Tax Lien Sales In California

Tax Lien Sales In California - The auction is conducted by the county tax collector, and the. Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property sold at a. The purpose of chapter 7 tax sales is to collect unpaid property taxes. What is the purpose of a chapter 7 tax sale? The california department of tax and fee. The tax sale is conducted pursuant to the california revenue and taxation code beginning with section 3691. Below is a list of the 500 largest delinquent sales and use tax accounts over $100,000.

The california department of tax and fee. The tax sale is conducted pursuant to the california revenue and taxation code beginning with section 3691. Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property sold at a. The purpose of chapter 7 tax sales is to collect unpaid property taxes. What is the purpose of a chapter 7 tax sale? Below is a list of the 500 largest delinquent sales and use tax accounts over $100,000. The auction is conducted by the county tax collector, and the.

The california department of tax and fee. The tax sale is conducted pursuant to the california revenue and taxation code beginning with section 3691. Below is a list of the 500 largest delinquent sales and use tax accounts over $100,000. What is the purpose of a chapter 7 tax sale? Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property sold at a. The auction is conducted by the county tax collector, and the. The purpose of chapter 7 tax sales is to collect unpaid property taxes.

How to Buy California Tax Lien Certificates Pocketsense

Below is a list of the 500 largest delinquent sales and use tax accounts over $100,000. The tax sale is conducted pursuant to the california revenue and taxation code beginning with section 3691. Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property sold at a. The california department of tax and.

Investing in Tax Lien Seminars and Courses

Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property sold at a. The purpose of chapter 7 tax sales is to collect unpaid property taxes. What is the purpose of a chapter 7 tax sale? The tax sale is conducted pursuant to the california revenue and taxation code beginning with section.

The Other Foreclosure Crisis Property Tax Lien Sales FORECLOSURE FRAUD

The auction is conducted by the county tax collector, and the. The california department of tax and fee. The tax sale is conducted pursuant to the california revenue and taxation code beginning with section 3691. Below is a list of the 500 largest delinquent sales and use tax accounts over $100,000. Refer to section 3712 of the california revenue and.

Colorado Tax Lien Sales 2024 Carla Cosette

The auction is conducted by the county tax collector, and the. The tax sale is conducted pursuant to the california revenue and taxation code beginning with section 3691. Below is a list of the 500 largest delinquent sales and use tax accounts over $100,000. The california department of tax and fee. The purpose of chapter 7 tax sales is to.

tax lien PDF Free Download

What is the purpose of a chapter 7 tax sale? The california department of tax and fee. The tax sale is conducted pursuant to the california revenue and taxation code beginning with section 3691. Below is a list of the 500 largest delinquent sales and use tax accounts over $100,000. Refer to section 3712 of the california revenue and taxation.

Tax Lien Properties California Real Estate Tax Lien Investing for

The tax sale is conducted pursuant to the california revenue and taxation code beginning with section 3691. What is the purpose of a chapter 7 tax sale? The california department of tax and fee. Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property sold at a. The auction is conducted by.

CA DMV Best Auto Lien Sales, Lien a Car by Lienworks, Top Auto Lien

The auction is conducted by the county tax collector, and the. The tax sale is conducted pursuant to the california revenue and taxation code beginning with section 3691. Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property sold at a. The purpose of chapter 7 tax sales is to collect unpaid.

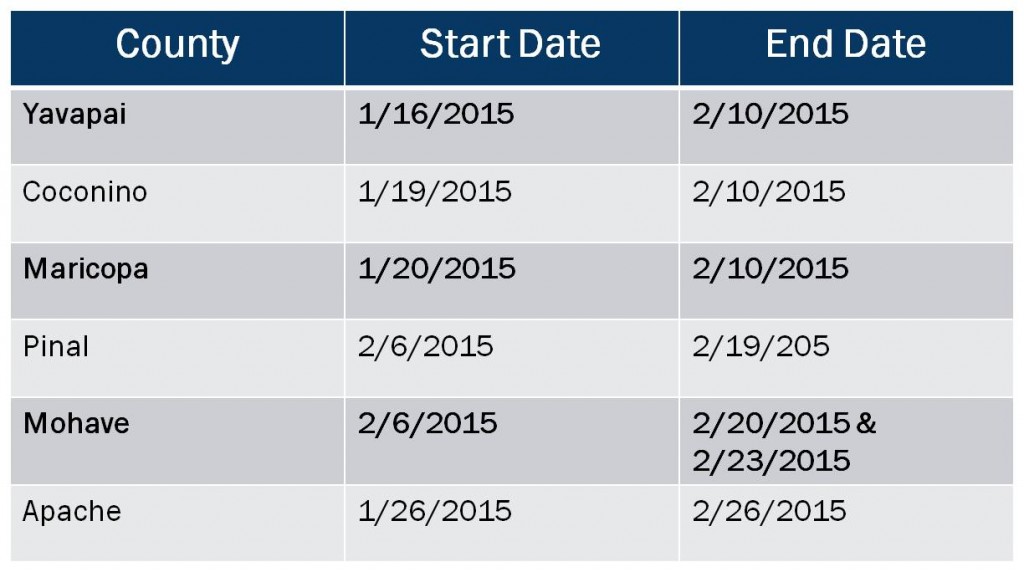

Arizona Tax Lien Sales Tax Lien Investing Tips

Below is a list of the 500 largest delinquent sales and use tax accounts over $100,000. The california department of tax and fee. The tax sale is conducted pursuant to the california revenue and taxation code beginning with section 3691. The purpose of chapter 7 tax sales is to collect unpaid property taxes. Refer to section 3712 of the california.

Tax Lien State Tax Lien California

The auction is conducted by the county tax collector, and the. The purpose of chapter 7 tax sales is to collect unpaid property taxes. Below is a list of the 500 largest delinquent sales and use tax accounts over $100,000. The tax sale is conducted pursuant to the california revenue and taxation code beginning with section 3691. Refer to section.

Tax Lien Sale Download Free PDF Tax Lien Taxes

The tax sale is conducted pursuant to the california revenue and taxation code beginning with section 3691. The california department of tax and fee. Below is a list of the 500 largest delinquent sales and use tax accounts over $100,000. The purpose of chapter 7 tax sales is to collect unpaid property taxes. What is the purpose of a chapter.

What Is The Purpose Of A Chapter 7 Tax Sale?

Below is a list of the 500 largest delinquent sales and use tax accounts over $100,000. Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property sold at a. The auction is conducted by the county tax collector, and the. The purpose of chapter 7 tax sales is to collect unpaid property taxes.

The California Department Of Tax And Fee.

The tax sale is conducted pursuant to the california revenue and taxation code beginning with section 3691.