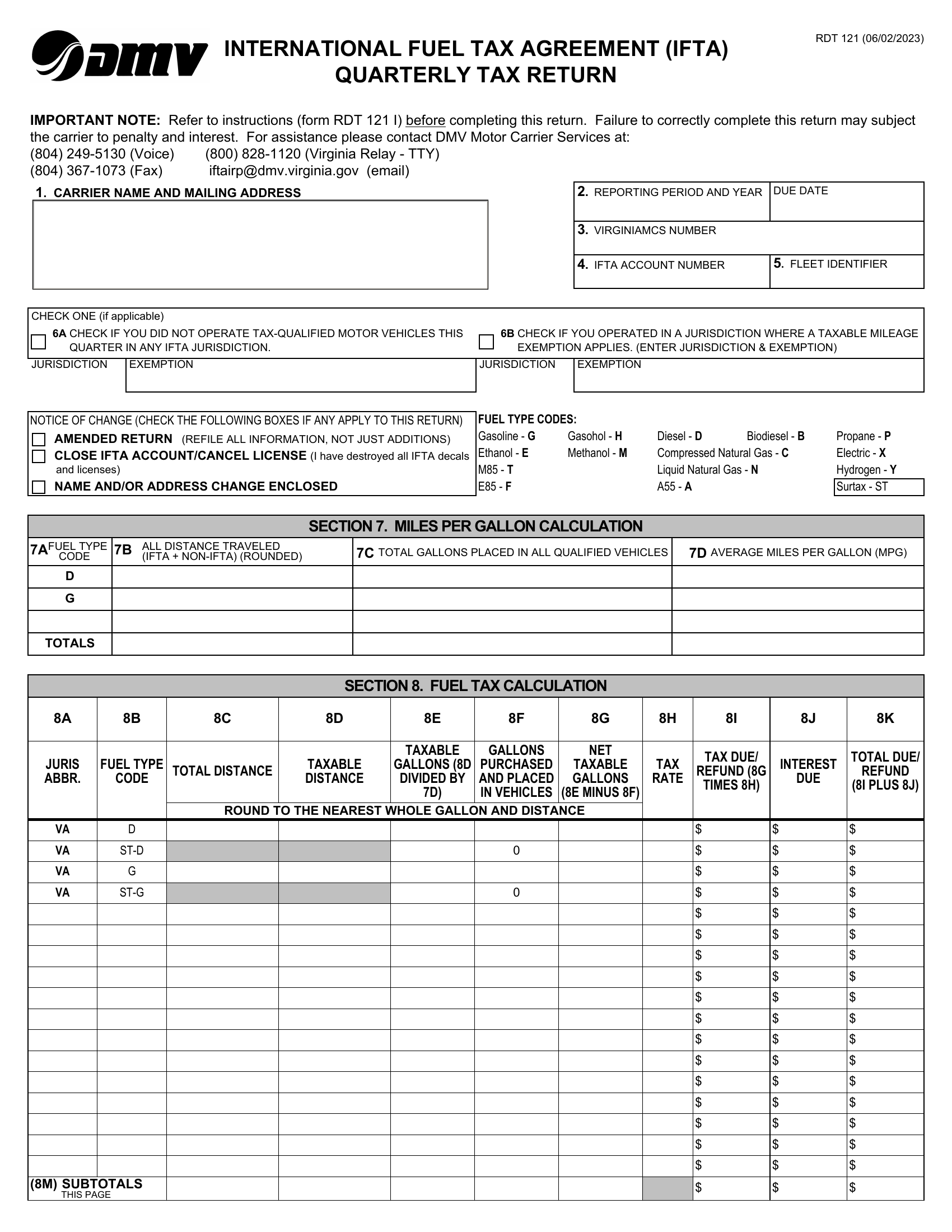

Va Ifta Quarterly Tax Return Form

Va Ifta Quarterly Tax Return Form - If the carrier is based in virginia, they will file one tax return every quarter with the virginia dmv for the total tax or refund due for. This form is for you to use to calculate your taxes. If the above dates fall on a weekend or legal holiday, the due. You must file your quarterly returns by: Refer to instructions (form rdt 121 i) before completing this return. Use these instructions to complete form rdt 121, ifta quarterly tax return. Ifta license number (fein or ssn) important note: Ifta account number important note: Failure to correctly complete this. The tax rates change every quarter and a saved file may give you incorrect tax amounts.

This form is for you to use to calculate your taxes. Ifta license number (fein or ssn) important note: You must file your quarterly returns by: Ifta account number important note: If the carrier is based in virginia, they will file one tax return every quarter with the virginia dmv for the total tax or refund due for. Refer to instructions (form rdt 121 i) before completing this return. Failure to correctly complete this. The tax rates change every quarter and a saved file may give you incorrect tax amounts. Use these instructions to complete form rdt 121, ifta quarterly tax return. Refer to instructions (form rdt 121 i) before completing this return.

If the carrier is based in virginia, they will file one tax return every quarter with the virginia dmv for the total tax or refund due for. Refer to instructions (form rdt 121 i) before completing this return. This form is for you to use to calculate your taxes. Failure to correctly complete this. Use these instructions to complete form rdt 121, ifta quarterly tax return. Ifta license number (fein or ssn) important note: If the above dates fall on a weekend or legal holiday, the due. The tax rates change every quarter and a saved file may give you incorrect tax amounts. Refer to instructions (form rdt 121 i) before completing this return. Ifta account number important note:

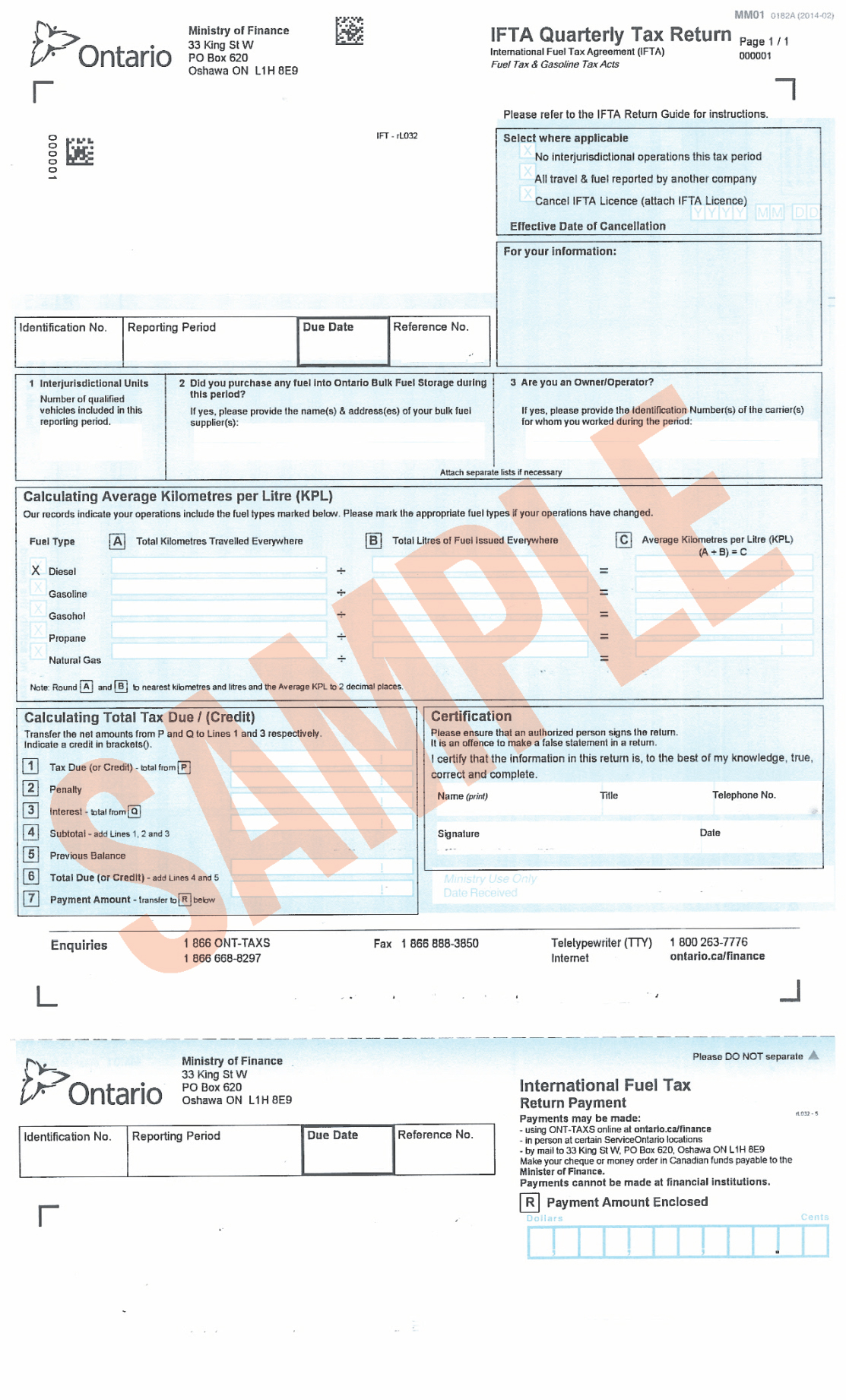

Interjurisdictional Carrier’s Manual International Fuel Tax Agreement

You must file your quarterly returns by: Refer to instructions (form rdt 121 i) before completing this return. If the above dates fall on a weekend or legal holiday, the due. Ifta account number important note: This form is for you to use to calculate your taxes.

Ifta quarters Fill out & sign online DocHub

If the carrier is based in virginia, they will file one tax return every quarter with the virginia dmv for the total tax or refund due for. Ifta account number important note: Failure to correctly complete this. The tax rates change every quarter and a saved file may give you incorrect tax amounts. Refer to instructions (form rdt 121 i).

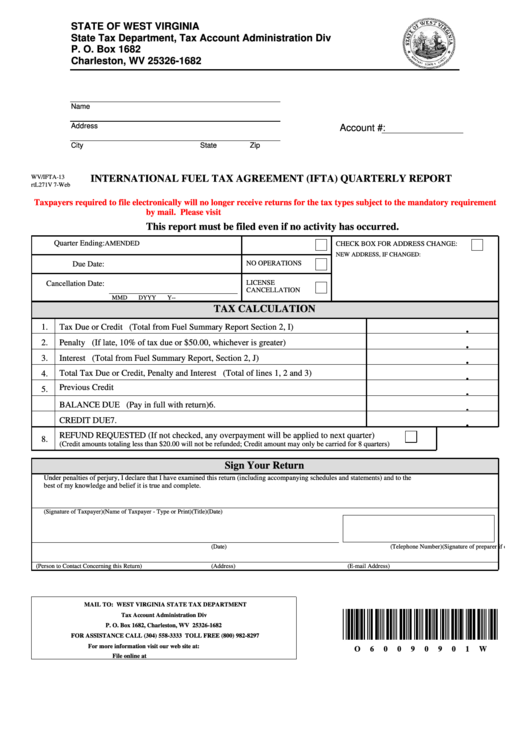

Printable Ifta Forms For Wv Printable Forms Free Online

Refer to instructions (form rdt 121 i) before completing this return. Ifta account number important note: Failure to correctly complete this. This form is for you to use to calculate your taxes. If the above dates fall on a weekend or legal holiday, the due.

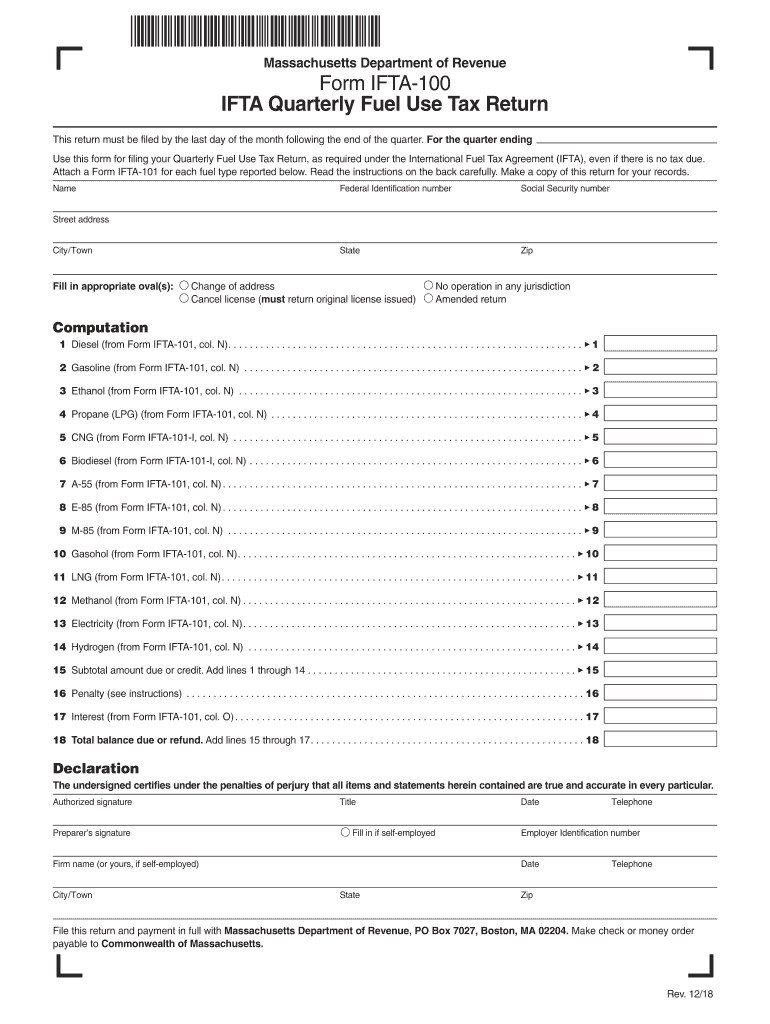

Ma Ifta Online 20182024 Form Fill Out and Sign Printable PDF

If the above dates fall on a weekend or legal holiday, the due. Failure to correctly complete this. You must file your quarterly returns by: Ifta account number important note: If the carrier is based in virginia, they will file one tax return every quarter with the virginia dmv for the total tax or refund due for.

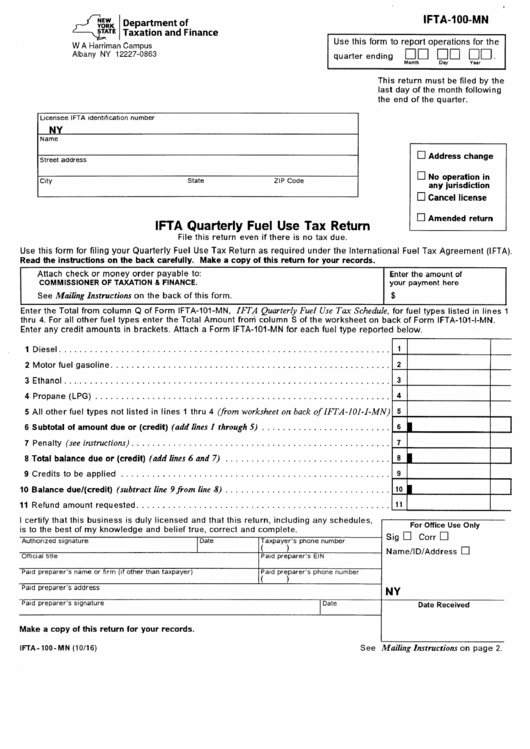

20192024 NY DTF IFTA100 (Formerly IFTA100MN) Fill Online, Printable

You must file your quarterly returns by: Ifta account number important note: Failure to correctly complete this. Use these instructions to complete form rdt 121, ifta quarterly tax return. Refer to instructions (form rdt 121 i) before completing this return.

Form RDT 121. IFTA Quarterly Tax Report Virginia Forms Docs 2023

If the carrier is based in virginia, they will file one tax return every quarter with the virginia dmv for the total tax or refund due for. The tax rates change every quarter and a saved file may give you incorrect tax amounts. You must file your quarterly returns by: Refer to instructions (form rdt 121 i) before completing this.

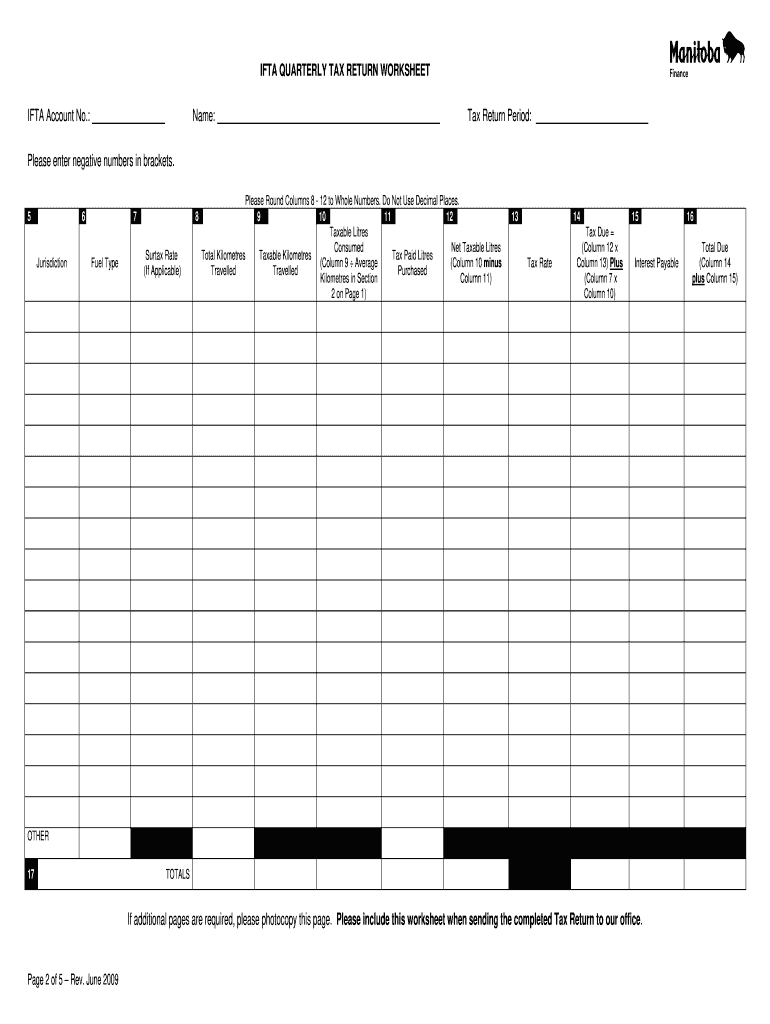

2009 Form Canada Manitoba IFTA Quarterly Tax Return Worksheet Fill

Ifta account number important note: You must file your quarterly returns by: If the above dates fall on a weekend or legal holiday, the due. Refer to instructions (form rdt 121 i) before completing this return. The tax rates change every quarter and a saved file may give you incorrect tax amounts.

Ifta Fuel Tax Form ≡ Fill Out Printable PDF Forms Online

Failure to correctly complete this. This form is for you to use to calculate your taxes. Ifta license number (fein or ssn) important note: You must file your quarterly returns by: Ifta account number important note:

Form Ifta100Mn Ifta Quarterly Fuel Use Tax Return printable pdf

Ifta account number important note: Use these instructions to complete form rdt 121, ifta quarterly tax return. The tax rates change every quarter and a saved file may give you incorrect tax amounts. You must file your quarterly returns by: Ifta license number (fein or ssn) important note:

Fillable Form Wv/ifta13 International Fuel Tax Agreement (Ifta

Ifta account number important note: The tax rates change every quarter and a saved file may give you incorrect tax amounts. Failure to correctly complete this. You must file your quarterly returns by: This form is for you to use to calculate your taxes.

The Tax Rates Change Every Quarter And A Saved File May Give You Incorrect Tax Amounts.

If the above dates fall on a weekend or legal holiday, the due. Refer to instructions (form rdt 121 i) before completing this return. Failure to correctly complete this. This form is for you to use to calculate your taxes.

If The Carrier Is Based In Virginia, They Will File One Tax Return Every Quarter With The Virginia Dmv For The Total Tax Or Refund Due For.

Use these instructions to complete form rdt 121, ifta quarterly tax return. Ifta license number (fein or ssn) important note: Ifta account number important note: You must file your quarterly returns by: