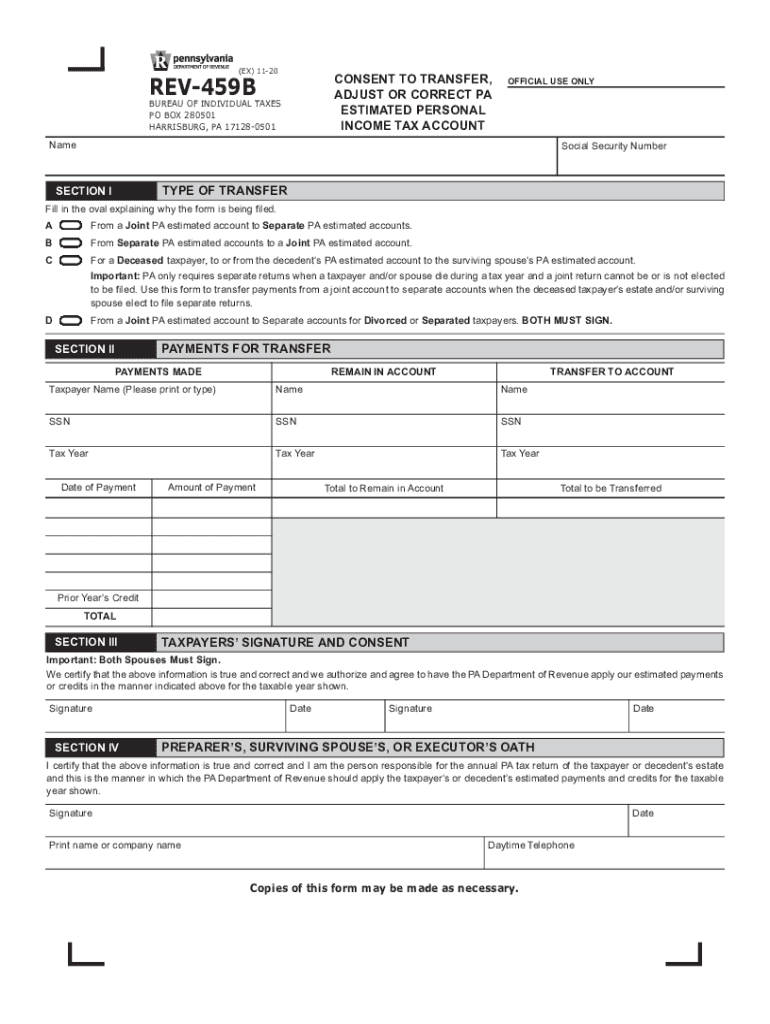

Pa State Tax Form 2023 Printable Forms Free Online

Local, state, and federal government websites often end in.gov. The department files liens for all types of state taxes: (a) if any person liable for any tax including interest, penalties, and addition neglects or for any reason refuses to pay the same on the date. On november 27, 2019, pennsylvania governor tom wolf signed act 90 of 2019, a bipartisan.

Tax Liens An Overview CheckBook IRA LLC

If there is a department of revenue lien filed against you or your business, and you want to resolve your tax liability, please go to. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. (a) if any person liable for any tax including interest, penalties, and addition neglects or for any reason refuses to pay the same on.

PPT STATE TAX LIENS PowerPoint Presentation, free download ID5396160

The department files liens for all types of state taxes: Local, state, and federal government websites often end in.gov. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of record by the. On november 27,.

Investing In Tax Liens Alts.co

The department files liens for all types of state taxes: If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of record by the. Commonwealth of pennsylvania government websites and email systems use. (a) (1) all municipal claims, municipal liens, taxes, tax claims and tax liens which.

Understanding Federal Tax Liens Winchester, VA

Corporation taxes, sales & use taxes, employer withholding taxes, personal income. On november 27, 2019, pennsylvania governor tom wolf signed act 90 of 2019, a bipartisan piece of legislation which, among other things,. Local, state, and federal government websites often end in.gov. If there is a department of revenue lien filed against you or your business, and you want to.

Tax Preparation Business Startup

If there is a department of revenue lien filed against you or your business, and you want to resolve your tax liability, please go to. (a) if any person liable for any tax including interest, penalties, and addition neglects or for any reason refuses to pay the same on the date. Commonwealth of pennsylvania government websites and email systems use..

Philippine Tax Academy

If there is a department of revenue lien filed against you or your business, and you want to resolve your tax liability, please go to. On november 27, 2019, pennsylvania governor tom wolf signed act 90 of 2019, a bipartisan piece of legislation which, among other things,. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. Local, state,.

Tax Solution Point Purnia

Local, state, and federal government websites often end in.gov. On november 27, 2019, pennsylvania governor tom wolf signed act 90 of 2019, a bipartisan piece of legislation which, among other things,. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. The department files liens for all types of state taxes: If there is a department of revenue lien.

Local, State, And Federal Government Websites Often End In.gov.

The department files liens for all types of state taxes: If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of record by the. (a) if any person liable for any tax including interest, penalties, and addition neglects or for any reason refuses to pay the same on the date. Commonwealth of pennsylvania government websites and email systems use.

Corporation Taxes, Sales & Use Taxes, Employer Withholding Taxes, Personal Income.

If there is a department of revenue lien filed against you or your business, and you want to resolve your tax liability, please go to. (a) (1) all municipal claims, municipal liens, taxes, tax claims and tax liens which may hereafter be lawfully imposed or. On november 27, 2019, pennsylvania governor tom wolf signed act 90 of 2019, a bipartisan piece of legislation which, among other things,.