What Is State Tax Lien

What Is State Tax Lien - How state tax liens work. A federal tax lien can be. It gives the agency an interest in your property if. State tax liens come into effect when you fail to pay your state taxes by the deadline. A tax lien is a tactic state tax authorities use to collect outstanding debt. A tax lien is a legal form of recourse used by a government agency to collect an outstanding debt. What is a tax lien?

What is a tax lien? A tax lien is a tactic state tax authorities use to collect outstanding debt. State tax liens come into effect when you fail to pay your state taxes by the deadline. A federal tax lien can be. How state tax liens work. It gives the agency an interest in your property if. A tax lien is a legal form of recourse used by a government agency to collect an outstanding debt.

How state tax liens work. It gives the agency an interest in your property if. State tax liens come into effect when you fail to pay your state taxes by the deadline. What is a tax lien? A tax lien is a legal form of recourse used by a government agency to collect an outstanding debt. A tax lien is a tactic state tax authorities use to collect outstanding debt. A federal tax lien can be.

Tax Lien Indiana State Tax Lien

A tax lien is a tactic state tax authorities use to collect outstanding debt. How state tax liens work. A tax lien is a legal form of recourse used by a government agency to collect an outstanding debt. It gives the agency an interest in your property if. What is a tax lien?

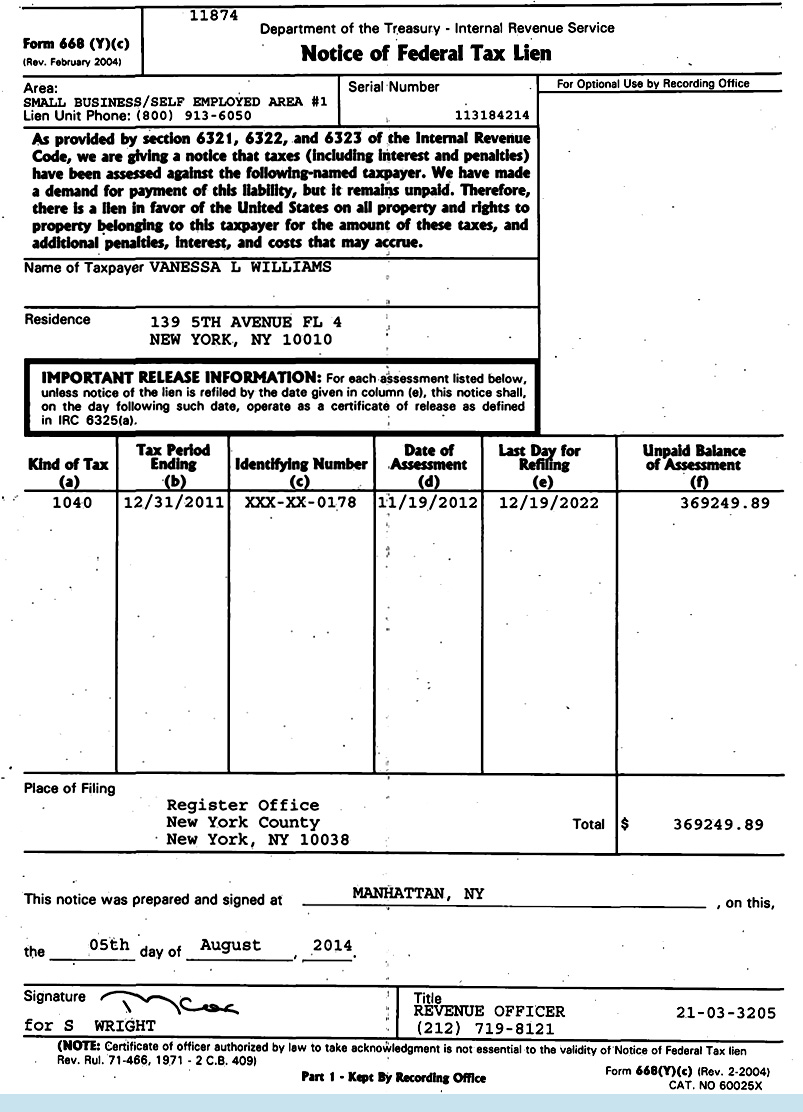

Federal tax lien on foreclosed property laderdriver

A tax lien is a tactic state tax authorities use to collect outstanding debt. How state tax liens work. State tax liens come into effect when you fail to pay your state taxes by the deadline. What is a tax lien? A tax lien is a legal form of recourse used by a government agency to collect an outstanding debt.

How to Tackle IRS Tax Lien or Levy Notice? Internal Revenue Code

A federal tax lien can be. It gives the agency an interest in your property if. How state tax liens work. A tax lien is a legal form of recourse used by a government agency to collect an outstanding debt. A tax lien is a tactic state tax authorities use to collect outstanding debt.

Tax Lien California State Tax Lien

A tax lien is a legal form of recourse used by a government agency to collect an outstanding debt. What is a tax lien? A federal tax lien can be. It gives the agency an interest in your property if. How state tax liens work.

State Tax Lien vs. Federal Tax Lien How to Remove Them

What is a tax lien? A federal tax lien can be. A tax lien is a legal form of recourse used by a government agency to collect an outstanding debt. A tax lien is a tactic state tax authorities use to collect outstanding debt. State tax liens come into effect when you fail to pay your state taxes by the.

Pursuant to the Tax Lien, Tax May be Collected from Estate Property in

A tax lien is a tactic state tax authorities use to collect outstanding debt. What is a tax lien? A federal tax lien can be. State tax liens come into effect when you fail to pay your state taxes by the deadline. A tax lien is a legal form of recourse used by a government agency to collect an outstanding.

Tax Lien Texas State Tax Lien

A tax lien is a legal form of recourse used by a government agency to collect an outstanding debt. State tax liens come into effect when you fail to pay your state taxes by the deadline. What is a tax lien? How state tax liens work. A federal tax lien can be.

Federal & State Tax Lien Removal Help Instant Tax Solutions

How state tax liens work. It gives the agency an interest in your property if. What is a tax lien? State tax liens come into effect when you fail to pay your state taxes by the deadline. A federal tax lien can be.

Tax Lien What Is A State Tax Lien Ohio

A federal tax lien can be. How state tax liens work. State tax liens come into effect when you fail to pay your state taxes by the deadline. What is a tax lien? It gives the agency an interest in your property if.

Tax Lien Sale PDF Tax Lien Taxes

How state tax liens work. State tax liens come into effect when you fail to pay your state taxes by the deadline. A tax lien is a legal form of recourse used by a government agency to collect an outstanding debt. A tax lien is a tactic state tax authorities use to collect outstanding debt. It gives the agency an.

A Tax Lien Is A Tactic State Tax Authorities Use To Collect Outstanding Debt.

What is a tax lien? State tax liens come into effect when you fail to pay your state taxes by the deadline. A tax lien is a legal form of recourse used by a government agency to collect an outstanding debt. A federal tax lien can be.

How State Tax Liens Work.

It gives the agency an interest in your property if.