Tax Liens In Maine

Tax Liens In Maine - The state of maine has a set procedure for the collection of taxes,. Except as provided in section 942‑a, liens on real estate created by section 552, in addition to other methods established by law, may be enforced. The filing of the tax lien certificate in the registry of deeds shall create a tax lien mortgage on said real estate to the municipality in which the real. In maine it is not possible to acquire property by just paying the back taxes. The legislature recently amended the process by which tax acquired properties can be sold by municipalities and maine revenue services. Filing of the lien by the assessor constitutes notice of lien for, and secures payment of, both the original assessment and. All property subject to taxes under this chapter, in whatever form of investment it may happen to be, is charged with a lien for all.

The filing of the tax lien certificate in the registry of deeds shall create a tax lien mortgage on said real estate to the municipality in which the real. The state of maine has a set procedure for the collection of taxes,. All property subject to taxes under this chapter, in whatever form of investment it may happen to be, is charged with a lien for all. Except as provided in section 942‑a, liens on real estate created by section 552, in addition to other methods established by law, may be enforced. In maine it is not possible to acquire property by just paying the back taxes. The legislature recently amended the process by which tax acquired properties can be sold by municipalities and maine revenue services. Filing of the lien by the assessor constitutes notice of lien for, and secures payment of, both the original assessment and.

All property subject to taxes under this chapter, in whatever form of investment it may happen to be, is charged with a lien for all. The state of maine has a set procedure for the collection of taxes,. Filing of the lien by the assessor constitutes notice of lien for, and secures payment of, both the original assessment and. The legislature recently amended the process by which tax acquired properties can be sold by municipalities and maine revenue services. Except as provided in section 942‑a, liens on real estate created by section 552, in addition to other methods established by law, may be enforced. In maine it is not possible to acquire property by just paying the back taxes. The filing of the tax lien certificate in the registry of deeds shall create a tax lien mortgage on said real estate to the municipality in which the real.

Tax Relief Services Honolulu HI

The legislature recently amended the process by which tax acquired properties can be sold by municipalities and maine revenue services. In maine it is not possible to acquire property by just paying the back taxes. The filing of the tax lien certificate in the registry of deeds shall create a tax lien mortgage on said real estate to the municipality.

TAX Consultancy Firm Gurugram

Except as provided in section 942‑a, liens on real estate created by section 552, in addition to other methods established by law, may be enforced. Filing of the lien by the assessor constitutes notice of lien for, and secures payment of, both the original assessment and. The legislature recently amended the process by which tax acquired properties can be sold.

Tax Liens An Overview CheckBook IRA LLC

In maine it is not possible to acquire property by just paying the back taxes. The state of maine has a set procedure for the collection of taxes,. All property subject to taxes under this chapter, in whatever form of investment it may happen to be, is charged with a lien for all. The legislature recently amended the process by.

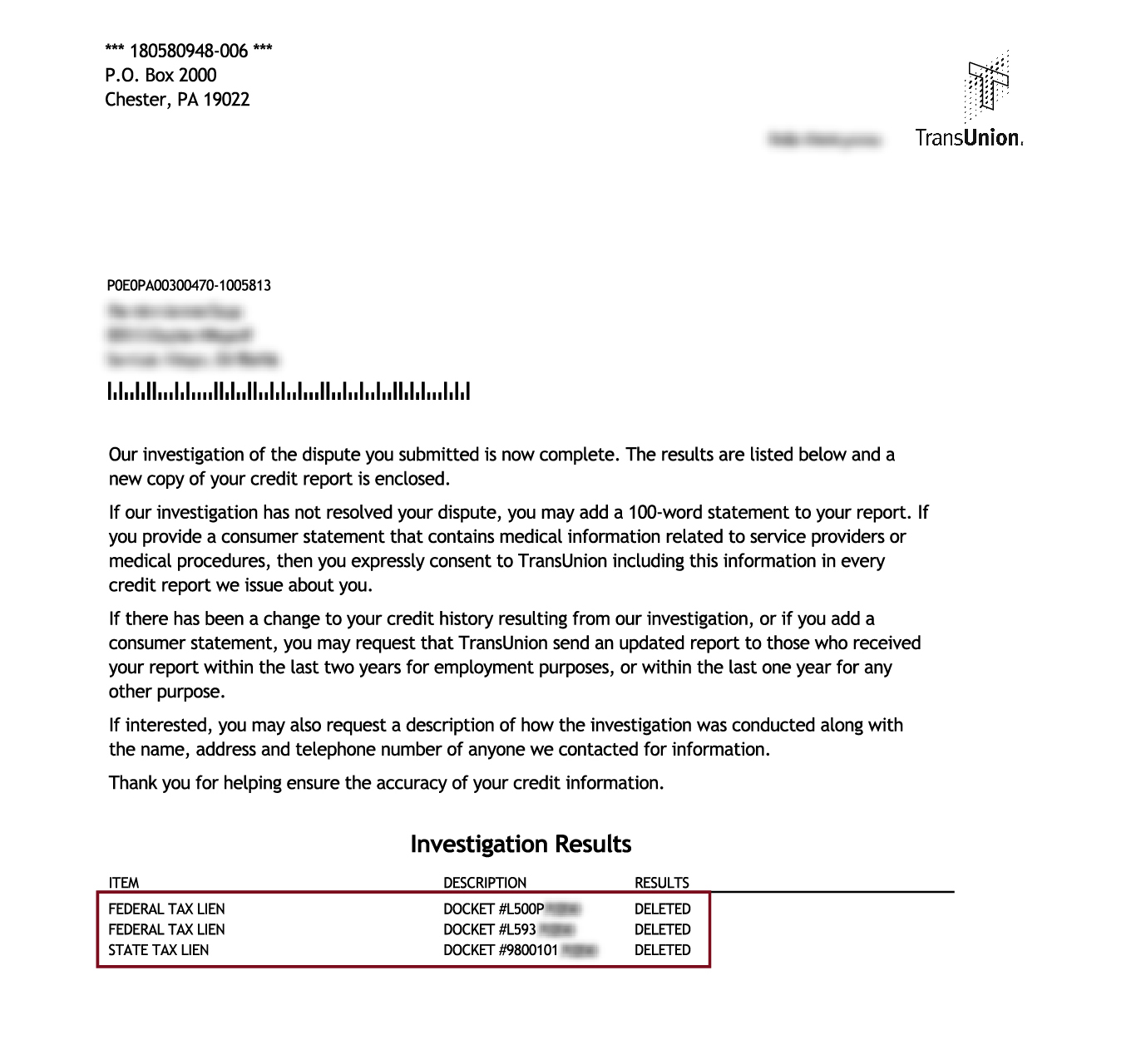

How to Remove an IRS Tax Lien from Your Credit Report

Except as provided in section 942‑a, liens on real estate created by section 552, in addition to other methods established by law, may be enforced. Filing of the lien by the assessor constitutes notice of lien for, and secures payment of, both the original assessment and. All property subject to taxes under this chapter, in whatever form of investment it.

Moore Tax & Financial Services Goose Creek SC

The state of maine has a set procedure for the collection of taxes,. All property subject to taxes under this chapter, in whatever form of investment it may happen to be, is charged with a lien for all. The legislature recently amended the process by which tax acquired properties can be sold by municipalities and maine revenue services. In maine.

Philippine Tax Academy

All property subject to taxes under this chapter, in whatever form of investment it may happen to be, is charged with a lien for all. Except as provided in section 942‑a, liens on real estate created by section 552, in addition to other methods established by law, may be enforced. In maine it is not possible to acquire property by.

Tax Preparation Business Startup

Except as provided in section 942‑a, liens on real estate created by section 552, in addition to other methods established by law, may be enforced. The legislature recently amended the process by which tax acquired properties can be sold by municipalities and maine revenue services. All property subject to taxes under this chapter, in whatever form of investment it may.

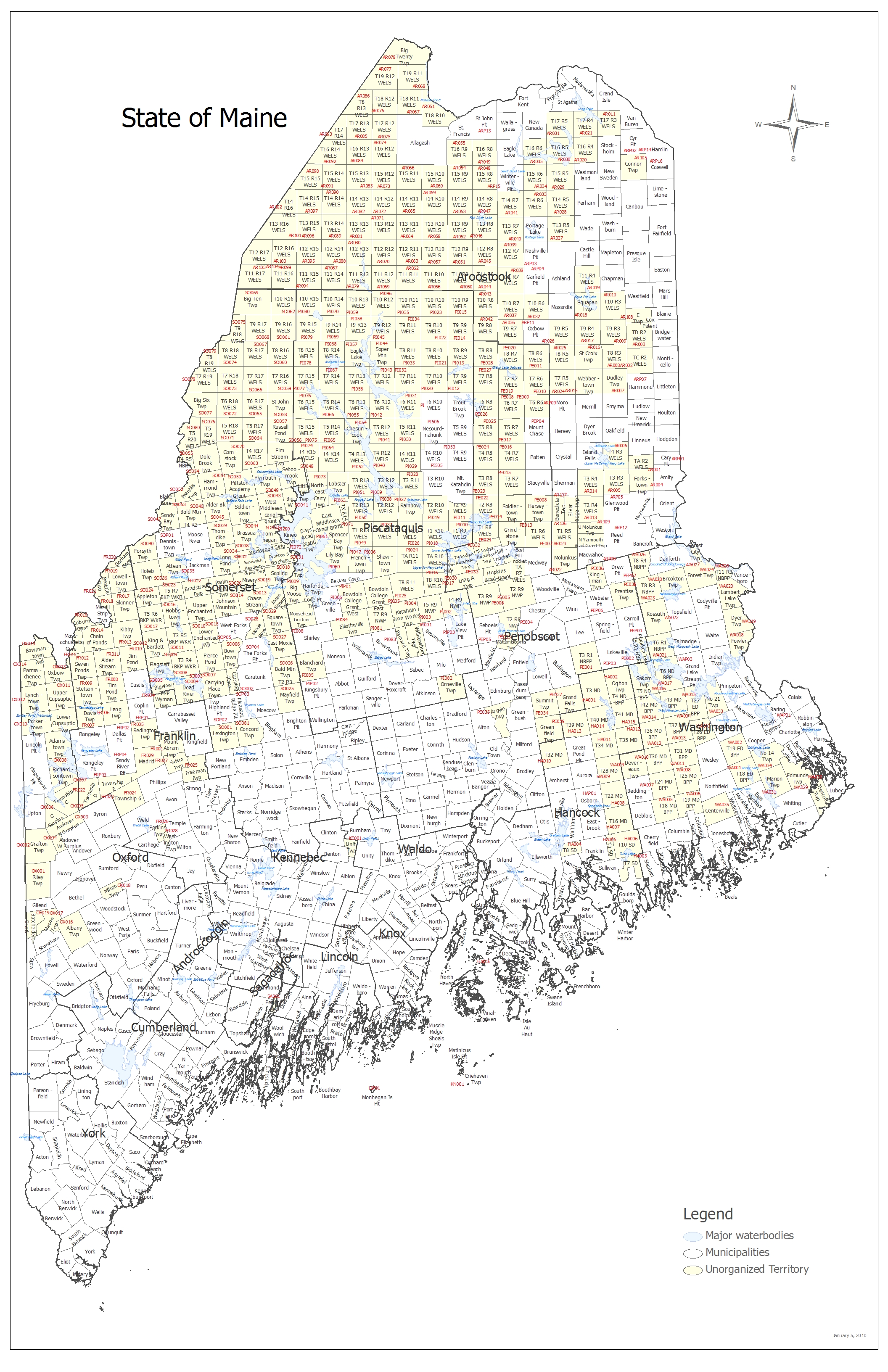

Tax Maps and Valuation Listings Maine Revenue Services

In maine it is not possible to acquire property by just paying the back taxes. The filing of the tax lien certificate in the registry of deeds shall create a tax lien mortgage on said real estate to the municipality in which the real. Filing of the lien by the assessor constitutes notice of lien for, and secures payment of,.

Tax Liens What You Need to Know Cumberland Law Group

All property subject to taxes under this chapter, in whatever form of investment it may happen to be, is charged with a lien for all. Except as provided in section 942‑a, liens on real estate created by section 552, in addition to other methods established by law, may be enforced. In maine it is not possible to acquire property by.

Tax Liens and Deeds Live Class Pips Path

The legislature recently amended the process by which tax acquired properties can be sold by municipalities and maine revenue services. Filing of the lien by the assessor constitutes notice of lien for, and secures payment of, both the original assessment and. The state of maine has a set procedure for the collection of taxes,. The filing of the tax lien.

In Maine It Is Not Possible To Acquire Property By Just Paying The Back Taxes.

The state of maine has a set procedure for the collection of taxes,. The filing of the tax lien certificate in the registry of deeds shall create a tax lien mortgage on said real estate to the municipality in which the real. All property subject to taxes under this chapter, in whatever form of investment it may happen to be, is charged with a lien for all. Except as provided in section 942‑a, liens on real estate created by section 552, in addition to other methods established by law, may be enforced.

The Legislature Recently Amended The Process By Which Tax Acquired Properties Can Be Sold By Municipalities And Maine Revenue Services.

Filing of the lien by the assessor constitutes notice of lien for, and secures payment of, both the original assessment and.