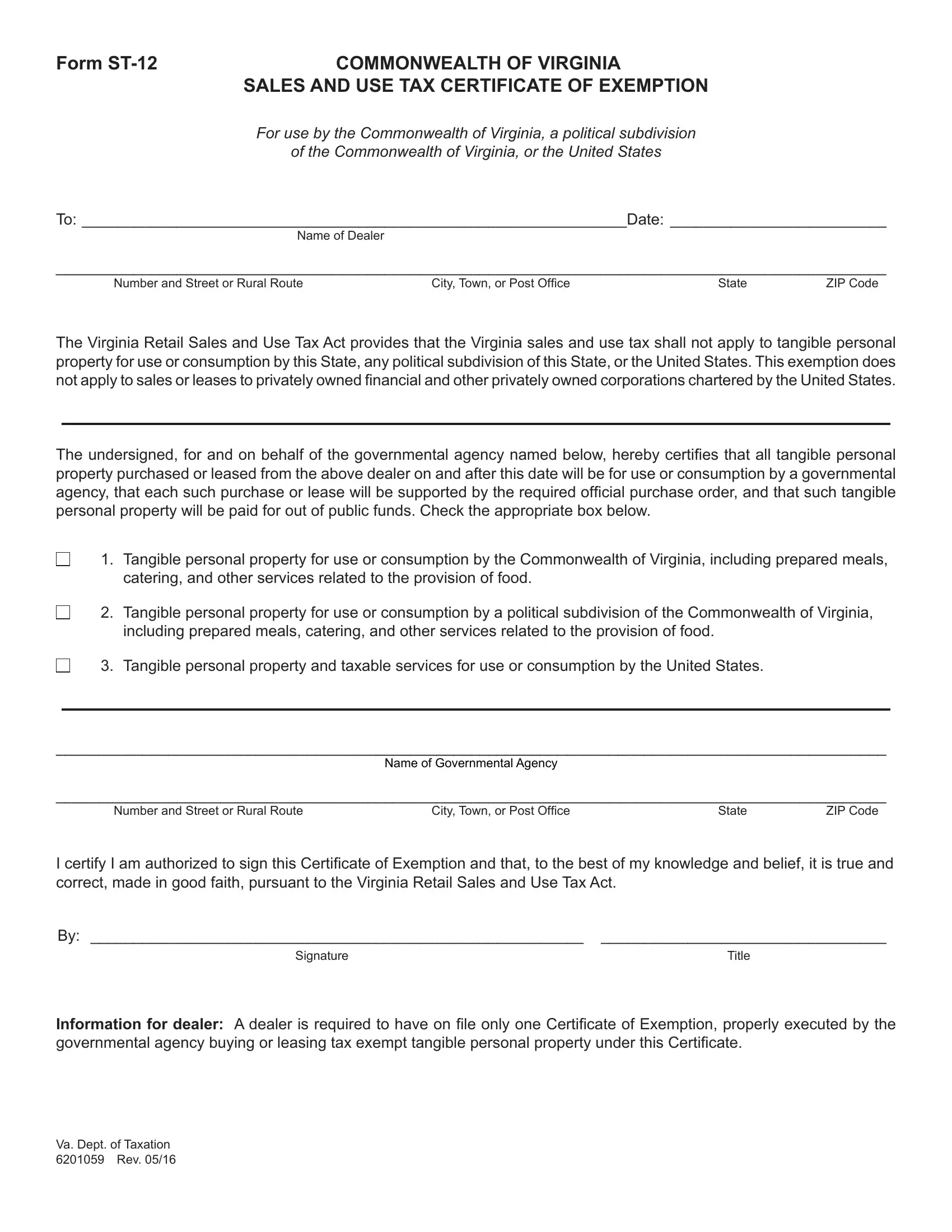

Virginia Tax Exempt Form St 13A

Virginia Tax Exempt Form St 13A - The virginia retail sales and use tax act provides that the sales and use tax shall not apply to: Tangible personal property, including prepared. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.

Tangible personal property, including prepared. The virginia retail sales and use tax act provides that the sales and use tax shall not apply to: A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.

The virginia retail sales and use tax act provides that the sales and use tax shall not apply to: Tangible personal property, including prepared. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.

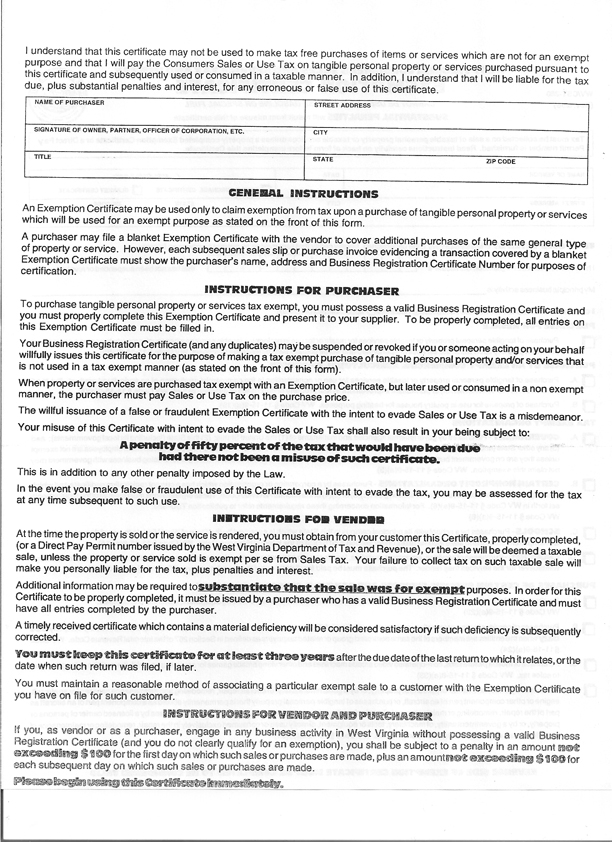

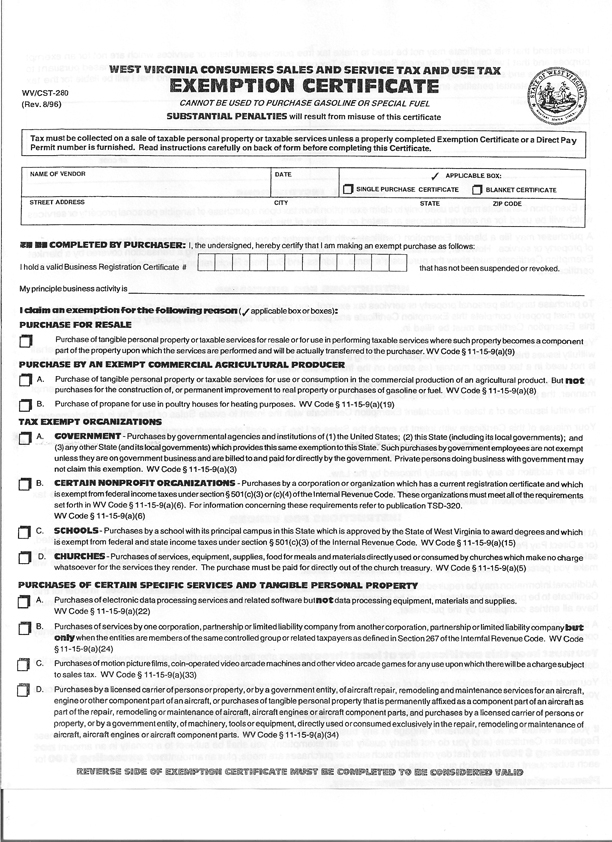

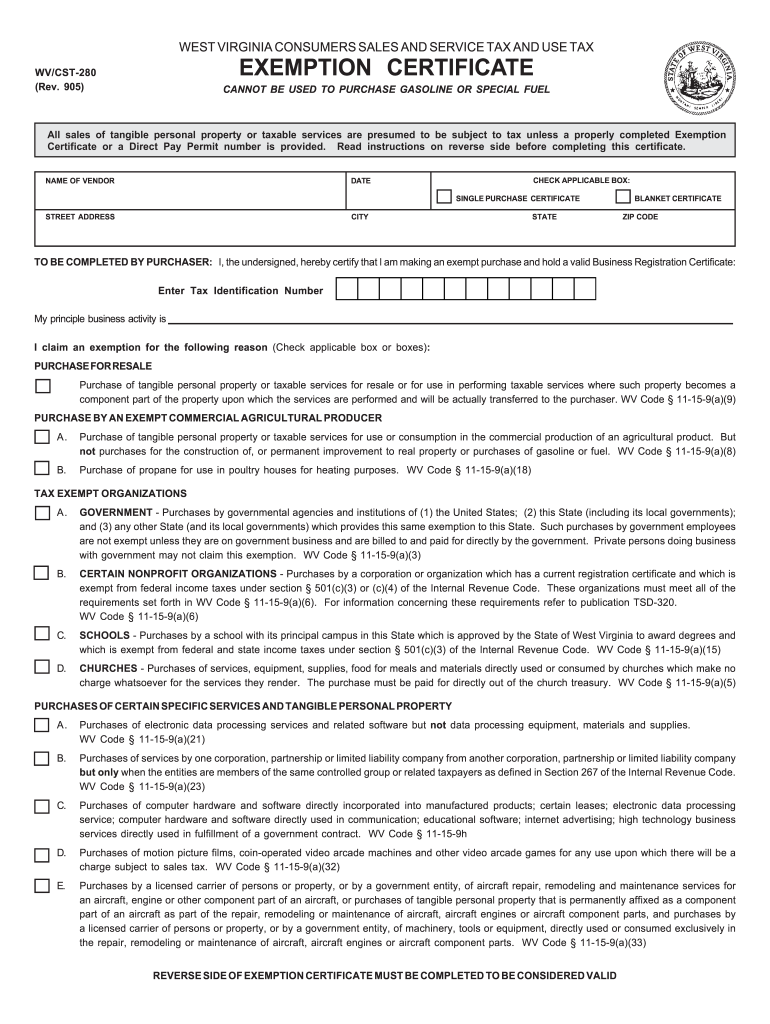

West Virginia Tax Exempt

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. The virginia retail sales and use tax act provides that the sales and use tax shall not apply to: Tangible personal property, including prepared.

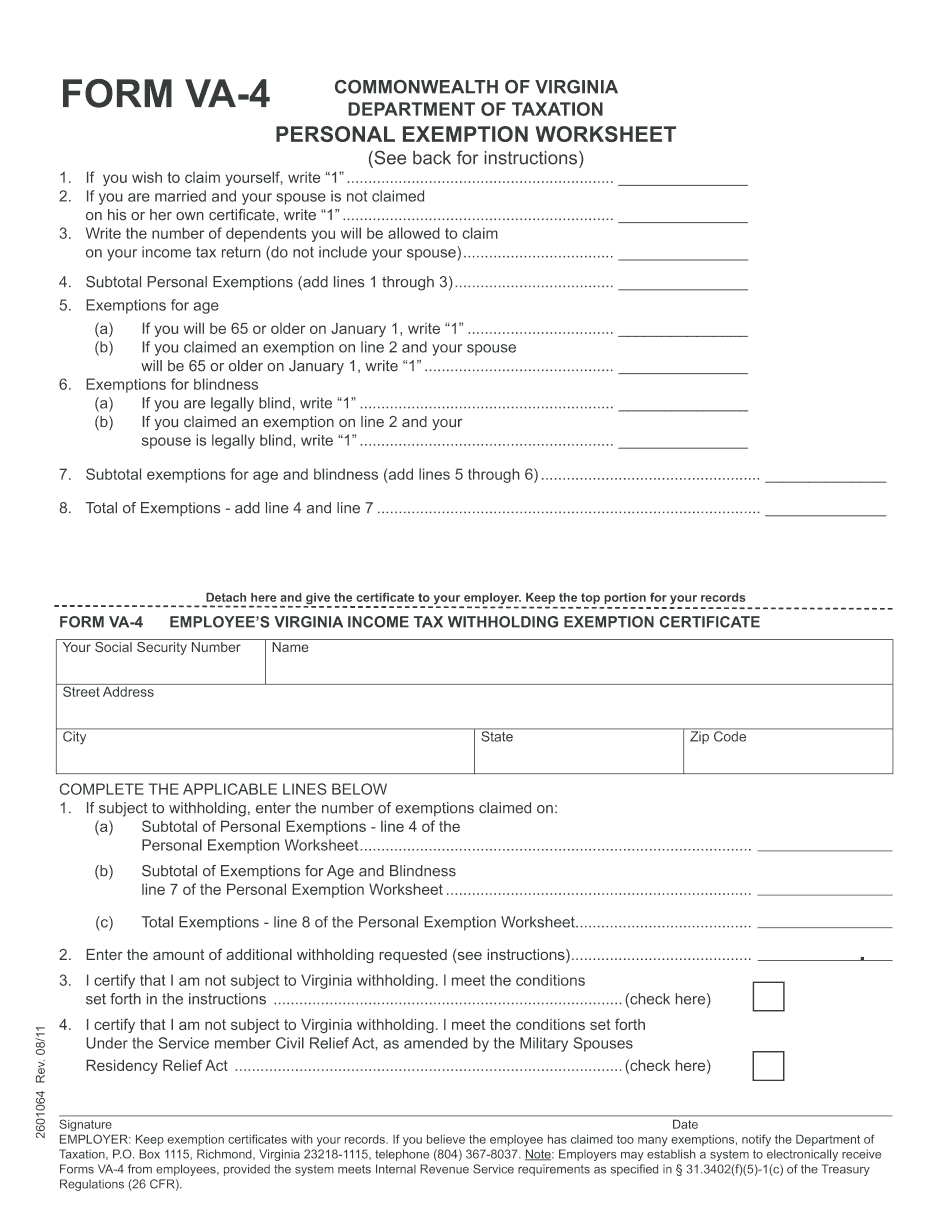

Va Tax Exempt Form 2024

The virginia retail sales and use tax act provides that the sales and use tax shall not apply to: A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Tangible personal property, including prepared.

Virginia Sales Tax Exemption PDF Form FormsPal

Tangible personal property, including prepared. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. The virginia retail sales and use tax act provides that the sales and use tax shall not apply to:

Virginia Sales Tax Exemption Form St 11 Fill Out And Sign Printable

Tangible personal property, including prepared. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. The virginia retail sales and use tax act provides that the sales and use tax shall not apply to:

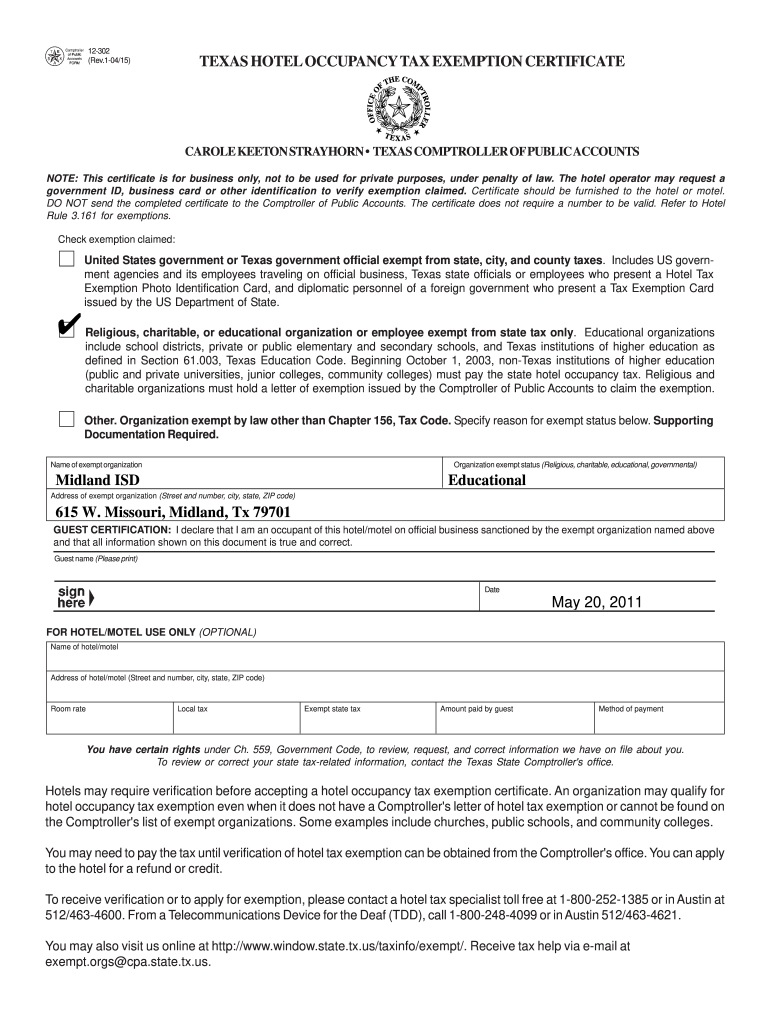

South Carolina Vehicle Tax Exemption Form

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Tangible personal property, including prepared. The virginia retail sales and use tax act provides that the sales and use tax shall not apply to:

West Virginia Tax Exemption Certificate Form

The virginia retail sales and use tax act provides that the sales and use tax shall not apply to: A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Tangible personal property, including prepared.

Wv Tax Exempt Form Fill Online Printable Fillable Blank PdfFiller

Tangible personal property, including prepared. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. The virginia retail sales and use tax act provides that the sales and use tax shall not apply to:

South Carolina Hotel Tax Exempt Form

Tangible personal property, including prepared. The virginia retail sales and use tax act provides that the sales and use tax shall not apply to: A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.

Virginia State Tax Exemption Form

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Tangible personal property, including prepared. The virginia retail sales and use tax act provides that the sales and use tax shall not apply to:

Va Tax Exempt Form 2024

Tangible personal property, including prepared. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. The virginia retail sales and use tax act provides that the sales and use tax shall not apply to:

Tangible Personal Property, Including Prepared.

The virginia retail sales and use tax act provides that the sales and use tax shall not apply to: A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.