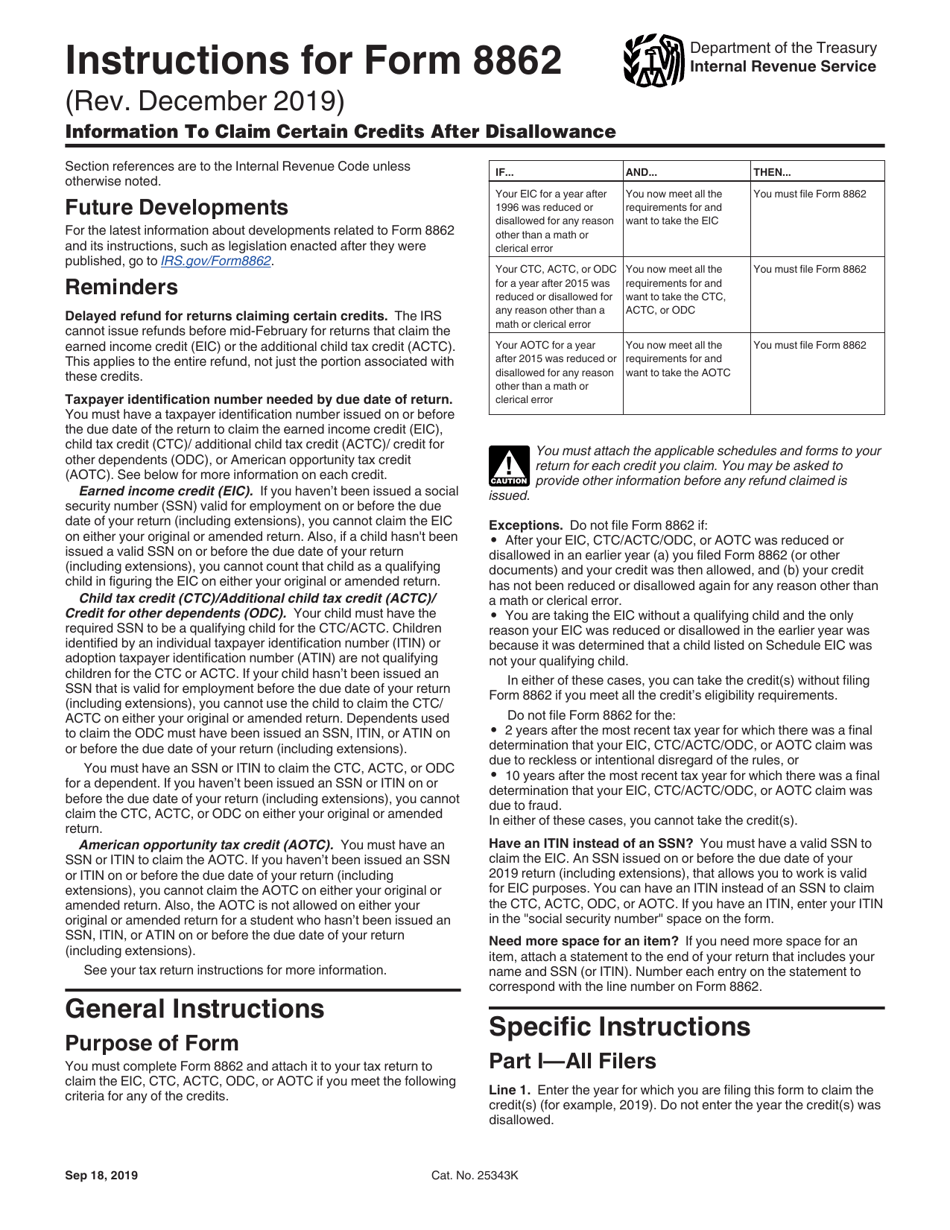

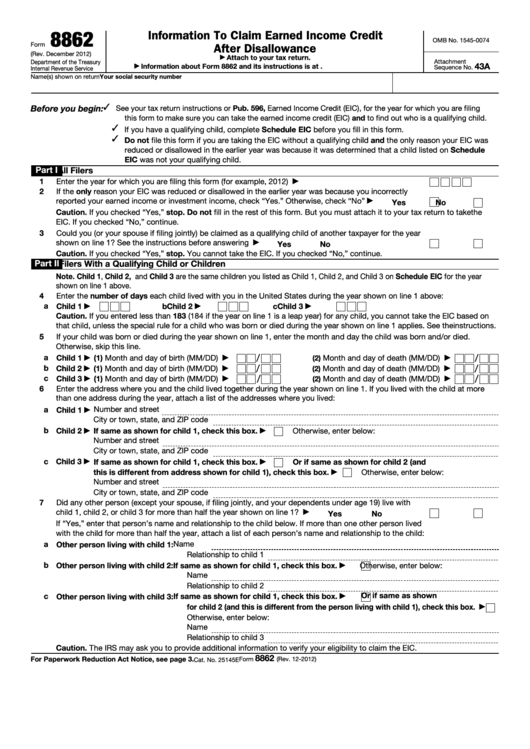

Tax Form 8862

Tax Form 8862 - If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. You do not need to file form 8862 in the year the credit was disallowed or reduced. Information to claim earned income credit after disallowance to your return. If so, follow the instructions in the irs letter for how to send the form, and what else to. Did you get a letter from the irs asking for form 8862 after you filed your tax return? Information to claim earned income credit after disallowance to your return. To resolve this rejection, you'll need to add form 8862: If your return was rejected because you need to file form 8862,. You'll need to add form 8862: Please see the faq link provided below for.

If so, follow the instructions in the irs letter for how to send the form, and what else to. Did you get a letter from the irs asking for form 8862 after you filed your tax return? If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Be sure to follow the instructions from the irs if you received a notice requiring you to file form 8862. Information to claim earned income credit after disallowance to your return. You'll need to add form 8862: Please see the faq link provided below for. To resolve this rejection, you'll need to add form 8862: Information to claim earned income credit after disallowance to your return. In the earned income credit section when you see do any of these.

To resolve this rejection, you'll need to add form 8862: Information to claim earned income credit after disallowance to your return. In the earned income credit section when you see do any of these. If so, follow the instructions in the irs letter for how to send the form, and what else to. Did you get a letter from the irs asking for form 8862 after you filed your tax return? You'll need to add form 8862: Be sure to follow the instructions from the irs if you received a notice requiring you to file form 8862. You do not need to file form 8862 in the year the credit was disallowed or reduced. Information to claim earned income credit after disallowance to your return. Please see the faq link provided below for.

What Is An 8862 Tax Form? SuperMoney

You'll need to add form 8862: Did you get a letter from the irs asking for form 8862 after you filed your tax return? If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. If so, follow the instructions in the irs letter for how to send.

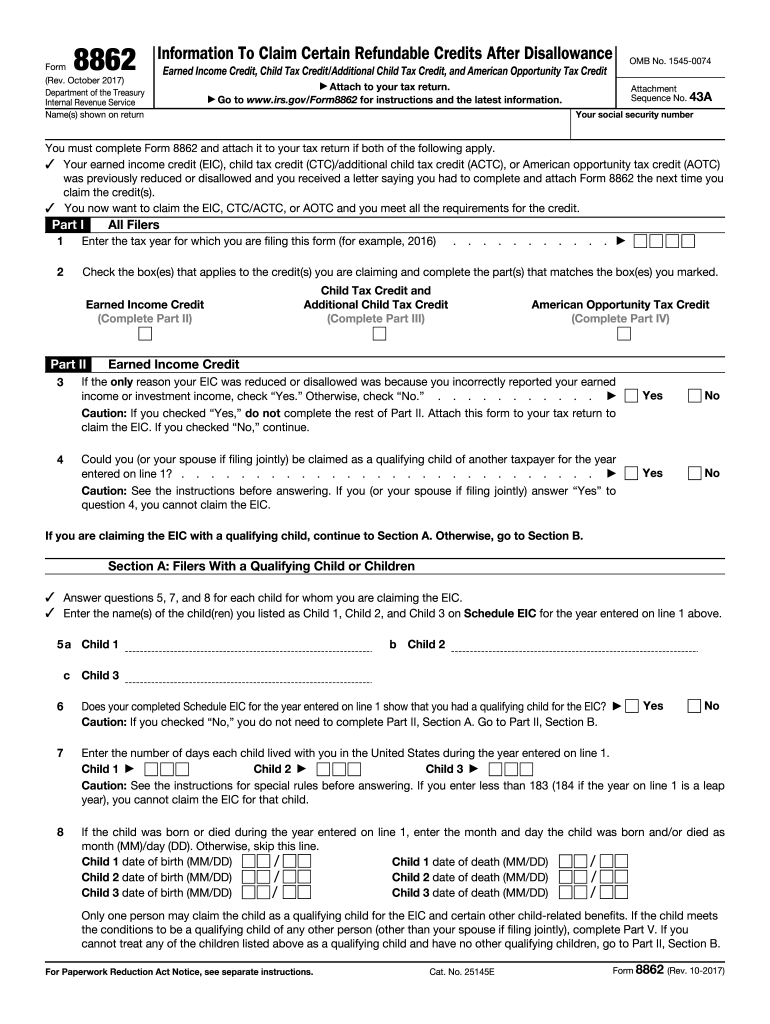

8862 Tax Form Fill and Sign Printable Template Online US Legal Forms

Please see the faq link provided below for. You'll need to add form 8862: If your return was rejected because you need to file form 8862,. You do not need to file form 8862 in the year the credit was disallowed or reduced. Information to claim earned income credit after disallowance to your return.

IRS Form 8862 Fill Out and Sign Printable PDF Template airSlate SignNow

Please see the faq link provided below for. You'll need to add form 8862: If your return was rejected because you need to file form 8862,. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Information to claim earned income credit after disallowance to your return.

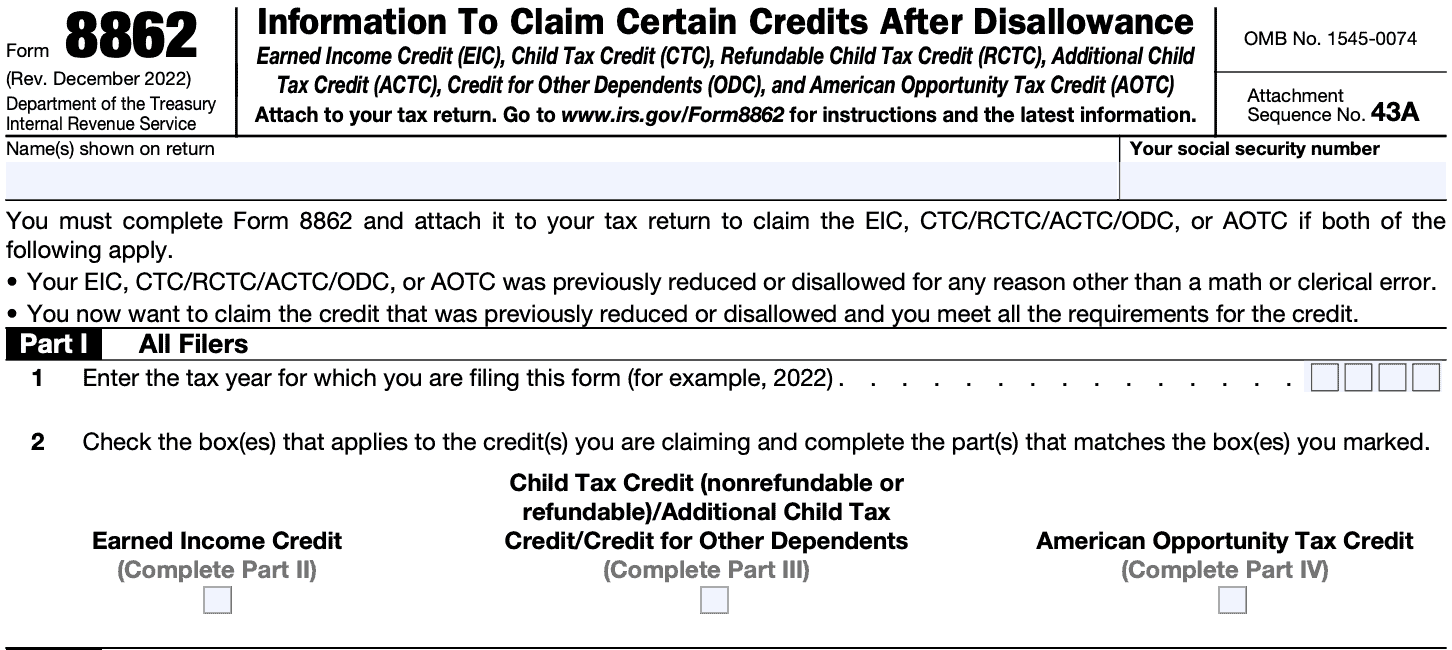

Form 8862 Information to Claim Earned Credit After

Information to claim earned income credit after disallowance to your return. You do not need to file form 8862 in the year the credit was disallowed or reduced. To resolve this rejection, you'll need to add form 8862: If your return was rejected because you need to file form 8862,. In the earned income credit section when you see do.

IRS Form 8862 Instructions

In the earned income credit section when you see do any of these. Information to claim earned income credit after disallowance to your return. You'll need to add form 8862: Information to claim earned income credit after disallowance to your return. If you are filing form 8862 because you received an irs letter, you should send it to the address.

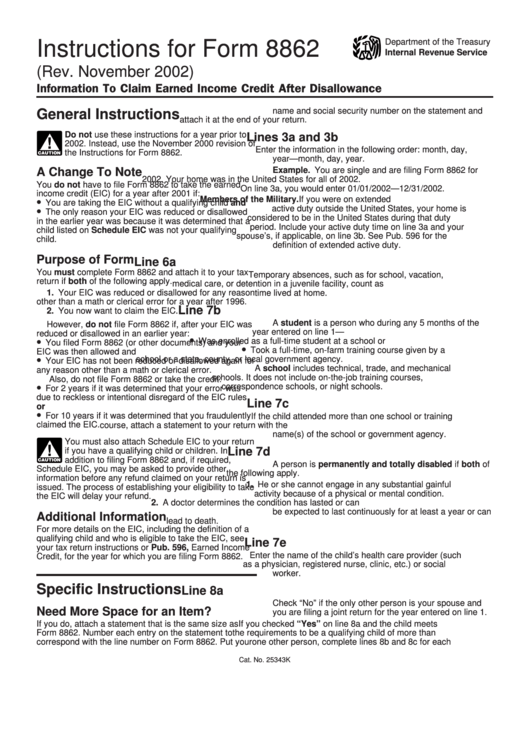

Instructions For Form 8862 Information To Claim Earned Credit

To resolve this rejection, you'll need to add form 8862: If your return was rejected because you need to file form 8862,. Please see the faq link provided below for. You'll need to add form 8862: Be sure to follow the instructions from the irs if you received a notice requiring you to file form 8862.

Fillable Online Irs Tax Form 8862 Instructions Fax Email Print pdfFiller

Information to claim earned income credit after disallowance to your return. You do not need to file form 8862 in the year the credit was disallowed or reduced. Be sure to follow the instructions from the irs if you received a notice requiring you to file form 8862. Did you get a letter from the irs asking for form 8862.

Fillable Form 8862 Printable Forms Free Online

Information to claim earned income credit after disallowance to your return. Be sure to follow the instructions from the irs if you received a notice requiring you to file form 8862. Information to claim earned income credit after disallowance to your return. You do not need to file form 8862 in the year the credit was disallowed or reduced. Did.

What Is IRS Form 8862?

If your return was rejected because you need to file form 8862,. Information to claim earned income credit after disallowance to your return. You'll need to add form 8862: To resolve this rejection, you'll need to add form 8862: In the earned income credit section when you see do any of these.

Download Instructions for IRS Form 8862 Information to Claim Certain

Information to claim earned income credit after disallowance to your return. Did you get a letter from the irs asking for form 8862 after you filed your tax return? You do not need to file form 8862 in the year the credit was disallowed or reduced. In the earned income credit section when you see do any of these. If.

Please See The Faq Link Provided Below For.

If so, follow the instructions in the irs letter for how to send the form, and what else to. Information to claim earned income credit after disallowance to your return. Information to claim earned income credit after disallowance to your return. You do not need to file form 8862 in the year the credit was disallowed or reduced.

If You Are Filing Form 8862 Because You Received An Irs Letter, You Should Send It To The Address Listed In The Letter.

To resolve this rejection, you'll need to add form 8862: You'll need to add form 8862: Did you get a letter from the irs asking for form 8862 after you filed your tax return? Be sure to follow the instructions from the irs if you received a notice requiring you to file form 8862.

In The Earned Income Credit Section When You See Do Any Of These.

If your return was rejected because you need to file form 8862,.

:max_bytes(150000):strip_icc()/2022-01-1111_48_02-Form8862Rev.December2021-f23f0eab085a467eb521f33bd3758904.jpg)