Tax Lien Foreclosures

Tax Lien Foreclosures - Tax foreclosure, also known as tax lien foreclosure, describes the sale of a property after the property owner fails to pay their tax bill,. The philadelphia sheriff’s office uses bid4assets. These properties have been seized and forfeited due to violations of federal laws enforced by the u.s. Search luzerne county prothonotary case records for liens, mortgage foreclosures, and tax assessment appeals by name, case type,. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific. Please visit the links below to view lists of tax foreclosure or mortgage foreclosure auctions.

Search luzerne county prothonotary case records for liens, mortgage foreclosures, and tax assessment appeals by name, case type,. Please visit the links below to view lists of tax foreclosure or mortgage foreclosure auctions. Tax foreclosure, also known as tax lien foreclosure, describes the sale of a property after the property owner fails to pay their tax bill,. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific. These properties have been seized and forfeited due to violations of federal laws enforced by the u.s. The philadelphia sheriff’s office uses bid4assets.

The philadelphia sheriff’s office uses bid4assets. Tax foreclosure, also known as tax lien foreclosure, describes the sale of a property after the property owner fails to pay their tax bill,. These properties have been seized and forfeited due to violations of federal laws enforced by the u.s. Please visit the links below to view lists of tax foreclosure or mortgage foreclosure auctions. Search luzerne county prothonotary case records for liens, mortgage foreclosures, and tax assessment appeals by name, case type,. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific.

What Are the 2 Types of Tax Lien Foreclosures United Tax Liens

Tax foreclosure, also known as tax lien foreclosure, describes the sale of a property after the property owner fails to pay their tax bill,. Search luzerne county prothonotary case records for liens, mortgage foreclosures, and tax assessment appeals by name, case type,. The philadelphia sheriff’s office uses bid4assets. These properties have been seized and forfeited due to violations of federal.

Tax Lien Foreclosure Update Levitt & Slafkes, P.C.

If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific. The philadelphia sheriff’s office uses bid4assets. Please visit the links below to view lists of tax foreclosure or mortgage foreclosure auctions. Tax foreclosure, also known as tax lien foreclosure, describes the sale of a.

Tax Lien Foreclosure What You Need To Know Crixeo

Please visit the links below to view lists of tax foreclosure or mortgage foreclosure auctions. Tax foreclosure, also known as tax lien foreclosure, describes the sale of a property after the property owner fails to pay their tax bill,. These properties have been seized and forfeited due to violations of federal laws enforced by the u.s. If the delinquent taxes.

Free and Clear Foreclosures Tax Lien Investing Tips

Tax foreclosure, also known as tax lien foreclosure, describes the sale of a property after the property owner fails to pay their tax bill,. The philadelphia sheriff’s office uses bid4assets. Search luzerne county prothonotary case records for liens, mortgage foreclosures, and tax assessment appeals by name, case type,. Please visit the links below to view lists of tax foreclosure or.

Tax Lien Foreclosure What You Need To Know Crixeo

The philadelphia sheriff’s office uses bid4assets. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific. Tax foreclosure, also known as tax lien foreclosure, describes the sale of a property after the property owner fails to pay their tax bill,. These properties have been.

Sales by Reinhardt Law Offices

These properties have been seized and forfeited due to violations of federal laws enforced by the u.s. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific. Please visit the links below to view lists of tax foreclosure or mortgage foreclosure auctions. The philadelphia.

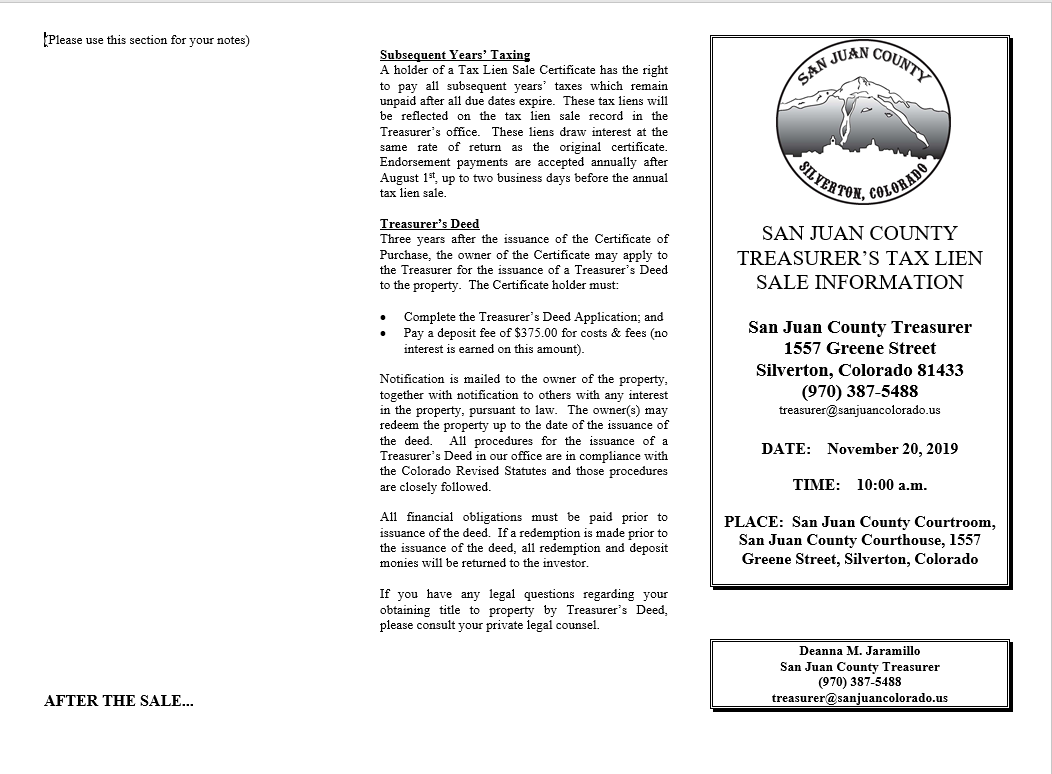

Tax Lien Sale San Juan County

If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific. Tax foreclosure, also known as tax lien foreclosure, describes the sale of a property after the property owner fails to pay their tax bill,. Search luzerne county prothonotary case records for liens, mortgage foreclosures,.

TAX LIEN & DEED FORECLOSURES EXPLAINED TAX SALE TRAINING TIP!

Please visit the links below to view lists of tax foreclosure or mortgage foreclosure auctions. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific. Tax foreclosure, also known as tax lien foreclosure, describes the sale of a property after the property owner fails.

About Apartment Foreclosures, Auctions, and Tax Lien Deeds

Search luzerne county prothonotary case records for liens, mortgage foreclosures, and tax assessment appeals by name, case type,. Tax foreclosure, also known as tax lien foreclosure, describes the sale of a property after the property owner fails to pay their tax bill,. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a.

Tax Lien Foreclosures and Surplus Funds The Supremes Rule — New York

Please visit the links below to view lists of tax foreclosure or mortgage foreclosure auctions. Tax foreclosure, also known as tax lien foreclosure, describes the sale of a property after the property owner fails to pay their tax bill,. Search luzerne county prothonotary case records for liens, mortgage foreclosures, and tax assessment appeals by name, case type,. These properties have.

Tax Foreclosure, Also Known As Tax Lien Foreclosure, Describes The Sale Of A Property After The Property Owner Fails To Pay Their Tax Bill,.

Search luzerne county prothonotary case records for liens, mortgage foreclosures, and tax assessment appeals by name, case type,. These properties have been seized and forfeited due to violations of federal laws enforced by the u.s. The philadelphia sheriff’s office uses bid4assets. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific.