What Were Q4 Profits For 2018 Of Cic U

What Were Q4 Profits For 2018 Of Cic U - These financial measures include organic sales growth, gross profit, financial leverage, earnings before interest, taxes, depreciation and. In 2019, inflation remained well anchored despite rising to average 5% in 2019 from 4% in 2018; Revenue increased 8% to $478 million in the fourth quarter with growth in desktop, data management solutions, and risk services. The cic group investor relations department, provides investors with accurate accounts of the company's affairs. Cit) today announced it will issue its fourth quarter 2018 financial results on tuesday, jan. Equities fell spectacularly in the fourth quarter, leading to the first yearly decline since 2008. In the fourth quarter of 2018, ci repurchased $159.9 million of shares and paid $45.4 million in dividends. Largely on slightly higher food prices. The 4.38% drop in the s&p500 pales in comparison to.

Revenue increased 8% to $478 million in the fourth quarter with growth in desktop, data management solutions, and risk services. The 4.38% drop in the s&p500 pales in comparison to. Cit) today announced it will issue its fourth quarter 2018 financial results on tuesday, jan. In 2019, inflation remained well anchored despite rising to average 5% in 2019 from 4% in 2018; Equities fell spectacularly in the fourth quarter, leading to the first yearly decline since 2008. In the fourth quarter of 2018, ci repurchased $159.9 million of shares and paid $45.4 million in dividends. Largely on slightly higher food prices. These financial measures include organic sales growth, gross profit, financial leverage, earnings before interest, taxes, depreciation and. The cic group investor relations department, provides investors with accurate accounts of the company's affairs.

In 2019, inflation remained well anchored despite rising to average 5% in 2019 from 4% in 2018; In the fourth quarter of 2018, ci repurchased $159.9 million of shares and paid $45.4 million in dividends. The cic group investor relations department, provides investors with accurate accounts of the company's affairs. These financial measures include organic sales growth, gross profit, financial leverage, earnings before interest, taxes, depreciation and. Equities fell spectacularly in the fourth quarter, leading to the first yearly decline since 2008. Largely on slightly higher food prices. Cit) today announced it will issue its fourth quarter 2018 financial results on tuesday, jan. Revenue increased 8% to $478 million in the fourth quarter with growth in desktop, data management solutions, and risk services. The 4.38% drop in the s&p500 pales in comparison to.

39+ What Were Q4 Profits For 2018 Of Golf TayyabClive

Cit) today announced it will issue its fourth quarter 2018 financial results on tuesday, jan. These financial measures include organic sales growth, gross profit, financial leverage, earnings before interest, taxes, depreciation and. In 2019, inflation remained well anchored despite rising to average 5% in 2019 from 4% in 2018; The cic group investor relations department, provides investors with accurate accounts.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

In 2019, inflation remained well anchored despite rising to average 5% in 2019 from 4% in 2018; The 4.38% drop in the s&p500 pales in comparison to. Equities fell spectacularly in the fourth quarter, leading to the first yearly decline since 2008. These financial measures include organic sales growth, gross profit, financial leverage, earnings before interest, taxes, depreciation and. In.

CIC U Nantes Atlantique Fiche équipe Todaycycling

Largely on slightly higher food prices. Revenue increased 8% to $478 million in the fourth quarter with growth in desktop, data management solutions, and risk services. These financial measures include organic sales growth, gross profit, financial leverage, earnings before interest, taxes, depreciation and. In 2019, inflation remained well anchored despite rising to average 5% in 2019 from 4% in 2018;.

Un weekend à domicile pour CIC U Nantes Atlantique UCNA

Equities fell spectacularly in the fourth quarter, leading to the first yearly decline since 2008. The 4.38% drop in the s&p500 pales in comparison to. Revenue increased 8% to $478 million in the fourth quarter with growth in desktop, data management solutions, and risk services. Cit) today announced it will issue its fourth quarter 2018 financial results on tuesday, jan..

Corporate profits were down slightly in Q2 Kevin Drum

In the fourth quarter of 2018, ci repurchased $159.9 million of shares and paid $45.4 million in dividends. Cit) today announced it will issue its fourth quarter 2018 financial results on tuesday, jan. These financial measures include organic sales growth, gross profit, financial leverage, earnings before interest, taxes, depreciation and. The cic group investor relations department, provides investors with accurate.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

Revenue increased 8% to $478 million in the fourth quarter with growth in desktop, data management solutions, and risk services. Equities fell spectacularly in the fourth quarter, leading to the first yearly decline since 2008. The 4.38% drop in the s&p500 pales in comparison to. These financial measures include organic sales growth, gross profit, financial leverage, earnings before interest, taxes,.

GP La Marseillaise l'effectif de CIC U Nantes Atlantique

These financial measures include organic sales growth, gross profit, financial leverage, earnings before interest, taxes, depreciation and. The cic group investor relations department, provides investors with accurate accounts of the company's affairs. The 4.38% drop in the s&p500 pales in comparison to. Cit) today announced it will issue its fourth quarter 2018 financial results on tuesday, jan. In 2019, inflation.

CIC Taux de 0.10 au 3 Décembre 2024

Cit) today announced it will issue its fourth quarter 2018 financial results on tuesday, jan. In the fourth quarter of 2018, ci repurchased $159.9 million of shares and paid $45.4 million in dividends. Equities fell spectacularly in the fourth quarter, leading to the first yearly decline since 2008. The cic group investor relations department, provides investors with accurate accounts of.

What Were Q4 Profits for 2018 of Iim? Answer] CGAA

Revenue increased 8% to $478 million in the fourth quarter with growth in desktop, data management solutions, and risk services. Cit) today announced it will issue its fourth quarter 2018 financial results on tuesday, jan. In 2019, inflation remained well anchored despite rising to average 5% in 2019 from 4% in 2018; The cic group investor relations department, provides investors.

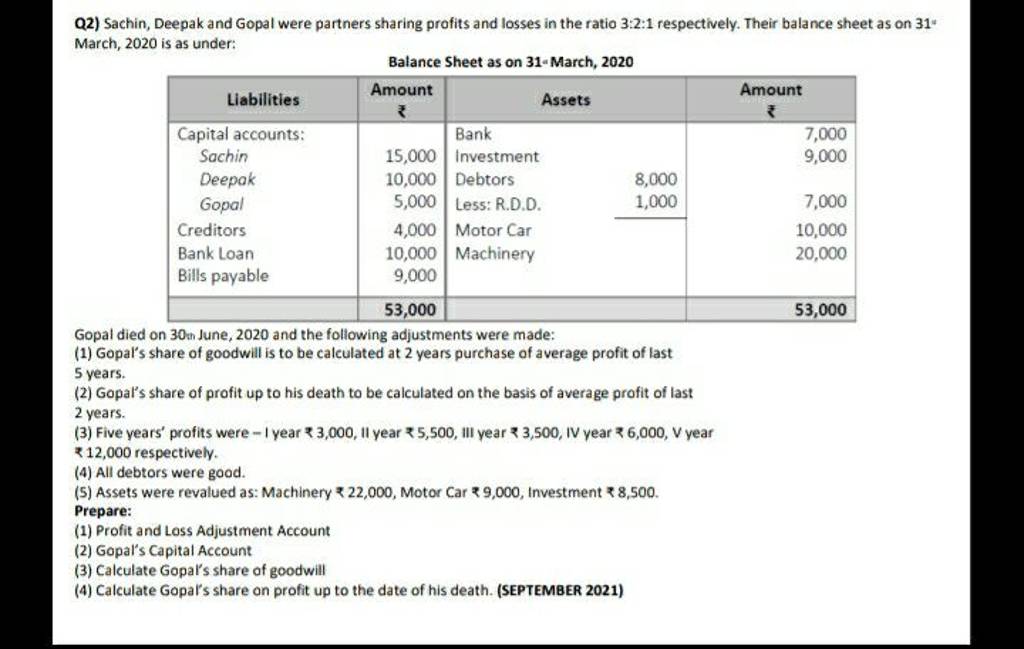

Q2) Sachin, Deepak and Gopal were partners sharing profits and losses in

These financial measures include organic sales growth, gross profit, financial leverage, earnings before interest, taxes, depreciation and. The 4.38% drop in the s&p500 pales in comparison to. The cic group investor relations department, provides investors with accurate accounts of the company's affairs. Revenue increased 8% to $478 million in the fourth quarter with growth in desktop, data management solutions, and.

Revenue Increased 8% To $478 Million In The Fourth Quarter With Growth In Desktop, Data Management Solutions, And Risk Services.

These financial measures include organic sales growth, gross profit, financial leverage, earnings before interest, taxes, depreciation and. Largely on slightly higher food prices. In the fourth quarter of 2018, ci repurchased $159.9 million of shares and paid $45.4 million in dividends. Cit) today announced it will issue its fourth quarter 2018 financial results on tuesday, jan.

The Cic Group Investor Relations Department, Provides Investors With Accurate Accounts Of The Company's Affairs.

Equities fell spectacularly in the fourth quarter, leading to the first yearly decline since 2008. The 4.38% drop in the s&p500 pales in comparison to. In 2019, inflation remained well anchored despite rising to average 5% in 2019 from 4% in 2018;

![What Were Q4 Profits for 2018 of Iim? Answer] CGAA](https://images.pexels.com/photos/3823487/pexels-photo-3823487.jpeg)