Texas Tax Liens

Texas Tax Liens - Sales results by month are posted on the delinquent tax sales link at the bottom of this page. (a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. State law requires that all past due taxes, fines, interest and penalties owed to the state must be secured by a lien. Tax liability secured by lien. Learn how to pay your property taxes in texas, including payment options, deadline, receipts and waivers. Cause numbers are noted as. The mhd tax lien database system is designed to allow taxing entities the ability to release their own liens as well as the liens for the entities. (a) on january 1 of each year, a tax lien attaches to property to. Tax liens and personal liability. Find out what to do if you don't receive.

(a) on january 1 of each year, a tax lien attaches to property to. Sales results by month are posted on the delinquent tax sales link at the bottom of this page. Find out what to do if you don't receive. Learn how to pay your property taxes in texas, including payment options, deadline, receipts and waivers. Please be aware that a tax. Tax liability secured by lien. Tax liens and personal liability. (a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. State law requires that all past due taxes, fines, interest and penalties owed to the state must be secured by a lien. Cause numbers are noted as.

(a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. Please be aware that a tax. Cause numbers are noted as. (a) on january 1 of each year, a tax lien attaches to property to. Tax liability secured by lien. State law requires that all past due taxes, fines, interest and penalties owed to the state must be secured by a lien. Learn how to pay your property taxes in texas, including payment options, deadline, receipts and waivers. Find out what to do if you don't receive. Sales results by month are posted on the delinquent tax sales link at the bottom of this page. Tax liens and personal liability.

Tax Liens An Overview CheckBook IRA LLC

Learn how to pay your property taxes in texas, including payment options, deadline, receipts and waivers. Sales results by month are posted on the delinquent tax sales link at the bottom of this page. Tax liability secured by lien. Cause numbers are noted as. (a) all taxes, fines, interest, and penalties due by a person to the state under this.

What Is A Tax Lien? Atlanta Tax Lawyer Alyssa Maloof Whatley

Tax liens and personal liability. State law requires that all past due taxes, fines, interest and penalties owed to the state must be secured by a lien. Find out what to do if you don't receive. Learn how to pay your property taxes in texas, including payment options, deadline, receipts and waivers. (a) all taxes, fines, interest, and penalties due.

TEXAS TAX LIEN SALES GUIDE

Find out what to do if you don't receive. (a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. State law requires that all past due taxes, fines, interest and penalties owed to the state must be secured by a lien. Tax liability secured by lien. Please be.

Investing In Tax Liens Alts.co

(a) on january 1 of each year, a tax lien attaches to property to. Sales results by month are posted on the delinquent tax sales link at the bottom of this page. Please be aware that a tax. Find out what to do if you don't receive. Tax liability secured by lien.

Federal Tax Liens Providence Title Company of Texas Providence

State law requires that all past due taxes, fines, interest and penalties owed to the state must be secured by a lien. Find out what to do if you don't receive. Cause numbers are noted as. (a) on january 1 of each year, a tax lien attaches to property to. Learn how to pay your property taxes in texas, including.

Tax Liens and Deeds Live Class Pips Path

Tax liability secured by lien. Find out what to do if you don't receive. Please be aware that a tax. Cause numbers are noted as. The mhd tax lien database system is designed to allow taxing entities the ability to release their own liens as well as the liens for the entities.

Tax Liens What You Need to Know Cumberland Law Group

Tax liens and personal liability. Learn how to pay your property taxes in texas, including payment options, deadline, receipts and waivers. Sales results by month are posted on the delinquent tax sales link at the bottom of this page. (a) on january 1 of each year, a tax lien attaches to property to. (a) all taxes, fines, interest, and penalties.

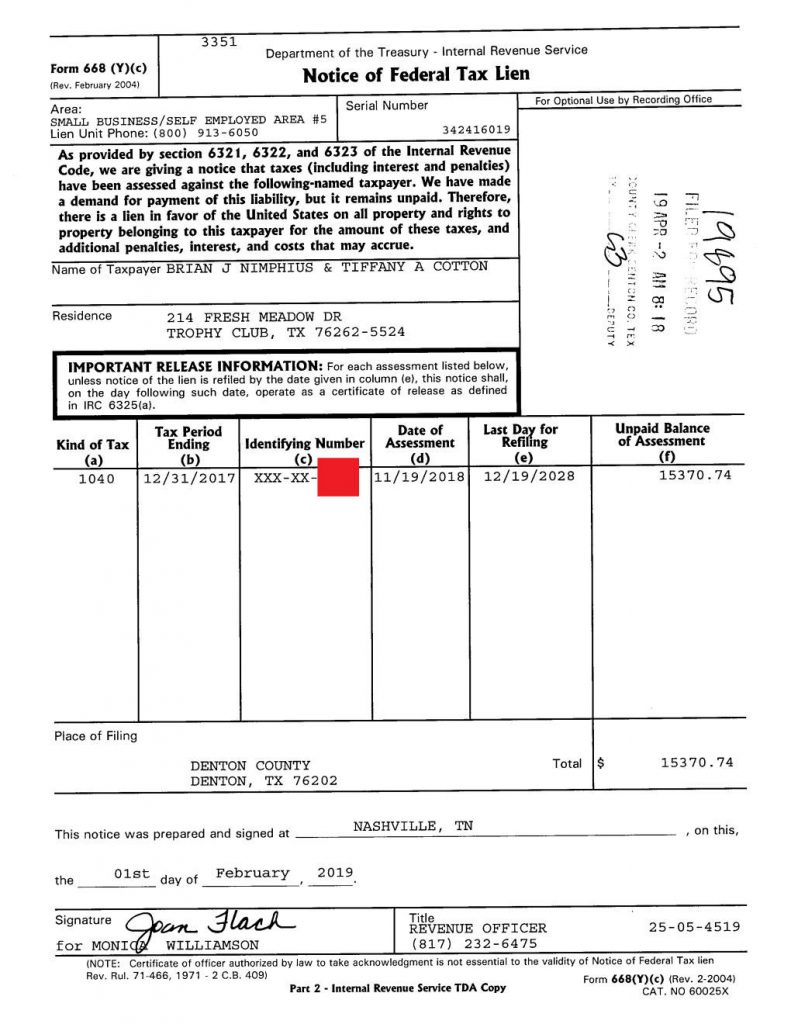

Council Candidate has 50k in Tax Liens Trophy Club Journal

The mhd tax lien database system is designed to allow taxing entities the ability to release their own liens as well as the liens for the entities. Please be aware that a tax. Tax liability secured by lien. Cause numbers are noted as. Find out what to do if you don't receive.

Tax Lien We Buy Texas City Houses

Please be aware that a tax. Tax liability secured by lien. Cause numbers are noted as. (a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. Find out what to do if you don't receive.

Looking to buy Tax liens in Texas. Best way to do? Tax, Looking to

(a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. Cause numbers are noted as. Tax liability secured by lien. Sales results by month are posted on the delinquent tax sales link at the bottom of this page. Please be aware that a tax.

Sales Results By Month Are Posted On The Delinquent Tax Sales Link At The Bottom Of This Page.

Learn how to pay your property taxes in texas, including payment options, deadline, receipts and waivers. The mhd tax lien database system is designed to allow taxing entities the ability to release their own liens as well as the liens for the entities. (a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. Tax liability secured by lien.

(A) On January 1 Of Each Year, A Tax Lien Attaches To Property To.

Please be aware that a tax. Cause numbers are noted as. State law requires that all past due taxes, fines, interest and penalties owed to the state must be secured by a lien. Find out what to do if you don't receive.