Tax And Interest Deduction Worksheet Turbotax

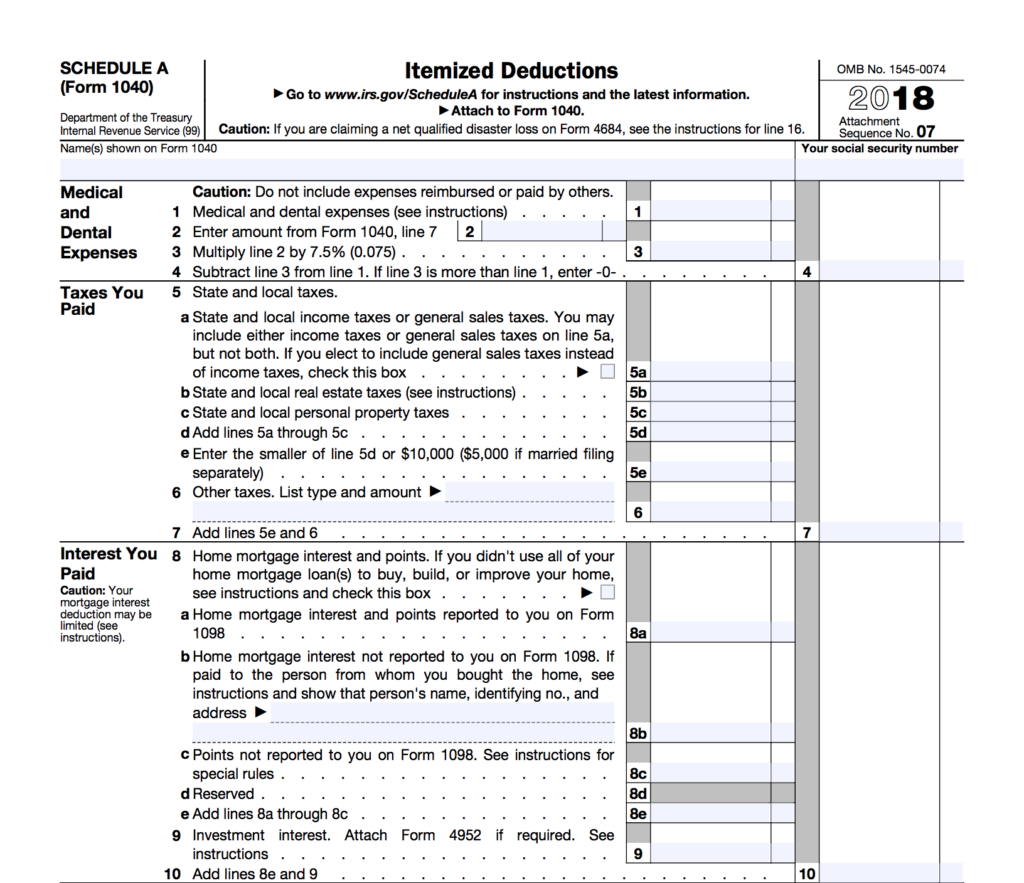

Tax And Interest Deduction Worksheet Turbotax - In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid). Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home.

Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid).

Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid).

How to Deduct Property Taxes On IRS Tax Forms Irs tax forms, Mortgage

In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid). Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home.

Federal Tax Worksheet Free printable worksheets, Irs taxes, Worksheets

Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid).

Tax And Interest Deduction Worksheet Turbotax Printable Word Searches

Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid).

Irs Itemized Deductions Worksheet

In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid). Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home.

Printable Real Estate Agent Tax Deductions Worksheet

In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid). Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home.

Tax Deduction Worksheet 2014 Worksheet Resume Examples

Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid).

Tax Deduction Worksheet For Law Enforcement Worksheet Resume Examples

In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid). Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home.

Tax & Interest deduction worksheet

In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid). Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home.

Free tax and interest deduction worksheet, Download Free tax and

In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid). Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home.

Tax And Interest Deduction Worksheet Turbotax Worksheets Library

In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid). Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home.

Generally, Home Interest Is Deductible On A Form 1040 Schedule A Attachment If It's Interest Paid On Debt Secured By Your Main Or Second Home.

In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid).