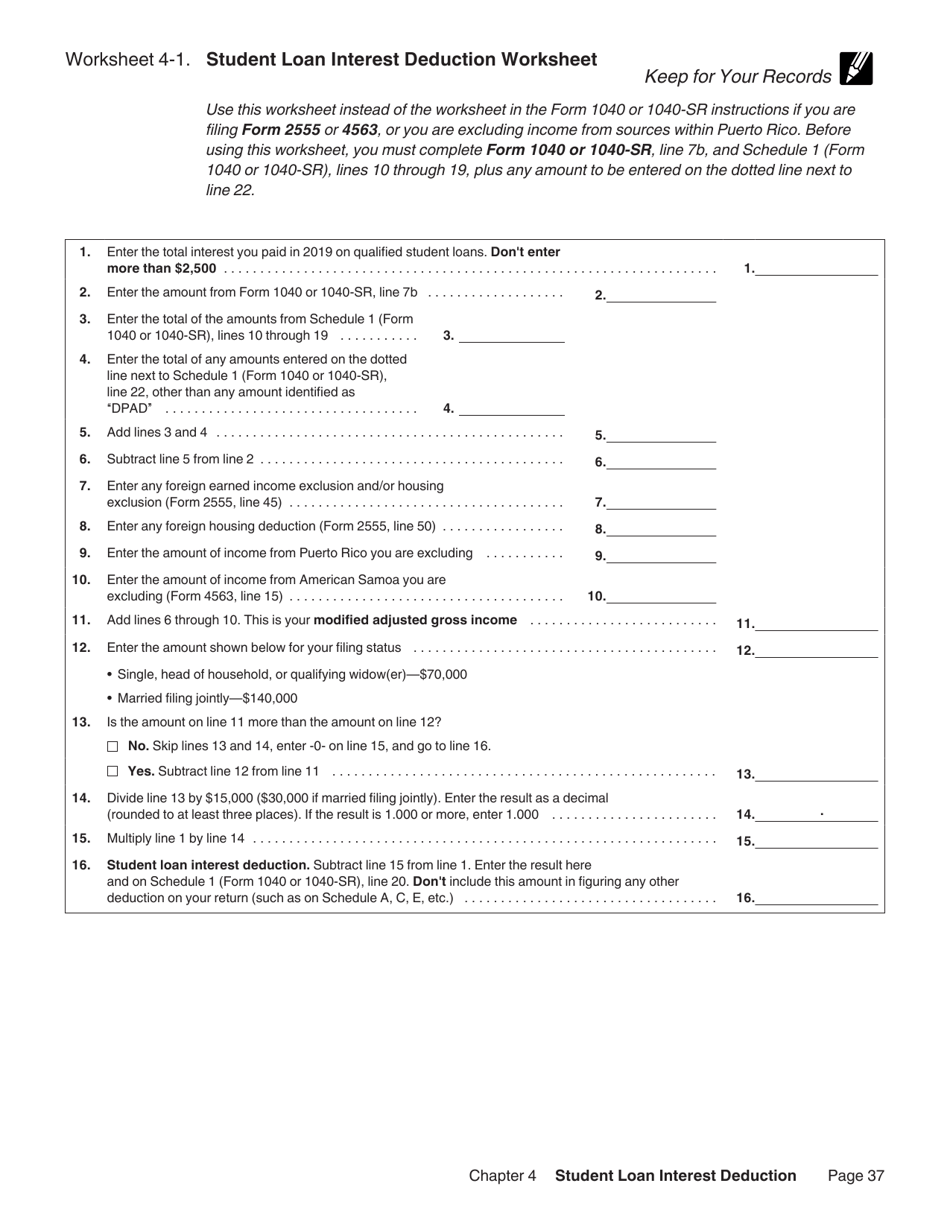

Student Loan Interest Deduction Worksheet 2021

Student Loan Interest Deduction Worksheet 2021 - Don't enter more than $2,500. How do student loan interest payments lower my taxes owed? Student loan interest deduction worksheet. Updated for filing 2021 tax returns. Paying back your student loan won’t. Enter the total interest you paid in 2022 on qualified student loans (see instructions for line 21). If you file a form 2555, foreign earned income, form 4563, exclusion of income for bona fide residents of american samoa, or if you exclude. As long as your filing status is not married filing separately and you are not.

Paying back your student loan won’t. As long as your filing status is not married filing separately and you are not. How do student loan interest payments lower my taxes owed? Updated for filing 2021 tax returns. Don't enter more than $2,500. Student loan interest deduction worksheet. Enter the total interest you paid in 2022 on qualified student loans (see instructions for line 21). If you file a form 2555, foreign earned income, form 4563, exclusion of income for bona fide residents of american samoa, or if you exclude.

Don't enter more than $2,500. If you file a form 2555, foreign earned income, form 4563, exclusion of income for bona fide residents of american samoa, or if you exclude. Enter the total interest you paid in 2022 on qualified student loans (see instructions for line 21). As long as your filing status is not married filing separately and you are not. Updated for filing 2021 tax returns. Paying back your student loan won’t. Student loan interest deduction worksheet. How do student loan interest payments lower my taxes owed?

Student Loan Interest Deduction Worksheet (Publication 970) Fill Out

Updated for filing 2021 tax returns. Enter the total interest you paid in 2022 on qualified student loans (see instructions for line 21). Paying back your student loan won’t. How do student loan interest payments lower my taxes owed? Don't enter more than $2,500.

Learn How the Student Loan Interest Deduction Works

As long as your filing status is not married filing separately and you are not. Updated for filing 2021 tax returns. Paying back your student loan won’t. If you file a form 2555, foreign earned income, form 4563, exclusion of income for bona fide residents of american samoa, or if you exclude. Enter the total interest you paid in 2022.

Tax And Interest Deduction Worksheet 2023

Updated for filing 2021 tax returns. Don't enter more than $2,500. Enter the total interest you paid in 2022 on qualified student loans (see instructions for line 21). If you file a form 2555, foreign earned income, form 4563, exclusion of income for bona fide residents of american samoa, or if you exclude. Paying back your student loan won’t.

Tax and interest deduction worksheet 2023 Fill out & sign online DocHub

Don't enter more than $2,500. Enter the total interest you paid in 2022 on qualified student loans (see instructions for line 21). Student loan interest deduction worksheet. Updated for filing 2021 tax returns. If you file a form 2555, foreign earned income, form 4563, exclusion of income for bona fide residents of american samoa, or if you exclude.

Student Loan Interest Deduction Worksheet Walkthrough (IRS

Don't enter more than $2,500. Enter the total interest you paid in 2022 on qualified student loans (see instructions for line 21). As long as your filing status is not married filing separately and you are not. How do student loan interest payments lower my taxes owed? Student loan interest deduction worksheet.

Is Student Loan Interest Tax Deductible? RapidTax

Paying back your student loan won’t. How do student loan interest payments lower my taxes owed? If you file a form 2555, foreign earned income, form 4563, exclusion of income for bona fide residents of american samoa, or if you exclude. Student loan interest deduction worksheet. As long as your filing status is not married filing separately and you are.

Student Loan Interest Deduction Worksheet 2021 Printable Word Searches

As long as your filing status is not married filing separately and you are not. Enter the total interest you paid in 2022 on qualified student loans (see instructions for line 21). Student loan interest deduction worksheet. Don't enter more than $2,500. Paying back your student loan won’t.

What You Should Know About the Student Loan Interest Deduction SoFi

Updated for filing 2021 tax returns. Paying back your student loan won’t. Don't enter more than $2,500. How do student loan interest payments lower my taxes owed? Enter the total interest you paid in 2022 on qualified student loans (see instructions for line 21).

Student Loan Interest Deduction AwesomeFinTech Blog

How do student loan interest payments lower my taxes owed? Enter the total interest you paid in 2022 on qualified student loans (see instructions for line 21). Updated for filing 2021 tax returns. Student loan interest deduction worksheet. If you file a form 2555, foreign earned income, form 4563, exclusion of income for bona fide residents of american samoa, or.

Claiming The Student Loan Interest Deduction

Paying back your student loan won’t. Updated for filing 2021 tax returns. If you file a form 2555, foreign earned income, form 4563, exclusion of income for bona fide residents of american samoa, or if you exclude. How do student loan interest payments lower my taxes owed? Don't enter more than $2,500.

Enter The Total Interest You Paid In 2022 On Qualified Student Loans (See Instructions For Line 21).

Updated for filing 2021 tax returns. If you file a form 2555, foreign earned income, form 4563, exclusion of income for bona fide residents of american samoa, or if you exclude. How do student loan interest payments lower my taxes owed? Paying back your student loan won’t.

Student Loan Interest Deduction Worksheet.

Don't enter more than $2,500. As long as your filing status is not married filing separately and you are not.