Utah Tax Extension Form Tc 546

Utah Tax Extension Form Tc 546 - Utah provides an automatic 6 month extension without filing a form or application. Utah does not require quarterly estimated tax payments. You can also make a. To avoid penalties, taxpayers must prepay one of. Use this worksheet to calculate your minimum required prepayment. Pay the amount on line 9 on or before the return due date.

You can also make a. To avoid penalties, taxpayers must prepay one of. Utah provides an automatic 6 month extension without filing a form or application. Use this worksheet to calculate your minimum required prepayment. Pay the amount on line 9 on or before the return due date. Utah does not require quarterly estimated tax payments.

To avoid penalties, taxpayers must prepay one of. You can also make a. Utah provides an automatic 6 month extension without filing a form or application. Use this worksheet to calculate your minimum required prepayment. Utah does not require quarterly estimated tax payments. Pay the amount on line 9 on or before the return due date.

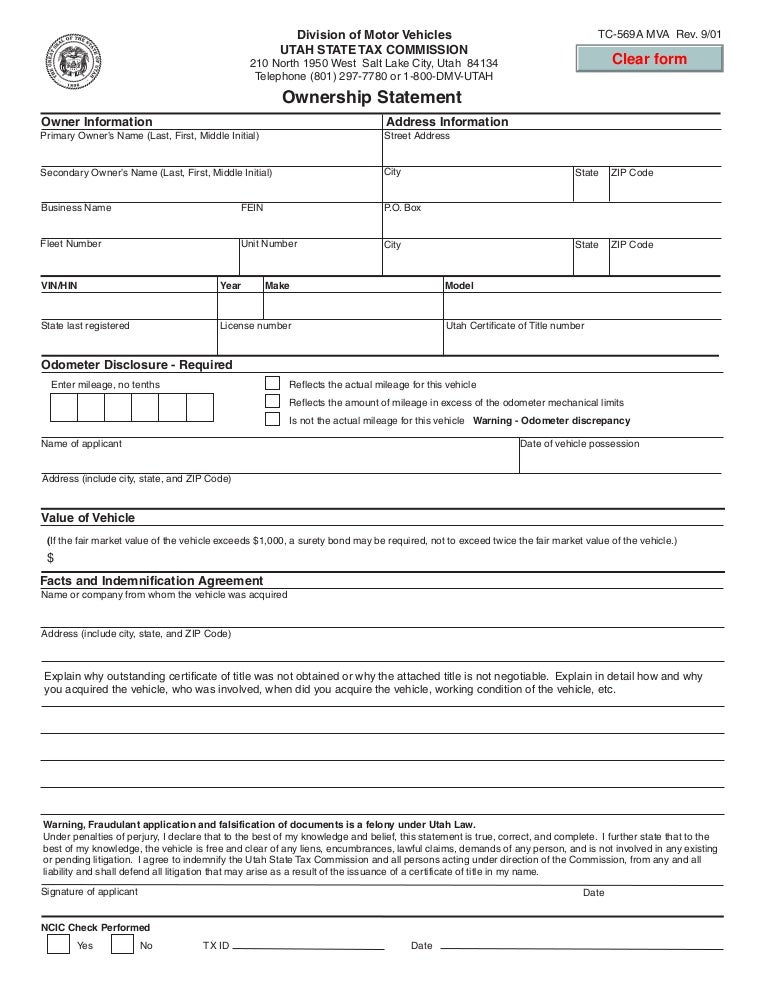

tax.utah.gov forms current tc tc569amva

Pay the amount on line 9 on or before the return due date. You can also make a. Use this worksheet to calculate your minimum required prepayment. Utah provides an automatic 6 month extension without filing a form or application. Utah does not require quarterly estimated tax payments.

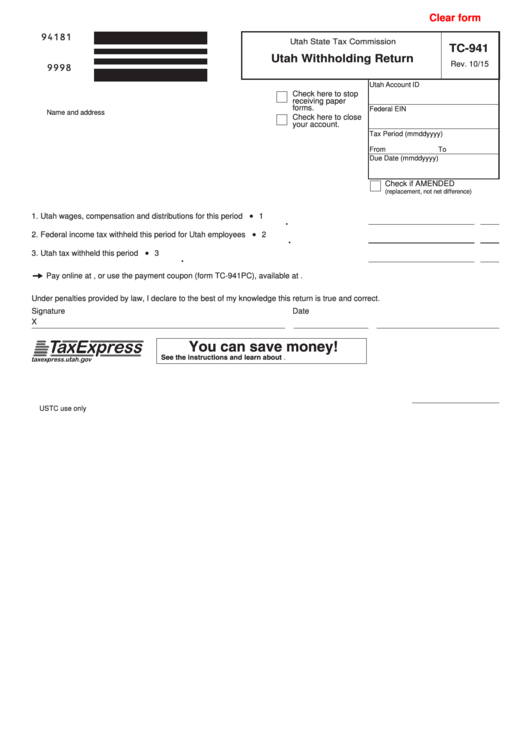

Fillable Form Tc941 Utah Withholding Return Utah State Tax

Use this worksheet to calculate your minimum required prepayment. Utah does not require quarterly estimated tax payments. Pay the amount on line 9 on or before the return due date. To avoid penalties, taxpayers must prepay one of. You can also make a.

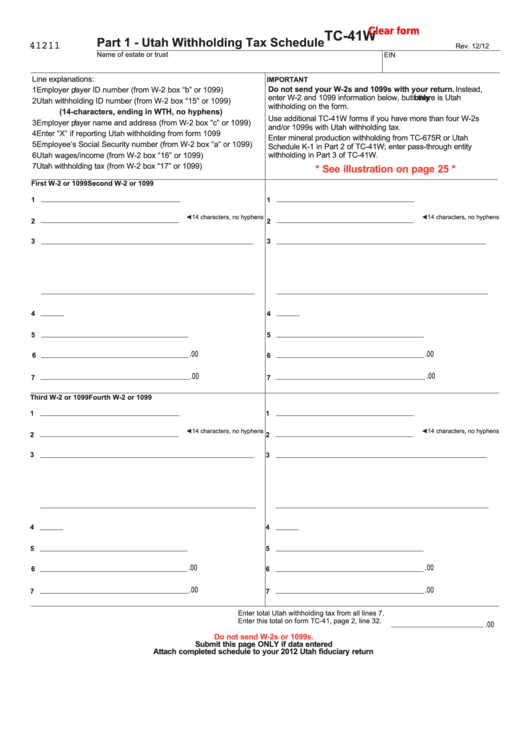

Fillable Form Tc41w Utah Withholding Tax Schedule printable pdf download

To avoid penalties, taxpayers must prepay one of. Pay the amount on line 9 on or before the return due date. Utah provides an automatic 6 month extension without filing a form or application. Use this worksheet to calculate your minimum required prepayment. Utah does not require quarterly estimated tax payments.

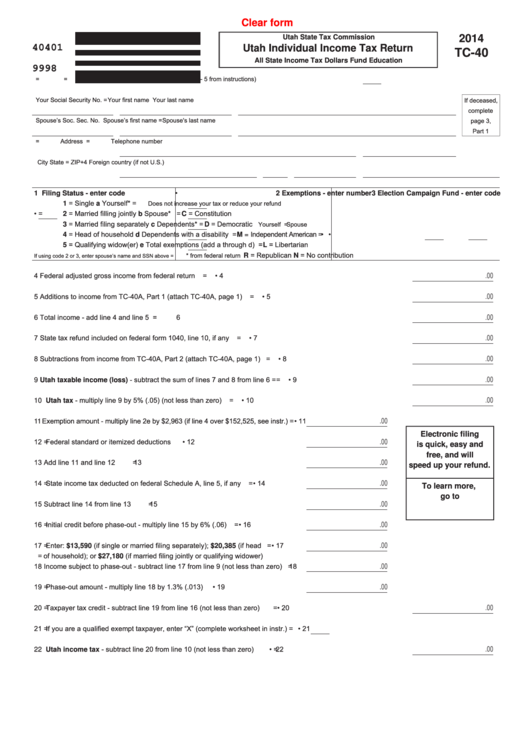

Fillable Form Tc40 Utah Individual Tax Return 2014

To avoid penalties, taxpayers must prepay one of. Pay the amount on line 9 on or before the return due date. Use this worksheet to calculate your minimum required prepayment. Utah does not require quarterly estimated tax payments. You can also make a.

tax.utah.gov forms current tc tc922pages

Use this worksheet to calculate your minimum required prepayment. To avoid penalties, taxpayers must prepay one of. Pay the amount on line 9 on or before the return due date. Utah does not require quarterly estimated tax payments. You can also make a.

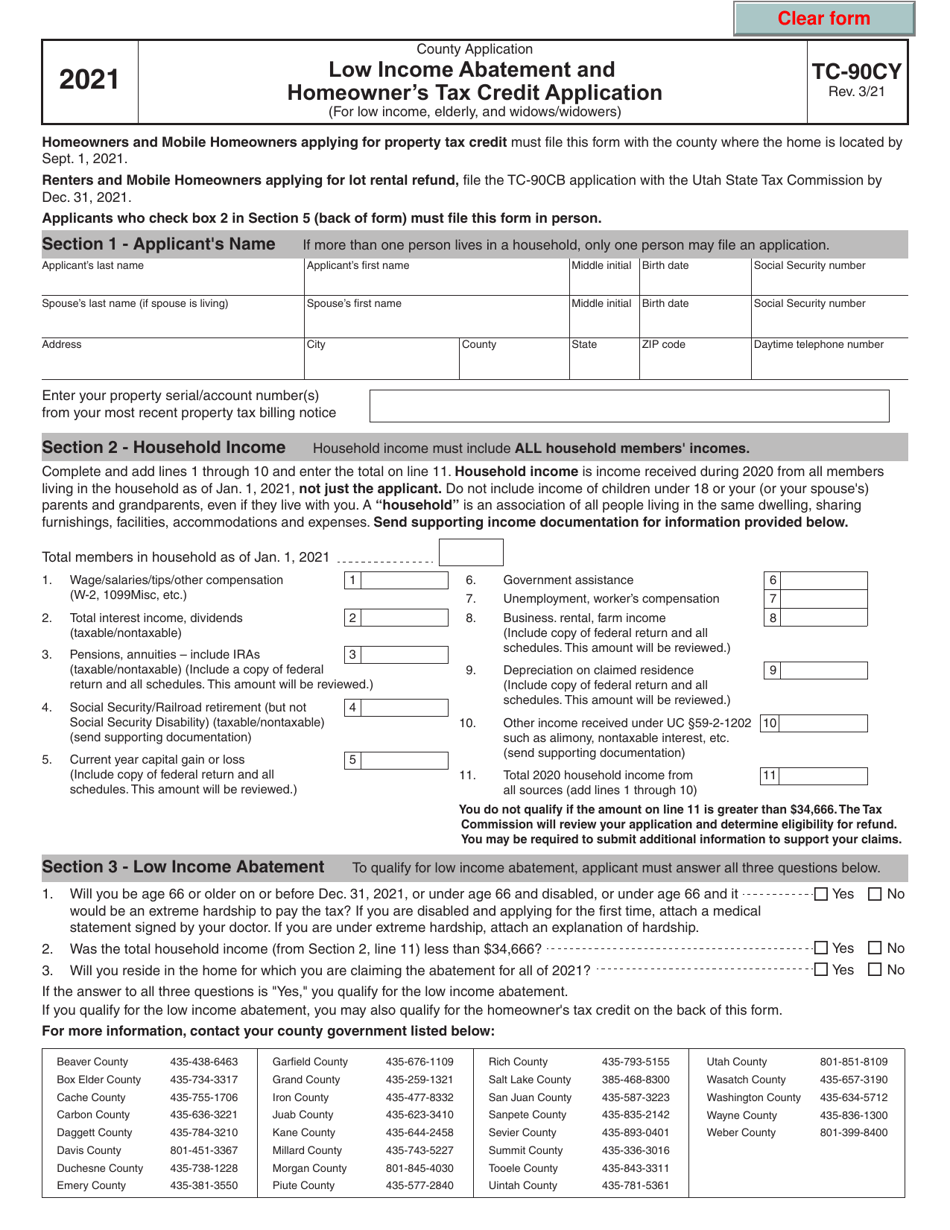

Form TC90CY Download Fillable PDF or Fill Online Low Abatement

Use this worksheet to calculate your minimum required prepayment. Pay the amount on line 9 on or before the return due date. Utah provides an automatic 6 month extension without filing a form or application. You can also make a. To avoid penalties, taxpayers must prepay one of.

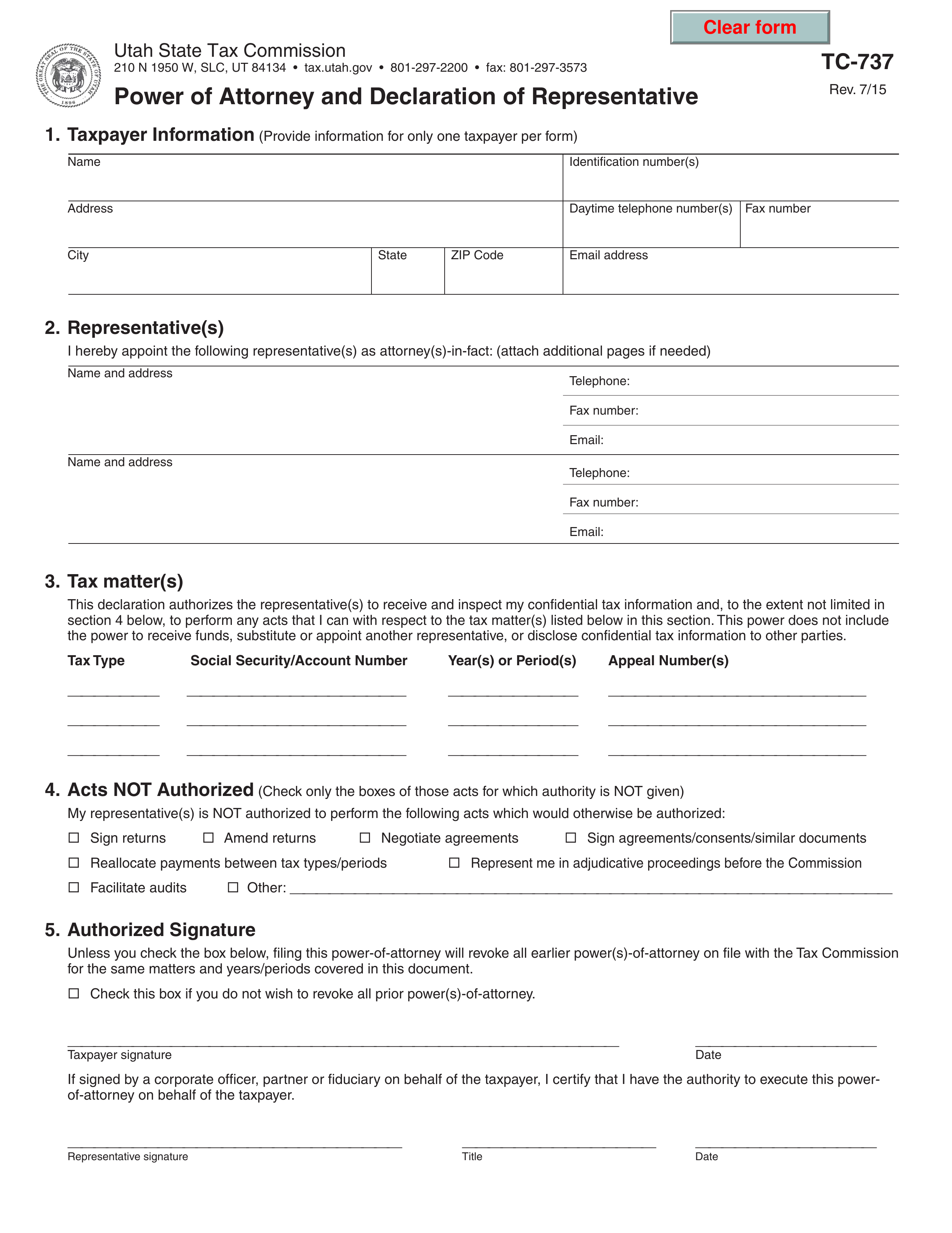

Free Utah Tax Power of Attorney (Form TC737) PDF eForms

Pay the amount on line 9 on or before the return due date. Use this worksheet to calculate your minimum required prepayment. You can also make a. Utah provides an automatic 6 month extension without filing a form or application. To avoid penalties, taxpayers must prepay one of.

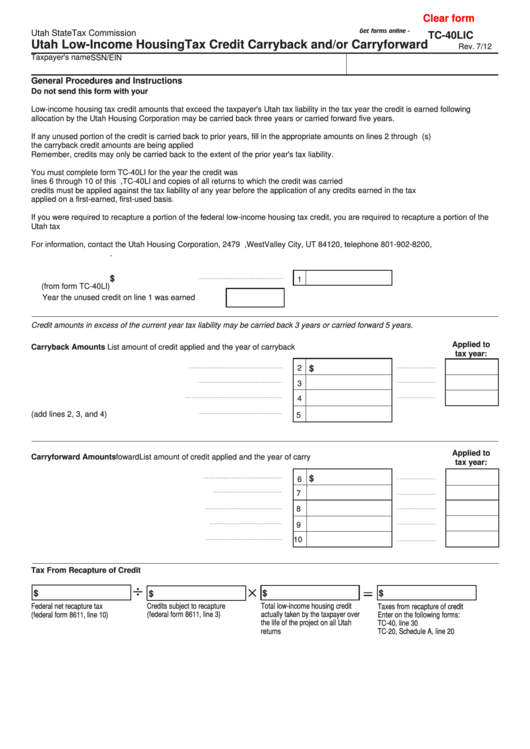

Fillable Form Tc40lic Utah Housing Tax Credit Carryback

Utah provides an automatic 6 month extension without filing a form or application. Pay the amount on line 9 on or before the return due date. Utah does not require quarterly estimated tax payments. You can also make a. Use this worksheet to calculate your minimum required prepayment.

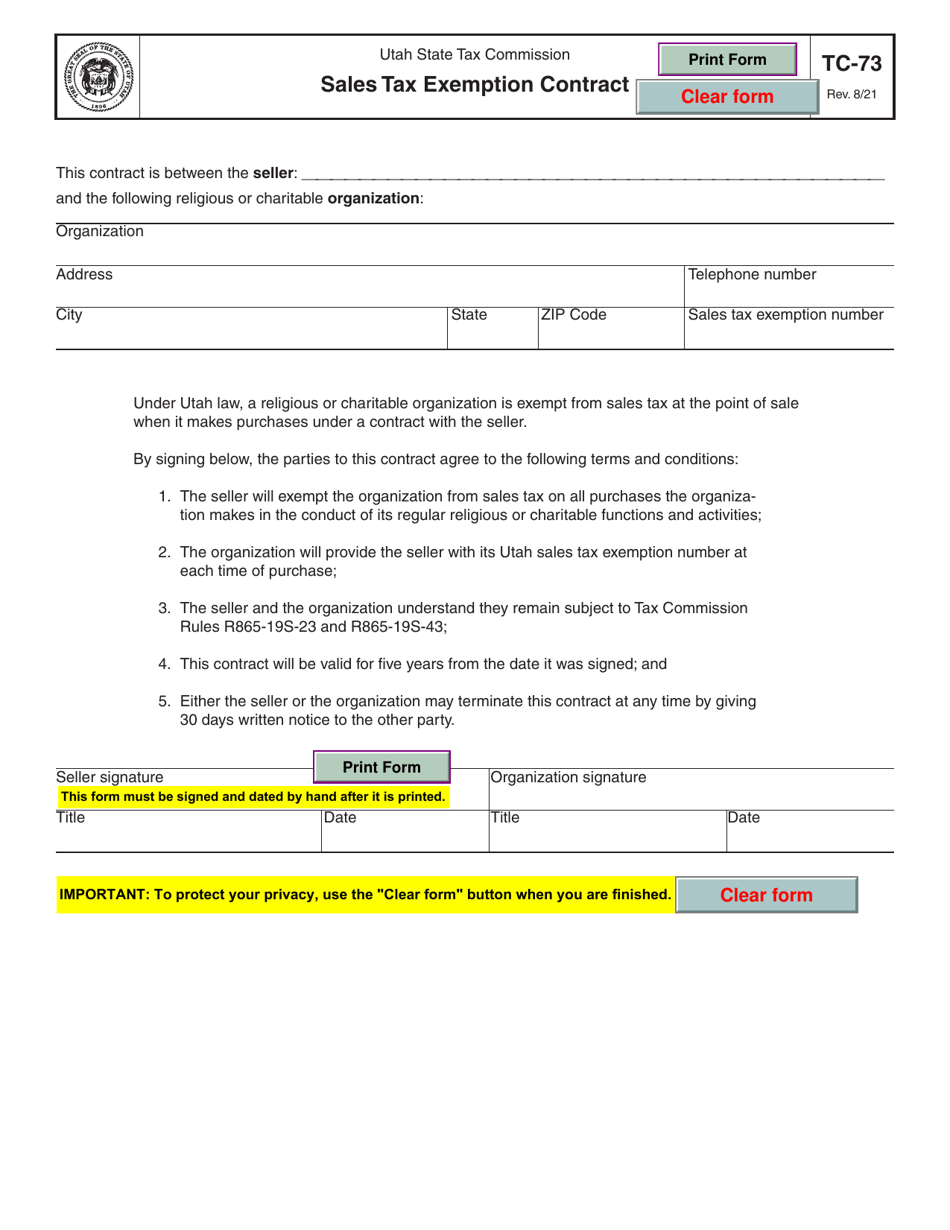

Form TC73 Download Fillable PDF or Fill Online Sales Tax Exemption

To avoid penalties, taxpayers must prepay one of. Pay the amount on line 9 on or before the return due date. Utah provides an automatic 6 month extension without filing a form or application. You can also make a. Utah does not require quarterly estimated tax payments.

tax.utah.gov forms current tc tc40hd

Utah does not require quarterly estimated tax payments. Use this worksheet to calculate your minimum required prepayment. To avoid penalties, taxpayers must prepay one of. Utah provides an automatic 6 month extension without filing a form or application. You can also make a.

Pay The Amount On Line 9 On Or Before The Return Due Date.

Use this worksheet to calculate your minimum required prepayment. Utah does not require quarterly estimated tax payments. Utah provides an automatic 6 month extension without filing a form or application. To avoid penalties, taxpayers must prepay one of.